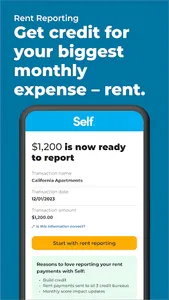

Want to build credit & savings together? Want credit for paying rent, cell phone, or utilities? Self has the tools for you to build credit.

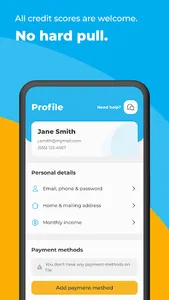

With the Self credit app, you’ll have everything you might need to build credit. Get started with a low credit score – or even no credit score. At Self, all credit scores are welcome.

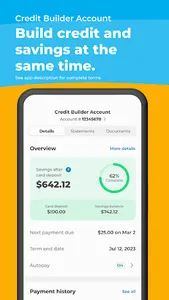

Start with the Self Credit Builder Account⁴.

- Build payment history — the #1 factor for building credit⁶

- Get back your savings¹

- No credit needed

- Reports to 3 credit bureaus

- Plans start at $25/month³

- Pay off over 24 months

- Includes credit score monitoring (VantageScore 3.0)²

- No hard pull

- 256-bit encryption to protect your data

- Your principal is safe in a bank account⁴

Unlock the secured Self Visa® Credit Card⁵ designed for building credit.

- Reports to 3 credit bureaus

- Your Credit Builder Account savings progress secures your Self credit card & sets your limit

- Includes credit usage monitoring & alerts

- Use everywhere Visa is accepted in the US

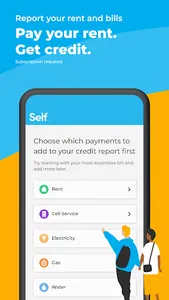

Build credit with rent, cell phone and utility payments

- Choose to add rent, cell phone, water, electric, and/or gas payments to your credit profile

- Securely link your bank account to Self

- Build credit by making on-time payments like you usually do

- Cancel anytime

TAKE YOUR CREDIT SCORE TO A NEW LEVEL

Self customers who make on-time payments lift their credit scores by 30 points, on average⁷.

Self customers who start with a credit score under 600 and make on-time payments lift their credit scores by 49 points, on average*.

JOIN THE BUILDER COMMUNITY

More than 3 million people have signed up to build credit with Self.

ACCESS THE SELF VISA CREDIT CARD

Card eligibility: Active Credit Builder Account in good standing, 3 on time payments, $100 or more in savings progress and satisfying income requirements. Criteria subject to change.

¹ Minus fees & interest. Individual results may vary and are not guaranteed. Improvement in your credit score is dependent on your specific situation & financial behavior. Failure to make monthly minimum payments by the due date each month may result in delinquent reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

² Credit scores will only be available to customers our 3rd party vendor is able to validate.

³Minimum and maximum repayment period for all loan products is 24 months. Maximum Annual Percentage Rate (APR) of all loan products is 15.97%. Sample products are $25 monthly loan payment at a $520 loan amount with a $9 administration fee, 24 month term and 15.92% APR, Total Payments of $600; Check the pricing page in the Self mobile app or www.self.inc for current pricing.

⁴ All Credit Builder Accounts are issued by Lead Bank, Sunrise Banks, N.A. First Century Bank, N.A.or SouthState Bank, N.A. Members FDIC. Subject to ID Verification, credit review and approval. Must be U.S. Citizen, permanent resident, or non-resident U.S. Alien, at least 18, and bank account required.

⁵ The Self Visa® Credit Card is issued by Lead Bank or SouthState Bank, N.A, Members FDIC.

⁶ See https://www.myfico.com/credit-education/whats-in-your-credit-score. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

⁷ Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, made on-time payments, based on VantageScore 3.0.

*Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, starting VantageScore 3.0 under 600, who made on-time payments. Other factors, including activity with other creditors, may impact results. On-time payments does not mean full program completion and past performance based on study does not guarantee future results. Credit score increase not guaranteed.

With the Self credit app, you’ll have everything you might need to build credit. Get started with a low credit score – or even no credit score. At Self, all credit scores are welcome.

Start with the Self Credit Builder Account⁴.

- Build payment history — the #1 factor for building credit⁶

- Get back your savings¹

- No credit needed

- Reports to 3 credit bureaus

- Plans start at $25/month³

- Pay off over 24 months

- Includes credit score monitoring (VantageScore 3.0)²

- No hard pull

- 256-bit encryption to protect your data

- Your principal is safe in a bank account⁴

Unlock the secured Self Visa® Credit Card⁵ designed for building credit.

- Reports to 3 credit bureaus

- Your Credit Builder Account savings progress secures your Self credit card & sets your limit

- Includes credit usage monitoring & alerts

- Use everywhere Visa is accepted in the US

Build credit with rent, cell phone and utility payments

- Choose to add rent, cell phone, water, electric, and/or gas payments to your credit profile

- Securely link your bank account to Self

- Build credit by making on-time payments like you usually do

- Cancel anytime

TAKE YOUR CREDIT SCORE TO A NEW LEVEL

Self customers who make on-time payments lift their credit scores by 30 points, on average⁷.

Self customers who start with a credit score under 600 and make on-time payments lift their credit scores by 49 points, on average*.

JOIN THE BUILDER COMMUNITY

More than 3 million people have signed up to build credit with Self.

ACCESS THE SELF VISA CREDIT CARD

Card eligibility: Active Credit Builder Account in good standing, 3 on time payments, $100 or more in savings progress and satisfying income requirements. Criteria subject to change.

¹ Minus fees & interest. Individual results may vary and are not guaranteed. Improvement in your credit score is dependent on your specific situation & financial behavior. Failure to make monthly minimum payments by the due date each month may result in delinquent reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

² Credit scores will only be available to customers our 3rd party vendor is able to validate.

³Minimum and maximum repayment period for all loan products is 24 months. Maximum Annual Percentage Rate (APR) of all loan products is 15.97%. Sample products are $25 monthly loan payment at a $520 loan amount with a $9 administration fee, 24 month term and 15.92% APR, Total Payments of $600; Check the pricing page in the Self mobile app or www.self.inc for current pricing.

⁴ All Credit Builder Accounts are issued by Lead Bank, Sunrise Banks, N.A. First Century Bank, N.A.or SouthState Bank, N.A. Members FDIC. Subject to ID Verification, credit review and approval. Must be U.S. Citizen, permanent resident, or non-resident U.S. Alien, at least 18, and bank account required.

⁵ The Self Visa® Credit Card is issued by Lead Bank or SouthState Bank, N.A, Members FDIC.

⁶ See https://www.myfico.com/credit-education/whats-in-your-credit-score. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

⁷ Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, made on-time payments, based on VantageScore 3.0.

*Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, starting VantageScore 3.0 under 600, who made on-time payments. Other factors, including activity with other creditors, may impact results. On-time payments does not mean full program completion and past performance based on study does not guarantee future results. Credit score increase not guaranteed.

Show More