AppRecs review analysis

AppRecs rating 3.7. Trustworthiness 79 out of 100. Review manipulation risk 31 out of 100. Based on a review sample analyzed.

★★★☆☆

3.7

AppRecs Rating

Ratings breakdown

5 star

67%

4 star

0%

3 star

0%

2 star

0%

1 star

33%

What to know

✓

Credible reviews

79% trustworthiness score from analyzed reviews

✓

Good user ratings

67% positive sampled reviews

About MFL Sparkle

MIDAS Financing PLC. (MFL), a well-known and reputed NBFI, commenced its operations on January 1st, 2000, primarily focusing on financing small and medium-sized businesses (SME). Presently, MFL's financing facilities cover a wide range of industries in addition to the SME sector, and it is significantly advancing Bangladesh's economic growth. The Company has diversified its product range and is now extending credit facilities such as Lease, Term Loan, Home Loan, Auto Loan, etc. to different corporate organizations, small & medium enterprises, and individuals. In addition to its head office in Dhaka, Bangladesh, the company offers its services through 15 (fifteen) branches spread throughout the nation. MFL offers a variety of term deposit options which also offer competitive interest rates and prompt repayment upon maturity.

The Board of the Company comprises renowned and well-respected citizens of Bangladesh. They embody a range of talents, skills, and expertise and offer wise counsel regarding the Company's operations.

