Ally Banking & Investing

Save, invest, and manage money

Making your financial life simple and secure has always been our thing. Easily manage your bank, credit card, invest, and home loan accounts on the go—all in one mobile banking app.

Bank with us to:

• Save faster with smart savings tools: buckets and boosters

• Set aside money for recurring expenses with spending buckets

• Stress less with no overdraft fees

• Transfer money, pay bills, or use Zelle® to pay anyone with a U.S. bank account

• Deposit checks from your phone with Ally eCheck Deposit℠

• Find 43,000+ no-fee Allpoint ATMs: we reimburse up to $10 per statement cycle for fees charged at other ATMs nationwide

• Keep tabs on your debit card usage with card controls

• Manage CD interest disbursement and maturity options

• View and send secure messages, or chat with us 24/7 using Ally Messenger

Keep up with your credit card:

• Make secure credit card payments, review credit statements, and check your FICO score for free

• Ally Mastercard credit cards available by invitation only

Three ways to invest with us:

Robo Portfolios

• Our intelligent tools do the heavy lifting to manage and monitor your investments

• Invest free of advisory fees with our cash-enhanced portfolio, or invest more of your money in the market with a market-focused portfolio (available for a fee)

• Automate your investing with one of our four portfolio strategies

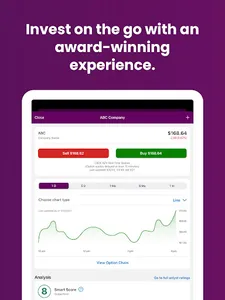

Self-Directed

• Trade commission-free on eligible U.S. stocks, options, and ETFs

• Filter and find exchange-traded funds with our ETF screener

• Use advanced charting tools for technical analysis

Wealth Management

• Receive ongoing guidance from one dedicated advisor for all your assets – even ones we don’t manage

• Link and track financial accounts outside of Ally for a 360° view of your finances

• View and monitor your net worth, investment exposure, and performance

• Start with a $100,000 minimum in assets under care (funds with us)

If your mortgage is serviced by us:

• Track your progress towards paying off your home loan with real-time updates

• View account details, upcoming statements, and past transactions

• Use Autopay to set up recurring payments with no additional payment fees

• Schedule additional principal-only payments at any time

We’re serious about security

• We never store personal or account information on your phone

• Our security codes provide extra protection when you log in from a computer or device we don’t recognize

• Our Online & Mobile Security Guarantee protects you against fraudulent transactions

More details

• Ally Mobile is free – your mobile carrier’s message and data rates may apply

• Compatible with iOS 15.0 or higher

• Deposit and mortgage products are offered by Ally Bank, Member FDIC; Equal Housing Lender [house logo], NMLS ID 181005

• Securities offered through Ally Invest Securities LLC, member FINRA/SIPC

• Advisory products and services are offered through Ally Invest Advisors Inc., a registered investment adviser

• Securities are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE

• You may not be approved for real-time quotes

• Savings buckets and boosters are features of the Ally Bank Savings Account. Spending buckets are a feature of the Ally Bank Spending Account

Save, invest, and manage money

Making your financial life simple and secure has always been our thing. Easily manage your bank, credit card, invest, and home loan accounts on the go—all in one mobile banking app.

Bank with us to:

• Save faster with smart savings tools: buckets and boosters

• Set aside money for recurring expenses with spending buckets

• Stress less with no overdraft fees

• Transfer money, pay bills, or use Zelle® to pay anyone with a U.S. bank account

• Deposit checks from your phone with Ally eCheck Deposit℠

• Find 43,000+ no-fee Allpoint ATMs: we reimburse up to $10 per statement cycle for fees charged at other ATMs nationwide

• Keep tabs on your debit card usage with card controls

• Manage CD interest disbursement and maturity options

• View and send secure messages, or chat with us 24/7 using Ally Messenger

Keep up with your credit card:

• Make secure credit card payments, review credit statements, and check your FICO score for free

• Ally Mastercard credit cards available by invitation only

Three ways to invest with us:

Robo Portfolios

• Our intelligent tools do the heavy lifting to manage and monitor your investments

• Invest free of advisory fees with our cash-enhanced portfolio, or invest more of your money in the market with a market-focused portfolio (available for a fee)

• Automate your investing with one of our four portfolio strategies

Self-Directed

• Trade commission-free on eligible U.S. stocks, options, and ETFs

• Filter and find exchange-traded funds with our ETF screener

• Use advanced charting tools for technical analysis

Wealth Management

• Receive ongoing guidance from one dedicated advisor for all your assets – even ones we don’t manage

• Link and track financial accounts outside of Ally for a 360° view of your finances

• View and monitor your net worth, investment exposure, and performance

• Start with a $100,000 minimum in assets under care (funds with us)

If your mortgage is serviced by us:

• Track your progress towards paying off your home loan with real-time updates

• View account details, upcoming statements, and past transactions

• Use Autopay to set up recurring payments with no additional payment fees

• Schedule additional principal-only payments at any time

We’re serious about security

• We never store personal or account information on your phone

• Our security codes provide extra protection when you log in from a computer or device we don’t recognize

• Our Online & Mobile Security Guarantee protects you against fraudulent transactions

More details

• Ally Mobile is free – your mobile carrier’s message and data rates may apply

• Compatible with iOS 15.0 or higher

• Deposit and mortgage products are offered by Ally Bank, Member FDIC; Equal Housing Lender [house logo], NMLS ID 181005

• Securities offered through Ally Invest Securities LLC, member FINRA/SIPC

• Advisory products and services are offered through Ally Invest Advisors Inc., a registered investment adviser

• Securities are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE

• You may not be approved for real-time quotes

• Savings buckets and boosters are features of the Ally Bank Savings Account. Spending buckets are a feature of the Ally Bank Spending Account

Show More