Corebridge

Corebridge Financial

2.0 ★

store rating

10,000+

downloads

Free

AppRecs review analysis

AppRecs rating 2.0. Trustworthiness 74 out of 100. Review manipulation risk 19 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.0

AppRecs Rating

Ratings breakdown

5 star

18%

4 star

6%

3 star

5%

2 star

4%

1 star

67%

What to know

✓

Low review manipulation risk

19% review manipulation risk

⚠

Mixed user feedback

Average 2.0★ rating suggests room for improvement

⚠

High negative review ratio

71% of sampled ratings are 1–2 stars

About Corebridge

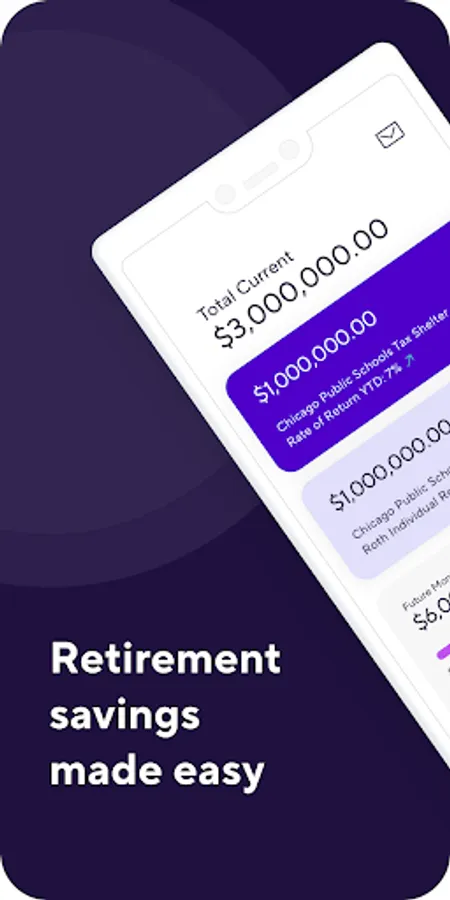

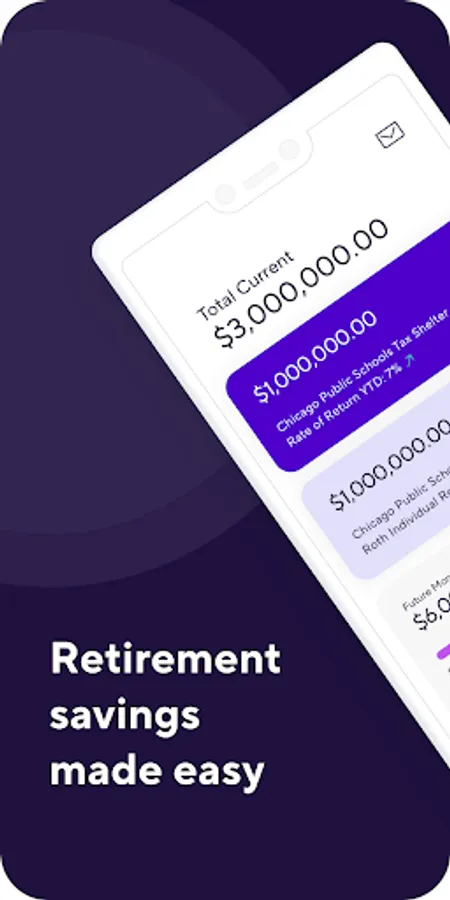

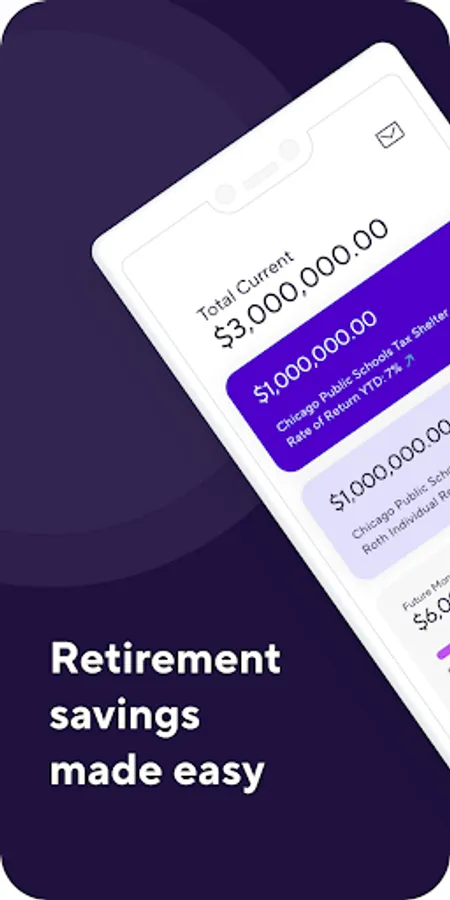

At Corebridge Financial, action is everything. And with the Corebridge mobile app, you can take action from anywhere.

