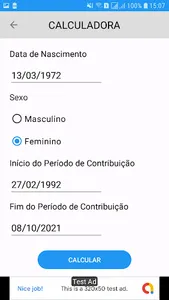

In this application you will be able to calculate the Social Security Deadline and check if you are eligible for the INSS lifetime review.

Also calculate the social security factor with our updated calculator.

About the INSS lifetime review:

The 2023 Lifetime Review is the reassessment or recalculation of a pension benefit.

In practice, this review aims to include your contribution salaries prior to July 1994 in the calculation of your benefit amount.

This is because contributions prior to July 1994 are not considered in the calculation by the INSS.

As of July 1991, with the entry into force of Law 8.213/1991, retirement began to be calculated with the 80% highest contributions that insured persons made to the INSS.

Soon after, the law that limited the contributions to be considered was law 9.876/1999.

With the Social Security Reform, in force since 11/13/2019, the new rule began to consider the average of all contributions - also only from July 1994 - that insured persons made to the INSS.

So, disregarding contributions prior to July 1994 harms:

who earned a good salary before July 1994;

who has few contributions from July 1994;

who began to receive a lower salary from July 1994 onwards.

Source: https://ingracio.adv.br/o-que-e-a-revisao-da-vida-toda/

Attention! This application is not official Social Security or Caixa Econômica Federal.

Also calculate the social security factor with our updated calculator.

About the INSS lifetime review:

The 2023 Lifetime Review is the reassessment or recalculation of a pension benefit.

In practice, this review aims to include your contribution salaries prior to July 1994 in the calculation of your benefit amount.

This is because contributions prior to July 1994 are not considered in the calculation by the INSS.

As of July 1991, with the entry into force of Law 8.213/1991, retirement began to be calculated with the 80% highest contributions that insured persons made to the INSS.

Soon after, the law that limited the contributions to be considered was law 9.876/1999.

With the Social Security Reform, in force since 11/13/2019, the new rule began to consider the average of all contributions - also only from July 1994 - that insured persons made to the INSS.

So, disregarding contributions prior to July 1994 harms:

who earned a good salary before July 1994;

who has few contributions from July 1994;

who began to receive a lower salary from July 1994 onwards.

Source: https://ingracio.adv.br/o-que-e-a-revisao-da-vida-toda/

Attention! This application is not official Social Security or Caixa Econômica Federal.

Show More