Motor vehicles tax includes motor vehicles registered and registered in traffic branches or offices according to the Highway Traffic Law; Aircraft and helicopters registered and registered to the General Directorate of Civil Aviation of the Ministry of Transport, and registered to the port or municipal registry and registered motor vehicles are subject to taxation.

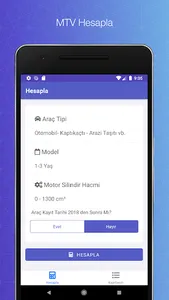

You can easily calculate this taxation through our application.

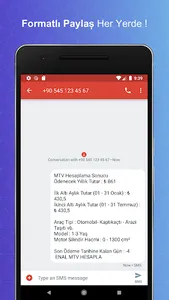

Taxpayers, “Motor Vehicle Tax liability begins with the registration and registration of the motor vehicle traffic olup. the liability is terminated as of the beginning of the following calendar year. Taxpayers who do not pay the motor vehicle tax in January and July, which is the installment payment time, are obliged to pay this tax with a delayed price. In addition, the non-taxable vehicles that are required to be carried out periodically according to the law can not be carried out and the sea or flight documents can not be given.

You can easily calculate this taxation through our application.

Taxpayers, “Motor Vehicle Tax liability begins with the registration and registration of the motor vehicle traffic olup. the liability is terminated as of the beginning of the following calendar year. Taxpayers who do not pay the motor vehicle tax in January and July, which is the installment payment time, are obliged to pay this tax with a delayed price. In addition, the non-taxable vehicles that are required to be carried out periodically according to the law can not be carried out and the sea or flight documents can not be given.

Show More