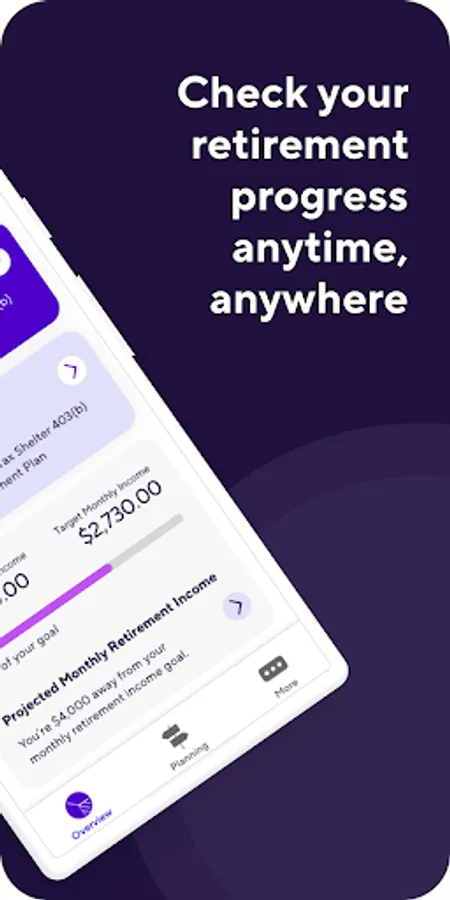

Learn if you are on track for retirement and receive suggestions on small changes you can make to reach your goals. Easily view account history, fund performance, and savings strategy all in one place. It’s easy to stop looking ahead and start moving ahead when you have the power to act at your fingertips.

Key features:

• Easy plan enrollment - A guided process helps you get started in your workplace retirement plan with ease. Choose contribution amount, investment strategy and you’re done! Finish your enrollment by completing your online profile to secure account information.

