Мой займ - Займы онлайн

Кредиты онлайн 24/7

10,000+

downloads

Free

About Мой займ - Займы онлайн

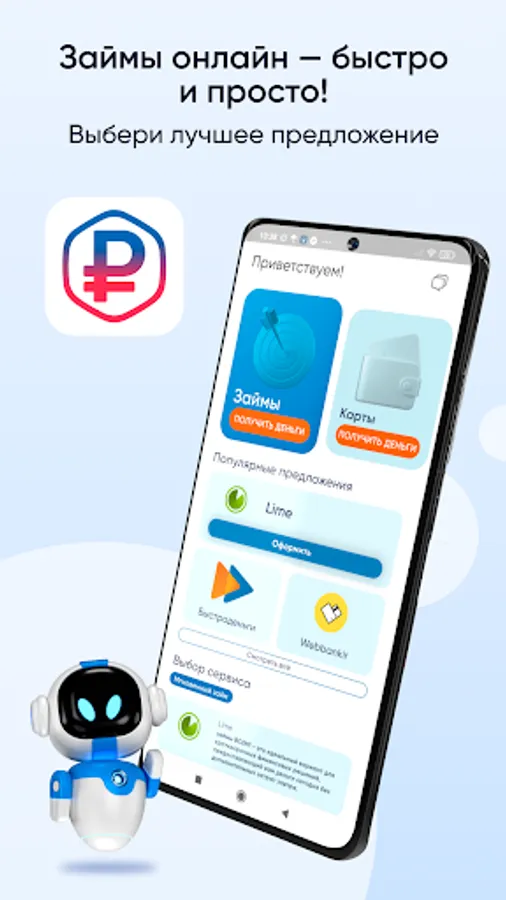

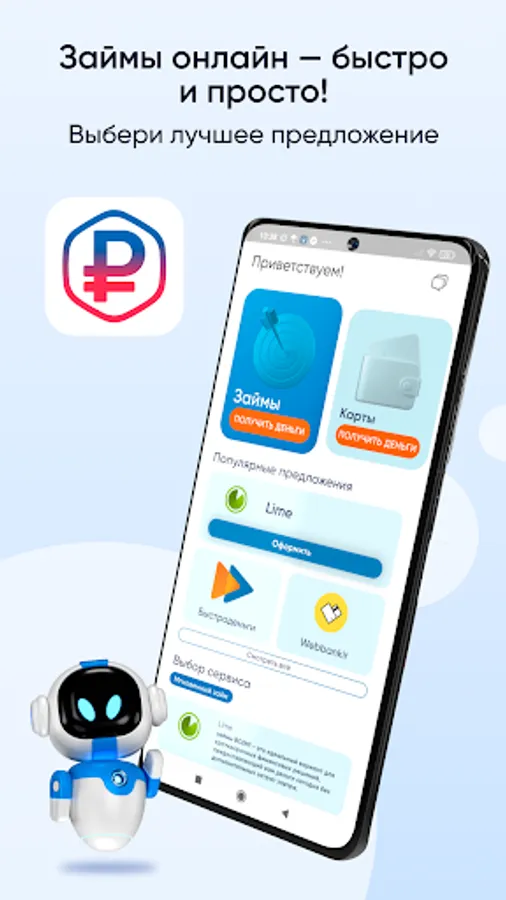

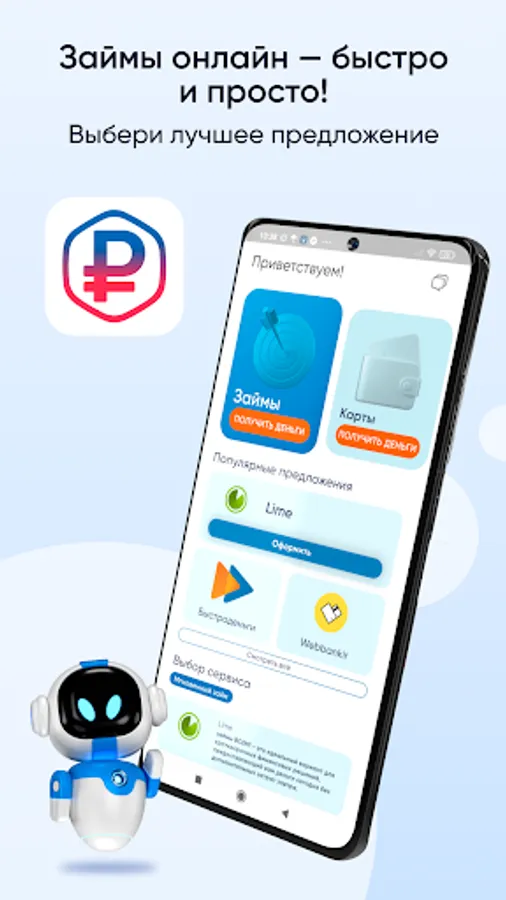

My Loan is your assistant in finding loans online.

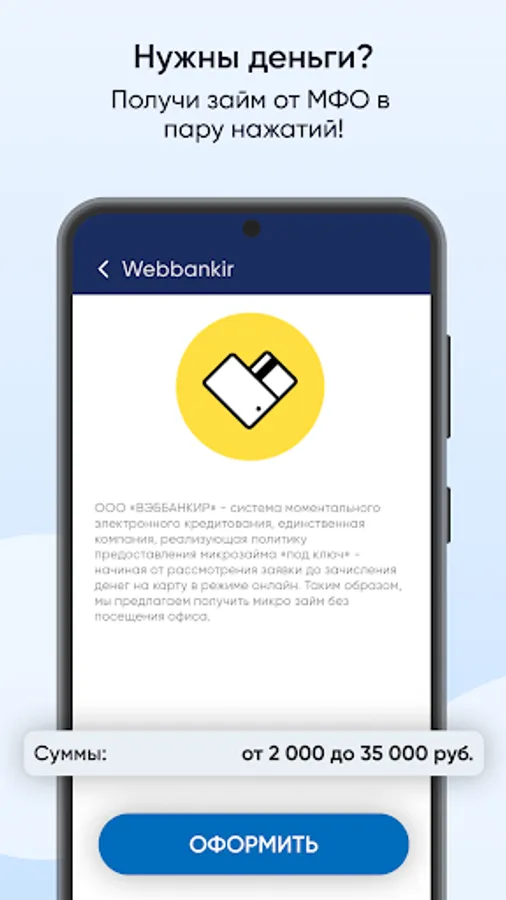

This is a convenient financial marketplace that helps you find and compare offers of microloans and loans to a card from trusted microfinance organizations. We do not issue loans and are not a lender, but provide up-to-date information so that you can make an informed choice.

📲 What you will find in the application

• Simple and clear interface: Easily navigate and find the information you need.

