WELCOME,

We introduce our application which aims to educate about BRI KUR, with this application it will be easier for you to understand BRI KUR in a complex way.

BRI KUR, an abbreviation of "BRI Kredit Usaha Rakyat," is a loan program provided by (BRI) to support the financing of small and micro businesses. This program is specifically designed to help small businesses develop or start their businesses.

Some of the distinctive characteristics of BRI KUR include:

Borrower Target:

This program is aimed at micro and small businesses, including small traders, farmers, fishermen, culinary entrepreneurs and other types of small businesses.

Loan Ceiling:

BRI KUR has an affordable loan ceiling according to the needs of micro and small businesses. This ceiling may vary depending on the type of business and the borrower's needs.

Low Interest Rates:

Usually, BRI KUR offers competitive and lower interest rates compared to other commercial loans. The goal is to make these loans more affordable for small businesses.

Loan Term:

The loan repayment period can be adjusted to the type of business and borrower's needs. Usually, BRI provides a fairly flexible time period.

Easy Application Process:

The BRI KUR application process is designed to be easy to understand and access for small businesses. The required documents are relatively simple, and borrowers can get help from the officer.

Funds Used for Business Capital:

BRI KUR loans can be used for various business needs, such as purchasing inventory, working capital, business equipment, and other needs that support business development or continuity.

Help and Training:

Apart from loans, BRI can also provide assistance and training to borrowers to help them manage their businesses better.

We introduce our application which aims to educate about BRI KUR, with this application it will be easier for you to understand BRI KUR in a complex way.

BRI KUR, an abbreviation of "BRI Kredit Usaha Rakyat," is a loan program provided by (BRI) to support the financing of small and micro businesses. This program is specifically designed to help small businesses develop or start their businesses.

Some of the distinctive characteristics of BRI KUR include:

Borrower Target:

This program is aimed at micro and small businesses, including small traders, farmers, fishermen, culinary entrepreneurs and other types of small businesses.

Loan Ceiling:

BRI KUR has an affordable loan ceiling according to the needs of micro and small businesses. This ceiling may vary depending on the type of business and the borrower's needs.

Low Interest Rates:

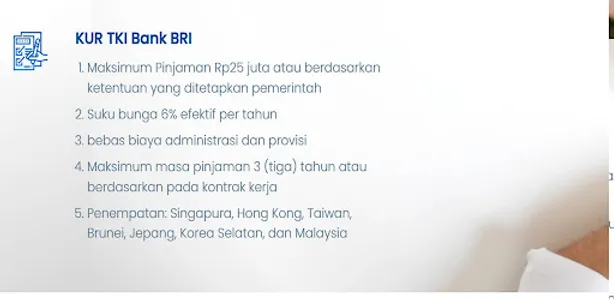

Usually, BRI KUR offers competitive and lower interest rates compared to other commercial loans. The goal is to make these loans more affordable for small businesses.

Loan Term:

The loan repayment period can be adjusted to the type of business and borrower's needs. Usually, BRI provides a fairly flexible time period.

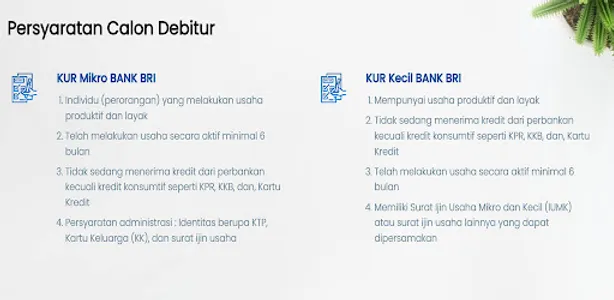

Easy Application Process:

The BRI KUR application process is designed to be easy to understand and access for small businesses. The required documents are relatively simple, and borrowers can get help from the officer.

Funds Used for Business Capital:

BRI KUR loans can be used for various business needs, such as purchasing inventory, working capital, business equipment, and other needs that support business development or continuity.

Help and Training:

Apart from loans, BRI can also provide assistance and training to borrowers to help them manage their businesses better.

Show More