BG Management

Digimind Technology

10+

downloads

Free

About BG Management

Bank Guarantee Management: A Comprehensive Overview

Bank Guarantee Management refers to the process of creating, tracking, and managing bank guarantees issued by financial institutions to support business transactions. A bank guarantee (BG) is a legal commitment provided by a bank on behalf of a business or vendor, assuring the beneficiary (such as a client, government agency, or contractor) that the bank will fulfill the financial obligation if the business fails to do so. This financial tool is widely used in contracts, trade transactions, and large-scale projects to mitigate risks and build trust between parties.

Importance of Bank Guarantee Management

Managing bank guarantees effectively is crucial for businesses to ensure compliance, prevent financial penalties, and avoid unnecessary risks. Poor management can lead to expired guarantees, financial losses, and legal disputes. A structured bank guarantee management system helps businesses track important details such as:

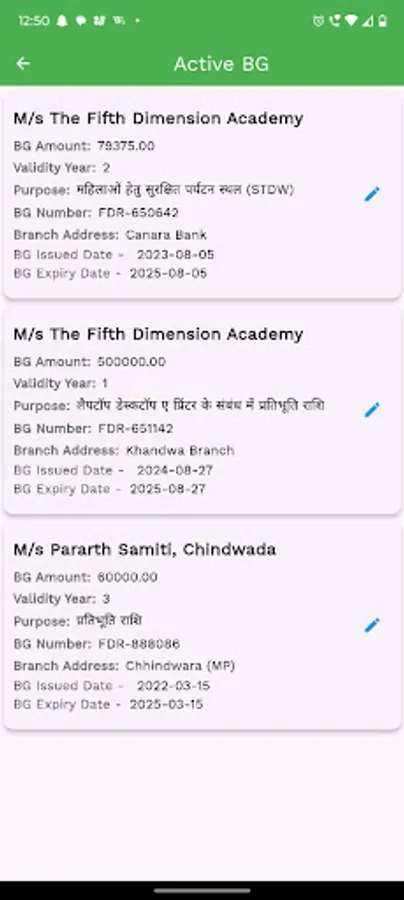

Issuance and Expiry Dates: Ensuring timely renewal or closure of guarantees.

Guarantee Amount: Keeping track of financial obligations and liabilities.

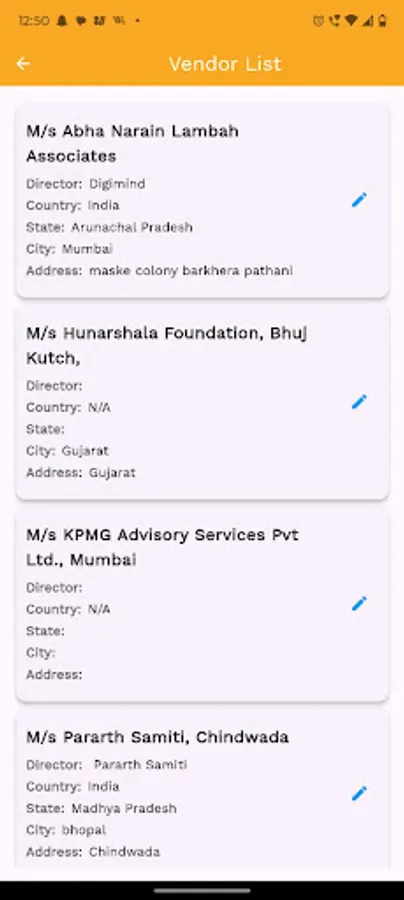

Beneficiary Details: Maintaining records of parties involved in the guarantee.

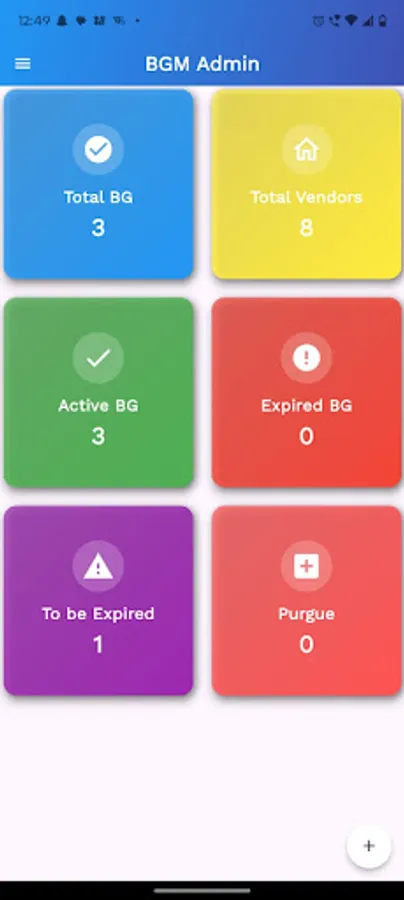

Status Monitoring: Tracking active, expired, and utilized guarantees.

