What is Smart Finance?

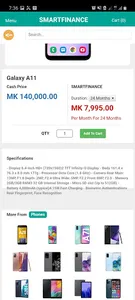

• Smart Finance is a scheme put in place by iT Centre in partnership with NBS Bank

(financing Partner) that allows customers to be able to enjoy and access various electronic

products ranging from TVs, Fridges, Mobile Phones, Aircons, Washing Machines and other

products offered by iT Centre while allowing the customer to be paying monthly

installments for up to 24 months.

Objective of The Scheme:

• To give opportunity to customers that cannot afford to purchase items on cash basis but

are Employed and can afford to make monthly commitments for a specified period while

they enjoy using their desired product.

Target Audience:

• The scheme is mainly designed for those who are getting a salary through a bank

account, and their employer can guarantee payments for them, monthly to NBS Bank.

• Those who have a good credit rating by the bank and can be approved for a loan

Main Steps of Smart Finance:

1. Customer visits iT Centre / Smart Zone and choose the product they are interested in

and are there after given a quotation of the value of the product they are interested in.

2. Customer takes the quotation to NBS Branch to get the quotation approved.

3. NBS Bank is responsible for vetting and approving Customer’s application.

4. Once NBS Bank approves the loan, they inform iT Centre that full payment has been

made.

5. iT Centre then releases the product to customer after confirmation of receipt of funds.

6. NBS Bank deducts monthly from customer’s bank account for the agreed period.

• Smart Finance is a scheme put in place by iT Centre in partnership with NBS Bank

(financing Partner) that allows customers to be able to enjoy and access various electronic

products ranging from TVs, Fridges, Mobile Phones, Aircons, Washing Machines and other

products offered by iT Centre while allowing the customer to be paying monthly

installments for up to 24 months.

Objective of The Scheme:

• To give opportunity to customers that cannot afford to purchase items on cash basis but

are Employed and can afford to make monthly commitments for a specified period while

they enjoy using their desired product.

Target Audience:

• The scheme is mainly designed for those who are getting a salary through a bank

account, and their employer can guarantee payments for them, monthly to NBS Bank.

• Those who have a good credit rating by the bank and can be approved for a loan

Main Steps of Smart Finance:

1. Customer visits iT Centre / Smart Zone and choose the product they are interested in

and are there after given a quotation of the value of the product they are interested in.

2. Customer takes the quotation to NBS Branch to get the quotation approved.

3. NBS Bank is responsible for vetting and approving Customer’s application.

4. Once NBS Bank approves the loan, they inform iT Centre that full payment has been

made.

5. iT Centre then releases the product to customer after confirmation of receipt of funds.

6. NBS Bank deducts monthly from customer’s bank account for the agreed period.

Show More