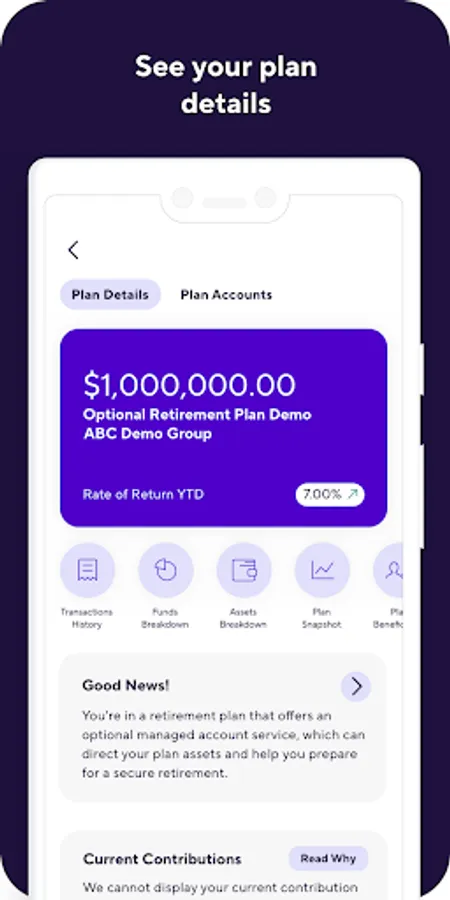

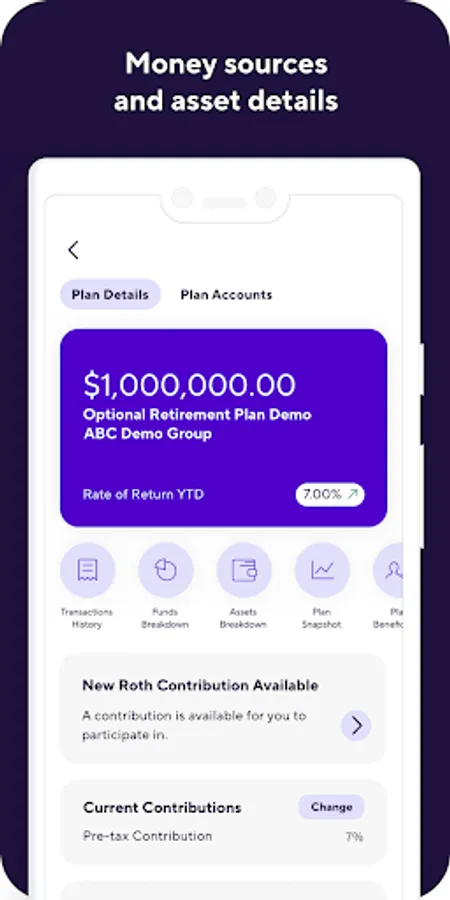

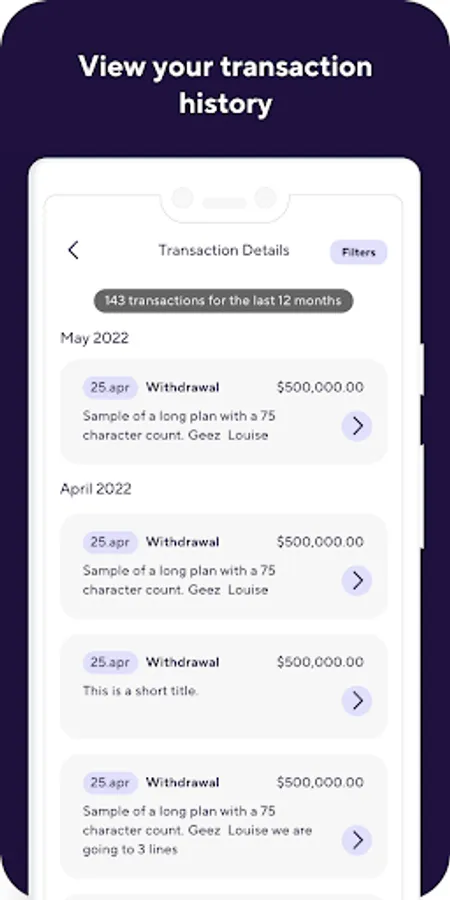

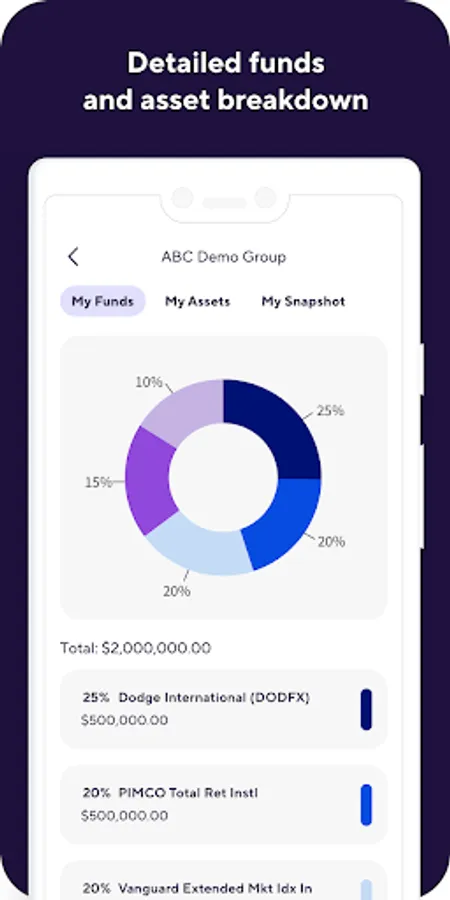

