AppRecs review analysis

AppRecs rating 1.0. Trustworthiness 55 out of 100. Review manipulation risk 15 out of 100. Based on a review sample analyzed.

★☆☆☆☆

1.0

AppRecs Rating

Ratings breakdown

5 star

0%

4 star

0%

3 star

0%

2 star

0%

1 star

100%

What to know

⚠

Mixed user feedback

Average 1.0★ rating suggests room for improvement

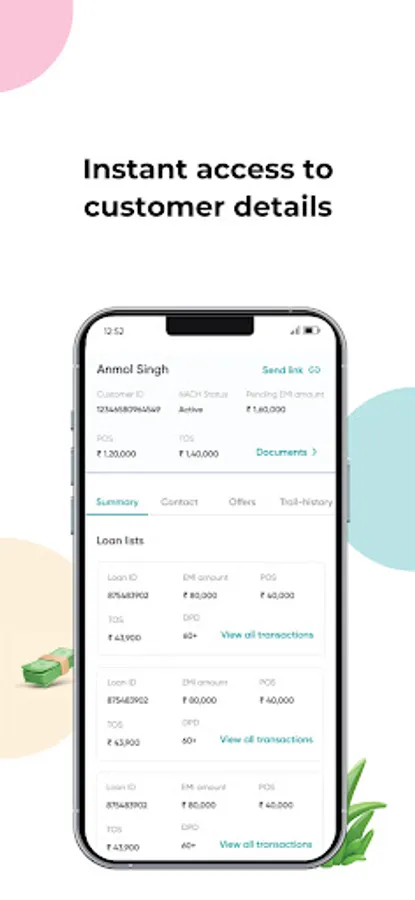

About Fibe CARE

Loan Description:-

* This app is for Fibe Collection Agents only.*

At Fibe, our Collect with Care policies reflect our commitment to treating each customer with the utmost respect and empathy throughout the collection process. Every interaction is handled with thoughtfulness and integrity, ensuring positive outcomes for both the customer and the institution.

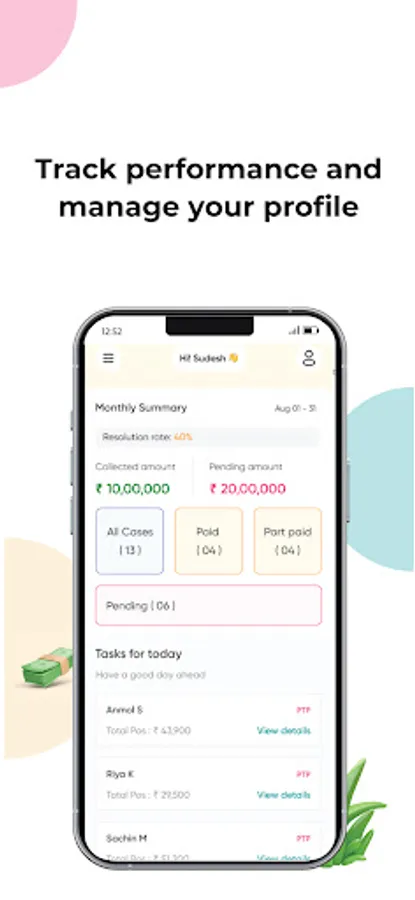

Powered by Fibe CA₹E’s advanced Collection & Recovery Engine, our solution provides a comprehensive analysis of individual borrower loans within the framework of strategic recovery initiatives. This tool streamlines the monitoring and management of outstanding loans, enabling data-driven decisions and the execution of effective recovery strategies.

Key Components:

Borrower Profile:

· Name: Full name of the borrower.

· Customer ID: Unique identification number assigned to each borrower.

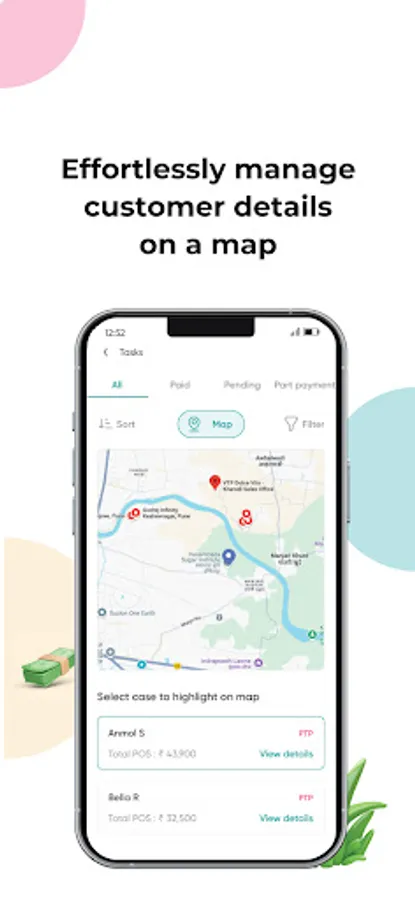

· Contact Information: Essential details including phone number, email and address.

Loan Overview:

· Loan ID: Distinct identifier for each loan.

· Loan Type: Categorizes the loan (e.g., cash loan, merchant loans).

