creditcase: Mutual Fund Loans

CASE Platforms: Invest with confidence

1,000+

downloads

Free

AppRecs review analysis

AppRecs rating . Trustworthiness 65 out of 100. Review manipulation risk 29 out of 100. Based on a review sample analyzed.

★

AppRecs Rating

Ratings breakdown

5 star

100%

4 star

0%

3 star

0%

2 star

0%

1 star

0%

What to know

✓

Low review manipulation risk

29% review manipulation risk

✓

High user satisfaction

100% of sampled ratings are 5 stars

About creditcase: Mutual Fund Loans

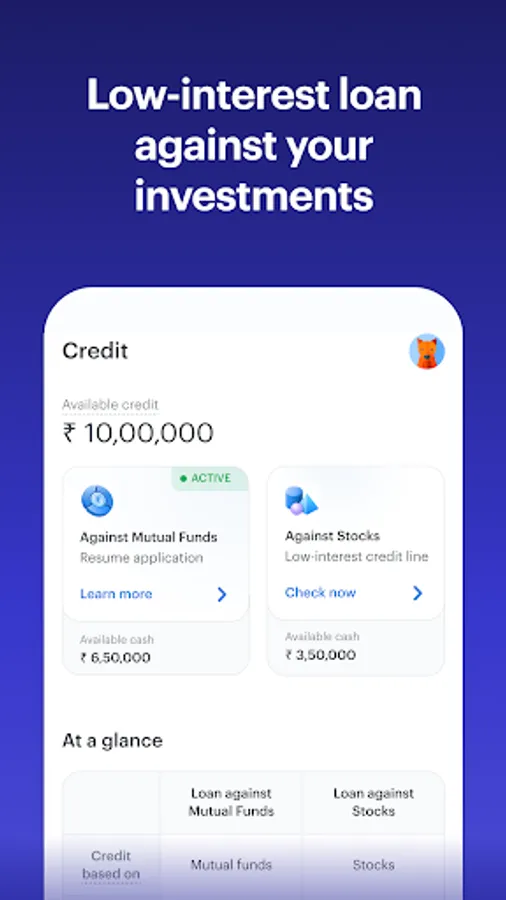

Get loan against MFs & stocks at 10.4% p.a. without breaking your investments!

creditcase, offers a simple and secure way to get a loan against your mutual fund and stock investments. Whether you’re looking for a flexible line of credit, a lower-cost secured loan, or just quick cash, creditcase helps you access funds instantly while your portfolio continues to grow.

WHY CREDITCASE?

⚡Fast disbursal – get loans on MFs in as little as 2 hours

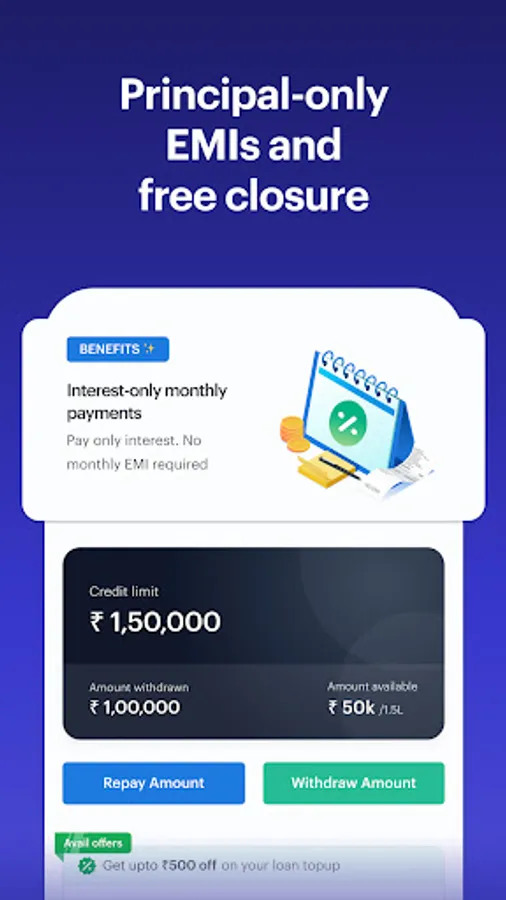

💸 Pay just interest on what you borrow – starting at 10.4% p.a.

