Bangkok Bank Mobile Banking

Bangkok Bank PCL

3.0 ★

store rating

10,000,000+

downloads

Free

AppRecs review analysis

AppRecs rating 2.2. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.2

AppRecs Rating

Ratings breakdown

5 star

44%

4 star

4%

3 star

4%

2 star

4%

1 star

44%

What to know

⚠

Ad complaints

Many low ratings mention excessive ads

⚠

Recent negative feedback

50% of recent sampled reviews report problems

⚠

Review quality concerns

59% of sampled 5-star reviews are very short

About Bangkok Bank Mobile Banking

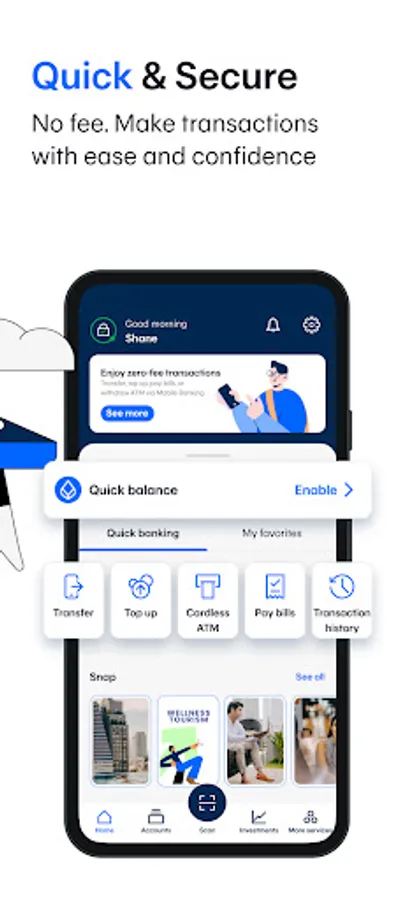

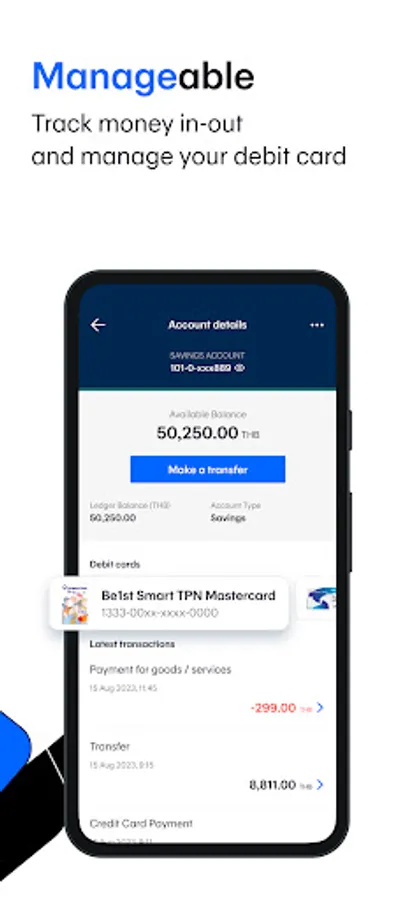

With the Bangkok Bank Mobile Banking app, your banking transactions are more convenient with these features:

