Migros Bank E-Banking

Migros Bank AG

2.5 ★

12K ratings

100,000+

downloads

Free

With this e-banking app, you can manage accounts, perform transfers, pay bills, and view market data. Includes account monitoring, transaction history, and notifications.

AppRecs review analysis

AppRecs rating 2.4. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.4

AppRecs Rating

Ratings breakdown

5 star

24%

4 star

10%

3 star

8%

2 star

13%

1 star

46%

What to know

✓

Authentic reviews

Natural distribution, no red flags

⚠

Mixed user feedback

Average 2.5★ rating suggests room for improvement

⚠

High negative review ratio

58% of sampled ratings are 1–2 stars

About Migros Bank E-Banking

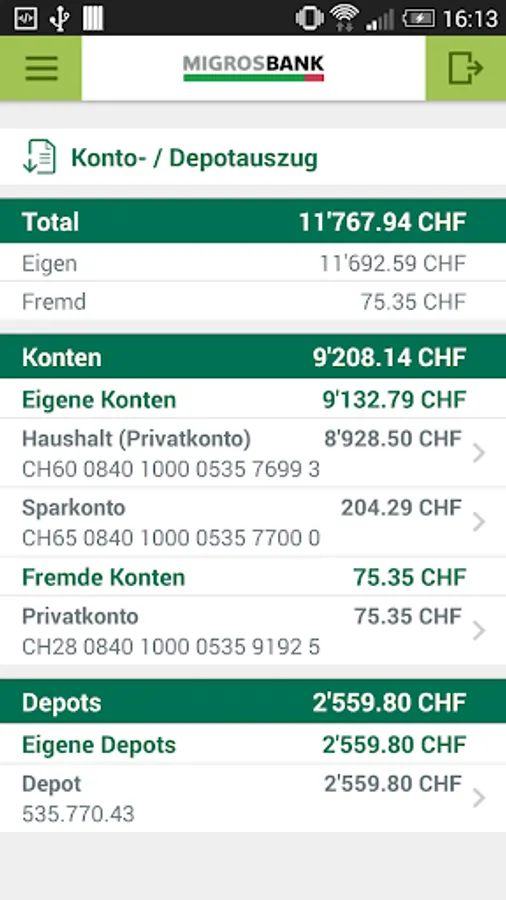

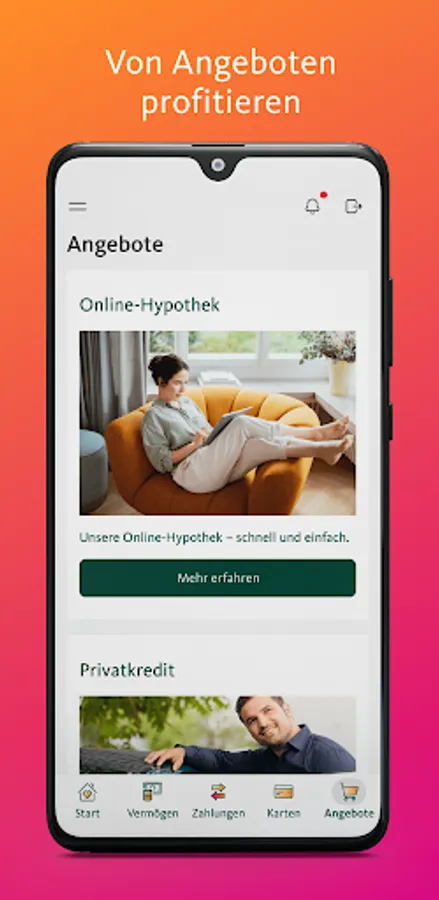

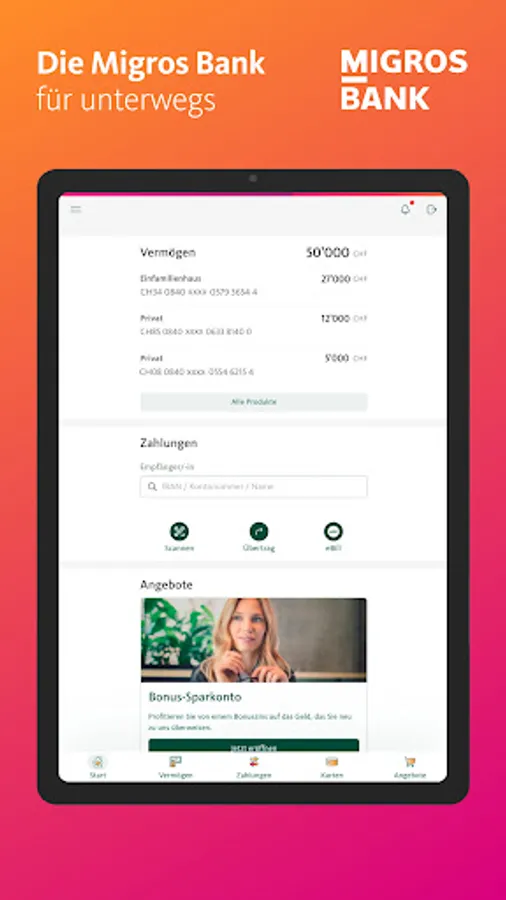

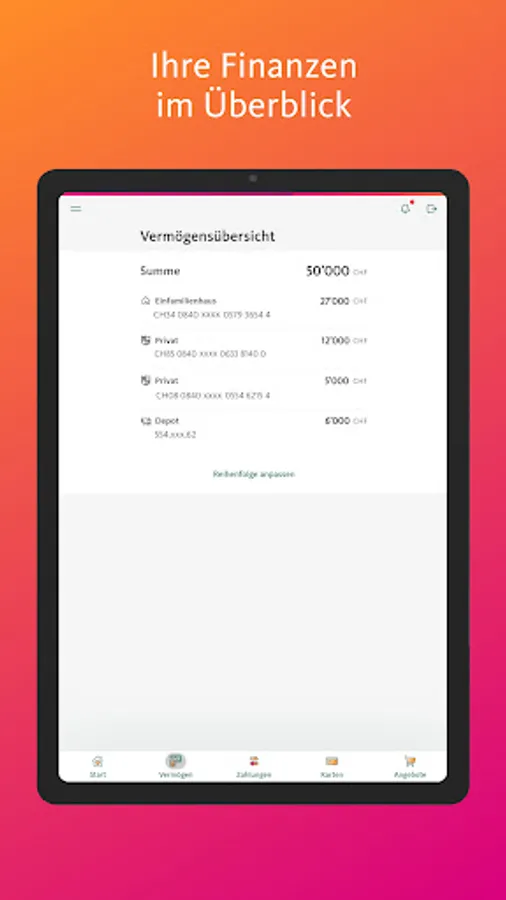

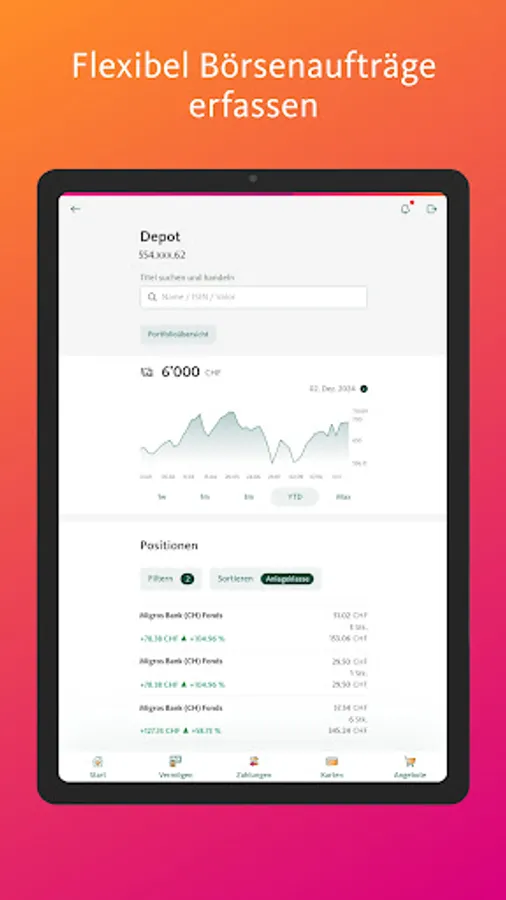

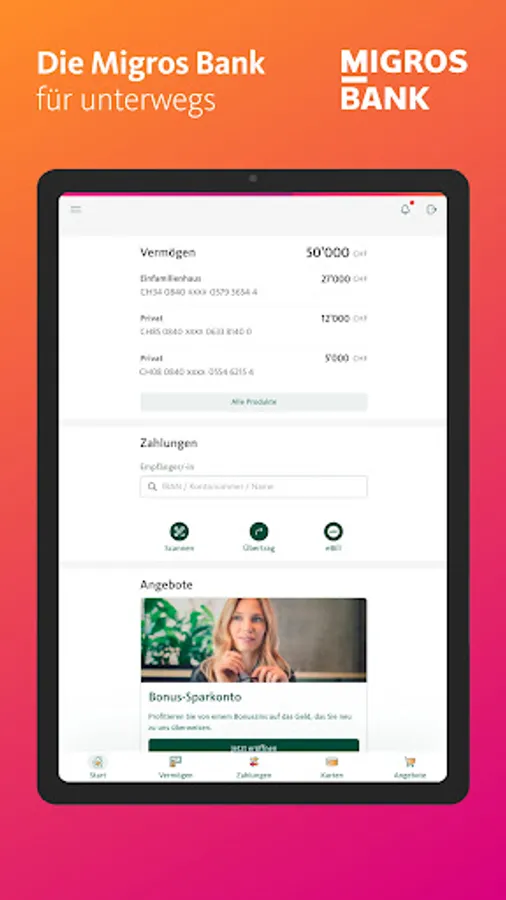