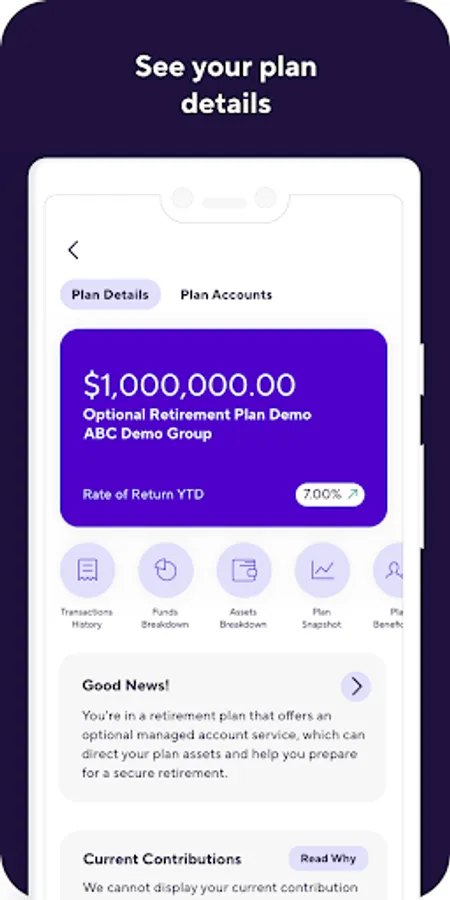

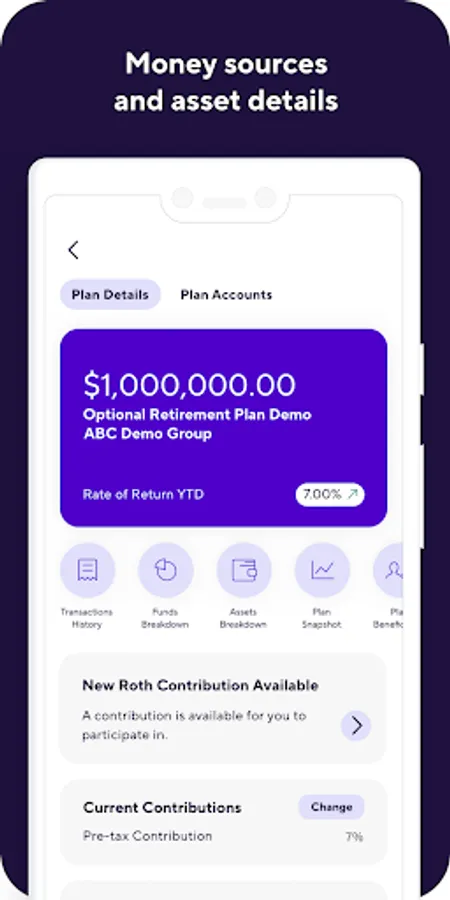

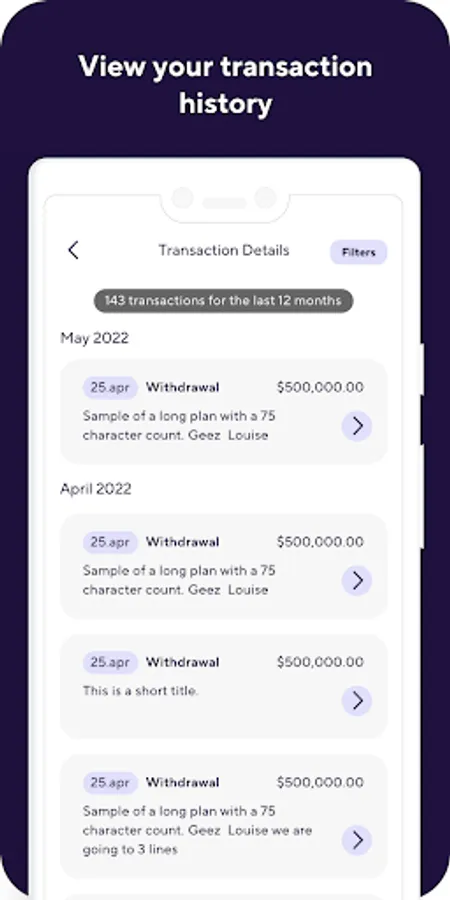

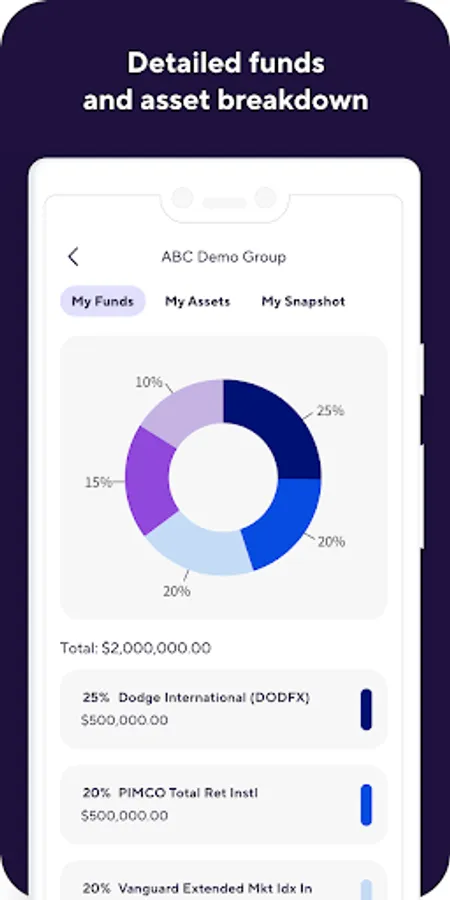

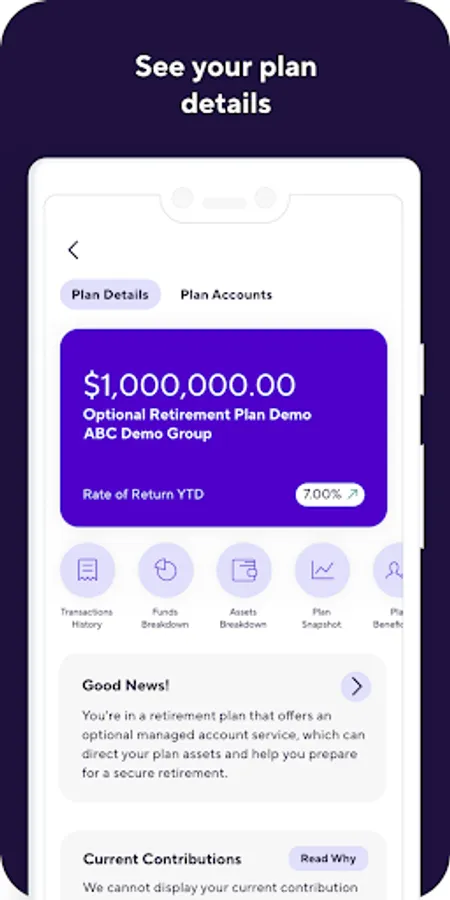