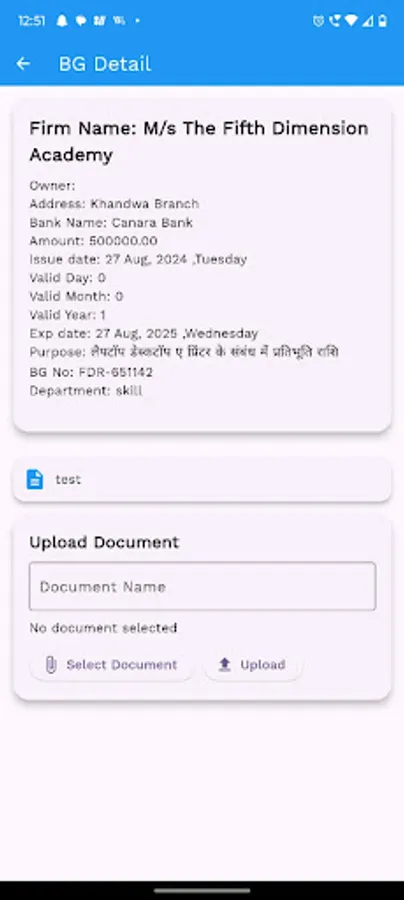

Compliance & Documentation: Ensuring legal and regulatory requirements are met.

How Bank Guarantee Management Works

Request & Issuance: The vendor applies for a bank guarantee through a financial institution. Upon approval, the bank issues the guarantee on behalf of the vendor to the beneficiary.

Storage & Tracking: Businesses must maintain a record of all active guarantees, including their terms, conditions, and expiry dates.

Renewal & Closure: If required, guarantees need to be renewed before expiration. Once obligations are met, the guarantee is closed, and any security deposit or collateral is released.

Risk Mitigation & Compliance: Organizations ensure that all guarantees comply with financial regulations and do not lapse, leading to potential contract breaches.

Benefits of Bank Guarantee Management

Reduces Financial Risk: Ensures businesses meet their contractual obligations.

Improves Cash Flow Management: Helps businesses avoid unnecessary bank charges.

Enhances Trust & Credibility: Strengthens relationships with clients and regulatory bodies.

Automates Tracking & Alerts: Prevents missed renewals and expirations.

Ensures Compliance: Keeps businesses aligned with legal and regulatory requirements.

Conclusion

Effective bank guarantee management is essential for businesses handling financial transactions involving secured commitments. By using proper tracking and management tools, businesses can safeguard their financial interests, maintain compliance, and ensure smooth operations. Whether done manually or through a specialized application, structured bank guarantee management minimizes risks and enhances business efficiency.

Bank Guarantee Management refers to the process of creating, tracking, and managing bank guarantees issued by financial institutions to support business transactions. A bank guarantee (BG) is a legal commitment provided by a bank on behalf of a business or vendor, assuring the beneficiary (such as a client, government agency, or contractor) that the bank will fulfill the financial obligation if the business fails to do so. This financial tool is widely used in contracts, trade transactions, and large-scale projects to mitigate risks and build trust between parties.

Importance of Bank Guarantee Management

Managing bank guarantees effectively is crucial for businesses to ensure compliance, prevent financial penalties, and avoid unnecessary risks. Poor management can lead to expired guarantees, financial losses, and legal disputes. A structured bank guarantee management system helps businesses track important details such as:

Issuance and Expiry Dates: Ensuring timely renewal or closure of guarantees.

Guarantee Amount: Keeping track of financial obligations and liabilities.

Beneficiary Details: Maintaining records of parties involved in the guarantee.

Status Monitoring: Tracking active, expired, and utilized guarantees.

Compliance & Documentation: Ensuring legal and regulatory requirements are met.

How Bank Guarantee Management Works

Request & Issuance: The vendor applies for a bank guarantee through a financial institution. Upon approval, the bank issues the guarantee on behalf of the vendor to the beneficiary.

Storage & Tracking: Businesses must maintain a record of all active guarantees, including their terms, conditions, and expiry dates.

Renewal & Closure: If required, guarantees need to be renewed before expiration. Once obligations are met, the guarantee is closed, and any security deposit or collateral is released.

Risk Mitigation & Compliance: Organizations ensure that all guarantees comply with financial regulations and do not lapse, leading to potential contract breaches.

Benefits of Bank Guarantee Management

Reduces Financial Risk: Ensures businesses meet their contractual obligations.

Improves Cash Flow Management: Helps businesses avoid unnecessary bank charges.

Enhances Trust & Credibility: Strengthens relationships with clients and regulatory bodies.

Automates Tracking & Alerts: Prevents missed renewals and expirations.

Ensures Compliance: Keeps businesses aligned with legal and regulatory requirements.

Conclusion

Effective bank guarantee management is essential for businesses handling financial transactions involving secured commitments. By using proper tracking and management tools, businesses can safeguard their financial interests, maintain compliance, and ensure smooth operations. Whether done manually or through a specialized application, structured bank guarantee management minimizes risks and enhances business efficiency.