MNB standard Qr code generating application for small businesses to facilitate instant transfers.

Qr coded payment meets the condition of electronic payment valid from 1 January 2021.

What does this mean?

Electronic payment without POS terminal (card reader). Using the QR code, the amount to be paid is transferred by the buyer to the merchant's bank account number. The money will immediately appear in the merchant's account. This provides a simple, cost-effective electronic payment option anywhere, anytime.

Properties

- Cost-effective: No monthly or turnover-based fees.

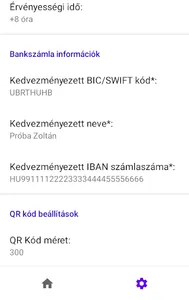

- Simple setting: Qr In the transfer, the bank account details must be entered and the information related to the transfer if necessary. You don't have to register anywhere. There is no need to contract with another service provider.

- Easy payment: All you have to do is enter the amount to be paid and the customer can already scan the QR code.

- Fast and offline operation: Only needs to be installed and configured once. It works even without an internet connection.

- Payment ID: Different IDs can be entered, which will appear in the notification section of the transfer, so the purchase can be easily identified.

How exactly does it work?

Thanks to the instant transfer, the transfer must be completed within 5 seconds, 24 hours a day, every day of the week.

This allows the buyer to pay by bank transfer using their mobile bank.

- The trader generates a QR code with the specified amount and the already saved bank account information with the Qr Transfer application.

- The buyer scans the QR code using his own mobile bank, which contains the seller's name, bank account number and amount. Then it starts the reference.

- The money will be transferred from the buyer's account to the merchant's account within 5 seconds.

- The merchant can check the completion of the transaction in an SMS notification or with the help of the mobile bank.

What is needed from the buyer?

You must have a mobile banking application that supports the QR code standardized by the Magyar Nemzeti Bank.

Qr coded payment meets the condition of electronic payment valid from 1 January 2021.

What does this mean?

Electronic payment without POS terminal (card reader). Using the QR code, the amount to be paid is transferred by the buyer to the merchant's bank account number. The money will immediately appear in the merchant's account. This provides a simple, cost-effective electronic payment option anywhere, anytime.

Properties

- Cost-effective: No monthly or turnover-based fees.

- Simple setting: Qr In the transfer, the bank account details must be entered and the information related to the transfer if necessary. You don't have to register anywhere. There is no need to contract with another service provider.

- Easy payment: All you have to do is enter the amount to be paid and the customer can already scan the QR code.

- Fast and offline operation: Only needs to be installed and configured once. It works even without an internet connection.

- Payment ID: Different IDs can be entered, which will appear in the notification section of the transfer, so the purchase can be easily identified.

How exactly does it work?

Thanks to the instant transfer, the transfer must be completed within 5 seconds, 24 hours a day, every day of the week.

This allows the buyer to pay by bank transfer using their mobile bank.

- The trader generates a QR code with the specified amount and the already saved bank account information with the Qr Transfer application.

- The buyer scans the QR code using his own mobile bank, which contains the seller's name, bank account number and amount. Then it starts the reference.

- The money will be transferred from the buyer's account to the merchant's account within 5 seconds.

- The merchant can check the completion of the transaction in an SMS notification or with the help of the mobile bank.

What is needed from the buyer?

You must have a mobile banking application that supports the QR code standardized by the Magyar Nemzeti Bank.

Show More