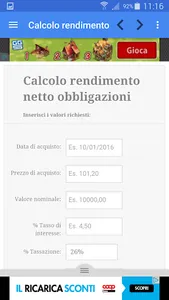

Net yield bonds is a free tool that allows you to calculate, in a simple and fast, the actual annual net return of a bond (and status as BTP), fixed-rate bonds.

Bonds can be an important part of an investment portfolio. If chosen carefully can give you stability, reducing the overall risk.

Investing in bonds is not a simple thing, investing is never easy. And to choose which is the best bonds to be included in your portfolio need a bit 'of information that will help you understand the reliability of the issuer and to calculate the yield.

So how do you calculate the yield of a bond? This Android application will help in calculating the effective annual yield on a fixed interest rate and coupon.

Just enter the required data into the form, and the app will calculate net interest income which makes the title,

the capital gain of the title, and most importantly, annual effective fixed rate bond with coupon.

To calculate the debt / bond yield, just the following data:

- Data acquisition

- Purchase price

- Nominal value

- Gross Interest Rate

- Taxation (12.5% or 26%)

- Price redemption / sale

- Date redemption / sale

After entering all the required data, the tool will give you back the bond's net annual effective yield to fixed rate you're analyzing.

The net yield of the bond is the actual bond yield (net of withholding tax on both the coupons that capital gains) calculated taking into account that the obligation is held in the portfolio until its natural end.

The app then allows you to choose between the different opportunities offered by the bond market.

Bonds can be an important part of an investment portfolio. If chosen carefully can give you stability, reducing the overall risk.

Investing in bonds is not a simple thing, investing is never easy. And to choose which is the best bonds to be included in your portfolio need a bit 'of information that will help you understand the reliability of the issuer and to calculate the yield.

So how do you calculate the yield of a bond? This Android application will help in calculating the effective annual yield on a fixed interest rate and coupon.

Just enter the required data into the form, and the app will calculate net interest income which makes the title,

the capital gain of the title, and most importantly, annual effective fixed rate bond with coupon.

To calculate the debt / bond yield, just the following data:

- Data acquisition

- Purchase price

- Nominal value

- Gross Interest Rate

- Taxation (12.5% or 26%)

- Price redemption / sale

- Date redemption / sale

After entering all the required data, the tool will give you back the bond's net annual effective yield to fixed rate you're analyzing.

The net yield of the bond is the actual bond yield (net of withholding tax on both the coupons that capital gains) calculated taking into account that the obligation is held in the portfolio until its natural end.

The app then allows you to choose between the different opportunities offered by the bond market.

Show More