Grana - IR da bolsa automático

Grana Capital

4.5 ★

4K ratings

100,000+

downloads

Free

+ in-app

In this app, users can automatically complete their income tax return and verify pending issues since Includes data import from B3, automatic calculation of DARF, and tools for tracking dividends and investment performance.

AppRecs review analysis

AppRecs rating 4.6. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.6

AppRecs Rating

Ratings breakdown

5 star

84%

4 star

5%

3 star

0%

2 star

0%

1 star

11%

What to know

✓

High user satisfaction

84% of sampled ratings are 5 stars

About Grana - IR da bolsa automático

GRANA is the income tax solution recommended by B3, which received investment from the Brazilian Stock Exchange itself.

WHAT GRANA DOES:

- Automatic completion of your Income Tax Return

- Monthly calculation of DARF (tax payment slip)

- Verification of pending issues since 2020

- Tool for legally reducing your income tax.

In addition, with Grana, you can track for free:

- Your detailed dividends

- The consolidated profitability of your investments

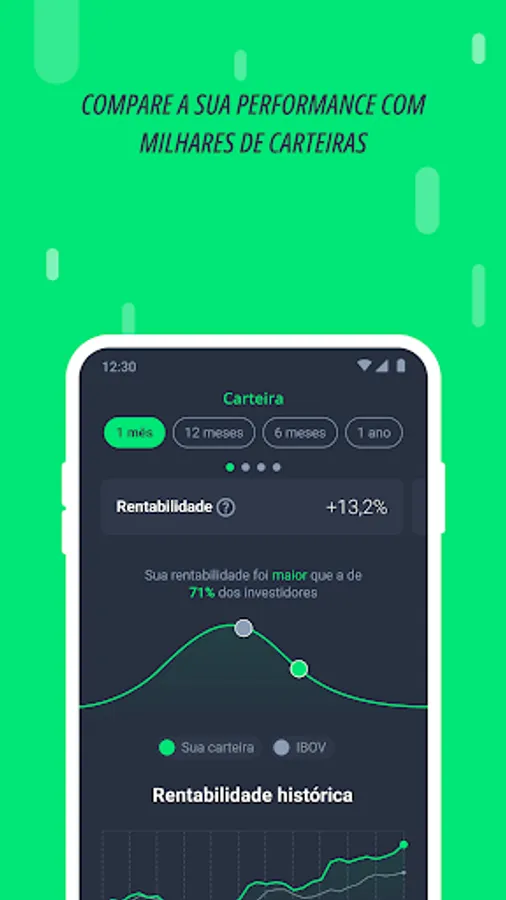

- Your performance compared to other investors

- Your unrealized profit or loss

And more: only with Grana can you find out if your profitability was higher or lower than that of other investors.

WHO USES GRANA

Gustavo Cerbasi, Professor Mira, and thousands of investors use and approve Grana.

TRY IT FREE for 7 days, no credit card registration required.

LEARN MORE: Grana Automatic Tax Return Filing

Declare your stock market investments in less than 5 minutes with our automatic 2025 Income Tax Return filing tool. See how it works:

1. Grana imports your data directly from the B3 system, officially and securely.

2. Grana generates a file for you to import into the official 2025 Income Tax Return program.

3. You import our file into the Income Tax Return program and that's it! Your stock market investment data will be filled in and you can proceed with filing your tax return.

SECURITY

Our system has been approved by B3, which guarantees that we meet the high security criteria required for data processing.

In addition, B3 recommends our solution and invested in Grana because it considers the app to offer a relevant solution for Brazilian investors, especially regarding Income Tax.

ALL AUTOMATIC

Activate the automatic import of your data from B3 and you're done! You don't need to upload brokerage statements or manually fill in data.

Grana is the only Brazilian income tax calculator that automates all stages of stock market income tax: calculation, payment, and declaration.

Your monthly income tax calculation is updated daily based on data our system receives from B3 (the Brazilian stock exchange), with your authorization, and the DARF (tax payment slip) can be paid directly in the app, via Pix (Brazilian instant payment system) or credit card – an exclusive advantage of Grana.

Your stock market investment declaration can also be automatically filled out by directly importing our file into your Federal Revenue Service program.