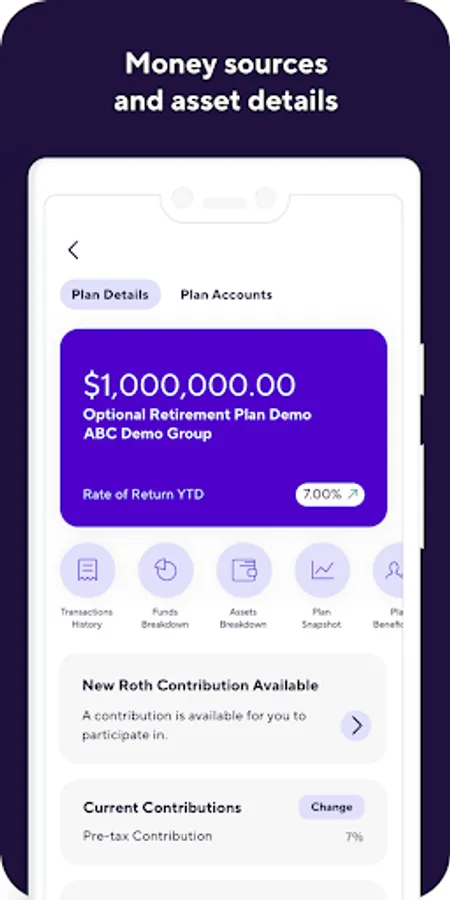

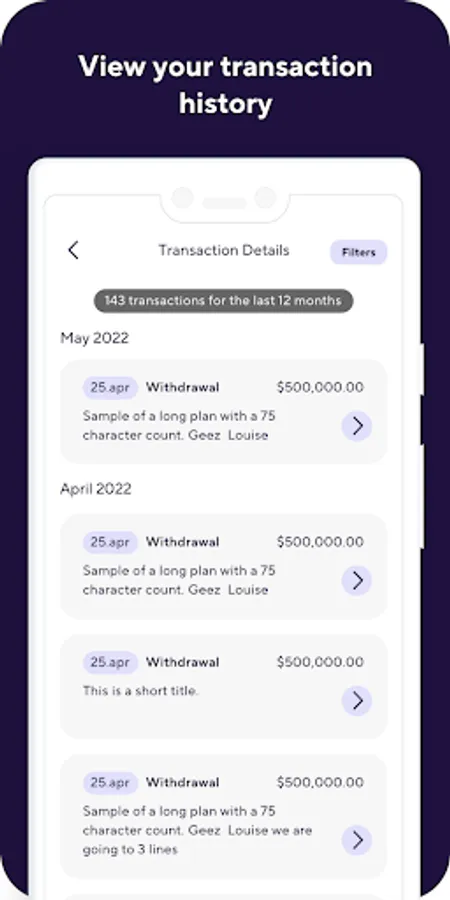

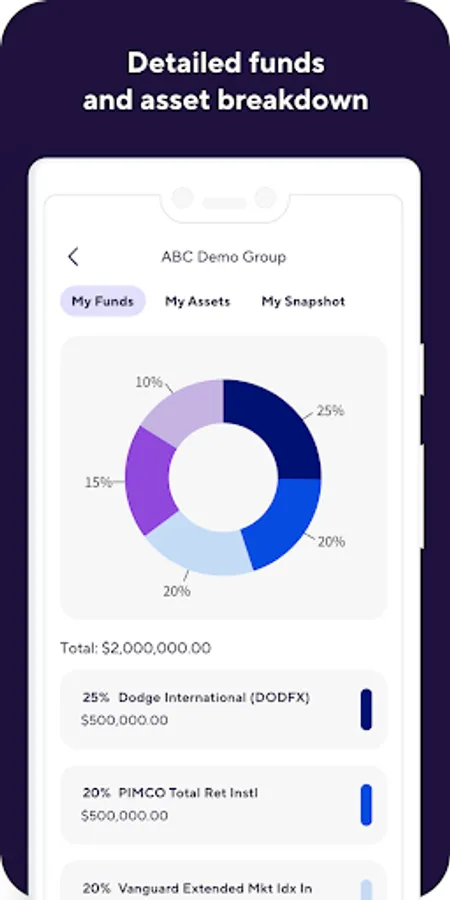

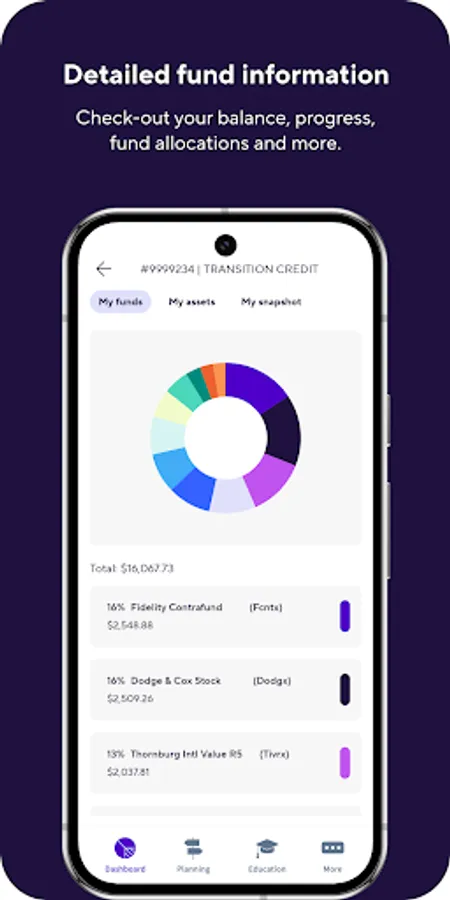

• Personal dashboard - Check-out your balance, progress, asset allocations, transaction history and more from your personal dashboard. Link additional accounts to view all your investments in one place.

