This cooperative android application is a companion digital tool for the eKSP cooperative management system. Currently, the eKSP system has been used in at least 5 large cooperatives in the country with a massive total number of members reaching more than 39 thousand members. The eKSP application has menu features:

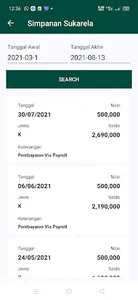

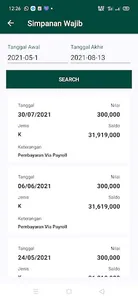

1. Member Savings: record deposit and withdrawal transactions for various types of deposits: principal, mandatory, voluntary and other types of deposits with uniquely defined characteristics (eg whether to receive monthly services/interest or only receive SHU portion at the end of the year)

2. Mini bank platforms: usually for school cooperatives, with the same mechanism as banks, calculating services/interest with an average balance, lowest balance, final balance. Can print transactions in books, validate stamps on each transaction.

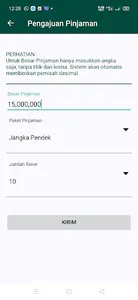

3. Loans: includes online loan applications by members, monitoring outstanding loan history, checking loan ceiling balances

4. Goods credit: for KSPs that have shop units. Transactions in stores that are credit (non-cash) can be monitored by installments through the application. Installment payments are usually through payroll / salary deductions.

5. Payroll deduction slips: for monitoring deposit payments, loan installment payments, credit for goods made through monthly payroll/salary deductions.

This eKSP application is ready to be implemented for all types of cooperatives, especially for SP cooperative types. For those interested in further discussing what the eKSP application can achieve for your cooperative, please visit us at https://berkoper.com, email : hadi@japati.net, mobile : 083876688967

1. Member Savings: record deposit and withdrawal transactions for various types of deposits: principal, mandatory, voluntary and other types of deposits with uniquely defined characteristics (eg whether to receive monthly services/interest or only receive SHU portion at the end of the year)

2. Mini bank platforms: usually for school cooperatives, with the same mechanism as banks, calculating services/interest with an average balance, lowest balance, final balance. Can print transactions in books, validate stamps on each transaction.

3. Loans: includes online loan applications by members, monitoring outstanding loan history, checking loan ceiling balances

4. Goods credit: for KSPs that have shop units. Transactions in stores that are credit (non-cash) can be monitored by installments through the application. Installment payments are usually through payroll / salary deductions.

5. Payroll deduction slips: for monitoring deposit payments, loan installment payments, credit for goods made through monthly payroll/salary deductions.

This eKSP application is ready to be implemented for all types of cooperatives, especially for SP cooperative types. For those interested in further discussing what the eKSP application can achieve for your cooperative, please visit us at https://berkoper.com, email : hadi@japati.net, mobile : 083876688967

Show More