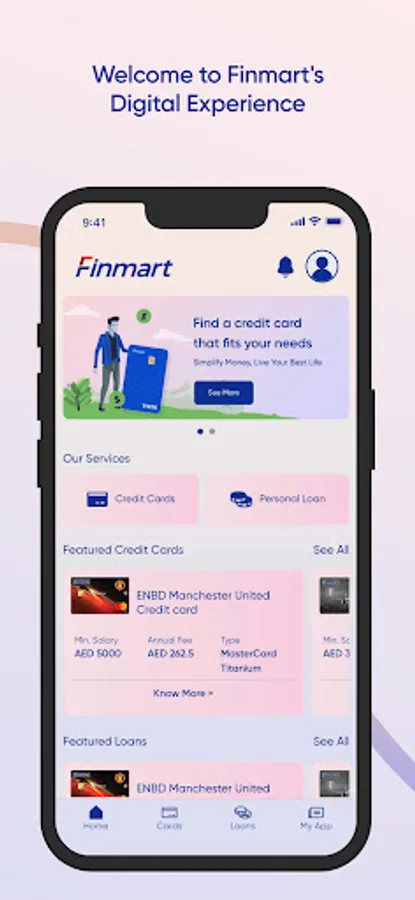

About Finmart

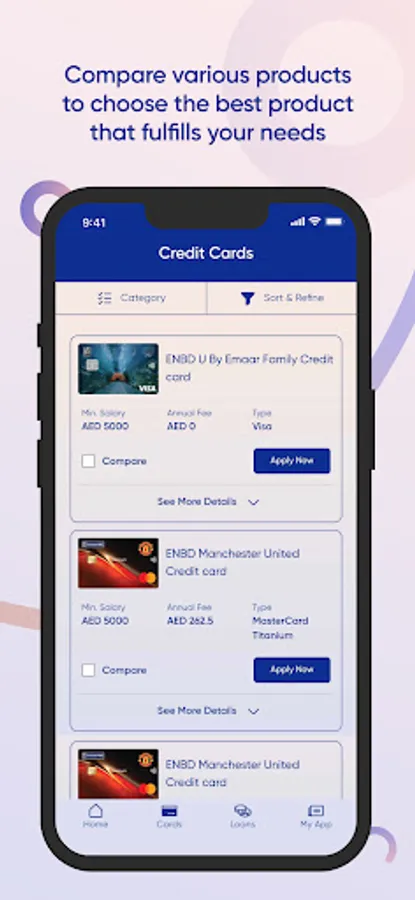

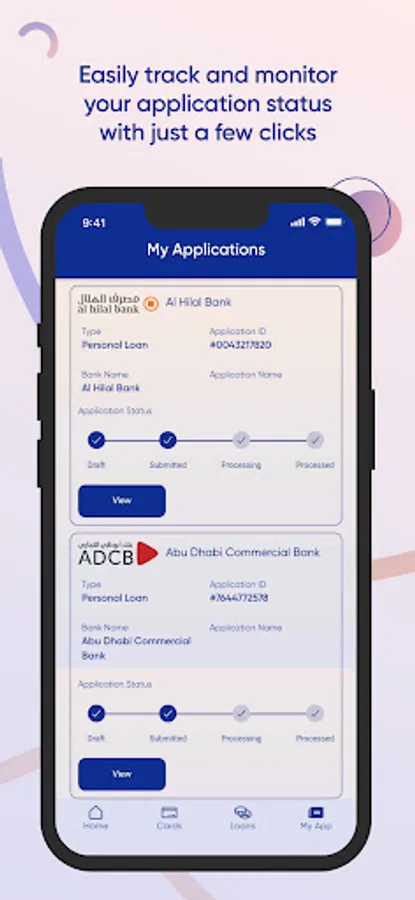

The Finmart group is one of UAE’s leading service providers of Retail financial products like Credit Cards, Personal Loans, Bank Accounts, Auto Loans, and more. We aspire to make your financial lives simple by providing you with information that is easy to understand, offering you a choice of products & services from a host of banks so that you can compare and select the one that best suits your needs and finally we facilitate the application process and stay with you until you have acquired the desired product or service and have been on boarded with the bank

Personal Loan Policy

Minimum and maximum period for repayment. - Minimum - 12 Months & Max – 48 Months.

Maximum Annual Percentage Rate (APR) Is based on multiple factors,

Conventional Bank – Reducing rate 15%

Non-Convention Bank (lslamic Bank) Flat 7.99%.

The fee and charges varies from bank to bank and the loan amount and repayment tenure. For Example

Emirates NBD – 1% processing fee + VAT ( Minimum 500 or 2500) No insurance.

Al Hilal - 1% processing fee + VAT ( Minimum 500 or 2500) Plus insurance.

