Every day, we spend too much money at many places and pay excessive taxes on every product and other things. Sometimes we do not have sufficient funds yet we prefer to buy products through a loan option. The spent amount can't be easily calculated for each rate of tax and interest rate. So, day-to-day family expense tracking is too complex.

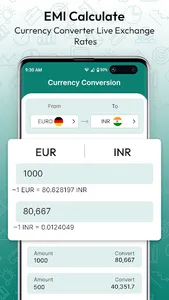

If you want to track your expenses and calculate simple and effective loan EMI then Finance Calculator is the great choice for you. Finance Calculator is designed for you to calculate EMI loans and view upcoming payment schedules. With Finance managing app you can plan your monthly tax expense to control and boost your wealth in a tap.

Features of Finance Calculator for GST TAX

1. EMI Calculator:

↦ In the EMI calculator insert separate value of your principal loan amount, interest rate, and loan tenure to calculate your monthly EMI and check the total interest which you will pay till the end of your loan.

↦ The EMI calculator for loan apps will help you calculate and compare various loan options, allowing you to determine which EMI best suits your needs and fulfill your criteria. Also, you can check the advance EMI payment option to control or manage your monthly finance budget.

2. TAX Calculator:

↦ GST Calculator: You can check the amount of GST applied to your purchased products also you can calculate the amount of GST that will be applied to your product.

3. Loan Calculator:

↦ In the mobile loan calculator app, it will allow you to calculate every type of loan. With Loan calculator simulation of personal loans, mortgage loans, vehicle loans, etc. This is everything that makes a personal loan EMI calculator.

↦ Every loan provider always ask first question how much you will pay every month. You just need to fill in the details of the loan calculator like loan amount, loan interest rate, and loan tenure. The Finance loan calculator quickly calculates the monthly EMI rate & total interest payable amount.

4. Banking Calculator:

↦ FD Calculator: It will help you to calculate how much interest will be earned on FD. Additionally you can check the calculation of the total interest earned, tenure amount, interest rate, and maturity amount of the deposit.

↦ Cash Calculator: Here you can calculate the number of notes and sum of the every note amount. (EX. 500*2 = 1000 currency)

With Finance Calculator for GST TAX app, financial planning has become easier. After calculation, you can share your financial data in xlsx format with anyone. You can share this financial calculator with your friends and family member to calculate the financial calculation.

NOTES:

↦ Finance calculator app is just for financial tools. It's not a loan provider or not connected with any financial service provider.

If you want to track your expenses and calculate simple and effective loan EMI then Finance Calculator is the great choice for you. Finance Calculator is designed for you to calculate EMI loans and view upcoming payment schedules. With Finance managing app you can plan your monthly tax expense to control and boost your wealth in a tap.

Features of Finance Calculator for GST TAX

1. EMI Calculator:

↦ In the EMI calculator insert separate value of your principal loan amount, interest rate, and loan tenure to calculate your monthly EMI and check the total interest which you will pay till the end of your loan.

↦ The EMI calculator for loan apps will help you calculate and compare various loan options, allowing you to determine which EMI best suits your needs and fulfill your criteria. Also, you can check the advance EMI payment option to control or manage your monthly finance budget.

2. TAX Calculator:

↦ GST Calculator: You can check the amount of GST applied to your purchased products also you can calculate the amount of GST that will be applied to your product.

3. Loan Calculator:

↦ In the mobile loan calculator app, it will allow you to calculate every type of loan. With Loan calculator simulation of personal loans, mortgage loans, vehicle loans, etc. This is everything that makes a personal loan EMI calculator.

↦ Every loan provider always ask first question how much you will pay every month. You just need to fill in the details of the loan calculator like loan amount, loan interest rate, and loan tenure. The Finance loan calculator quickly calculates the monthly EMI rate & total interest payable amount.

4. Banking Calculator:

↦ FD Calculator: It will help you to calculate how much interest will be earned on FD. Additionally you can check the calculation of the total interest earned, tenure amount, interest rate, and maturity amount of the deposit.

↦ Cash Calculator: Here you can calculate the number of notes and sum of the every note amount. (EX. 500*2 = 1000 currency)

With Finance Calculator for GST TAX app, financial planning has become easier. After calculation, you can share your financial data in xlsx format with anyone. You can share this financial calculator with your friends and family member to calculate the financial calculation.

NOTES:

↦ Finance calculator app is just for financial tools. It's not a loan provider or not connected with any financial service provider.

Show More