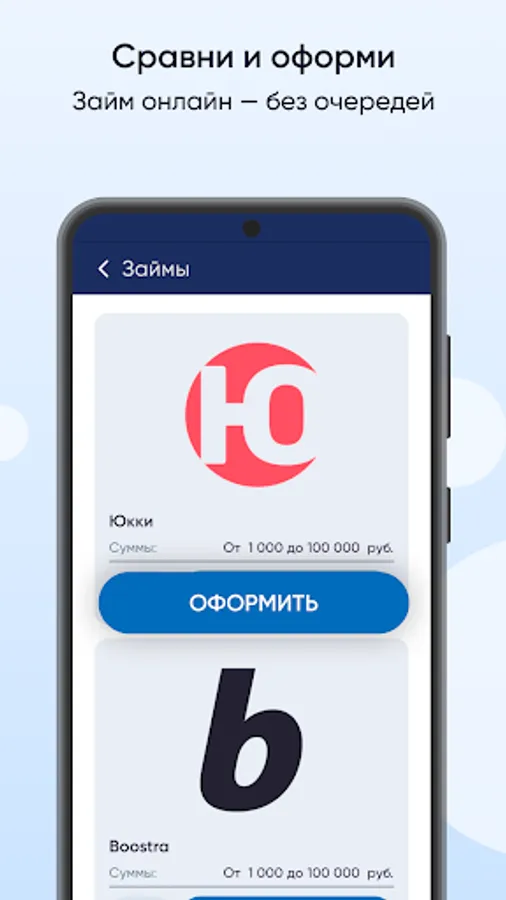

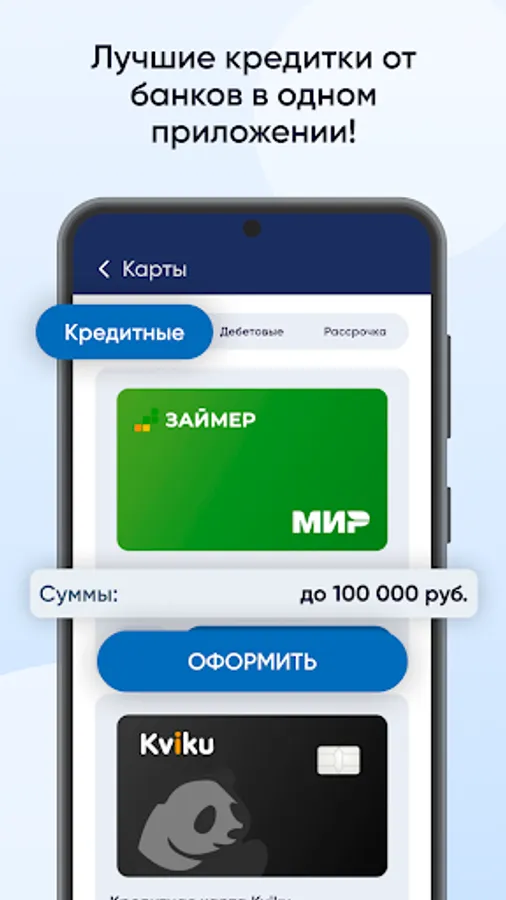

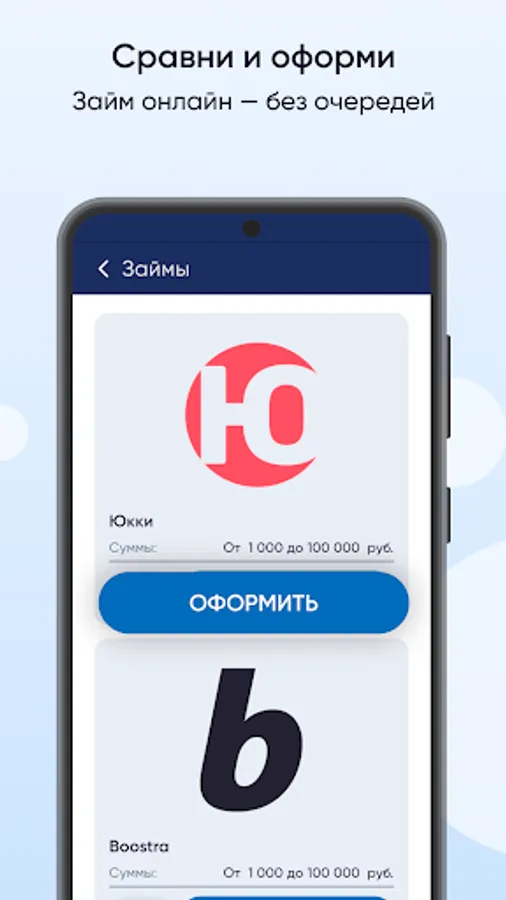

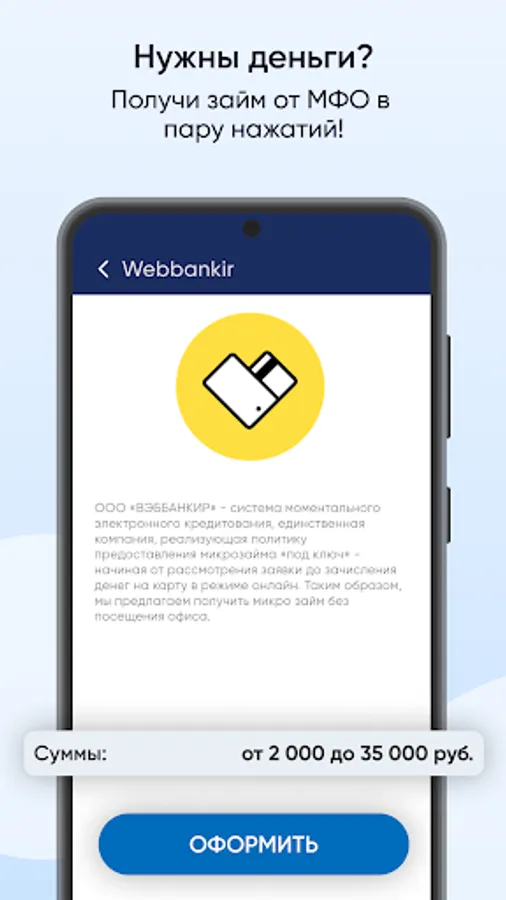

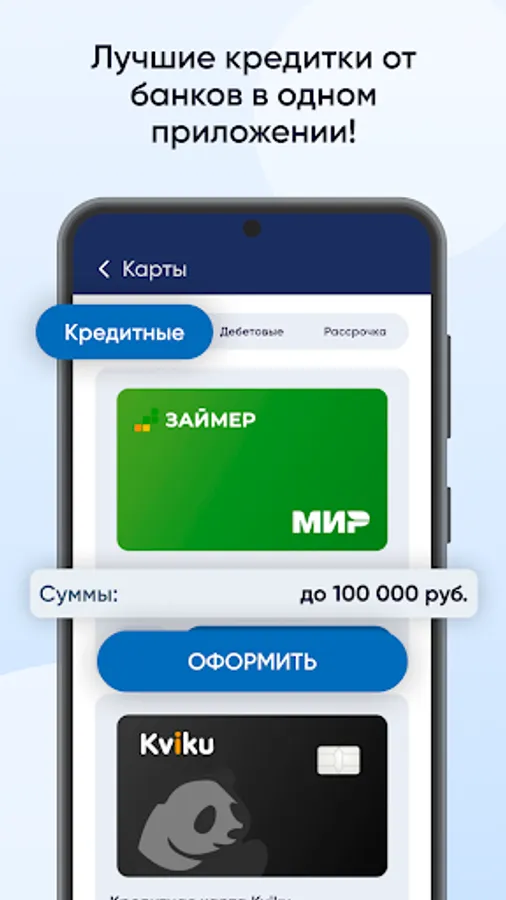

• Offer overview: Study the terms of loans to a card and microloans.

• Compare parameters: Evaluate amounts, terms and rates to choose the right option.

• Convenient form: Transfer data directly to lenders through the application.