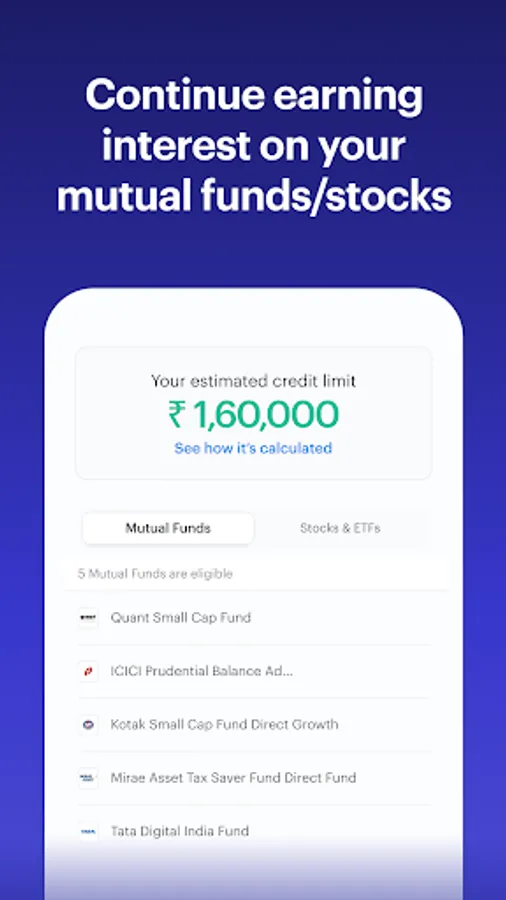

📈 Stay invested – no need to sell your MFs or shares to access cash

💰 Save capital gains tax - avoid paying any tax on exiting your investments

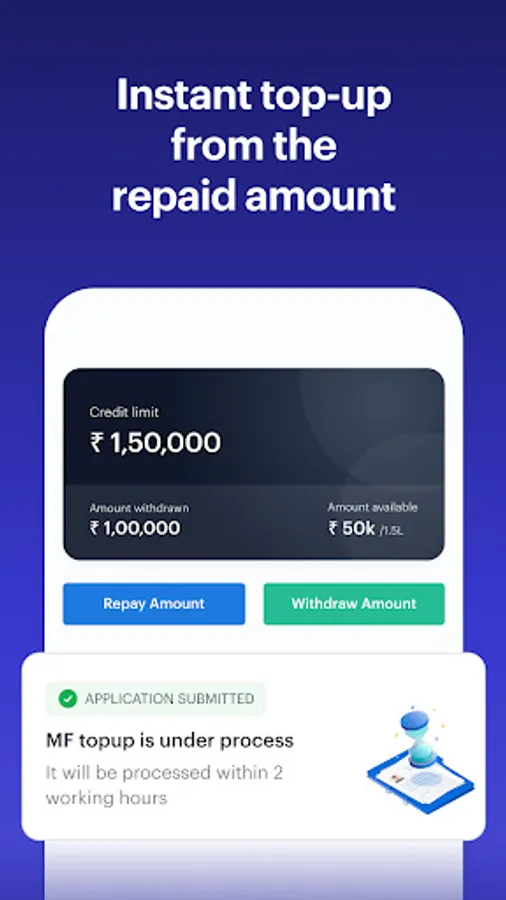

🔄 Flexible credit line – borrow, repay, and borrow again anytime

✅ No foreclosure charges – close your loan early without penalties

🧾 Check safely – checking your credit limit doesn’t affect your credit score

🏦 Trusted lending – loans are provided by RBI-regulated NBFC and Bank partners

🔒 Fully digital & secure – 100% paperless with best in class encryption

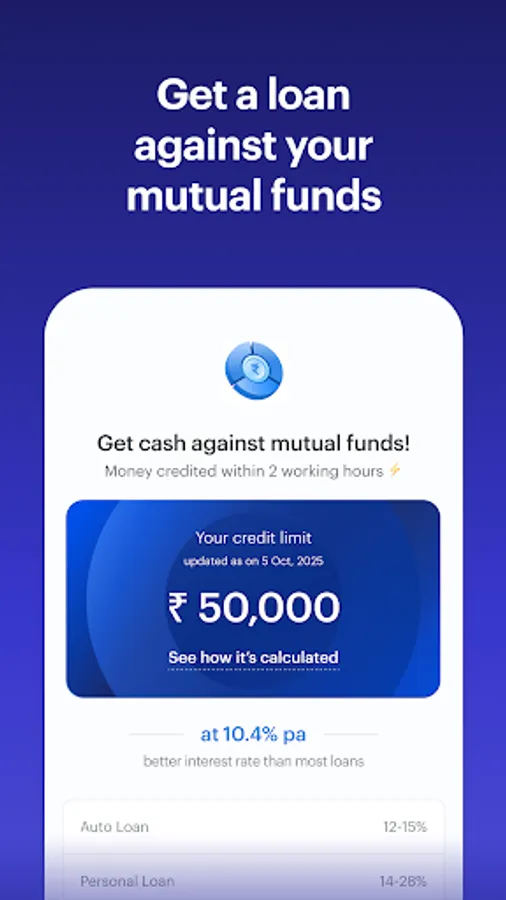

LOAN AGAINST MUTUAL FUNDS

Turn your mutual funds into a source of instant liquidity without redeeming them. With creditcase, your mutual fund units remain invested and continue to earn returns, while you unlock a loan against them.

- Borrow against equity mutual funds (up to 50% of fund value) or debt funds (up to 80% of fund value).

- Loan tenure up to 36 months.

- Get cash within 2 working hours

- Continue investing in SIPs while your pledged funds remain secure.