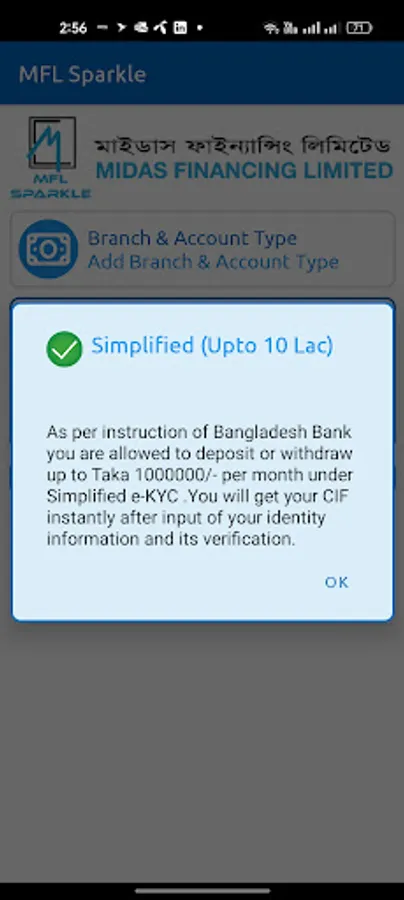

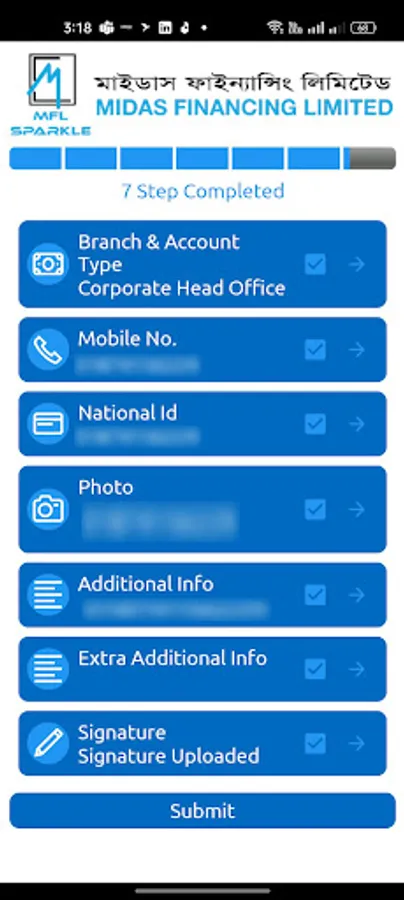

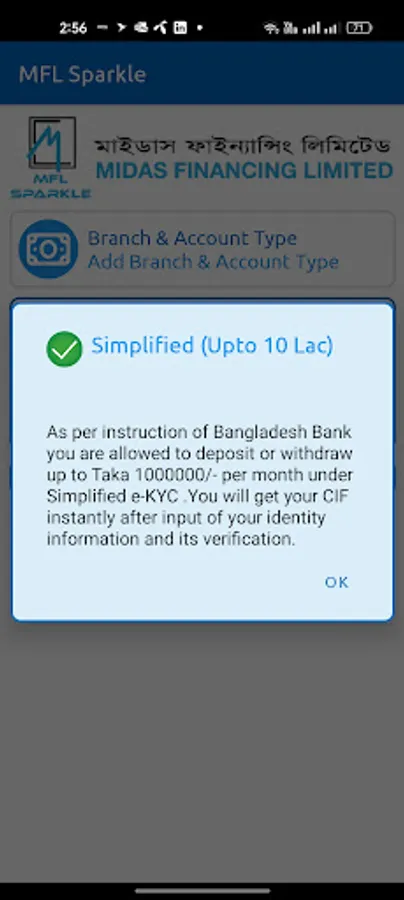

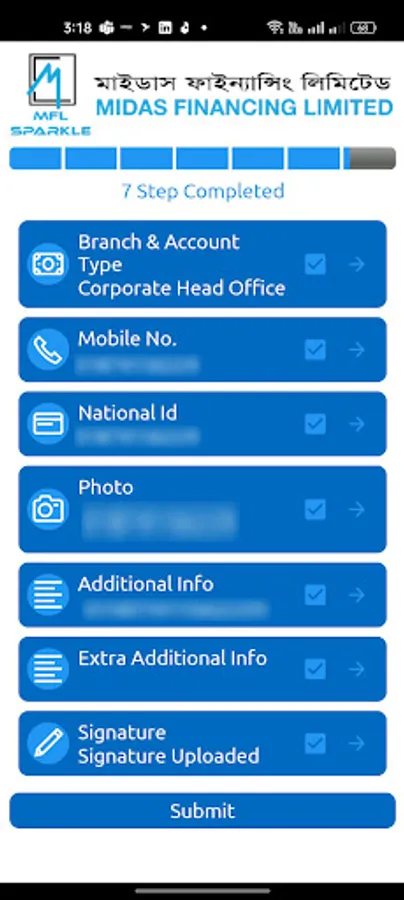

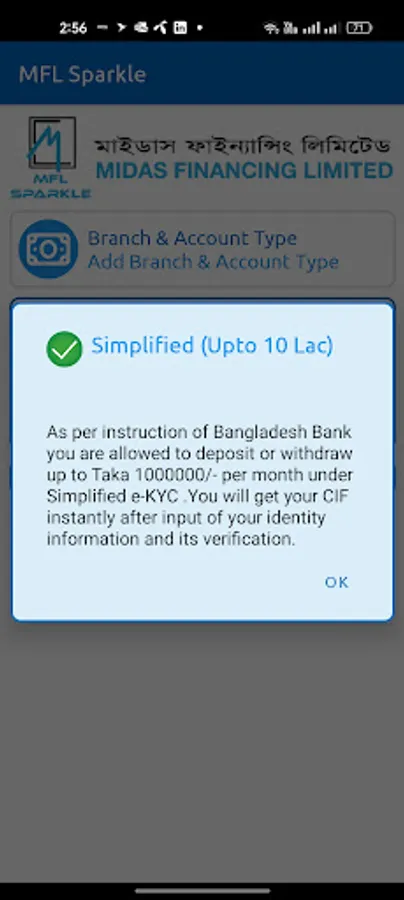

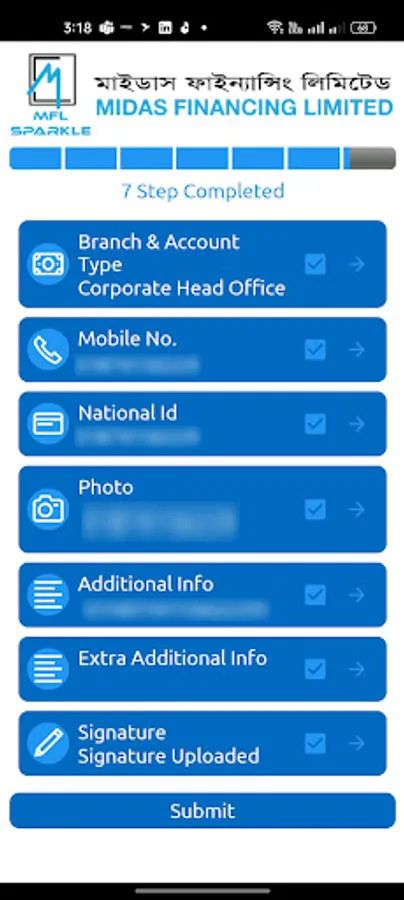

MFL Sparkle follows Electronic Know Your Customer (e-KYC) process which provides the most convenient way to open an account, anytime, anywhere. It can save time of customer onboarding from 4-5 days to 5-6 minutes without any cost.