RAK Bank - % processing fee + VAT ( Minimum 500 or 2500) Plus insurance.

EIB - % processing fee + VAT ( Minimum 500 or 2500).

Representative example of the total cost of the loan, including the principal and all applicable fees. Sample calculation for AED 500000 with 1% processing fee + VAT ( Minimum 500 or 2500) and No insurance.

Loan amount: AED 500,000

Loan term: 48 months

Interest/Profit rate: 8% per year

Arrangement fee: 1% of the loan amount + 5% VAT

The arrangement fee excluding VAT is AED 5,000 (1% x AED 500,000).

The VAT on the arrangement fee is AED 250 (5% x AED 5,000).

The total arrangement fee including VAT is AED 5,250 (AED 5,000 + AED 250).

The total amount borrowed, including the arrangement fee and VAT, is AED 505,250 (AED 500,000 + AED 5,250).

Monthly payment: AED 12,198.34 (calculated using the loan amortization formula)

Total interest/profit paid over the life of the loan: AED 93,916.27

Total arrangement fee paid: AED 5,250

Total VAT paid: AED 250

Total cost of the loan: AED 599,416.27 (principal + interest + arrangement fee + VAT)

Here's a breakdown of the interest calculation for the first few months of the loan:

Month 1:

Starting balance: AED 505,250

Monthly interest/profit rate: 0.00667 (8% divided by 12 months)

Interest/Profit charged: AED 2,670.83 (0.00667 x AED 505,250)

Principal paid: AED 9,527.51 (AED 12,198.34 - AED 2,670.83)

Ending balance: AED 495,722.49 (AED 505,250 - AED 9,527.51)

Month 2:

Starting balance: AED 495,722.49

Monthly interest/profit rate: 0.00667

Interest/Profit charged: AED 2,618.47 (0.00667 x AED 495,722.49)

Principal paid: AED 9,579.87 (AED 12,198.34 - AED 2,618.47)

Ending balance: AED 486,142.62 (AED 495,722.49 - AED 9,579.87)

And so on, until the loan is paid off after 48 months.

Personal Loan Policy

Minimum and maximum period for repayment. - Minimum - 12 Months & Max – 48 Months.

Maximum Annual Percentage Rate (APR) Is based on multiple factors,

Conventional Bank – Reducing rate 15%

Non-Convention Bank (lslamic Bank) Flat 7.99%.

The fee and charges varies from bank to bank and the loan amount and repayment tenure. For Example

Emirates NBD – 1% processing fee + VAT ( Minimum 500 or 2500) No insurance.

Al Hilal - 1% processing fee + VAT ( Minimum 500 or 2500) Plus insurance.

RAK Bank - % processing fee + VAT ( Minimum 500 or 2500) Plus insurance.

EIB - % processing fee + VAT ( Minimum 500 or 2500).

Representative example of the total cost of the loan, including the principal and all applicable fees. Sample calculation for AED 500000 with 1% processing fee + VAT ( Minimum 500 or 2500) and No insurance.

Loan amount: AED 500,000

Loan term: 48 months

Interest/Profit rate: 8% per year

Arrangement fee: 1% of the loan amount + 5% VAT

The arrangement fee excluding VAT is AED 5,000 (1% x AED 500,000).

The VAT on the arrangement fee is AED 250 (5% x AED 5,000).

The total arrangement fee including VAT is AED 5,250 (AED 5,000 + AED 250).

The total amount borrowed, including the arrangement fee and VAT, is AED 505,250 (AED 500,000 + AED 5,250).

Monthly payment: AED 12,198.34 (calculated using the loan amortization formula)

Total interest/profit paid over the life of the loan: AED 93,916.27

Total arrangement fee paid: AED 5,250

Total VAT paid: AED 250

Total cost of the loan: AED 599,416.27 (principal + interest + arrangement fee + VAT)

Here's a breakdown of the interest calculation for the first few months of the loan:

Month 1:

Starting balance: AED 505,250

Monthly interest/profit rate: 0.00667 (8% divided by 12 months)

Interest/Profit charged: AED 2,670.83 (0.00667 x AED 505,250)

Principal paid: AED 9,527.51 (AED 12,198.34 - AED 2,670.83)

Ending balance: AED 495,722.49 (AED 505,250 - AED 9,527.51)

Month 2:

Starting balance: AED 495,722.49

Monthly interest/profit rate: 0.00667

Interest/Profit charged: AED 2,618.47 (0.00667 x AED 495,722.49)

Principal paid: AED 9,579.87 (AED 12,198.34 - AED 2,618.47)

Ending balance: AED 486,142.62 (AED 495,722.49 - AED 9,579.87)

And so on, until the loan is paid off after 48 months.