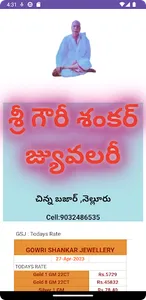

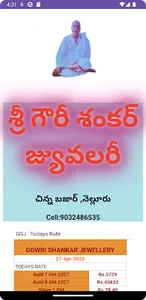

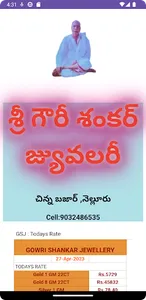

Gowri Shankar Jewellery, Nellore

The daily gold rates are the prices of gold that are set each day by the global gold market. They are influenced by a number of factors, including the supply and demand for gold, the price of oil, and the overall economic climate. Gold is a valuable metal that has been used for centuries as a form of currency and investment. It is also used in jewelry and other decorative items. The daily gold rates can fluctuate significantly, so it is important to stay up-to-date on the latest prices if you are planning to buy or sell gold.

Here are some of the factors that can affect the daily gold rates:

Supply and demand: The supply of gold is limited, while the demand for gold is relatively high. This means that the price of gold is often driven by supply and demand.

The price of oil: The price of oil is often used as a proxy for the overall economic climate. When the price of oil is high, it can lead to inflation, which can make gold more expensive.

The overall economic climate: The overall economic climate can also affect the price of gold. When the economy is doing well, people are more likely to invest in stocks and other assets, which can drive down the price of gold.

It is important to keep these factors in mind when you are considering buying or selling gold. The daily gold rates can fluctuate significantly, so it is important to stay up-to-date on the latest prices.

The daily gold rates are the prices of gold that are set each day by the global gold market. They are influenced by a number of factors, including the supply and demand for gold, the price of oil, and the overall economic climate. Gold is a valuable metal that has been used for centuries as a form of currency and investment. It is also used in jewelry and other decorative items. The daily gold rates can fluctuate significantly, so it is important to stay up-to-date on the latest prices if you are planning to buy or sell gold.

Here are some of the factors that can affect the daily gold rates:

Supply and demand: The supply of gold is limited, while the demand for gold is relatively high. This means that the price of gold is often driven by supply and demand.

The price of oil: The price of oil is often used as a proxy for the overall economic climate. When the price of oil is high, it can lead to inflation, which can make gold more expensive.

The overall economic climate: The overall economic climate can also affect the price of gold. When the economy is doing well, people are more likely to invest in stocks and other assets, which can drive down the price of gold.

It is important to keep these factors in mind when you are considering buying or selling gold. The daily gold rates can fluctuate significantly, so it is important to stay up-to-date on the latest prices.

Show More