오늘의 대출 - 금리 비교부터 등기 리스크까지!

에잇퍼센트

500+

downloads

Free

About 오늘의 대출 - 금리 비교부터 등기 리스크까지!

Start a smart mortgage loan with ‘Today’s Loan’!

‘Today’s Loan’ service is a customized housing finance platform that provides everything from register copy interpretation to interest rate information to consumers planning to take out a home mortgage loan.

We interpret complex register copies in an easy-to-understand manner and provide a way to check the risks that must be checked at a glance.

In addition, beyond providing simple interest rate information, we help you choose a mortgage loan more accurately and carefully through analysis of interest rate trends for products of interest, AI briefings, and market reports.

Make a smart choice and save time and effort with a loan today!

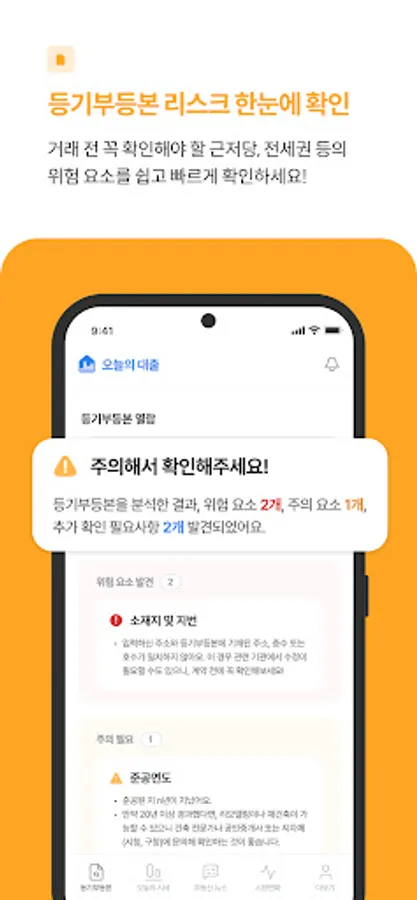

1. Interpretation of register copy

By entering your address, you can view the actual register, and AI automatically analyzes major risk factors such as mortgages, leasehold rights, and provisional seizures to help you understand risks at a glance.

The analysis results are formatted in a card format so that even users without much real estate transaction experience can easily understand them. They can be checked along with market price information, allowing for a more intuitive judgment of the conditions of the property.

2. Real-time interest rate comparison

You can compare mortgage loan products from major domestic financial institutions at a glance.

Once you save the products you're interested in, we'll provide interest rate trends for the most recent month, allowing you to monitor interest rate changes and determine the most advantageous time to borrow. This allows users to choose the optimal product that suits their situation among fixed-rate, variable-rate, and mixed-rate loans.

3. Curation of loan news

You can collect today's news on mortgage loan keywords. This allows you to check the overall flow and outlook of the loan market.

4. AI Briefing

Based on AI, we analyze the real estate market, loan market, and interest rate trends for products of interest and provide summarized loan strategies that are easy for users to understand.

AI Briefing is an important tool that presents the optimal loan plan to users and helps them understand complex interest rate changes and market trends at a glance.

5. Notification talk

Lowest Price Notification: If the interest rate of the loan product you are interested in becomes lower, you will be notified by notification message.

Receive major news on mortgage loans in a weekly report.

‘Today’s Loan’ service is a customized housing finance platform that provides everything from register copy interpretation to interest rate information to consumers planning to take out a home mortgage loan.

We interpret complex register copies in an easy-to-understand manner and provide a way to check the risks that must be checked at a glance.

In addition, beyond providing simple interest rate information, we help you choose a mortgage loan more accurately and carefully through analysis of interest rate trends for products of interest, AI briefings, and market reports.

Make a smart choice and save time and effort with a loan today!

1. Interpretation of register copy

By entering your address, you can view the actual register, and AI automatically analyzes major risk factors such as mortgages, leasehold rights, and provisional seizures to help you understand risks at a glance.

The analysis results are formatted in a card format so that even users without much real estate transaction experience can easily understand them. They can be checked along with market price information, allowing for a more intuitive judgment of the conditions of the property.

2. Real-time interest rate comparison

You can compare mortgage loan products from major domestic financial institutions at a glance.

Once you save the products you're interested in, we'll provide interest rate trends for the most recent month, allowing you to monitor interest rate changes and determine the most advantageous time to borrow. This allows users to choose the optimal product that suits their situation among fixed-rate, variable-rate, and mixed-rate loans.

3. Curation of loan news

You can collect today's news on mortgage loan keywords. This allows you to check the overall flow and outlook of the loan market.

4. AI Briefing

Based on AI, we analyze the real estate market, loan market, and interest rate trends for products of interest and provide summarized loan strategies that are easy for users to understand.

AI Briefing is an important tool that presents the optimal loan plan to users and helps them understand complex interest rate changes and market trends at a glance.

5. Notification talk

Lowest Price Notification: If the interest rate of the loan product you are interested in becomes lower, you will be notified by notification message.

Receive major news on mortgage loans in a weekly report.