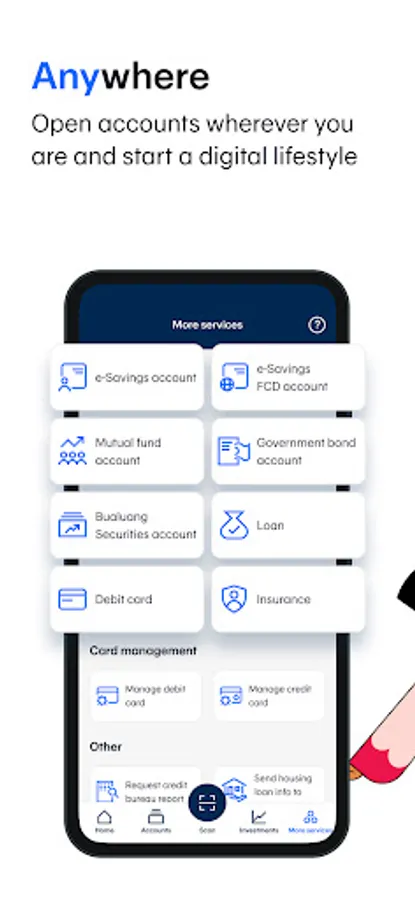

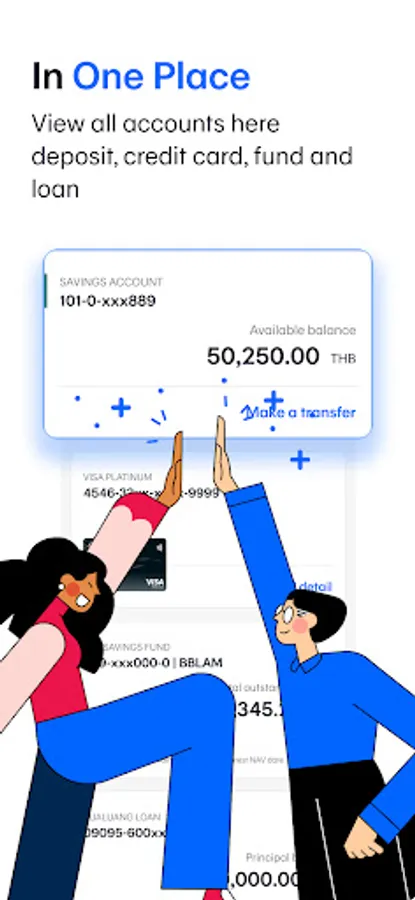

• View all types of deposits, credit cards, mutual funds, government bonds and Bualuang loan accounts

• Request Thai baht and FCD account statements

• Open an e-Savings account

• Make cardless withdrawals at Bangkok Bank and KBank ATM and Banking Agents (7-Eleven, Thailand Post offices, Sabuy Counter and TermDee kiosk)

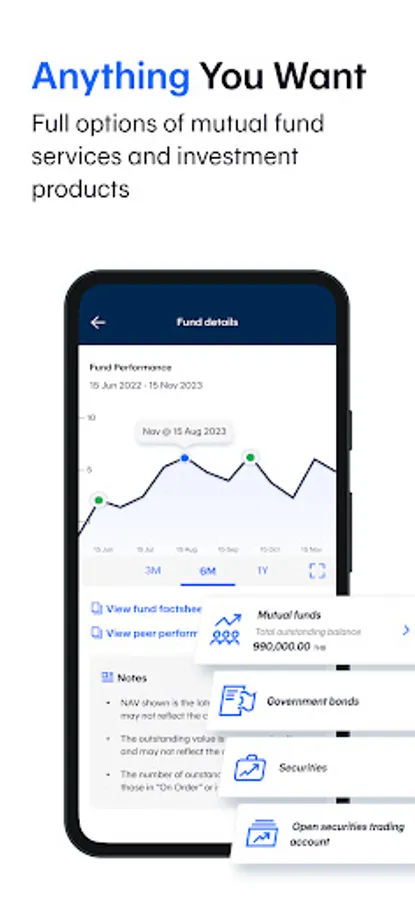

• Invest in mutual funds, government bonds and corporate debentures

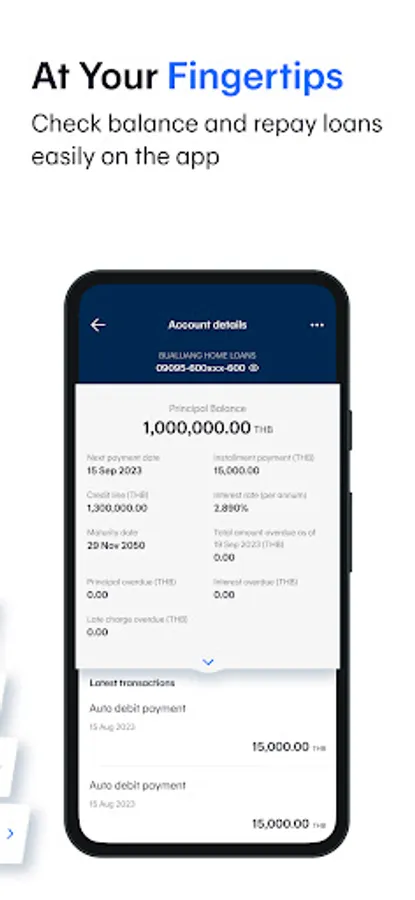

• Make a Bualuang home loan payment and request the Bank to submit housing loan information to the Revenue Department for a convenient tax deduction claim

• Add a Foreign Currency Deposit Account (FCD) and transfer funds to your own FCD account