· Loan Amount: Initial borrowed amount.

· Interest Rate: The applicable interest rate.

· Loan Tenure: Duration for which the loan is granted.

· Disbursement Date: Date on which the loan was disbursed.

· Repayment Schedule: Detailed breakdown of repayment dates and amounts.

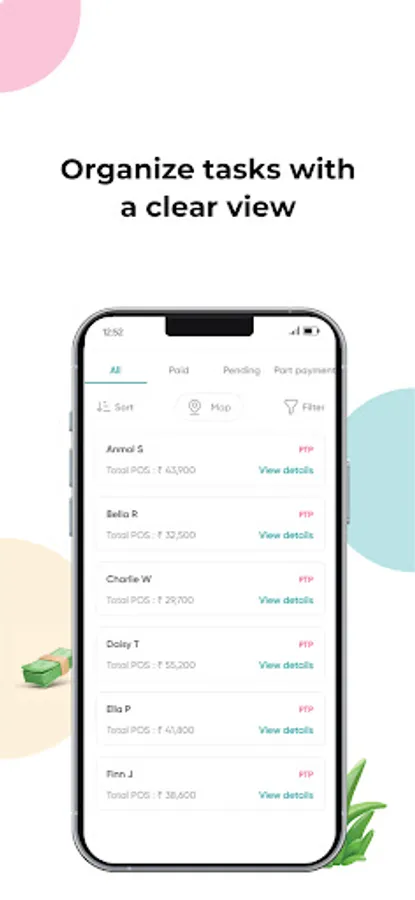

Current Loan Status:

· Outstanding Balance: Remaining balance to be repaid by the borrower.

· Current Payment Status: Up-to-date status (e.g., on time, in arrears, in default).

· Last Payment Date: The date of the most recent payment made along with mode of payment.

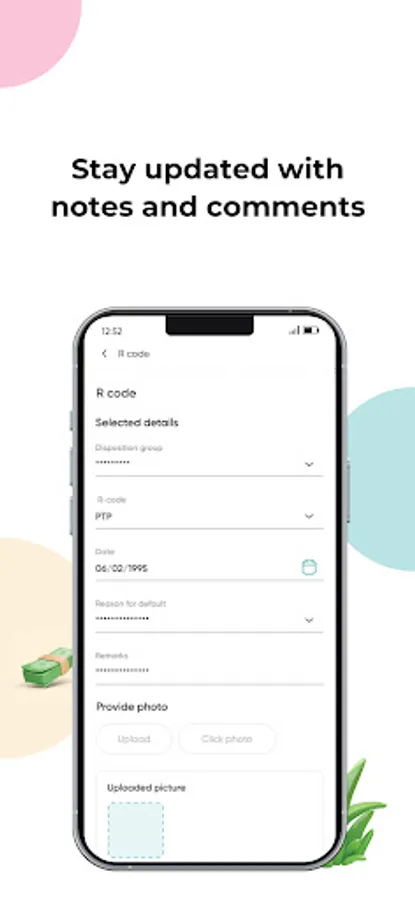

Recovery Strategies:

· Recovery Plan Details: Different collection strategies that can used to close the case.

· Communication History: Detailed tracking of borrower engagement, including negotiations and discussions.

· Legal Actions: Information about any legal steps taken or being considered.

· Internal Comments: Notes from loan officers, collection agents, or legal teams contributing to the loan recovery journey.

* This app is for Fibe Collection Agents only.*

At Fibe, our Collect with Care policies reflect our commitment to treating each customer with the utmost respect and empathy throughout the collection process. Every interaction is handled with thoughtfulness and integrity, ensuring positive outcomes for both the customer and the institution.

Powered by Fibe CA₹E’s advanced Collection & Recovery Engine, our solution provides a comprehensive analysis of individual borrower loans within the framework of strategic recovery initiatives. This tool streamlines the monitoring and management of outstanding loans, enabling data-driven decisions and the execution of effective recovery strategies.

Key Components:

Borrower Profile:

· Name: Full name of the borrower.

· Customer ID: Unique identification number assigned to each borrower.

· Contact Information: Essential details including phone number, email and address.

Loan Overview:

· Loan ID: Distinct identifier for each loan.

· Loan Type: Categorizes the loan (e.g., cash loan, merchant loans).

· Loan Amount: Initial borrowed amount.

· Interest Rate: The applicable interest rate.

· Loan Tenure: Duration for which the loan is granted.

· Disbursement Date: Date on which the loan was disbursed.

· Repayment Schedule: Detailed breakdown of repayment dates and amounts.

Current Loan Status:

· Outstanding Balance: Remaining balance to be repaid by the borrower.

· Current Payment Status: Up-to-date status (e.g., on time, in arrears, in default).

· Last Payment Date: The date of the most recent payment made along with mode of payment.

Recovery Strategies:

· Recovery Plan Details: Different collection strategies that can used to close the case.

· Communication History: Detailed tracking of borrower engagement, including negotiations and discussions.

· Legal Actions: Information about any legal steps taken or being considered.

· Internal Comments: Notes from loan officers, collection agents, or legal teams contributing to the loan recovery journey.