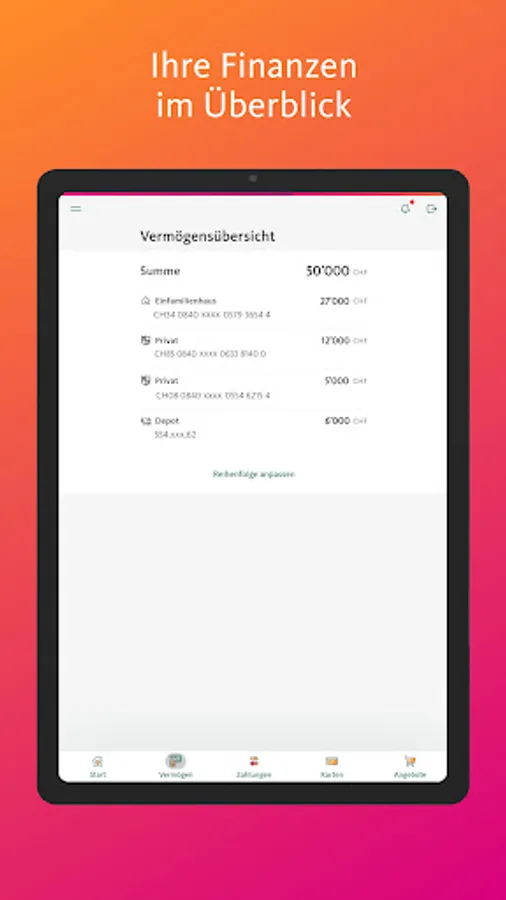

With the Migros Bank E-Banking app you have access to your accounts and deposits anytime, anywhere. You can scan and pay invoices and record account transfers or stock market orders. At a glance you can see the current stock market prices, currencies and interest rates.

E-banking – the most important functions

- Always keep an eye on your accounts, deposits, mortgages and loans.

- Check your transactions and create account and securities account statements.