We emphasize on continuous development endeavors and value addition to become a real friend of entrepreneurs and remain competitive in the financial service market.

Download MFL Sparkle from Google Play store only. Do not use any other websites for downloading this application. You can also access MFL Sparkle through the web https://www.mfl.com.bd.

For feedback & suggestions, please email us at info@mfl.com.bd and visit https://www.mfl.com.bd for more details.

MFL Sparkle Features:

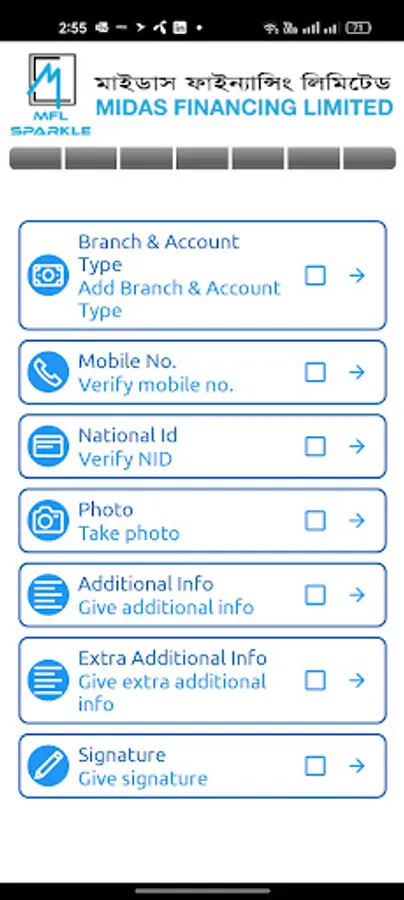

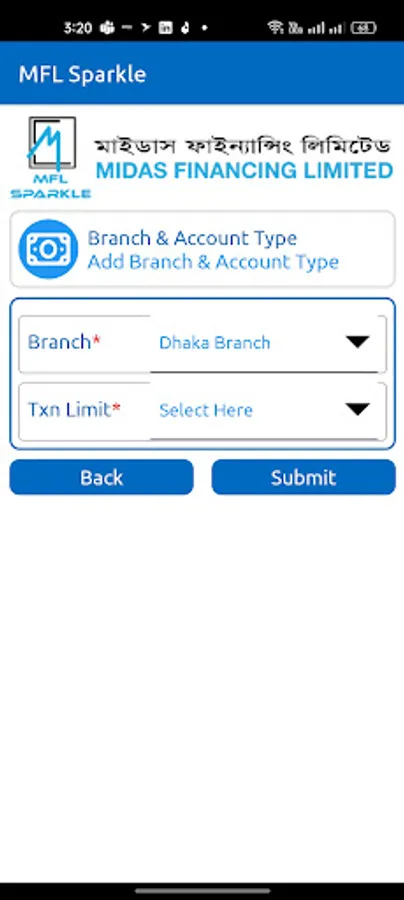

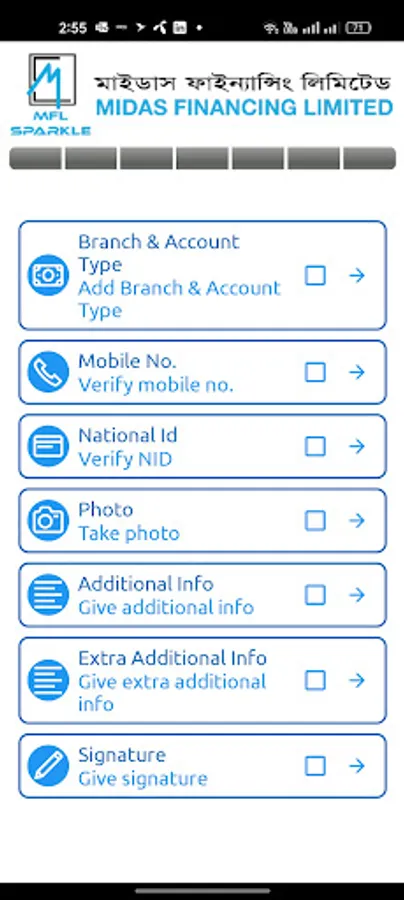

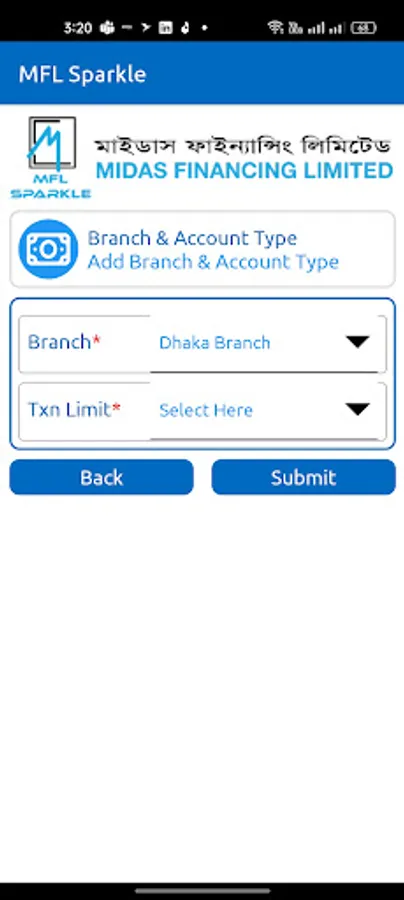

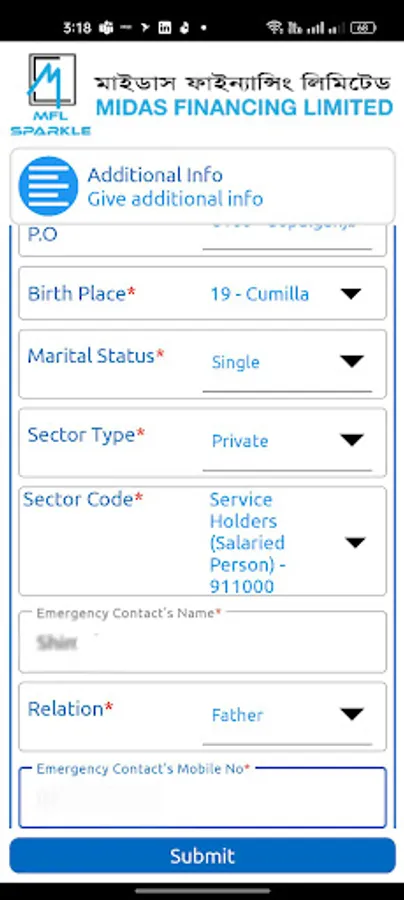

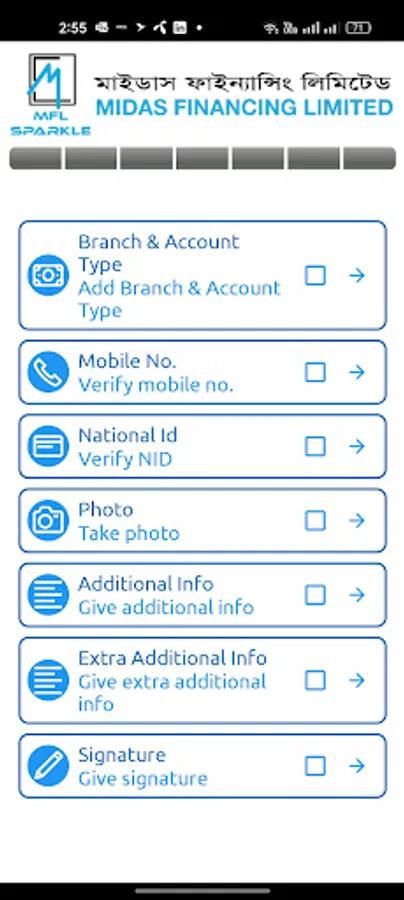

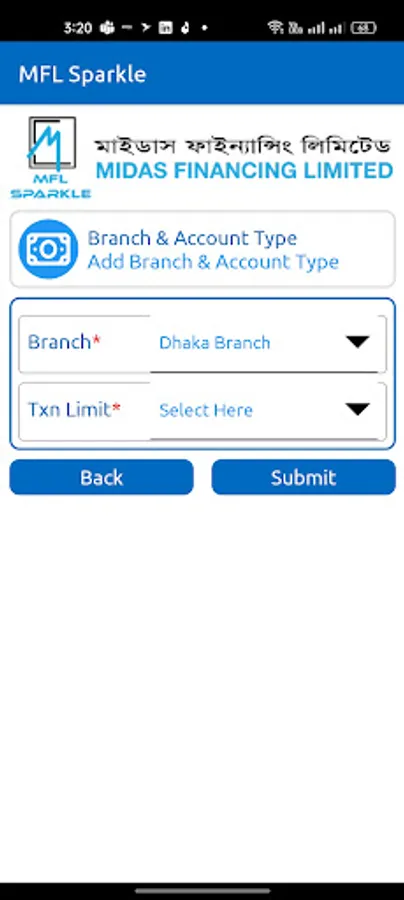

• Customer verification through Mobile device.

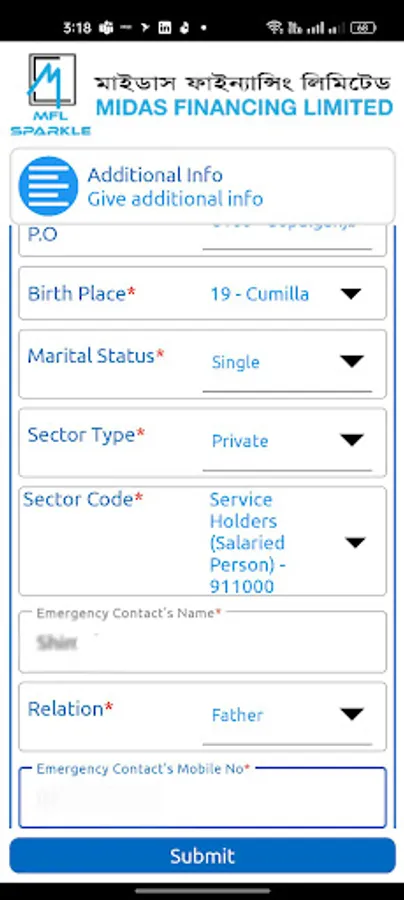

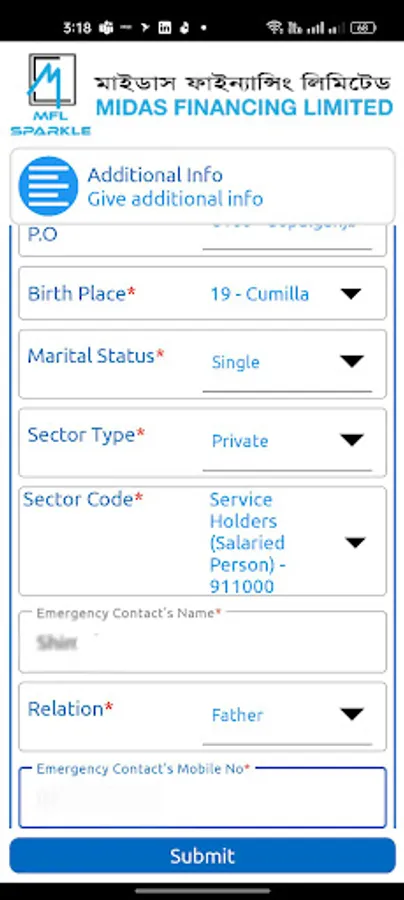

• Customer profiling.

• Sanction Screening.