• Direct responses: Receive a response from lenders without unnecessary steps.

🔍 How it works

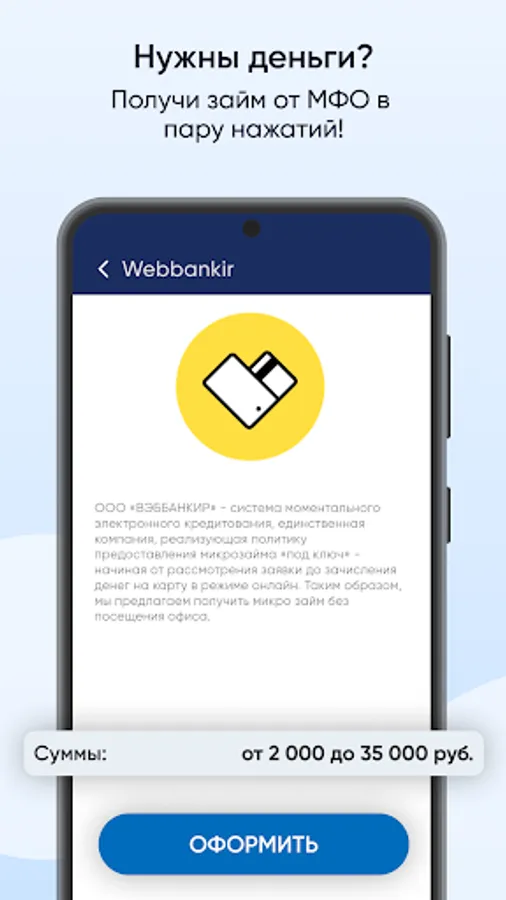

My Loan gives you access to current offers from partner organizations. You choose the loan that suits you, and the app helps you transfer your information to the lender. We do not analyze data or select personal solutions, the choice is yours!