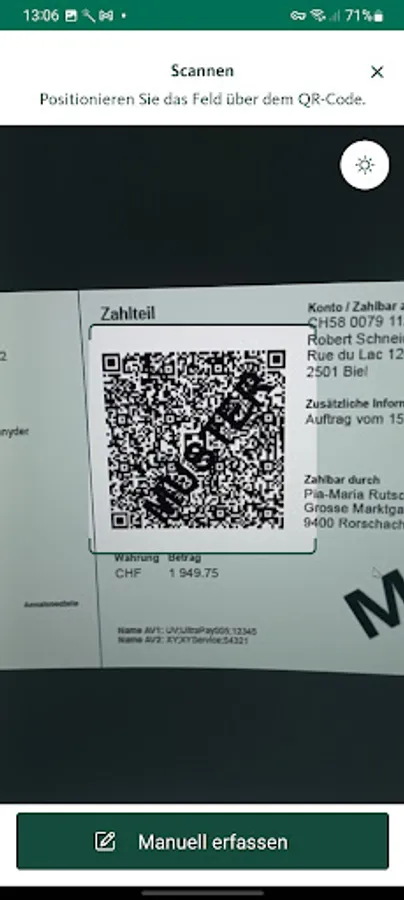

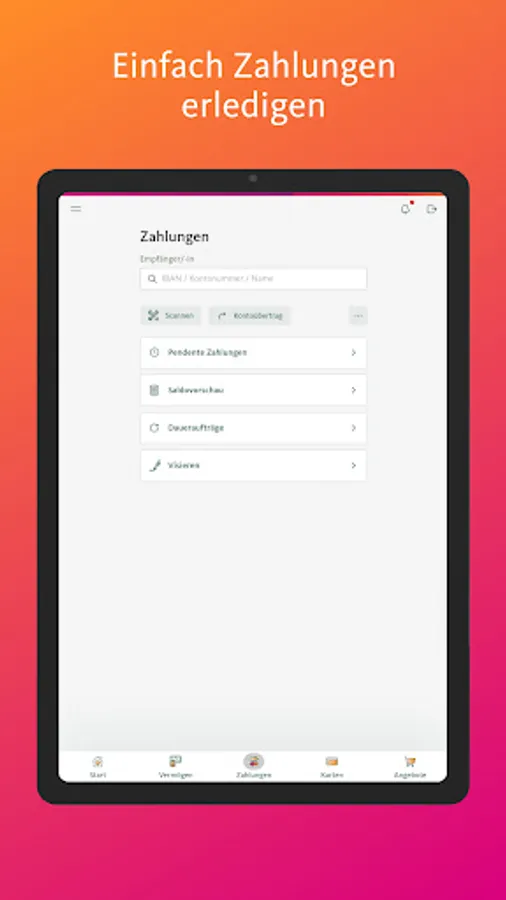

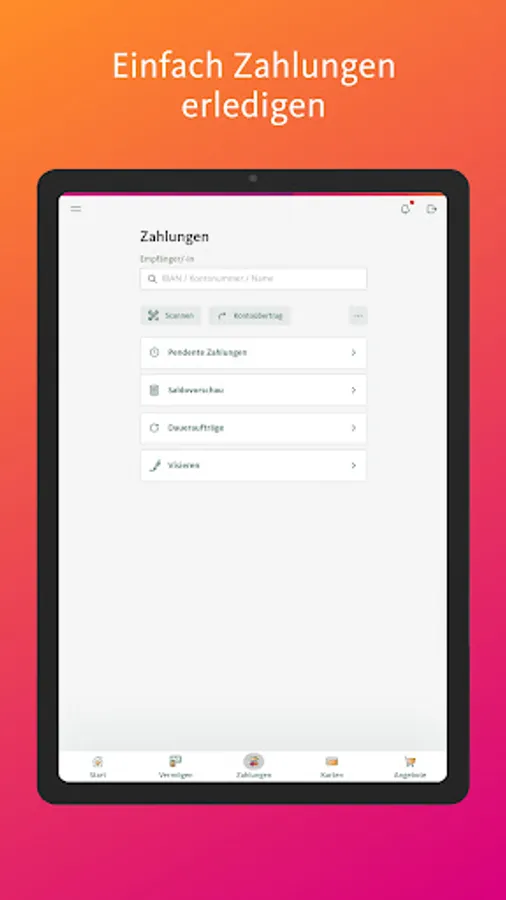

- Scan and pay QR bills or share eBill invoices.