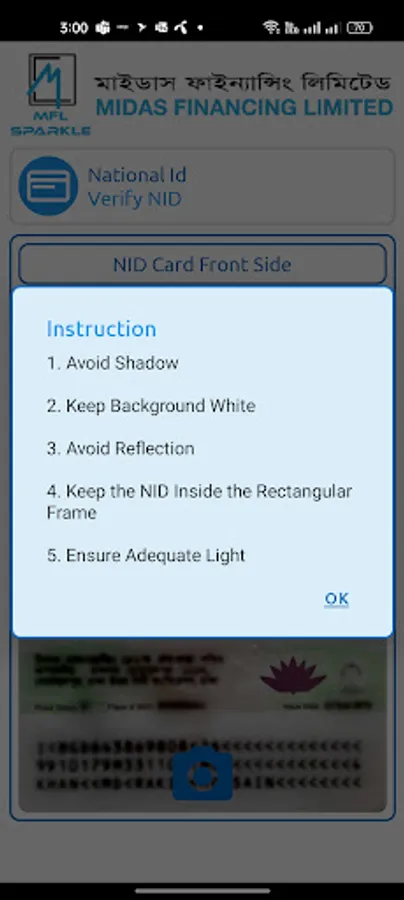

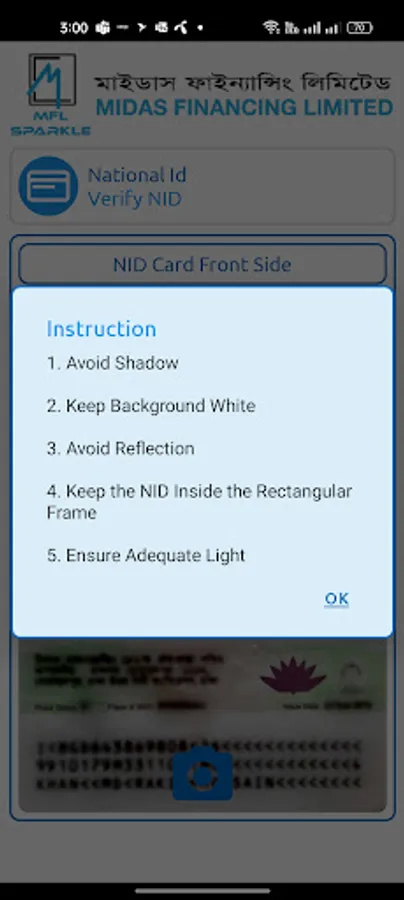

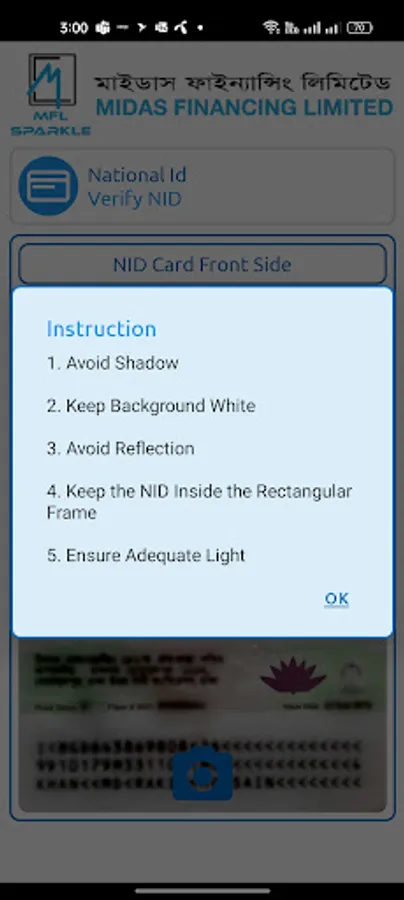

• Verification of NID and Smart NID with Election Commission server.

• AI based Live Photo Capture.

• Face matching with NID server.

The Board of the Company comprises renowned and well-respected citizens of Bangladesh. They embody a range of talents, skills, and expertise and offer wise counsel regarding the Company's operations.

MFL Sparkle follows Electronic Know Your Customer (e-KYC) process which provides the most convenient way to open an account, anytime, anywhere. It can save time of customer onboarding from 4-5 days to 5-6 minutes without any cost.

We emphasize on continuous development endeavors and value addition to become a real friend of entrepreneurs and remain competitive in the financial service market.

Download MFL Sparkle from Google Play store only. Do not use any other websites for downloading this application. You can also access MFL Sparkle through the web https://www.mfl.com.bd.

For feedback & suggestions, please email us at info@mfl.com.bd and visit https://www.mfl.com.bd for more details.

MFL Sparkle Features:

• Customer verification through Mobile device.

• Customer profiling.

• Sanction Screening.

• Verification of NID and Smart NID with Election Commission server.

• AI based Live Photo Capture.

• Face matching with NID server.