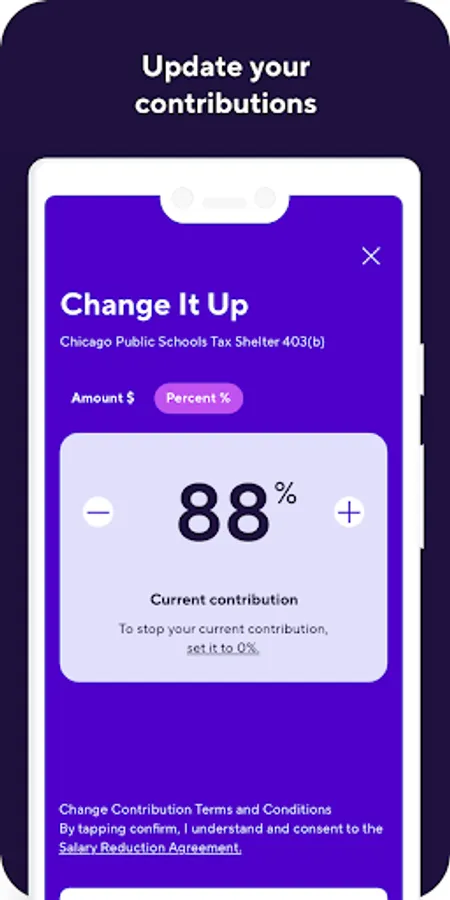

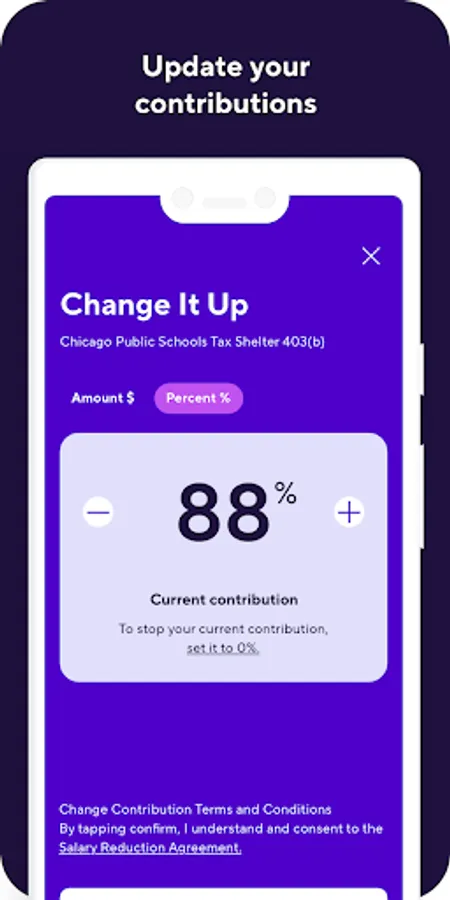

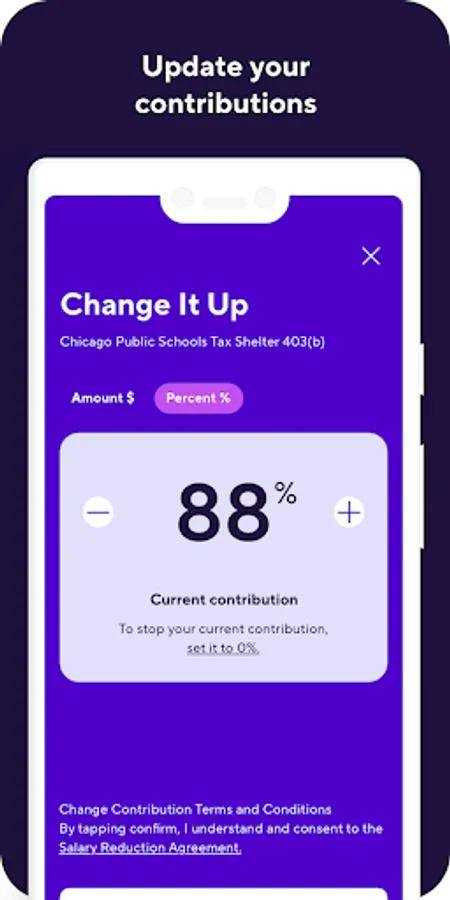

• Simplified transactions - In just a few quick clicks, you can update your contributions, manage beneficiaries, add a trusted contact, go paperless with e-Delivery, and adjust your asset allocation.

