Every government today needs revenue to improve service delivery to the citizens. The Local governments have mandate to levy, collect, administer and account for local revenue though at the same time face challenges in performing this role. Therefore, the local governments need an integrated revenue processing system with the capability and tools to improve the efficiency of processing and managing the taxpayer and revenue collection data.

The European Union Action; Program On Integrated Local Finances for Sustainable Urban Development (PIFUD) in the Greater Kampala Metropolitan Area (GKMA) is supporting the efforts of World Bank, UNCDF and Government of Uganda for implementing and rollout of a locally developed, affordable and accessible local revenue administration system – the Integrated Local Revenue Administration System (IRAS).

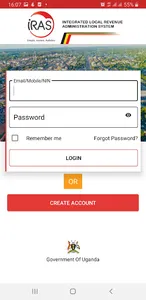

The IRAS is made of both the web and mobile application platform that provides a 360 degree of the taxpayer profile and the revenue functions. The development of IRAS is based on the aging technology and best practices providing the required capability to Local governments to transform their tax and revenue collections into a fully integrated customer centric service.

The IRAS mobile application provides the capability to Local Governments and Cities increase process efficiency, that enforces compliance in taxpayer registration, assessment, billing, payments, enforcement, sensitization of the taxpayers, linking the citizens to the LGs and lowers the associated collection costs.

Objectives of the IRAS Mobile App;

. Conversion of Taxpayer services into self-service; minimizing the efforts of taxpayers to comply with tax and revenue laws and reducing administrative burden on local government officials.

. Minimize the cost of tax compliance for taxpayers and the cost of revenue administration for LGs.

. Establishment of an integrated view on taxpayer information and tax liabilities across the taxes/ revenue sources based on information available within and outside LGs.

. Implementation of service delivery channels to cater for all segments of tax payers with or without access to computers.

The IRAS Mobile App Services;

The platform facilitates self-service to both the Local Government Staff and taxpayers as listed below;

. Registration for an IRAS Account.

. Registration for a Revenue Source.

. Retrieving Taxpayer Profile.

. Checking Registration Status.

. Registration for a Payment.

. Checking PRN status.

. Citizen Feedback.

. Locating a Business.

. Self-Assessment.

. Enforcement- Verification of Certificates using inbuilt QR code.

Benefits of IRAS to Taxpayers;

IRAS is customer centered and the taxpayers have realized the following benefits from this system;

. Efficiency- A tax payer can create IRAS account, register the different taxes, self-generation of receipts and licenses, request and receive services from anywhere any time without moving to the LGs offices.

. Transparency- A tax payer receives real time notifications via sms and email about their assessment and payment acknowledgements when they effect payments, in addition to monitoring the status of their payments.

. Better Services- When there is increased revenue for the municipality the taxpayer benefits from the better services such as roads, health facilities, schools, jobs creation programs etc.

. Reduced Cost of Doing Business; because taxpayers can pay LGs taxes/revenue/fines/dues from anywhere, at any time using accessible payment channels.

. Instant Reminders; Taxpayers receive instant reminders of outstanding liabilities sent on mail and mobile phones.

. Instant Access to Services; the taxpayers receive their trade license certificates within approx. 30mins compared to 30days before IRAS.

. Reduced Monopoly; various payment channels have been brought on board to allow taxpayers enjoy the economies of scale.

The European Union Action; Program On Integrated Local Finances for Sustainable Urban Development (PIFUD) in the Greater Kampala Metropolitan Area (GKMA) is supporting the efforts of World Bank, UNCDF and Government of Uganda for implementing and rollout of a locally developed, affordable and accessible local revenue administration system – the Integrated Local Revenue Administration System (IRAS).

The IRAS is made of both the web and mobile application platform that provides a 360 degree of the taxpayer profile and the revenue functions. The development of IRAS is based on the aging technology and best practices providing the required capability to Local governments to transform their tax and revenue collections into a fully integrated customer centric service.

The IRAS mobile application provides the capability to Local Governments and Cities increase process efficiency, that enforces compliance in taxpayer registration, assessment, billing, payments, enforcement, sensitization of the taxpayers, linking the citizens to the LGs and lowers the associated collection costs.

Objectives of the IRAS Mobile App;

. Conversion of Taxpayer services into self-service; minimizing the efforts of taxpayers to comply with tax and revenue laws and reducing administrative burden on local government officials.

. Minimize the cost of tax compliance for taxpayers and the cost of revenue administration for LGs.

. Establishment of an integrated view on taxpayer information and tax liabilities across the taxes/ revenue sources based on information available within and outside LGs.

. Implementation of service delivery channels to cater for all segments of tax payers with or without access to computers.

The IRAS Mobile App Services;

The platform facilitates self-service to both the Local Government Staff and taxpayers as listed below;

. Registration for an IRAS Account.

. Registration for a Revenue Source.

. Retrieving Taxpayer Profile.

. Checking Registration Status.

. Registration for a Payment.

. Checking PRN status.

. Citizen Feedback.

. Locating a Business.

. Self-Assessment.

. Enforcement- Verification of Certificates using inbuilt QR code.

Benefits of IRAS to Taxpayers;

IRAS is customer centered and the taxpayers have realized the following benefits from this system;

. Efficiency- A tax payer can create IRAS account, register the different taxes, self-generation of receipts and licenses, request and receive services from anywhere any time without moving to the LGs offices.

. Transparency- A tax payer receives real time notifications via sms and email about their assessment and payment acknowledgements when they effect payments, in addition to monitoring the status of their payments.

. Better Services- When there is increased revenue for the municipality the taxpayer benefits from the better services such as roads, health facilities, schools, jobs creation programs etc.

. Reduced Cost of Doing Business; because taxpayers can pay LGs taxes/revenue/fines/dues from anywhere, at any time using accessible payment channels.

. Instant Reminders; Taxpayers receive instant reminders of outstanding liabilities sent on mail and mobile phones.

. Instant Access to Services; the taxpayers receive their trade license certificates within approx. 30mins compared to 30days before IRAS.

. Reduced Monopoly; various payment channels have been brought on board to allow taxpayers enjoy the economies of scale.

Show More