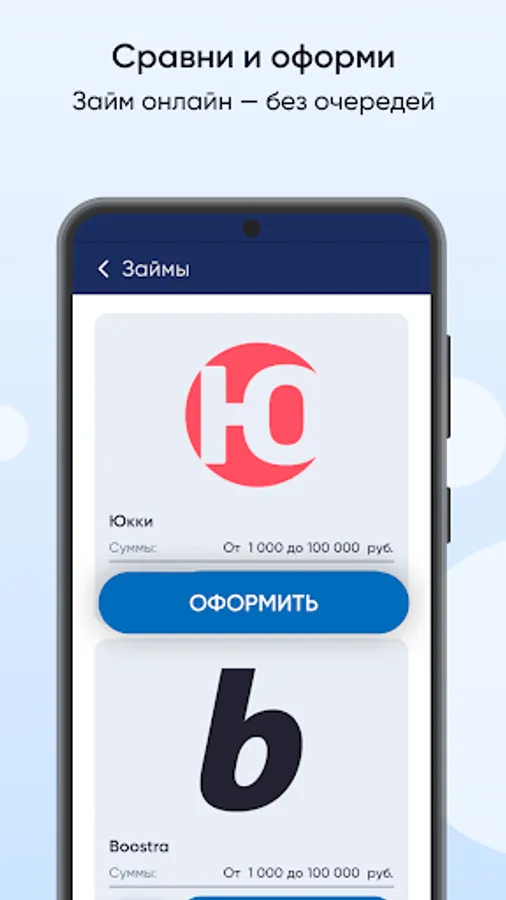

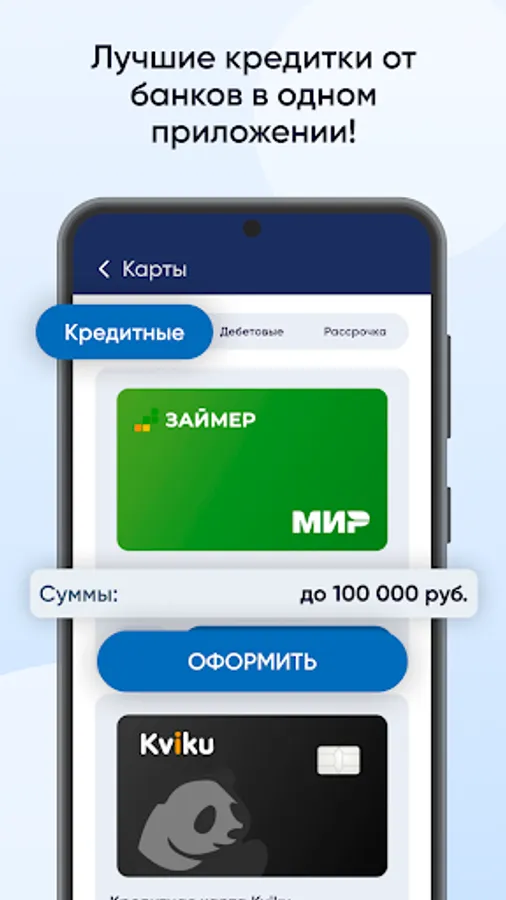

💳 Loans to a card and microloans

The app contains offers from reliable partners. You will find:

• Information on amounts, terms, and rates.

• Convenient access to offers 24/7.

• The ability to apply online without visiting the office.

🔐 Data security

Your data is protected using the SSL protocol, which guarantees the security of information transfer in accordance with modern standards.

📥 Why choose My Loan

- Wide selection: Check out the best loan offers online.

- Convenience: Simple interface for quick search.

- Security: Reliable protection of your data.

- Flexibility: Suitable for short-term financial goals.

- Transparency: All conditions are available for review before applying.

