NSBank Mobile Banking

Zions Bancorporation, N.A.

4.8 ★

store rating

50,000+

downloads

Free

AppRecs review analysis

AppRecs rating 4.5. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.5

AppRecs Rating

Ratings breakdown

5 star

88%

4 star

8%

3 star

1%

2 star

1%

1 star

1%

What to know

✓

High user satisfaction

88% of sampled ratings are 5 stars

⚠

Ad complaints

Many low ratings mention excessive ads

About NSBank Mobile Banking

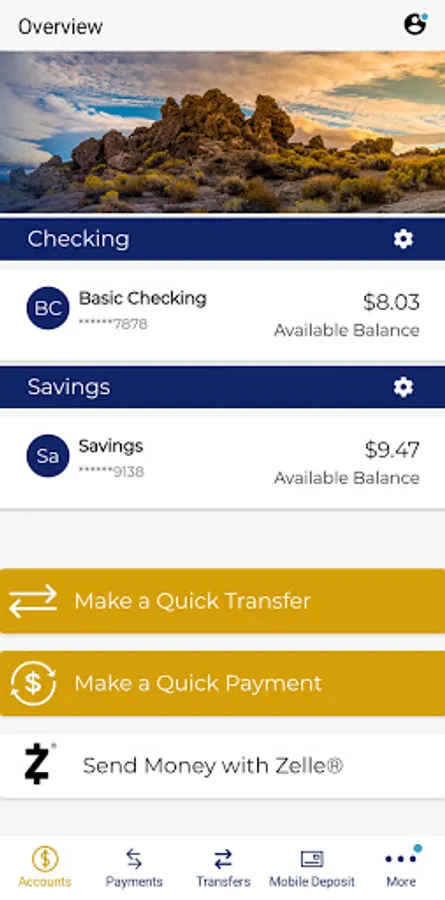

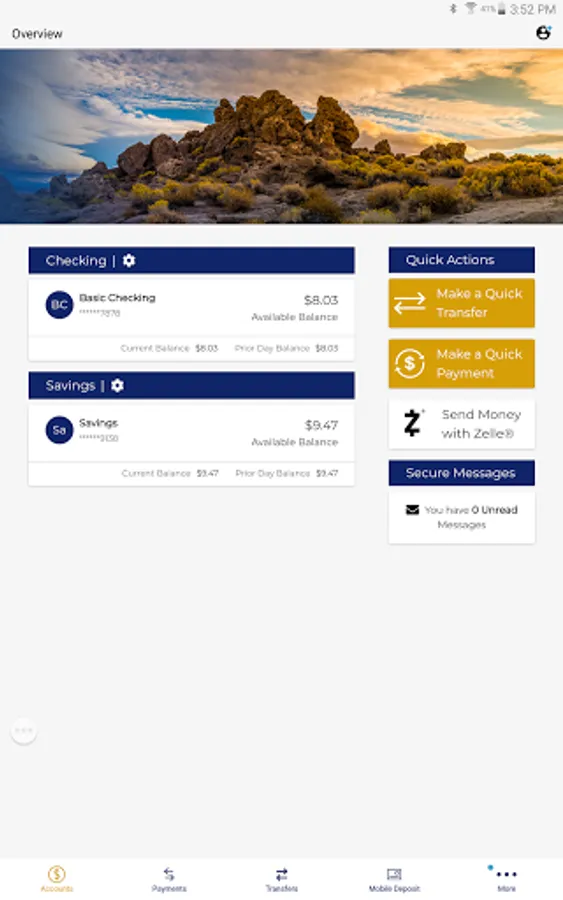

Managing your finances on the go has never been easier with the Nevada State Bank Mobile Banking app.¹