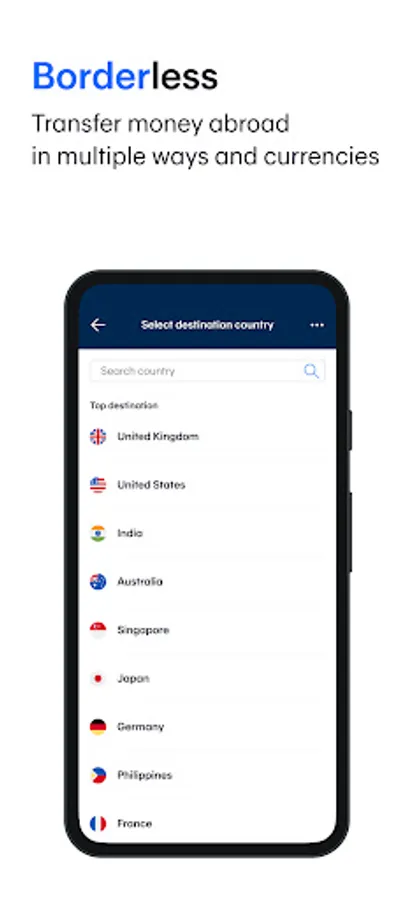

• Make an international funds transfer via SWIFT with 18 currencies for 135 countries

• Make an international funds transfer to Singapore via PromptPay International

• Send and receive money to or from more than 200 countries via Western Union

• Apply for Be Together Smart Return 789 savings insurance from AIA.

• Buy travel insurance

• Check the balance of and top up your Rabbit LINE Pay and view BTS trip history

• Apply for and manage the following banking services:

- Request and activate a debit card

- Apply for a Bangkok Bank Credit Card – choose the card that fits your lifestyle then upload the relevant documents and check your approval status in the app

- Request to open a Securities Trading Account with Bualuang Securities

- Register for direct debit service

- Register/edit/deregister with PromptPay

- Suspend debit card/credit card

- Renew debit card

- Request a Bualuang Home Loan

- Request a Credit Bureau Report

- Lock and Unlock accounts to prevent transfers, top ups and payments

• QuickPay – scan to pay merchants without a mobile PIN

• Scan a QR Code for payment with a Widget

• Change your registered mobile number/email

How to apply:

For customers without a Bangkok Bank account

• Open an e-Savings account and apply for mobile banking services in the app

For customers with a Bangkok Bank account

• Download the application and apply with your Bangkok Bank deposit account, debit card or credit card.

• Visit any Bangkok Bank ATM or branch to get a temporary PIN to log in to the application.

For further assistance please call 1333 or (66) 0-2645-5555 or visit www.bangkokbank.com/mobilebanking

Head Office: 333 Silom Road, Silom, Bang Rak, Bangkok 10500

Disclaimer: The use of this application is for prospective customers and customers of Bangkok Bank only and this application shall not be used for any illegal purpose.

• View all types of deposits, credit cards, mutual funds, government bonds and Bualuang loan accounts

• Request Thai baht and FCD account statements

• Open an e-Savings account

• Make cardless withdrawals at Bangkok Bank and KBank ATM and Banking Agents (7-Eleven, Thailand Post offices, Sabuy Counter and TermDee kiosk)

• Invest in mutual funds, government bonds and corporate debentures

• Make a Bualuang home loan payment and request the Bank to submit housing loan information to the Revenue Department for a convenient tax deduction claim

• Add a Foreign Currency Deposit Account (FCD) and transfer funds to your own FCD account

• Make an international funds transfer via SWIFT with 18 currencies for 135 countries

• Make an international funds transfer to Singapore via PromptPay International

• Send and receive money to or from more than 200 countries via Western Union

• Apply for Be Together Smart Return 789 savings insurance from AIA.

• Buy travel insurance

• Check the balance of and top up your Rabbit LINE Pay and view BTS trip history

• Apply for and manage the following banking services:

- Request and activate a debit card

- Apply for a Bangkok Bank Credit Card – choose the card that fits your lifestyle then upload the relevant documents and check your approval status in the app

- Request to open a Securities Trading Account with Bualuang Securities

- Register for direct debit service

- Register/edit/deregister with PromptPay

- Suspend debit card/credit card

- Renew debit card

- Request a Bualuang Home Loan

- Request a Credit Bureau Report

- Lock and Unlock accounts to prevent transfers, top ups and payments

• QuickPay – scan to pay merchants without a mobile PIN

• Scan a QR Code for payment with a Widget

• Change your registered mobile number/email

How to apply:

For customers without a Bangkok Bank account

• Open an e-Savings account and apply for mobile banking services in the app

For customers with a Bangkok Bank account

• Download the application and apply with your Bangkok Bank deposit account, debit card or credit card.

• Visit any Bangkok Bank ATM or branch to get a temporary PIN to log in to the application.

For further assistance please call 1333 or (66) 0-2645-5555 or visit www.bangkokbank.com/mobilebanking

Head Office: 333 Silom Road, Silom, Bang Rak, Bangkok 10500

Disclaimer: The use of this application is for prospective customers and customers of Bangkok Bank only and this application shall not be used for any illegal purpose.