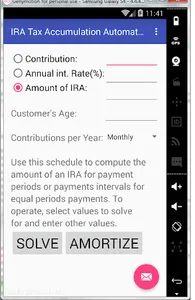

IRA Tax Accumulation computes the funds saved or invested in an IRA for

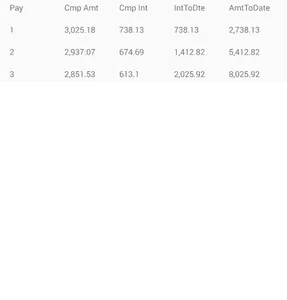

payment per payment intervals for equal periodic payment. Includes payment

number, compound amount, compound interest, interest to date and

amount to date. Taxable accumulation assumes a 28% federal tax bracket.

payment per payment intervals for equal periodic payment. Includes payment

number, compound amount, compound interest, interest to date and

amount to date. Taxable accumulation assumes a 28% federal tax bracket.

Show More