Personal banking features

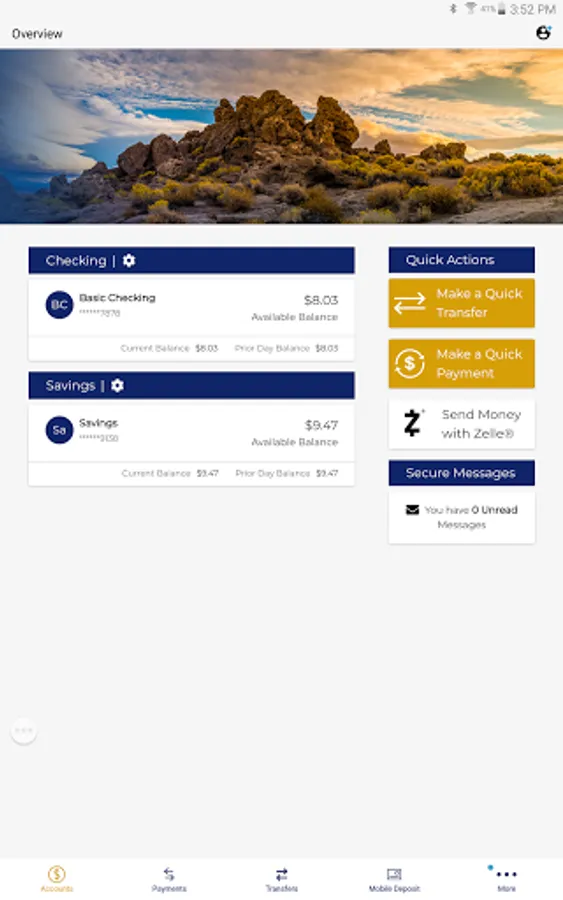

Account management

• View account balances, details, and activity across accounts

• See your free personal credit score and report

• Apply for new accounts

• Review statements and notices

• Export transactions options

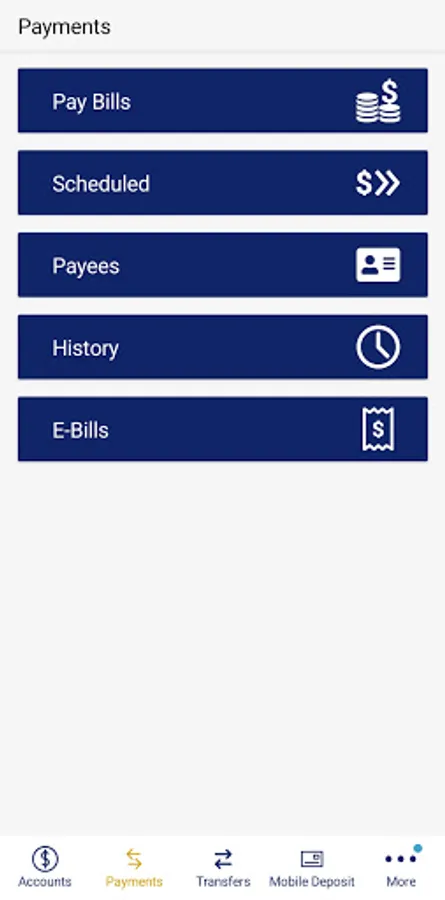

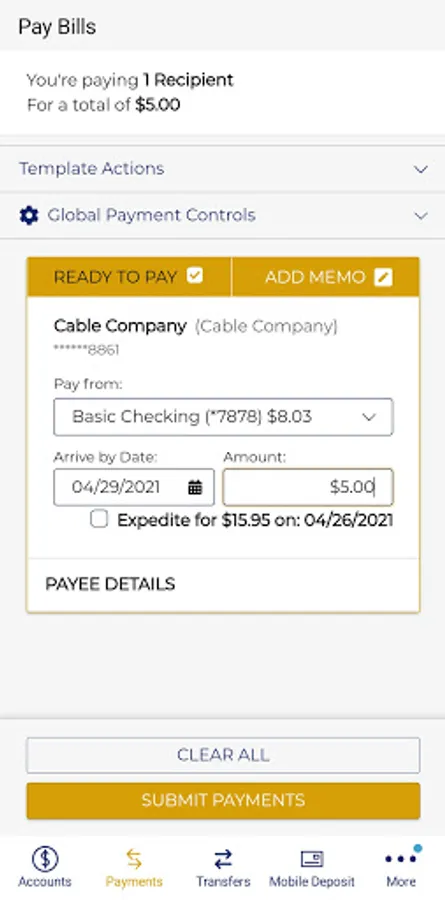

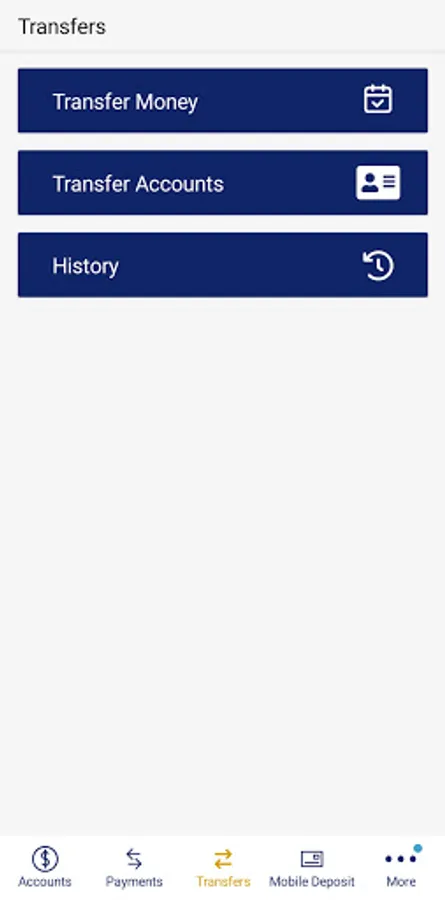

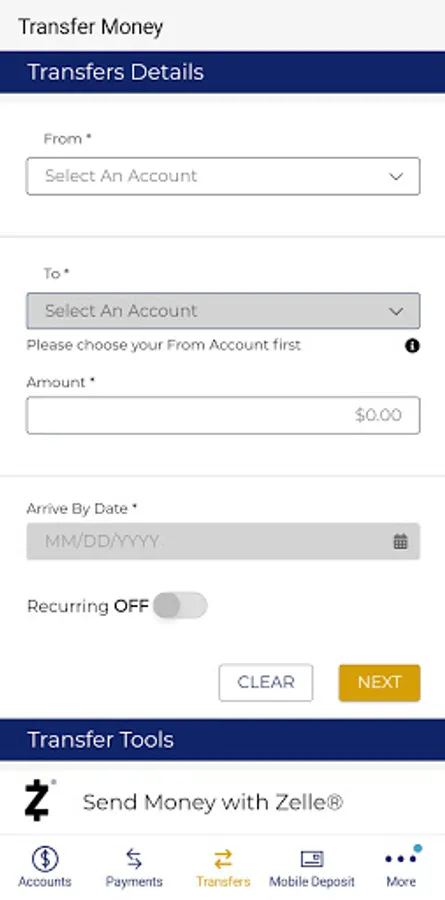

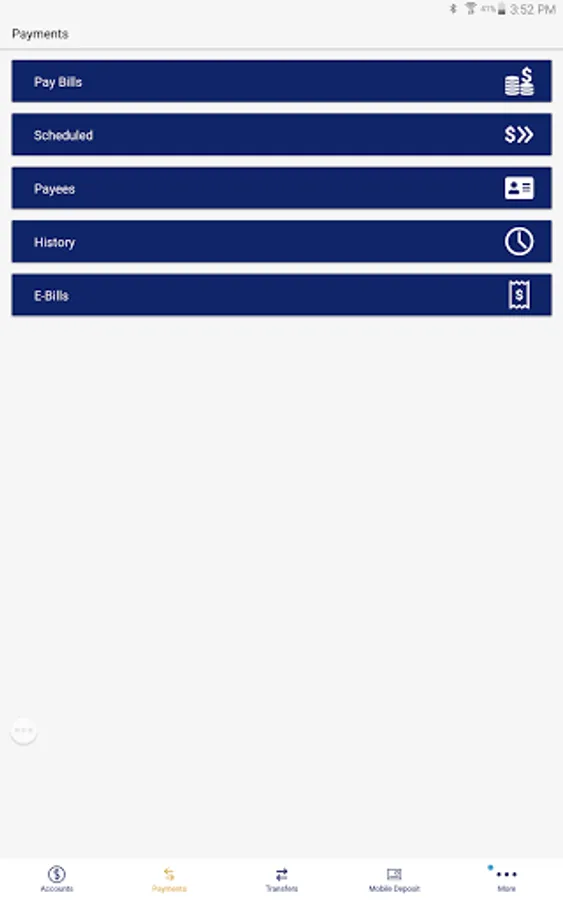

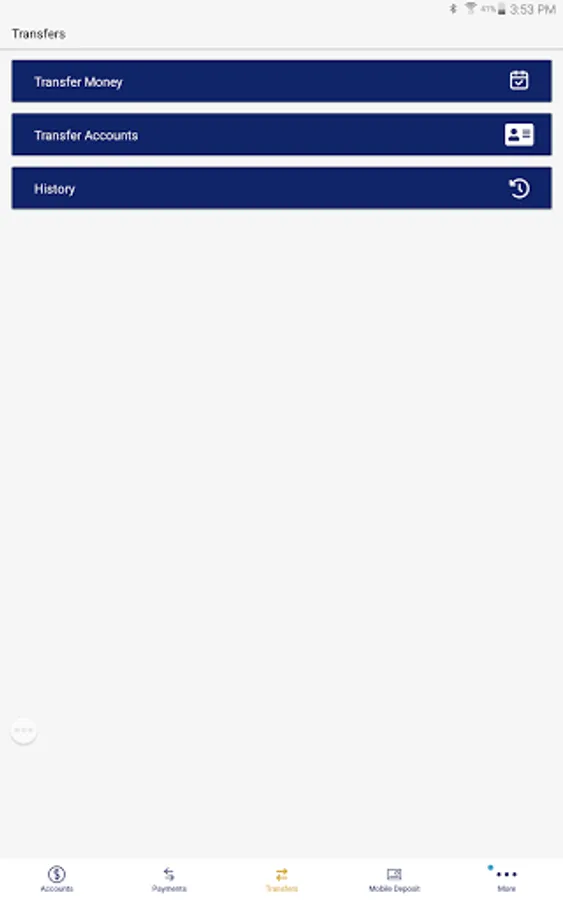

