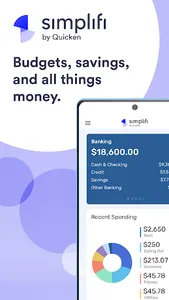

Making a budget, saving more, spending less, and managing your money should be simple. Enter Quicken Simplifi, a powerful budget and personal finance app developed by Quicken, a trusted name for over 40 years.

Whether you're making your first budget or managing a sophisticated money portfolio, Quicken Simplifi gives you the tools to simplify your finances. Set money goals, track your spending, and live a healthier financial life.

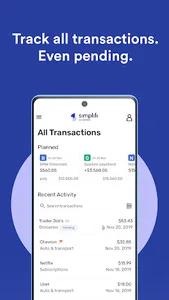

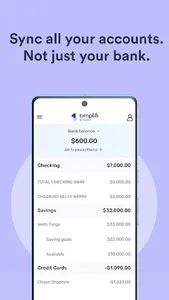

Step One: Track Your Money

Connect your financial accounts (banks, credit cards, loans, investments, retirement, etc.) to get a complete view of your money and finances. All transactions (including pending) are automatically imported – allowing you to keep track of your finances and budget in real-time. Mark recurring bills so they're automatically added to future monthly budgets.

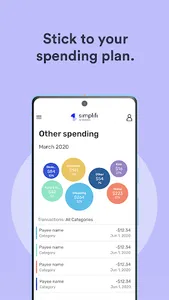

Step Two: The Budget

Making a budget starts with knowing your income and expenses. Use imported paychecks and transactions to see your income and spending then give every dollar a job.

– See where paychecks and expenses land throughout the month

– Watch spending in budget categories like online shopping, food delivery, and subscriptions

– Get alerts on upcoming bills to ensure there's always money to cover expenses

Reach Your Money Goals. Faster.

Paying off debt, buying a house, saving for a vacation or planning retirement? A budget app helps you stay on track and make progress towards your money goals.

– Connect debt accounts like credit cards, student loan debt, and car loans to track your debt payoff progress

– Create multiple savings goals and track them in the budget

– Set reminders if your goals are off-track so you can adjust your savings

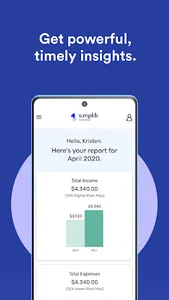

Personal Financial Insights & Money Dashboard

– See month-to-date spending and upcoming bills so you stay in control of your money

– Customize your dashboard to prioritize the reports most important to you

– Easy access to summary balances for banking, property and debt, investing, and net worth

Trusted in Personal Finance

For 40+ years, Quicken has been the leader in personal financial management – empowering people to budget better, make smart financial decisions, stay on track with their money goals, and lead healthy financial lives. Quicken Simplifi furthers that legacy as a budget and money management app.

We take privacy and security seriously; learn more at quicken.com/privacy/us. California residents may use the link to opt out of the use of personal information per the CCPA.

Whether you're making your first budget or managing a sophisticated money portfolio, Quicken Simplifi gives you the tools to simplify your finances. Set money goals, track your spending, and live a healthier financial life.

Step One: Track Your Money

Connect your financial accounts (banks, credit cards, loans, investments, retirement, etc.) to get a complete view of your money and finances. All transactions (including pending) are automatically imported – allowing you to keep track of your finances and budget in real-time. Mark recurring bills so they're automatically added to future monthly budgets.

Step Two: The Budget

Making a budget starts with knowing your income and expenses. Use imported paychecks and transactions to see your income and spending then give every dollar a job.

– See where paychecks and expenses land throughout the month

– Watch spending in budget categories like online shopping, food delivery, and subscriptions

– Get alerts on upcoming bills to ensure there's always money to cover expenses

Reach Your Money Goals. Faster.

Paying off debt, buying a house, saving for a vacation or planning retirement? A budget app helps you stay on track and make progress towards your money goals.

– Connect debt accounts like credit cards, student loan debt, and car loans to track your debt payoff progress

– Create multiple savings goals and track them in the budget

– Set reminders if your goals are off-track so you can adjust your savings

Personal Financial Insights & Money Dashboard

– See month-to-date spending and upcoming bills so you stay in control of your money

– Customize your dashboard to prioritize the reports most important to you

– Easy access to summary balances for banking, property and debt, investing, and net worth

Trusted in Personal Finance

For 40+ years, Quicken has been the leader in personal financial management – empowering people to budget better, make smart financial decisions, stay on track with their money goals, and lead healthy financial lives. Quicken Simplifi furthers that legacy as a budget and money management app.

We take privacy and security seriously; learn more at quicken.com/privacy/us. California residents may use the link to opt out of the use of personal information per the CCPA.

Show More