AppRecs review analysis

AppRecs rating 3.7. Trustworthiness 79 out of 100. Review manipulation risk 20 out of 100. Based on a review sample analyzed.

★★★☆☆

3.7

AppRecs Rating

Ratings breakdown

5 star

43%

4 star

14%

3 star

14%

2 star

0%

1 star

29%

What to know

✓

Low review manipulation risk

20% review manipulation risk

✓

Credible reviews

79% trustworthiness score from analyzed reviews

About e-PACS Mobile

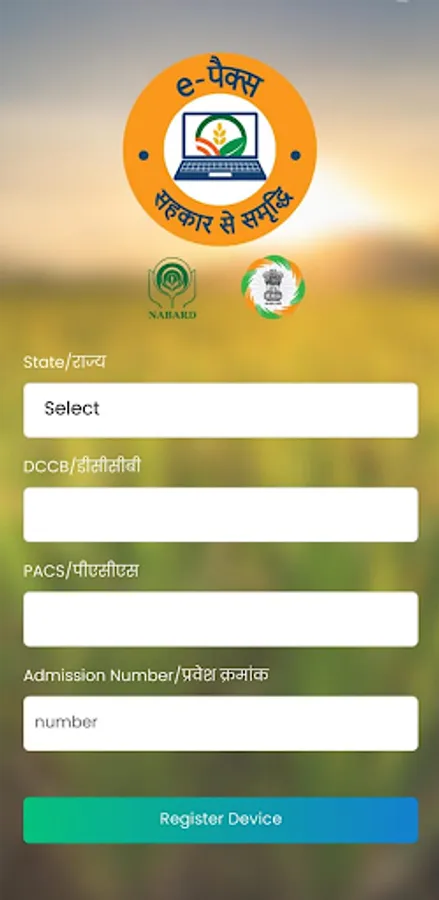

ePACS Mobile is the official mobile application of the ePACS ERP platform, developed under the Government of India’s initiative to digitize Primary Agricultural Credit Societies (PACS). It empowers PACS members to access essential financial services and warehousing services anytime, anywhere—ensuring transparency, convenience, and operational efficiency.

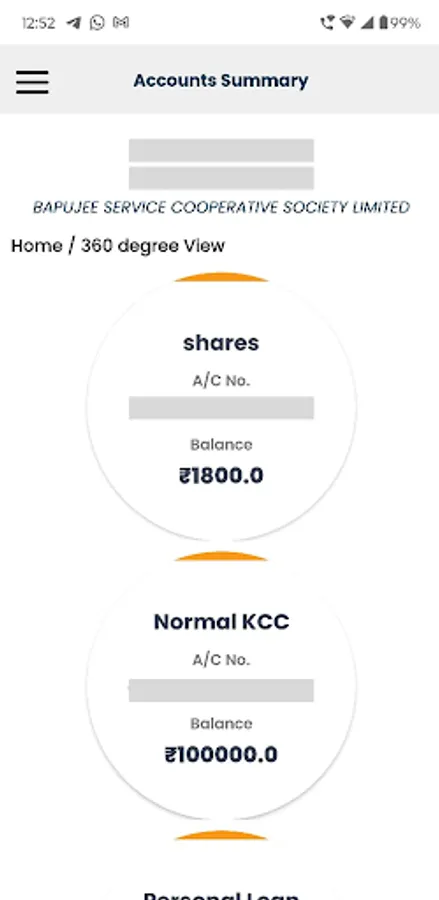

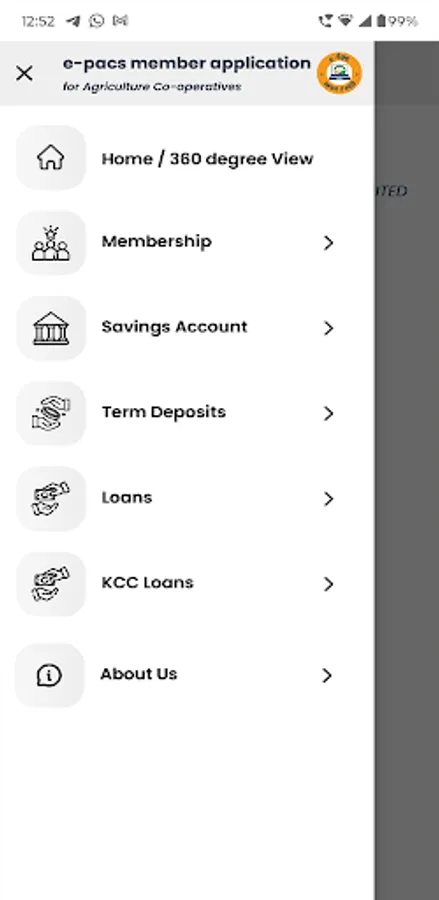

Built as a view system, ePACS Mobile provides streamlined access to membership details, savings account balances, term deposit summaries, loan EMIs, sales and purchases—without any direct transaction functionality. Designed specifically for rural India, this app bridges the digital divide in cooperative banking and agriculture.

Membership View – Access Admission Number, KYC status, share capital ledger, and land ownership details (for A-Class members).

Savings Accounts – View Savings account, Current account, and Thrift Deposit account balances, nominee details, and complete ledger history.

Fixed/Recurring – Track deposit amounts, interest schedules, maturity dates, and interest earned—FD and RD.

Loans – Monitor loan balances, EMI schedules, payment history, and overdue penalty calculations (KCC, MT, LT loans supported).

Built as a view system, ePACS Mobile provides streamlined access to membership details, savings account balances, term deposit summaries, loan EMIs, sales and purchases—without any direct transaction functionality. Designed specifically for rural India, this app bridges the digital divide in cooperative banking and agriculture.

Membership View – Access Admission Number, KYC status, share capital ledger, and land ownership details (for A-Class members).

Savings Accounts – View Savings account, Current account, and Thrift Deposit account balances, nominee details, and complete ledger history.

Fixed/Recurring – Track deposit amounts, interest schedules, maturity dates, and interest earned—FD and RD.

Loans – Monitor loan balances, EMI schedules, payment history, and overdue penalty calculations (KCC, MT, LT loans supported).