Important: Loan terms are set by lenders. We recommend that you carefully study the details of each offer before using the service.

My Loan is your reliable information assistant for finding online loans and microloans. Install the application and find a suitable financial solution today!

Conditions for receiving loans online:

• The minimum period for repaying an online loan is 91 days, the maximum does not exceed 365 days.

• The annual interest rate will not exceed 32.5%. The basic rate for using credit funds ranges from 6.0% to 32.5%.

• The interest rate for using the loan varies from a minimum of 0.01% to a maximum of 0.01% daily.

• A penalty of 0.1% of the overdue amount is provided for in case of delay every day, but the total penalty amount will not exceed 10% of the original amount of the online loan.

• Additional commissions or fees do not burden the client with a loan to the card.

A detailed example of calculating the interest rate for microloans:

1. Loan - 10,000 rubles.

2. The loan period is 91 days.

3. The daily commission is 0.01% or 10 rubles, which is approximately 3% monthly (calculated for 30 days) or 300 rubles per month.

4. Summing up all the commission charges for 91 days, we get 900 rubles.

5. The total amount to be returned is 10,900 rubles.

6. The FLC or full cost (FLC) expressed as a percentage is 32.5% per annum.

If you miss the payment deadline, the penalty will be 0.1% of the total amount of the overdue payment each day, but not more than 10% of the total loan amount.

Requirements: age from 18 to 65 years.

This is a convenient financial marketplace that helps you find and compare offers of microloans and loans to a card from trusted microfinance organizations. We do not issue loans and are not a lender, but provide up-to-date information so that you can make an informed choice.

📲 What you will find in the application

• Simple and clear interface: Easily navigate and find the information you need.

• Offer overview: Study the terms of loans to a card and microloans.

• Compare parameters: Evaluate amounts, terms and rates to choose the right option.

• Convenient form: Transfer data directly to lenders through the application.

• Direct responses: Receive a response from lenders without unnecessary steps.

🔍 How it works

My Loan gives you access to current offers from partner organizations. You choose the loan that suits you, and the app helps you transfer your information to the lender. We do not analyze data or select personal solutions, the choice is yours!

💳 Loans to a card and microloans

The app contains offers from reliable partners. You will find:

• Information on amounts, terms, and rates.

• Convenient access to offers 24/7.

• The ability to apply online without visiting the office.

🔐 Data security

Your data is protected using the SSL protocol, which guarantees the security of information transfer in accordance with modern standards.

📥 Why choose My Loan

- Wide selection: Check out the best loan offers online.

- Convenience: Simple interface for quick search.

- Security: Reliable protection of your data.

- Flexibility: Suitable for short-term financial goals.

- Transparency: All conditions are available for review before applying.

Important: Loan terms are set by lenders. We recommend that you carefully study the details of each offer before using the service.

My Loan is your reliable information assistant for finding online loans and microloans. Install the application and find a suitable financial solution today!

Conditions for receiving loans online:

• The minimum period for repaying an online loan is 91 days, the maximum does not exceed 365 days.

• The annual interest rate will not exceed 32.5%. The basic rate for using credit funds ranges from 6.0% to 32.5%.

• The interest rate for using the loan varies from a minimum of 0.01% to a maximum of 0.01% daily.

• A penalty of 0.1% of the overdue amount is provided for in case of delay every day, but the total penalty amount will not exceed 10% of the original amount of the online loan.

• Additional commissions or fees do not burden the client with a loan to the card.

A detailed example of calculating the interest rate for microloans:

1. Loan - 10,000 rubles.

2. The loan period is 91 days.

3. The daily commission is 0.01% or 10 rubles, which is approximately 3% monthly (calculated for 30 days) or 300 rubles per month.

4. Summing up all the commission charges for 91 days, we get 900 rubles.

5. The total amount to be returned is 10,900 rubles.

6. The FLC or full cost (FLC) expressed as a percentage is 32.5% per annum.

If you miss the payment deadline, the penalty will be 0.1% of the total amount of the overdue payment each day, but not more than 10% of the total loan amount.

Requirements: age from 18 to 65 years.