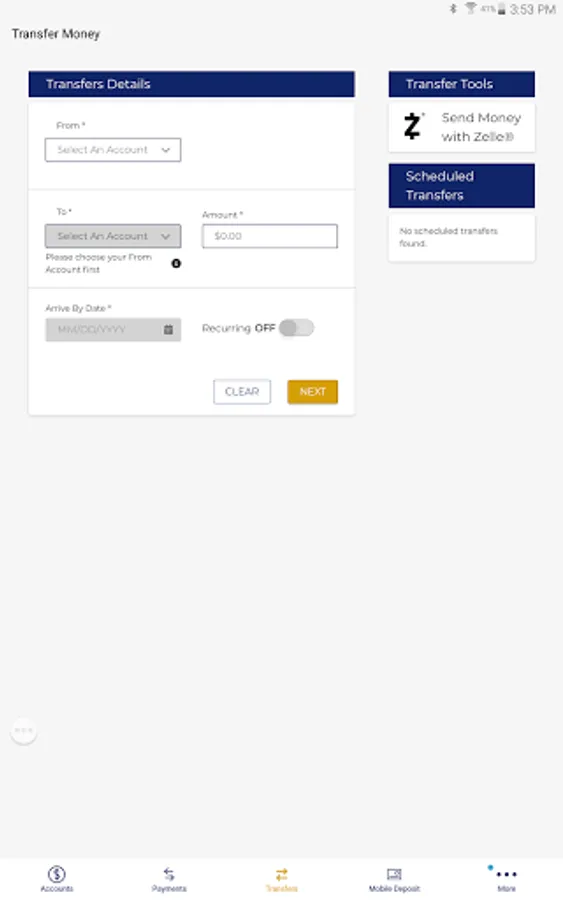

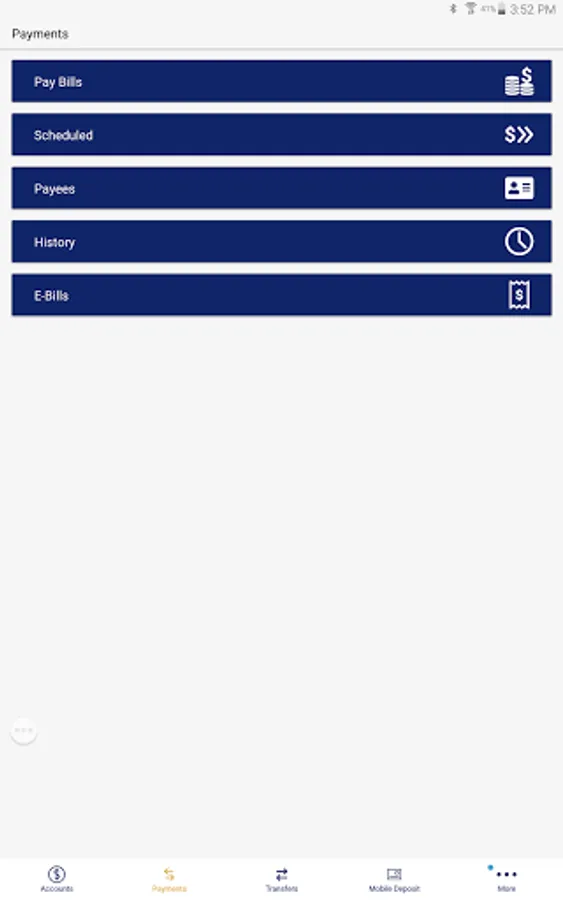

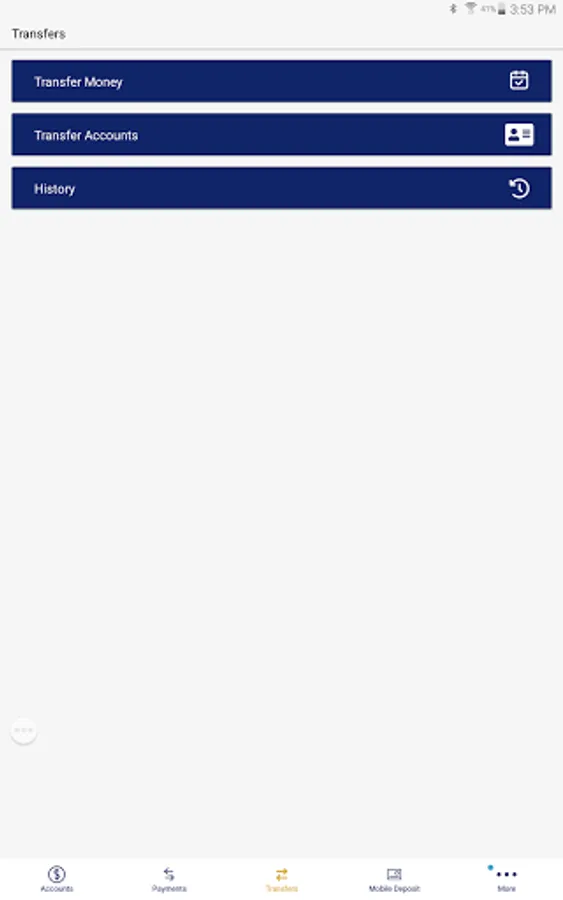

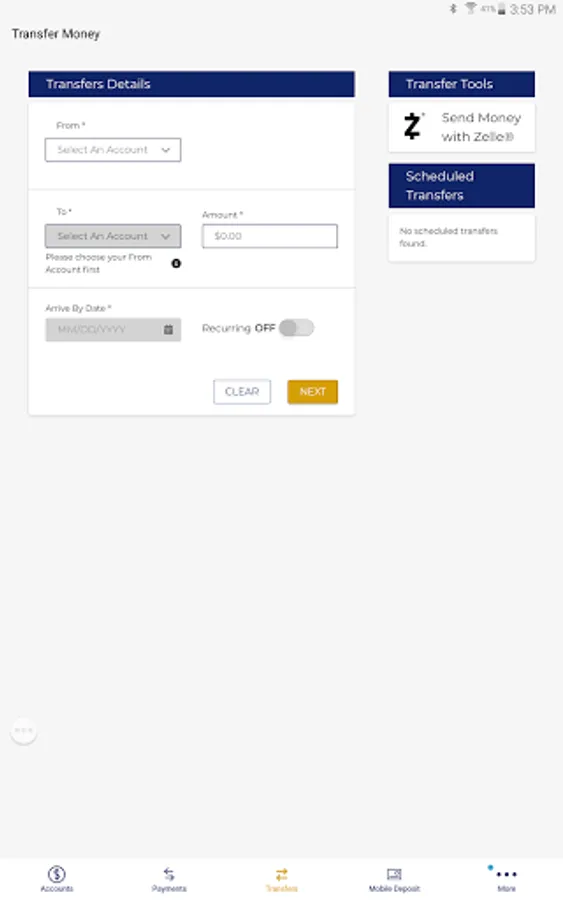

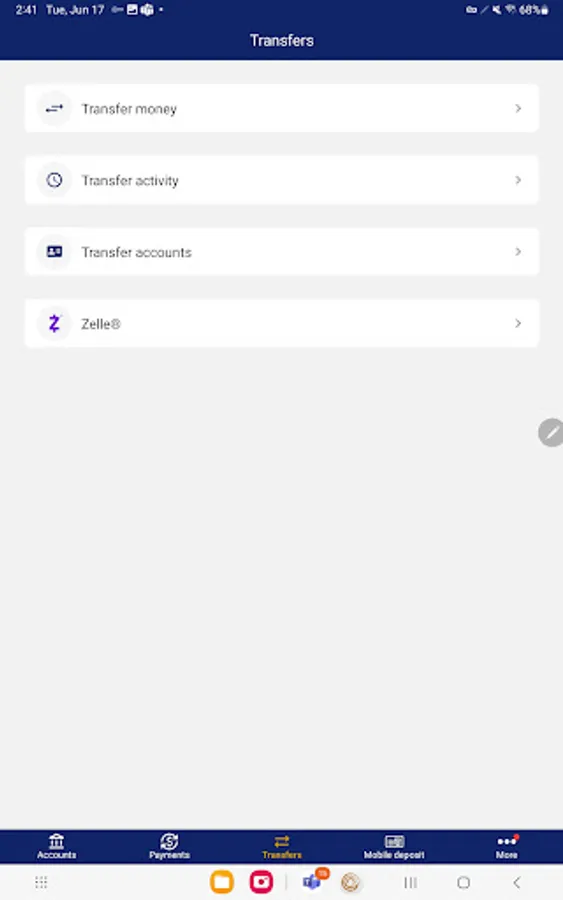

Payments & transfers²

• Send/receive money with Zelle®

• Transfer funds, pay bills, and send wires

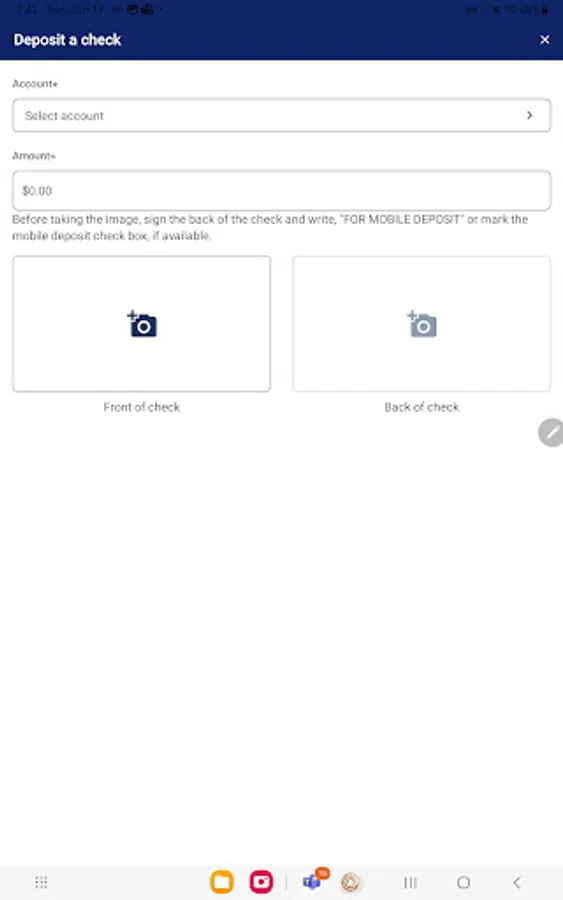

• Mobile check deposit

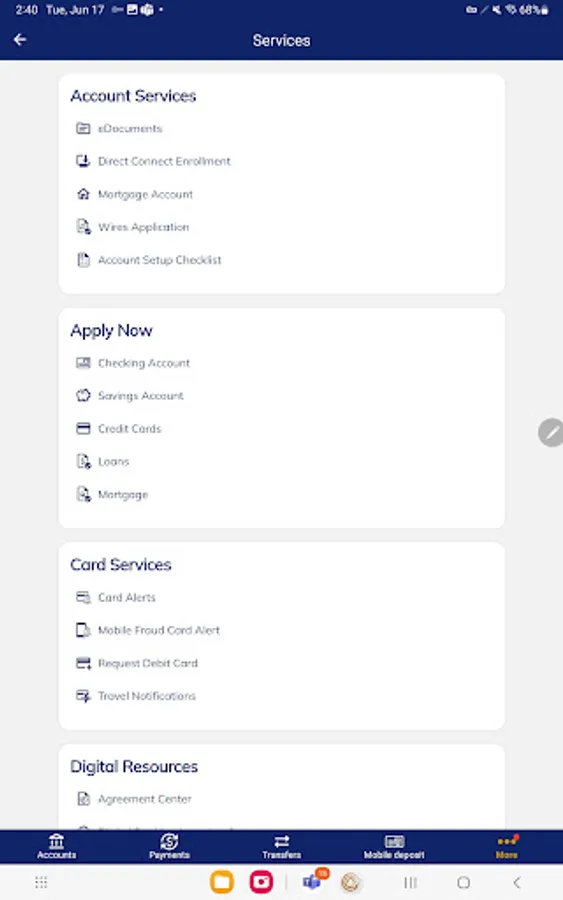

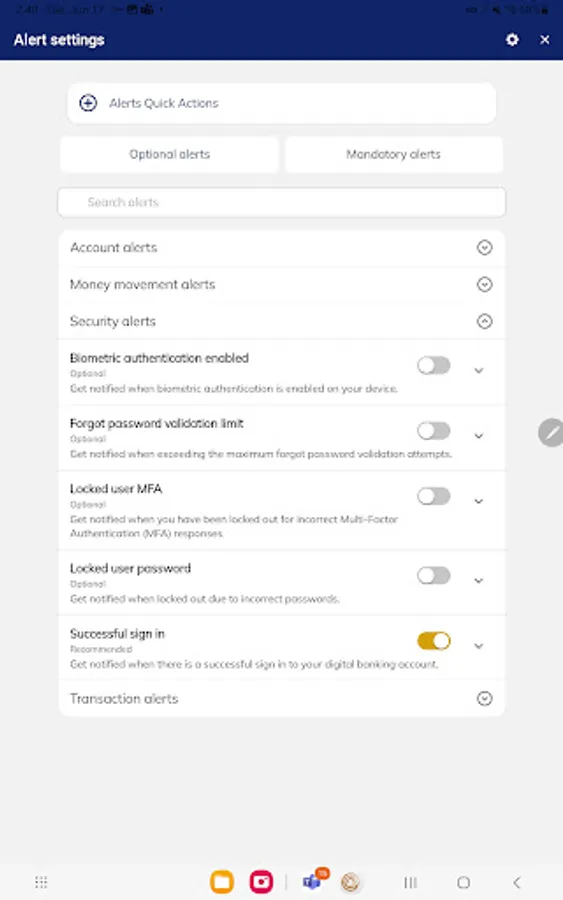

Security & card controls

• Use biometrics for sign-in on supported devices

• Lock/unlock cards instantly