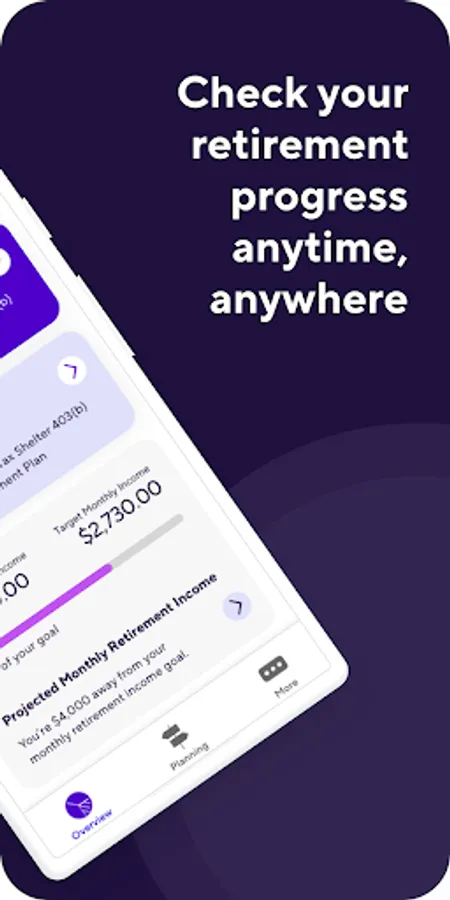

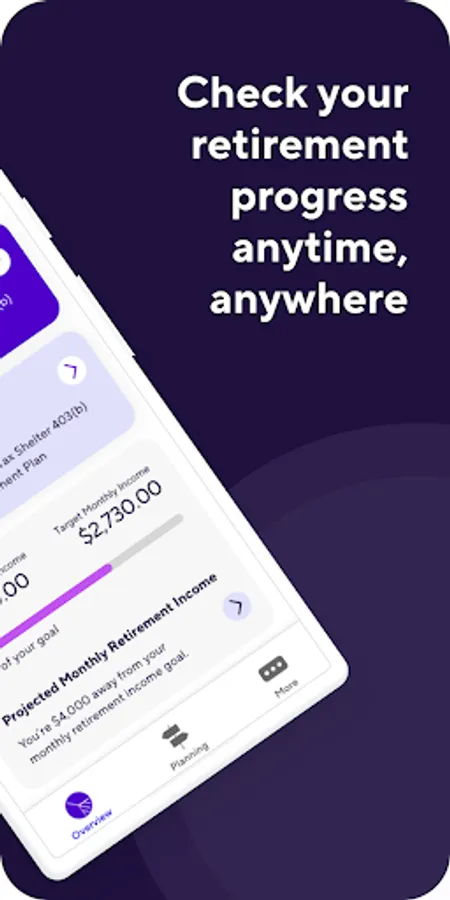

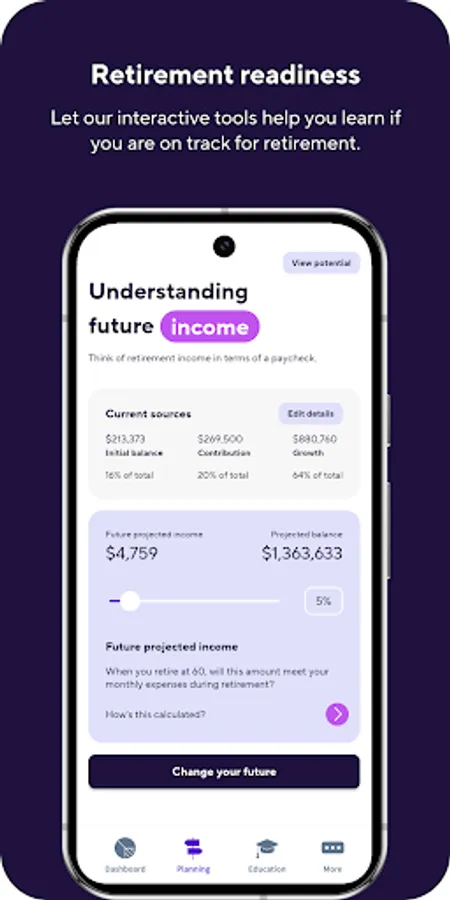

• Retirement guidance - Let our interactive retirement readiness tool help you learn if you are on track for retirement or if a few quick adjustments can help. Make changes to your strategy instantly and see how your progress improves.

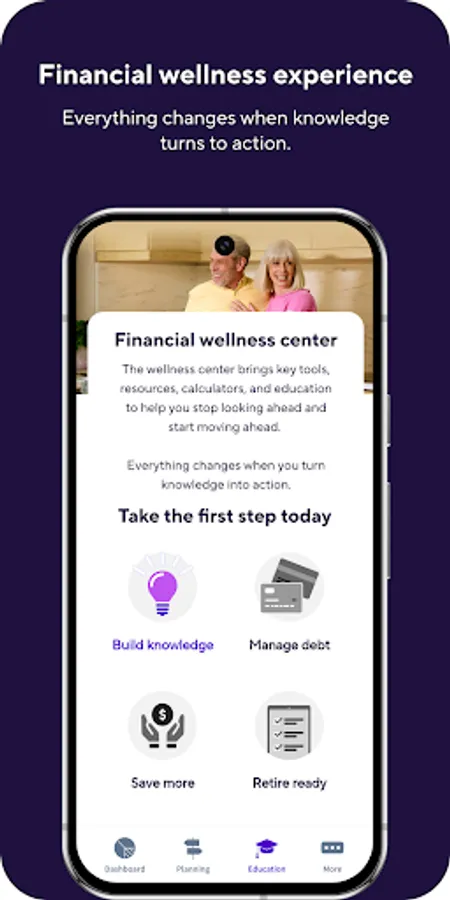

• Financial wellness experience - Become active in your learning journey and explore tools, articles and calculators aligned to your greatest financial wellness need. Everything changes when knowledge turns to action.

• Secure features - Multi-factor authentication and biometric capabilities are available to help safeguard your account from fraud and cyber threats.

Learn if you are on track for retirement and receive suggestions on small changes you can make to reach your goals. Easily view account history, fund performance, and savings strategy all in one place. It’s easy to stop looking ahead and start moving ahead when you have the power to act at your fingertips.

Key features:

• Easy plan enrollment - A guided process helps you get started in your workplace retirement plan with ease. Choose contribution amount, investment strategy and you’re done! Finish your enrollment by completing your online profile to secure account information.

• Personal dashboard - Check-out your balance, progress, asset allocations, transaction history and more from your personal dashboard. Link additional accounts to view all your investments in one place.

• Simplified transactions - In just a few quick clicks, you can update your contributions, manage beneficiaries, add a trusted contact, go paperless with e-Delivery, and adjust your asset allocation.

• Retirement guidance - Let our interactive retirement readiness tool help you learn if you are on track for retirement or if a few quick adjustments can help. Make changes to your strategy instantly and see how your progress improves.

• Financial wellness experience - Become active in your learning journey and explore tools, articles and calculators aligned to your greatest financial wellness need. Everything changes when knowledge turns to action.

• Secure features - Multi-factor authentication and biometric capabilities are available to help safeguard your account from fraud and cyber threats.