NOTE: The logbook app can only be used in conjunction with the web-based accounting system drive IFAS and with original hardware of the AMS. there are all info here: www.ams-gruppe.de

Compliance with tax law (Income Tax Act)

With the logbook APP you can edit your driving mobile and utilize many intelligent functions and thereby reduce processing times significantly. The conformity to legal requirements of the Income Tax Act is ensured through close coordination with the tax authorities.

The fixed mounting of the AMS hardware not only the manipulation in the processing, but also the manipulation of the hardware itself much more difficult is (as intentional or accidental pulling a plug). The drive data are recorded via GPS and transmitted via GSM tamper-proof to the AMS server.

Compliance for Data Protection (BDSG)

Particular attention was paid to the security of informational self-determination. You can decide which personal data should be driving when deleted or blocked for further processing. Or whether or not personal data should be driving at all transferred to the logbook.

Your employer receives only overviews of business trips, do not allow any conclusions on private trips. Thus, a monitor is excluded during the period of service (no danger of the "Glass employee")

Proposal has no access to data on your smartphone.

Main features:

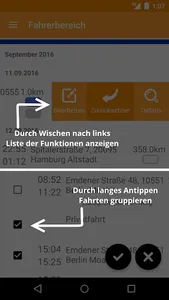

- Location-independent, mobile machining of the logbook

- Automatic detection and transmission every trip to the AMS Server

- Conformity to the income and Privacy Act

- Comprehensive Data Protection Options

- Extensive options for intelligent processing

- Compliance with statutory retention periods

Automatic functions:

- Plausibility checks for tax compliance

- Grouping of trips

- Recognition of periods with private use only (individual preferences)

- Detection of recurrent trips and objectives (private and business)

Compliance with tax law (Income Tax Act)

With the logbook APP you can edit your driving mobile and utilize many intelligent functions and thereby reduce processing times significantly. The conformity to legal requirements of the Income Tax Act is ensured through close coordination with the tax authorities.

The fixed mounting of the AMS hardware not only the manipulation in the processing, but also the manipulation of the hardware itself much more difficult is (as intentional or accidental pulling a plug). The drive data are recorded via GPS and transmitted via GSM tamper-proof to the AMS server.

Compliance for Data Protection (BDSG)

Particular attention was paid to the security of informational self-determination. You can decide which personal data should be driving when deleted or blocked for further processing. Or whether or not personal data should be driving at all transferred to the logbook.

Your employer receives only overviews of business trips, do not allow any conclusions on private trips. Thus, a monitor is excluded during the period of service (no danger of the "Glass employee")

Proposal has no access to data on your smartphone.

Main features:

- Location-independent, mobile machining of the logbook

- Automatic detection and transmission every trip to the AMS Server

- Conformity to the income and Privacy Act

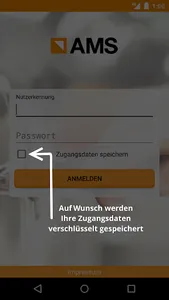

- Comprehensive Data Protection Options

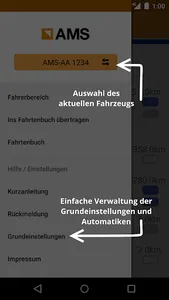

- Extensive options for intelligent processing

- Compliance with statutory retention periods

Automatic functions:

- Plausibility checks for tax compliance

- Grouping of trips

- Recognition of periods with private use only (individual preferences)

- Detection of recurrent trips and objectives (private and business)

Show More