• Set up and manage security alerts

Rewards & offers

• View credit card rewards

• Discover personalized offers

Self service

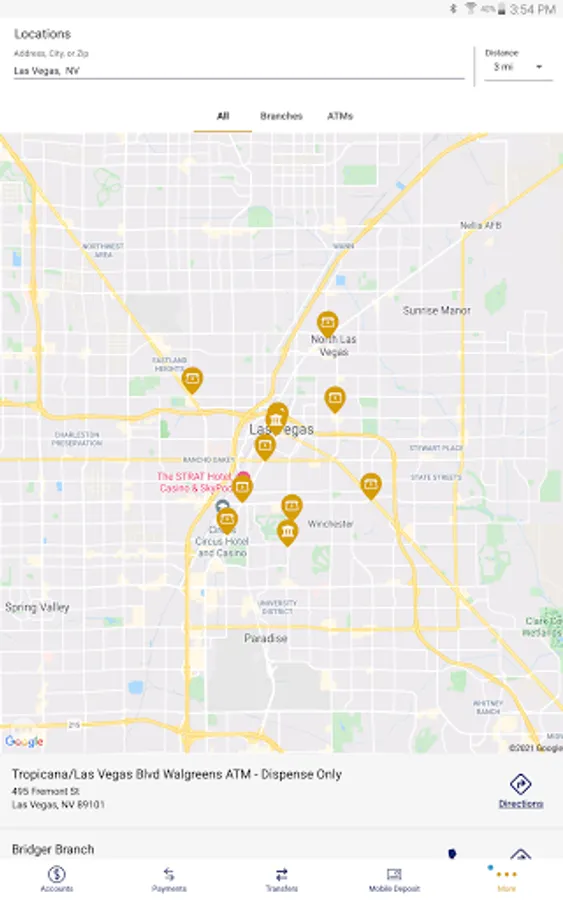

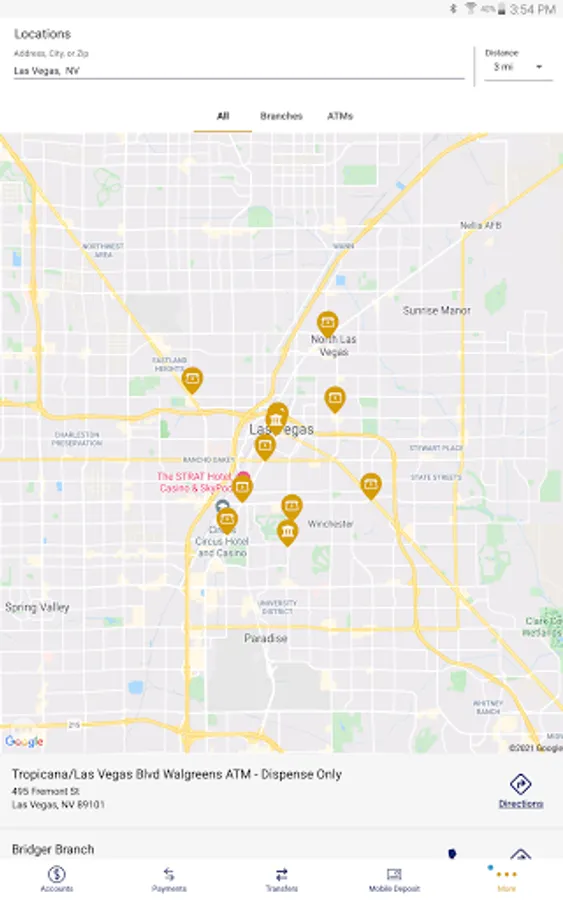

• Find a branch and ATM

• Schedule travel notifications

• And more

Business banking features

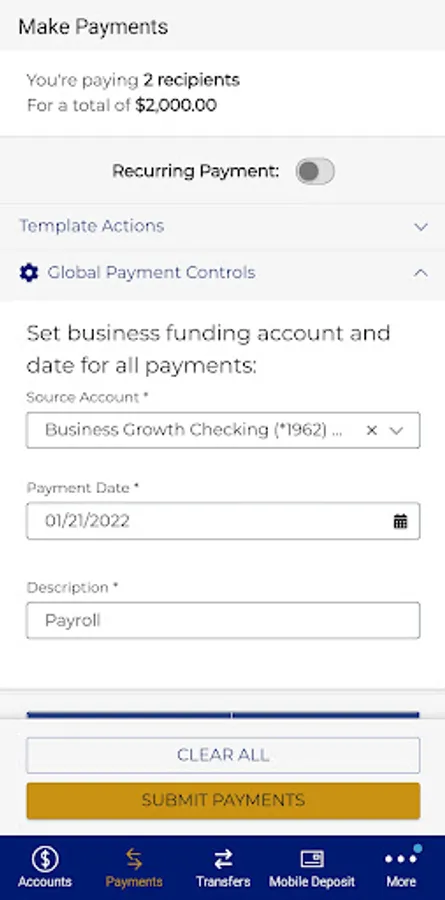

Payments & Transfers² ³ ⁴

• Pay bills and employees

• Send and receive wire transfers

• Use Zelle® for business payments

• Send ACH direct deposits

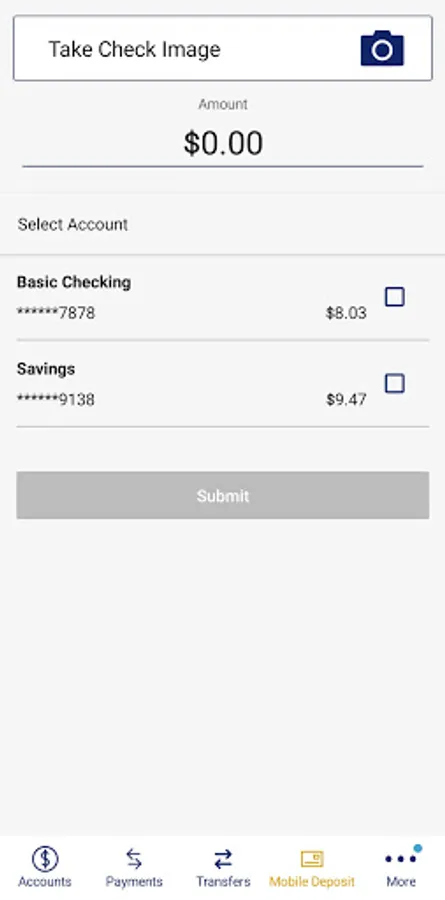

