About Aspen Digital

Aspen Digital is the trusted partner for HNWI, Private Wealth Managers/External Asset Managers and Institutions investing in Digital Assets

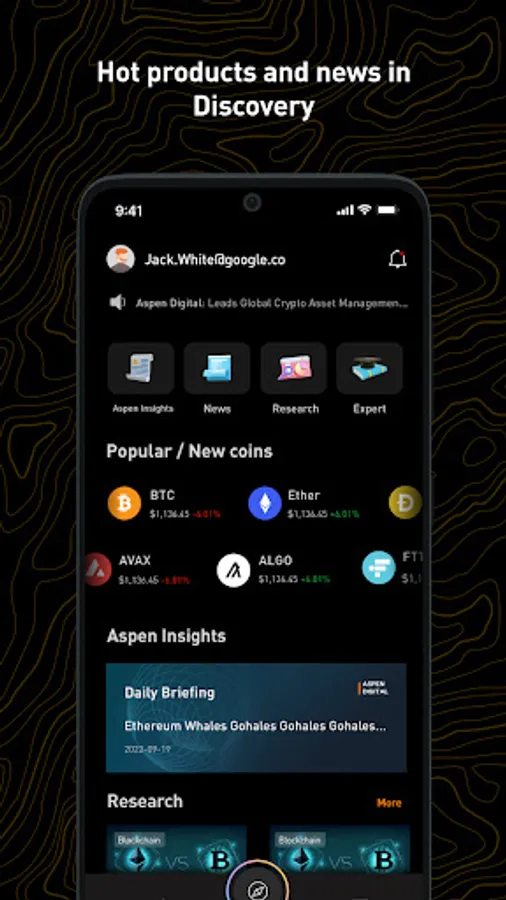

Through the Aspen Digital APP, get access to exlusive products, intelligence and events to help you navigate the asset class. We provide a full service platform across key products:

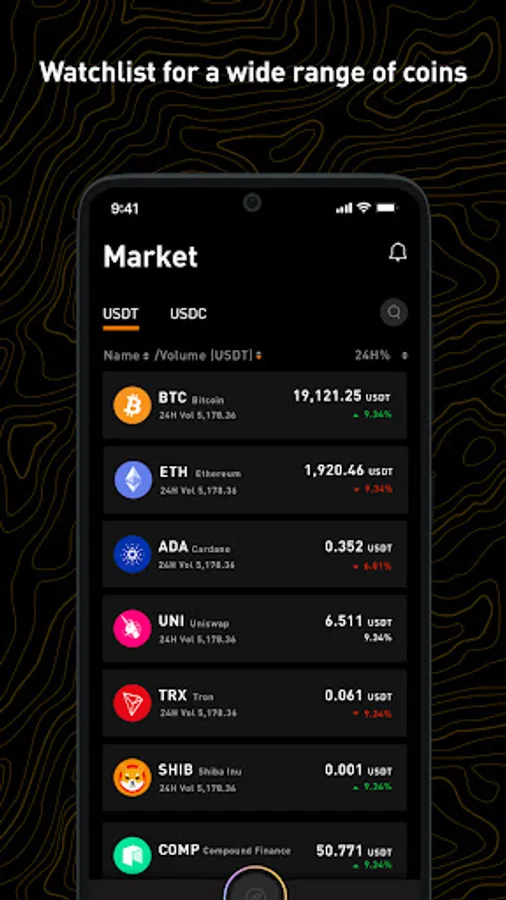

MARKET

View the most popular token pairs in the market.

STAKING

Learn about different ways to stake digital assets on-chain. We aggregate various staking providers' pricing for clients' convenience.

QUANT STRATEGIES

Allocate to our in-house market neutral arbitrage and DeFi yield farming quant strategies that offer higher return alternatives to the yield products.

SMART BETA

Our thematic baskets allow clients to get broad access to the top assets to key crypto sectors. Choose from our blockchain, smart contract, metaverse and DeFi baskets which are rebalanced weekely for automated allocation.

VENTURE

Through our eco-system, we enable clients to secure allocations into some of the most high profile crypto and blockchain deals. From token deals to equity and external funds we have a wide range of early stage opportunities

By allocating through the Aspen Digital portal, clients are able to get a full portfolio management experience,with transaction history and intelligence capabilities for smarter allocation .

Through the Aspen Digital APP, get access to exlusive products, intelligence and events to help you navigate the asset class. We provide a full service platform across key products:

MARKET

View the most popular token pairs in the market.

STAKING

Learn about different ways to stake digital assets on-chain. We aggregate various staking providers' pricing for clients' convenience.

QUANT STRATEGIES

Allocate to our in-house market neutral arbitrage and DeFi yield farming quant strategies that offer higher return alternatives to the yield products.

SMART BETA

Our thematic baskets allow clients to get broad access to the top assets to key crypto sectors. Choose from our blockchain, smart contract, metaverse and DeFi baskets which are rebalanced weekely for automated allocation.

VENTURE

Through our eco-system, we enable clients to secure allocations into some of the most high profile crypto and blockchain deals. From token deals to equity and external funds we have a wide range of early stage opportunities

By allocating through the Aspen Digital portal, clients are able to get a full portfolio management experience,with transaction history and intelligence capabilities for smarter allocation .