Mei Lik Ko credit products include mortgage loans, SME loans, civil servant and professional loans, personal loans, and owner loans, all of which can provide you with a comfortable and appropriate loan solution. Private loans are more convenient because they can be tailored to your specific repayment schedule and interest rate; the highest APR is 48%.

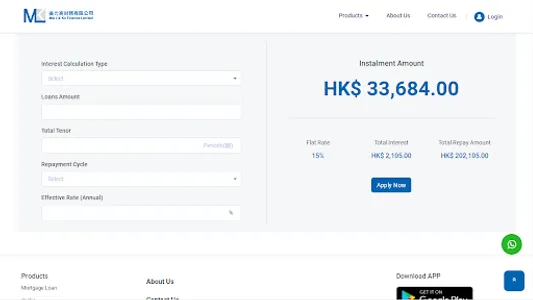

There will be a complete and clear repayment schedule whether the loan is repaid using the reducing balance method or interest first. You can clearly understand your repayment plan before making a decision, which is very deserving of your trust. Our repayment period can range from 4 to 60 months. It can handle large-value settlements at once, allowing customers to repay debts in a systematic manner and reduce their financial burden.

----------------------------------------

Mei Lik Ko Loan Features:

-Trustworthy - Strong professional and reliable company with 30 years of experience

-Simple Application - Simple documents; exempt from credit score; approval within 24 hours

-Large Loan Amount - No upper limit of the loan amount to meet your needs

-Save Interest – Low-interest rate; flexible repayment period; interest is calculated on a daily basis

-$0 of Extra Charge - Exempt from handling fee, legal fee and valuation fee

-One-Stop Loan Solutions - Provide mortgage and multiple loan products for evaluating the best solution

** An application's final approval is contingent on the client's financial situation.

-----------------------------------------

The following examples of total loan costs are for reference only:

Loan Amount: $100,000

Term: 12 months, $8792 per installment

Monthly flat rate: 0.4587%

Annual interest rate: 10%

Total repayments: $105,504

==================================================

Company Name: Mei Lik Ko Finance Limited

Address: Room 801, Kelly Commercial Centre, 570-572 Nathan Road, Kowloon, Hong Kong

Tel: 2781 1883

License No.: 1350/2022

Date of establishment: 04/07/1995

Website: https://mlkfinance.com.hk/

Warning: You have to repay your loans. Don't pay any intermediaries.

==================================================== ==

*The company reserves the right to determine final loan interest and amount approval, which is subject to relevant terms and conditions.

There will be a complete and clear repayment schedule whether the loan is repaid using the reducing balance method or interest first. You can clearly understand your repayment plan before making a decision, which is very deserving of your trust. Our repayment period can range from 4 to 60 months. It can handle large-value settlements at once, allowing customers to repay debts in a systematic manner and reduce their financial burden.

----------------------------------------

Mei Lik Ko Loan Features:

-Trustworthy - Strong professional and reliable company with 30 years of experience

-Simple Application - Simple documents; exempt from credit score; approval within 24 hours

-Large Loan Amount - No upper limit of the loan amount to meet your needs

-Save Interest – Low-interest rate; flexible repayment period; interest is calculated on a daily basis

-$0 of Extra Charge - Exempt from handling fee, legal fee and valuation fee

-One-Stop Loan Solutions - Provide mortgage and multiple loan products for evaluating the best solution

** An application's final approval is contingent on the client's financial situation.

-----------------------------------------

The following examples of total loan costs are for reference only:

Loan Amount: $100,000

Term: 12 months, $8792 per installment

Monthly flat rate: 0.4587%

Annual interest rate: 10%

Total repayments: $105,504

==================================================

Company Name: Mei Lik Ko Finance Limited

Address: Room 801, Kelly Commercial Centre, 570-572 Nathan Road, Kowloon, Hong Kong

Tel: 2781 1883

License No.: 1350/2022

Date of establishment: 04/07/1995

Website: https://mlkfinance.com.hk/

Warning: You have to repay your loans. Don't pay any intermediaries.

==================================================== ==

*The company reserves the right to determine final loan interest and amount approval, which is subject to relevant terms and conditions.

Show More