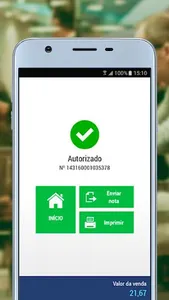

With Pagzilla, your sale becomes much more agile and effective.

• Full integration:

Integrate debit/credit card payment with the generation of Electronic Invoice (NFC-e) directly to SEFAZ.

• Cost reduction:

Decrease your maintenance costs for fixed cash points at the point of sale.

• Resource optimization:

Simultaneously eliminate the problem of idle boxes and give your business more versatility.

• More satisfied customers:

Your customers' shopping experience becomes more fluid, generating satisfaction and greater flow in your establishment.

Check if your company's CFOP is accepted by Pagzilla.

CFOP (Operations and Provision Fiscal Code) is a code that defines whether or not taxes are collected on goods received and transported in your company.

Check below the CFOP’s allowed by Pagzilla:

• 5,101 – Sale of the establishment's production

• 5.102 – Sale of third-party merchandise

• 5.103 – Sale of the establishment's production carried out outside the establishment

• 5.104 – Sale of goods purchased or received from third parties, carried out outside the establishment

• 5,115 – Sale of goods acquired or received from third parties, previously received on commercial consignment

• 5,405 – Sale of merchandise acquired or received from third parties in an operation with merchandise subject to the tax substitution regime, as a substituted taxpayer

• 5,656 – Sale of fuel or lubricant purchased or received from third parties to consumers or end users

Register now: www.pagzilla.com.br.

Contact:

E-mail - atendimento@pagzilla.com.br

WhatsApp - (51) 99533-6398

• Full integration:

Integrate debit/credit card payment with the generation of Electronic Invoice (NFC-e) directly to SEFAZ.

• Cost reduction:

Decrease your maintenance costs for fixed cash points at the point of sale.

• Resource optimization:

Simultaneously eliminate the problem of idle boxes and give your business more versatility.

• More satisfied customers:

Your customers' shopping experience becomes more fluid, generating satisfaction and greater flow in your establishment.

Check if your company's CFOP is accepted by Pagzilla.

CFOP (Operations and Provision Fiscal Code) is a code that defines whether or not taxes are collected on goods received and transported in your company.

Check below the CFOP’s allowed by Pagzilla:

• 5,101 – Sale of the establishment's production

• 5.102 – Sale of third-party merchandise

• 5.103 – Sale of the establishment's production carried out outside the establishment

• 5.104 – Sale of goods purchased or received from third parties, carried out outside the establishment

• 5,115 – Sale of goods acquired or received from third parties, previously received on commercial consignment

• 5,405 – Sale of merchandise acquired or received from third parties in an operation with merchandise subject to the tax substitution regime, as a substituted taxpayer

• 5,656 – Sale of fuel or lubricant purchased or received from third parties to consumers or end users

Register now: www.pagzilla.com.br.

Contact:

E-mail - atendimento@pagzilla.com.br

WhatsApp - (51) 99533-6398

Show More