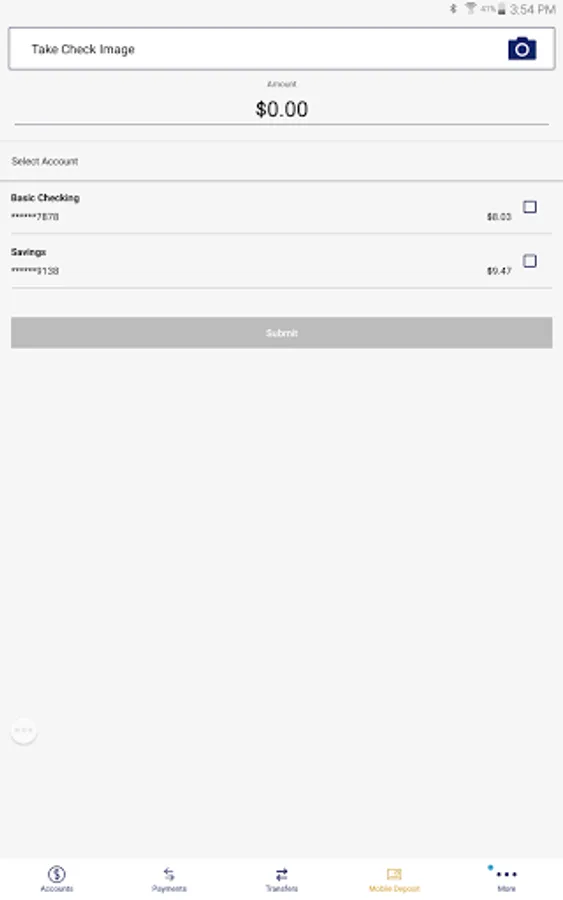

• Mobile check deposit

• Edit or cancel payments

• Review payment history

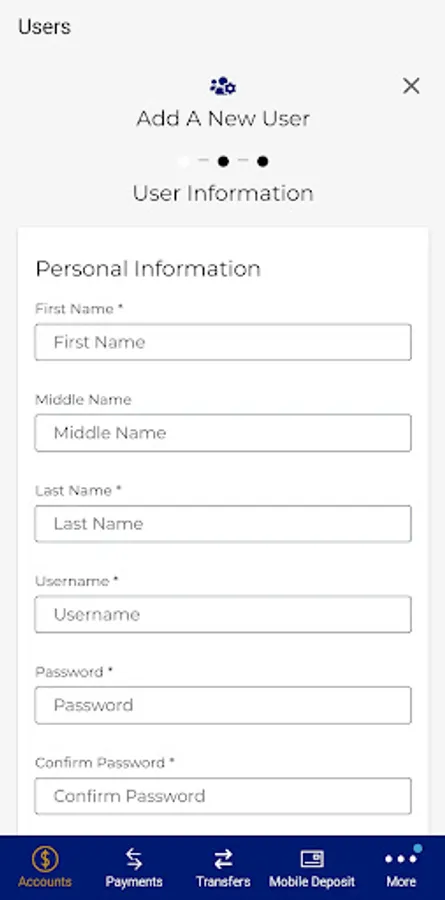

User management⁵

• Manage users and permissions

• Reset passwords and access

• Receive personalized activity alerts

Invoice & Get Paid³ ⁴

• Create and send invoices

• Share payment links and QR codes

• Accept cards, ACH, and Apple Pay

Security & authorization⁶

• Use biometric sign-in

• Multi-factor authentication (MFA)

• Enable dual authorization

• Manage alerts and secure messages

To use the App, you must:

• Have a deposit, loan, line of credit, or credit card account with Nevada State Bank

• Have a compatible mobile device and U.S. phone number

• Be connected to Wi-Fi or a mobile internet data service**

Have a comment or question? Email us at MobileBankingCustomerSupport@zionsbancorp.com.

**Message and data rates may apply. Please check with your carrier for details.

1 Mobile Banking requires enrollment in Digital Banking. Fees from your wireless provider may apply. Please refer to the applicable Rate and Fee Schedule (Personal or Business Accounts Schedule of Fees or Service Charge Information). Subject to terms and conditions of the Digital Banking Service Agreement. Trademarks used are the property of their registered owner and Nevada State Bank is neither affiliated with nor endorses these companies or their products/services.

2 U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. See your Zelle® and Other Payment Services Agreement for more details. Standard text and data rates from your mobile phone carrier may apply. Available services are subject to change without notice.

