With this tax app, you can connect bank accounts, uncover deductions, and file taxes for all states. Includes AI guidance, expert support, and security features.

AppRecs review analysis

AppRecs rating 3.9. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★☆☆

3.9

AppRecs Rating

Ratings breakdown

5 star

86%

4 star

4%

3 star

2%

2 star

1%

1 star

8%

What to know

✓

High user satisfaction

86% of sampled ratings are 5 stars

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About Keeper

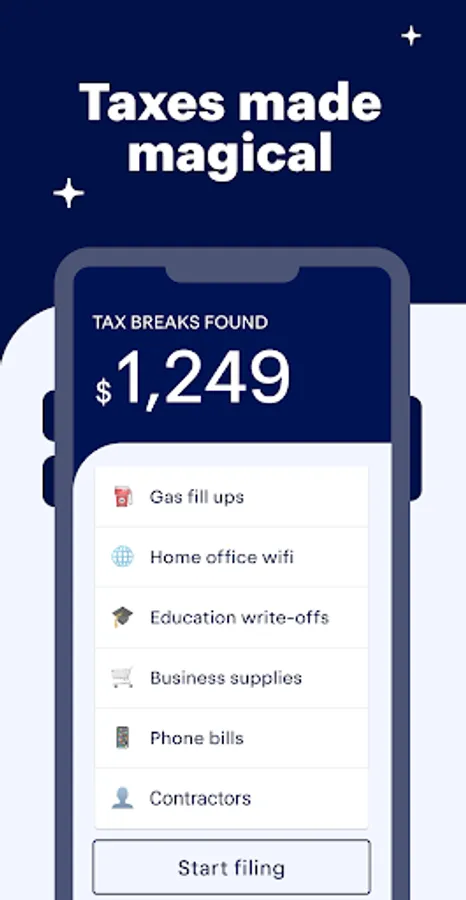

Once you outgrow traditional DIY tax filing software, there’s Keeper. You’ll have access to AI-powered tax guidance as well as our network of expert tax preparers. Together, they’ll help you easily handle the hairiest of tax complexities.

- Connect your bank for instant personalization

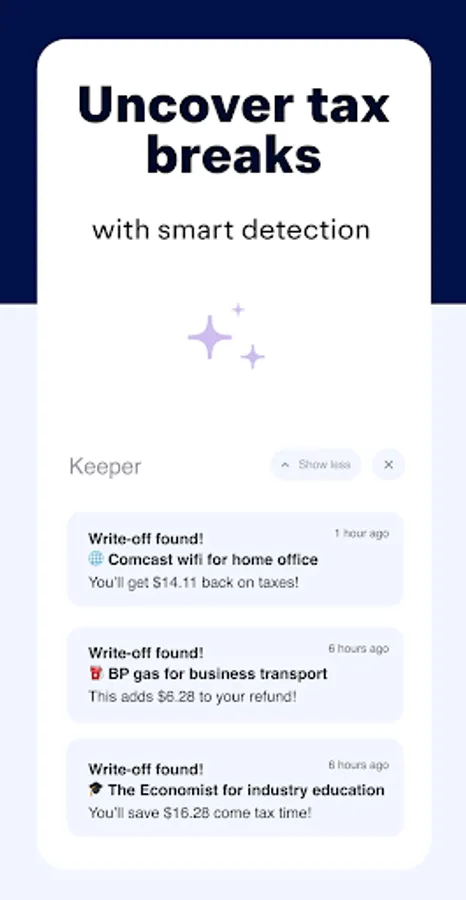

- Automatically uncover tax breaks

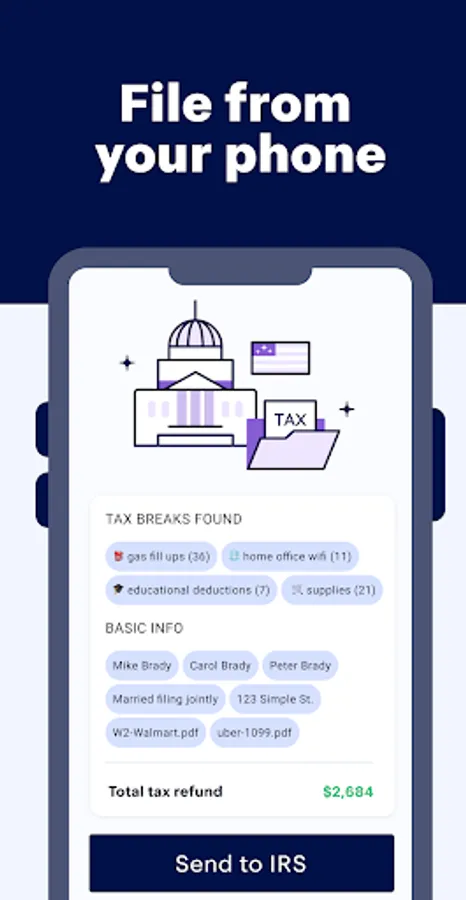

- File your taxes (including all 50 states)

- Supports W-2, 1099, investments, and more

- 300+ types of credits and deductions

- Smart audit protection included

- An assigned tax assistant answers questions

Keeper is especially valuable for small business owner, self-employed digital freelancers, and 1099 independent contractors because it automatically uncovers tax deductible business expenses among past transactions.

Keeper is secured using SSL 256-bit encryption— the same security protocol banks use — to ensure that your sensitive personal information is fully protected and securely stored. Keeper does not store your online banking credentials, or sell your information to anyone.

DISCLAIMERS

- Keeper is an independent company with no affiliation to any government entity. This Keeper app also doesn't represent any government entity. The websites for the IRS (https://irs.gov), as well as state tax authorities (https://www.keepertax.com/state-tax-authorities), are the source of information for specific tax requirements.

- Usage of Keeper is subject to our terms and conditions (https://www.keepertax.com/terms) and privacy policy (https://www.keepertax.com/privacy).

- Connect your bank for instant personalization

- Automatically uncover tax breaks

- File your taxes (including all 50 states)

- Supports W-2, 1099, investments, and more

- 300+ types of credits and deductions

- Smart audit protection included

- An assigned tax assistant answers questions

Keeper is especially valuable for small business owner, self-employed digital freelancers, and 1099 independent contractors because it automatically uncovers tax deductible business expenses among past transactions.

Keeper is secured using SSL 256-bit encryption— the same security protocol banks use — to ensure that your sensitive personal information is fully protected and securely stored. Keeper does not store your online banking credentials, or sell your information to anyone.

DISCLAIMERS

- Keeper is an independent company with no affiliation to any government entity. This Keeper app also doesn't represent any government entity. The websites for the IRS (https://irs.gov), as well as state tax authorities (https://www.keepertax.com/state-tax-authorities), are the source of information for specific tax requirements.

- Usage of Keeper is subject to our terms and conditions (https://www.keepertax.com/terms) and privacy policy (https://www.keepertax.com/privacy).