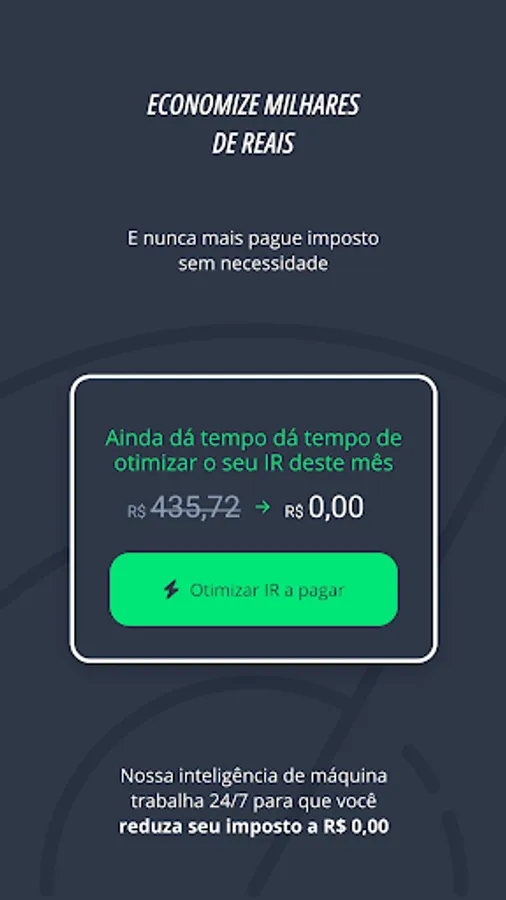

REDUCING YOUR INCOME TAX

When the system identifies that your operations have generated taxable profit, the Income Tax Optimizer suggests operations that can reduce the tax due through legal exemption, without altering the composition of your portfolio.

This feature is exclusive to Grana.

ASSETS COVERED

Grana calculates Income Tax for Stocks, REITs, ETFs, BDRs, Options, and the Futures Market (IND, WIN, DOL, WDO, BIT, and CCM).

PLANS

More Annual Grana:

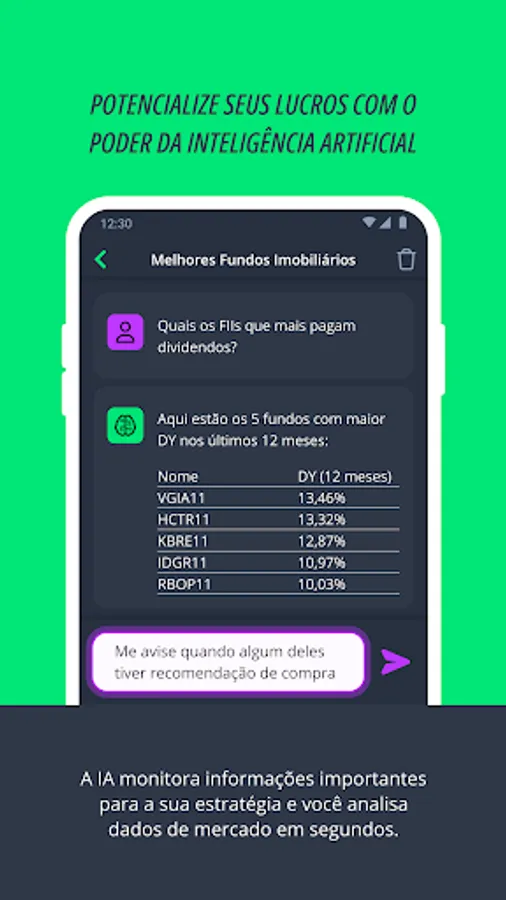

This is our most complete plan. It includes the Grana Automatic Tax Return, the Income Tax Optimizer, Grana's AI, and all other app features.

Grana Annual Income Tax:

Includes a report with all your stock market income tax data for you to copy and paste into the Federal Revenue Service program, but does not include the Grana Automatic Tax Return. It also includes the calculation of retroactive monthly income tax since January 2020 with payment options via Pix or card, but does not include the Income Tax Optimizer or Grana's AI.