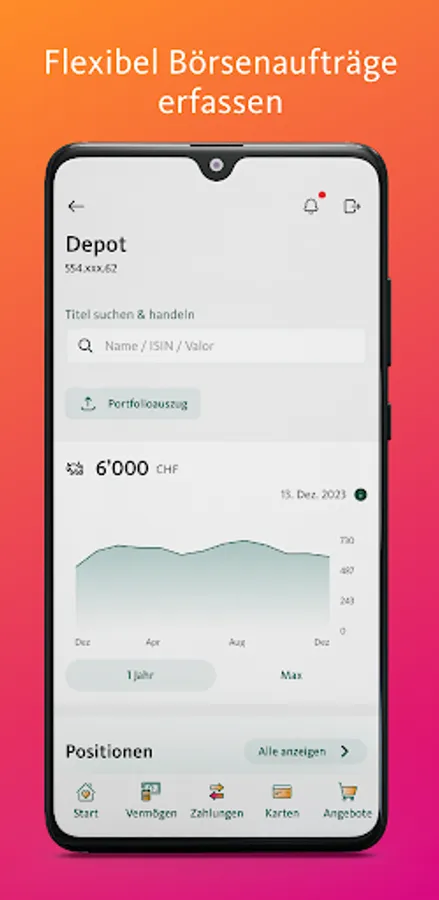

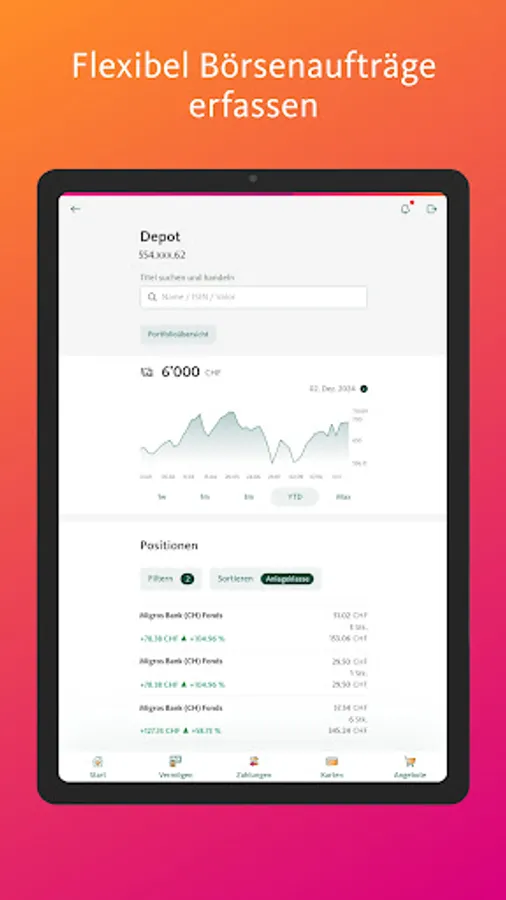

- Enter account transfers, standing orders or stock exchange orders.