Zelle® is intended for sending money to family, friends, and people you know and trust. It is recommended that you do not use Zelle® to send money to people you don’t know. Neither Zions Bancorporation, N.A. nor Zelle® offer a protection program for any authorized purchase made with Zelle®.

In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled in Zelle®.

Zelle and Zelle related marks are wholly owned by Early Warning Services, LLC. and are used herein under license.

3 Wire Transfers and ACH Direct Deposit require enrollment in each service. See the Personal or Business Accounts Schedule of Fees for fees associated with each service.

4 Feature availability for business users is subject to user Entitlements.

5 User Management and certain administrative capabilities are restricted to Customer System Administrators (CSAs) on the business profile. Other conditions may apply, such as if the business has enrolled in Dual Authorization for certain transactions. Refer to the Digital Banking Service Agreement for more information.

6 Approvals are currently applicable for businesses who are enrolled in Dual Authorization, where two business users are required to complete certain transactions (one initiator and one approver).

Personal banking features

Account management

• View account balances, details, and activity across accounts

• See your free personal credit score and report

• Apply for new accounts

• Review statements and notices

• Export transactions options

Payments & transfers²

• Send/receive money with Zelle®

• Transfer funds, pay bills, and send wires

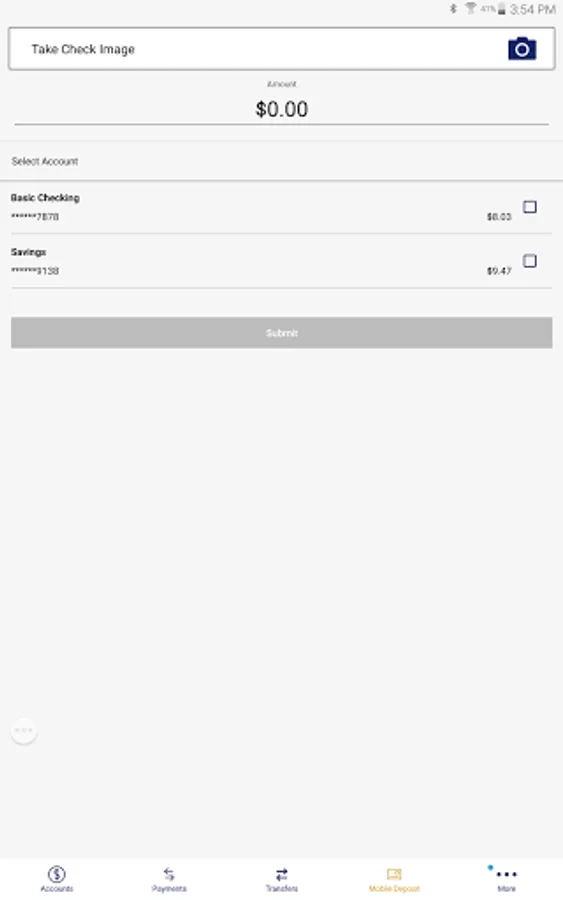

• Mobile check deposit

Security & card controls

• Use biometrics for sign-in on supported devices

• Lock/unlock cards instantly

• Set up and manage security alerts

Rewards & offers

• View credit card rewards

• Discover personalized offers

Self service

• Find a branch and ATM

• Schedule travel notifications

• And more

Business banking features

Payments & Transfers² ³ ⁴

• Pay bills and employees

• Send and receive wire transfers

• Use Zelle® for business payments

• Send ACH direct deposits

• Mobile check deposit

• Edit or cancel payments

• Review payment history

User management⁵

• Manage users and permissions

• Reset passwords and access

• Receive personalized activity alerts

Invoice & Get Paid³ ⁴

• Create and send invoices

• Share payment links and QR codes

• Accept cards, ACH, and Apple Pay

Security & authorization⁶

• Use biometric sign-in

• Multi-factor authentication (MFA)

• Enable dual authorization

• Manage alerts and secure messages

To use the App, you must:

• Have a deposit, loan, line of credit, or credit card account with Nevada State Bank

• Have a compatible mobile device and U.S. phone number

• Be connected to Wi-Fi or a mobile internet data service**

Have a comment or question? Email us at MobileBankingCustomerSupport@zionsbancorp.com.

**Message and data rates may apply. Please check with your carrier for details.

1 Mobile Banking requires enrollment in Digital Banking. Fees from your wireless provider may apply. Please refer to the applicable Rate and Fee Schedule (Personal or Business Accounts Schedule of Fees or Service Charge Information). Subject to terms and conditions of the Digital Banking Service Agreement. Trademarks used are the property of their registered owner and Nevada State Bank is neither affiliated with nor endorses these companies or their products/services.

2 U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. See your Zelle® and Other Payment Services Agreement for more details. Standard text and data rates from your mobile phone carrier may apply. Available services are subject to change without notice.

Zelle® is intended for sending money to family, friends, and people you know and trust. It is recommended that you do not use Zelle® to send money to people you don’t know. Neither Zions Bancorporation, N.A. nor Zelle® offer a protection program for any authorized purchase made with Zelle®.

In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled in Zelle®.

Zelle and Zelle related marks are wholly owned by Early Warning Services, LLC. and are used herein under license.

3 Wire Transfers and ACH Direct Deposit require enrollment in each service. See the Personal or Business Accounts Schedule of Fees for fees associated with each service.

4 Feature availability for business users is subject to user Entitlements.

5 User Management and certain administrative capabilities are restricted to Customer System Administrators (CSAs) on the business profile. Other conditions may apply, such as if the business has enrolled in Dual Authorization for certain transactions. Refer to the Digital Banking Service Agreement for more information.

6 Approvals are currently applicable for businesses who are enrolled in Dual Authorization, where two business users are required to complete certain transactions (one initiator and one approver).