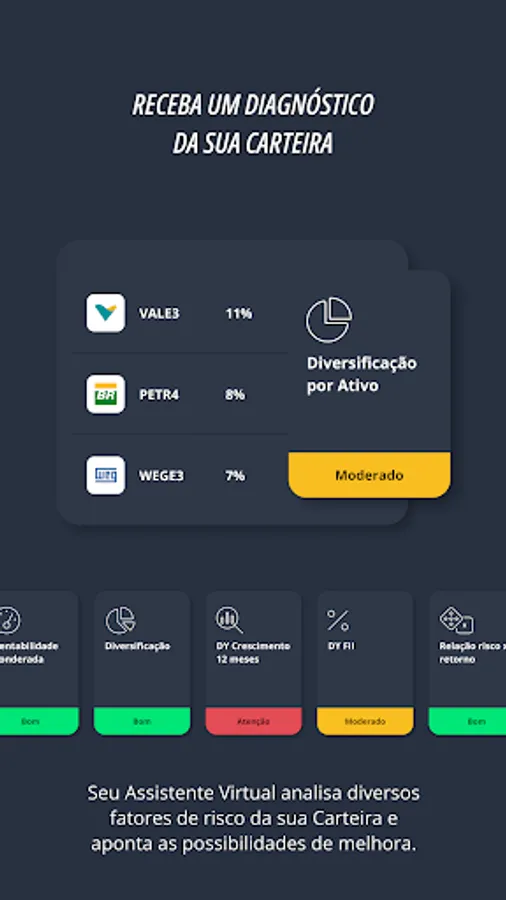

Grana AI Annual Plan:

Includes Grana's AI features: portfolio risk diagnosis, creation of personalized alerts, and other portfolio consolidation features present in other paid plans, but does not include income tax solutions.

Download now and solve your income tax for this month for free – take advantage of our 7-day free trial.

WHAT GRANA DOES:

- Automatic completion of your Income Tax Return

- Monthly calculation of DARF (tax payment slip)

- Verification of pending issues since 2020

- Tool for legally reducing your income tax.

In addition, with Grana, you can track for free:

- Your detailed dividends

- The consolidated profitability of your investments

- Your performance compared to other investors

- Your unrealized profit or loss

And more: only with Grana can you find out if your profitability was higher or lower than that of other investors.

WHO USES GRANA

Gustavo Cerbasi, Professor Mira, and thousands of investors use and approve Grana.

TRY IT FREE for 7 days, no credit card registration required.

LEARN MORE: Grana Automatic Tax Return Filing

Declare your stock market investments in less than 5 minutes with our automatic 2025 Income Tax Return filing tool. See how it works:

1. Grana imports your data directly from the B3 system, officially and securely.

2. Grana generates a file for you to import into the official 2025 Income Tax Return program.

3. You import our file into the Income Tax Return program and that's it! Your stock market investment data will be filled in and you can proceed with filing your tax return.

SECURITY

Our system has been approved by B3, which guarantees that we meet the high security criteria required for data processing.

In addition, B3 recommends our solution and invested in Grana because it considers the app to offer a relevant solution for Brazilian investors, especially regarding Income Tax.

ALL AUTOMATIC

Activate the automatic import of your data from B3 and you're done! You don't need to upload brokerage statements or manually fill in data.

Grana is the only Brazilian income tax calculator that automates all stages of stock market income tax: calculation, payment, and declaration.

Your monthly income tax calculation is updated daily based on data our system receives from B3 (the Brazilian stock exchange), with your authorization, and the DARF (tax payment slip) can be paid directly in the app, via Pix (Brazilian instant payment system) or credit card – an exclusive advantage of Grana.

Your stock market investment declaration can also be automatically filled out by directly importing our file into your Federal Revenue Service program.

REDUCING YOUR INCOME TAX

When the system identifies that your operations have generated taxable profit, the Income Tax Optimizer suggests operations that can reduce the tax due through legal exemption, without altering the composition of your portfolio.

This feature is exclusive to Grana.

ASSETS COVERED

Grana calculates Income Tax for Stocks, REITs, ETFs, BDRs, Options, and the Futures Market (IND, WIN, DOL, WDO, BIT, and CCM).

PLANS

More Annual Grana:

This is our most complete plan. It includes the Grana Automatic Tax Return, the Income Tax Optimizer, Grana's AI, and all other app features.

Grana Annual Income Tax:

Includes a report with all your stock market income tax data for you to copy and paste into the Federal Revenue Service program, but does not include the Grana Automatic Tax Return. It also includes the calculation of retroactive monthly income tax since January 2020 with payment options via Pix or card, but does not include the Income Tax Optimizer or Grana's AI.

Grana AI Annual Plan:

Includes Grana's AI features: portfolio risk diagnosis, creation of personalized alerts, and other portfolio consolidation features present in other paid plans, but does not include income tax solutions.

Download now and solve your income tax for this month for free – take advantage of our 7-day free trial.