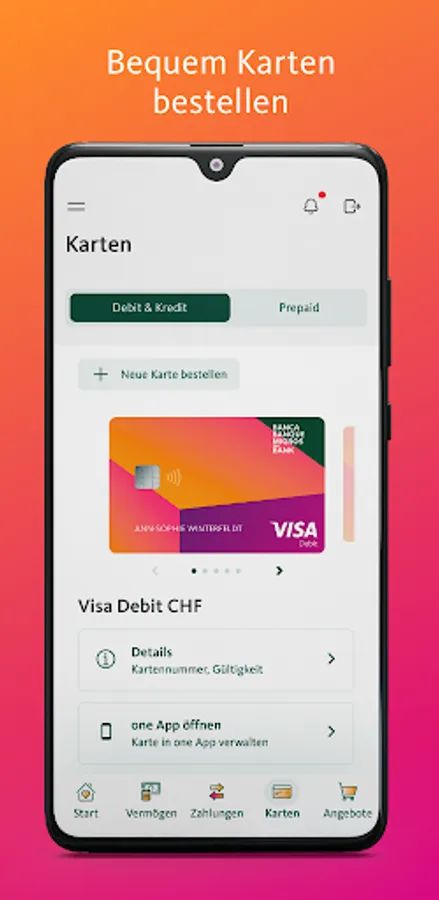

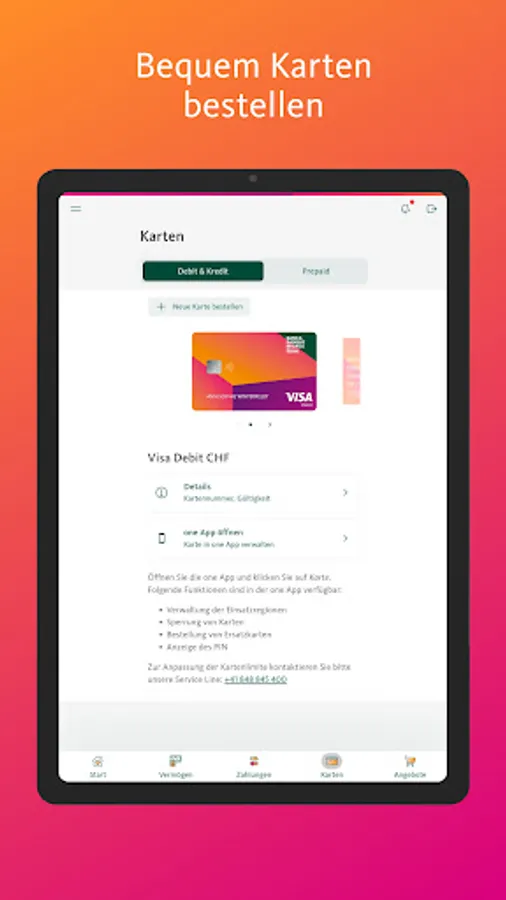

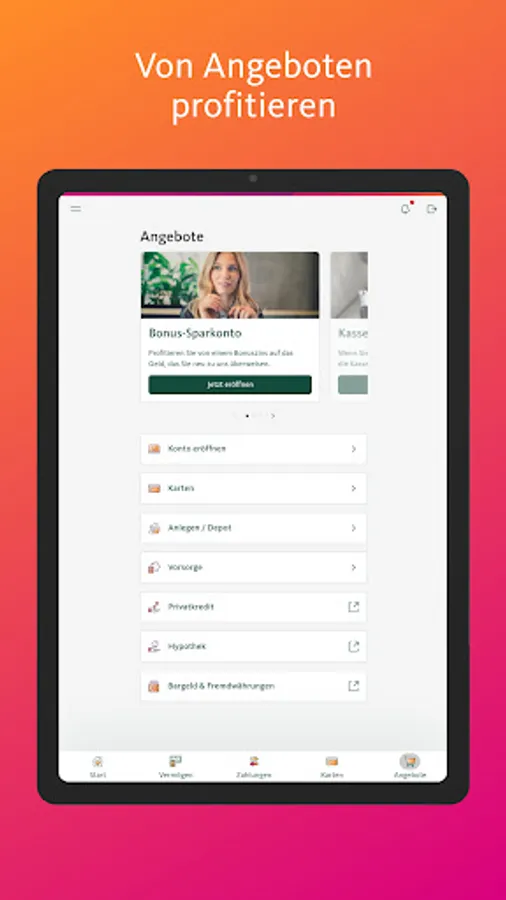

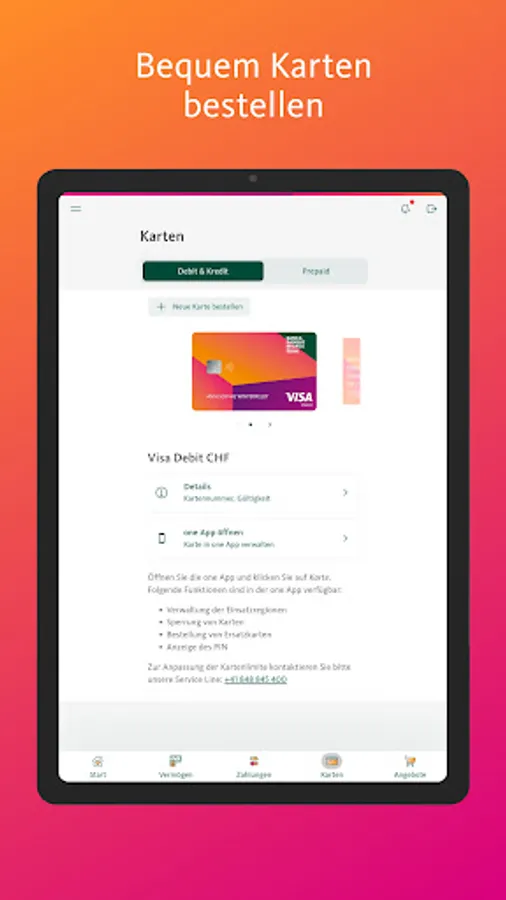

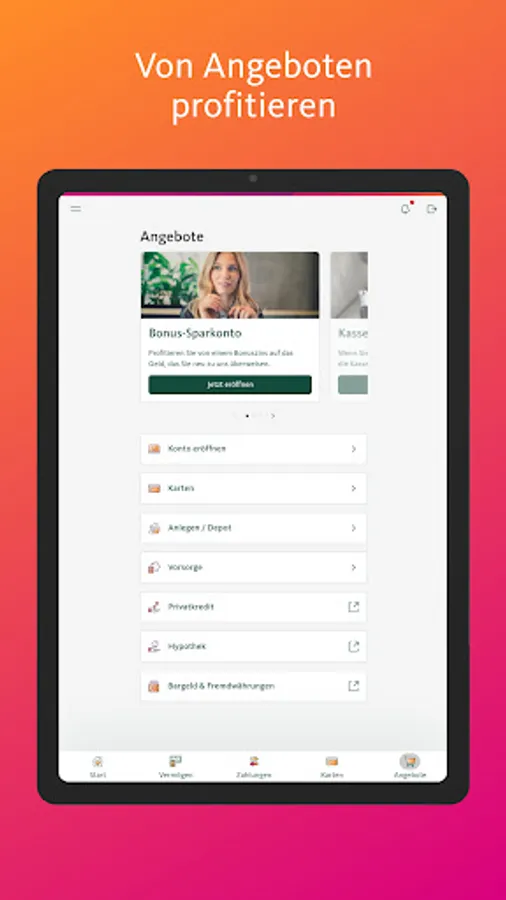

- Order new cards and open new accounts directly in the app.

- Use the QR code scanning function in your app to conveniently log in to e-banking from any computer via the Migros Bank website.

Financial data

- Follow stock market prices with the watchlist.

- Find out the Migros Bank banknote and foreign exchange rates.

- View the interest rates on our accounts, mortgages and medium-term notes.

Services

- Get notified by email or SMS when new bank documents are received, account transactions are made or payments are not made.

- Send us messages or arrange a personal consultation.

- Find all important phone numbers and addresses including emergency numbers for card blocking.

- Use the location search to find the nearest Migros Bank branch or free cash withdrawal options.

Requirement

In order to use the Migros Bank e-banking app, you must be a customer of Migros Bank.

safety instructions

Migros Bank meets strict security standards in the area of e-banking. You can also make an important contribution to safety by taking simple measures:

- Do not leave your device unattended.

- Keep your password secret.

- Enter your password hidden.

- Update your operating system and your Migros Bank e-banking app regularly; Enable automatic updates whenever possible.

E-banking – the most important functions

- Always keep an eye on your accounts, deposits, mortgages and loans.

- Check your transactions and create account and securities account statements.

- Scan and pay QR bills or share eBill invoices.

- Enter account transfers, standing orders or stock exchange orders.

- Order new cards and open new accounts directly in the app.

- Use the QR code scanning function in your app to conveniently log in to e-banking from any computer via the Migros Bank website.

Financial data

- Follow stock market prices with the watchlist.

- Find out the Migros Bank banknote and foreign exchange rates.

- View the interest rates on our accounts, mortgages and medium-term notes.

Services

- Get notified by email or SMS when new bank documents are received, account transactions are made or payments are not made.

- Send us messages or arrange a personal consultation.

- Find all important phone numbers and addresses including emergency numbers for card blocking.

- Use the location search to find the nearest Migros Bank branch or free cash withdrawal options.

Requirement

In order to use the Migros Bank e-banking app, you must be a customer of Migros Bank.

safety instructions

Migros Bank meets strict security standards in the area of e-banking. You can also make an important contribution to safety by taking simple measures:

- Do not leave your device unattended.

- Keep your password secret.

- Enter your password hidden.

- Update your operating system and your Migros Bank e-banking app regularly; Enable automatic updates whenever possible.