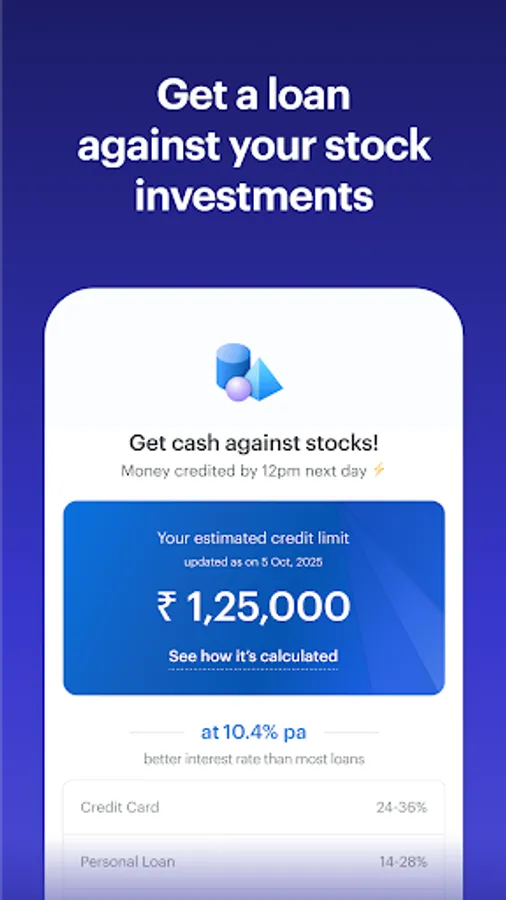

LOAN AGAINST STOCKS

Your shares are valuable — you don’t need to sell them for cash flow. With creditcase, you can pledge your listed stocks or ETFs to access a secured loan while keeping ownership intact.

- Borrow up to ₹5 crore against approved stocks & ETFs.

- Loan-to-value up to 50% of eligible securities.

- Get cash within 24 hours

- Keep enjoying dividends, bonuses, and rights issues on pledged shares.

Tenure: 36 months

Maximum Annual Percentage Rate (APR): 13%

RBI Registered Lending Partners :

- Bajaj Finance Ltd

Example:

Interest Rate: 10.4% p.a.

Tenure: 36 months

Cash to be credited: ₹48,821

Processing Fee: ₹999

GST: ₹180

Total Loan Amount: ₹50,000

EMI: ₹433

Total Repayment Amount: ₹65,600

APR:11.33%

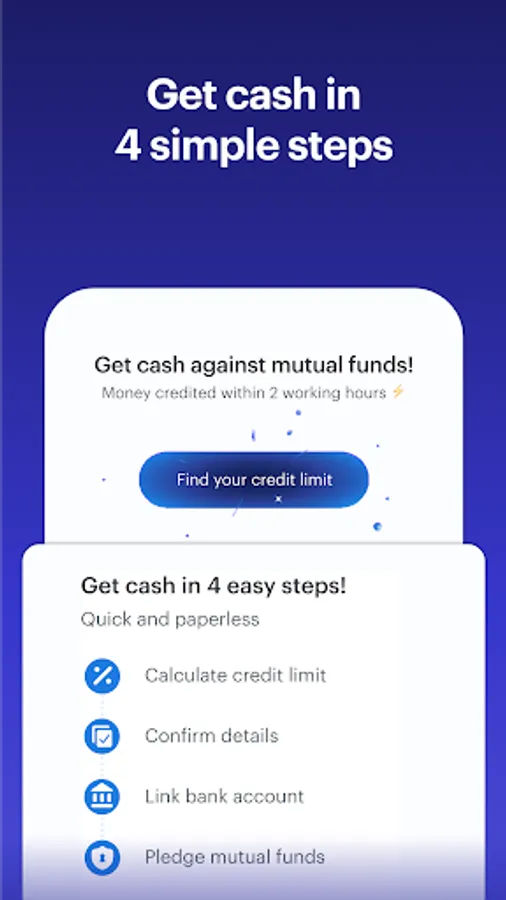

GET STARTED IN 4 SIMPLE STEPS:

1. Calculate your credit limit with PAN & investment details.

2. Confirm details digitally – no paperwork.

3. Link your bank account.

4. Pledge eligible MFs or stocks securely.

Funds are credited directly to your bank account once approved.

DISCLAIMER:

Loans are subject to eligibility and lender approval. All loans are facilitated via Essential Investment Managers Pvt Ltd through its DLAs - digital lending apps (smallcase.com), registered with the partner lenders.

Registered Address:

#51, 3rd Floor, Le Parc Richmonde,

Richmond Road, Shanthala Nagar,

Richmond Town, Bangalore - 560025

creditcase, offers a simple and secure way to get a loan against your mutual fund and stock investments. Whether you’re looking for a flexible line of credit, a lower-cost secured loan, or just quick cash, creditcase helps you access funds instantly while your portfolio continues to grow.

WHY CREDITCASE?

⚡Fast disbursal – get loans on MFs in as little as 2 hours

💸 Pay just interest on what you borrow – starting at 10.4% p.a.

📈 Stay invested – no need to sell your MFs or shares to access cash

💰 Save capital gains tax - avoid paying any tax on exiting your investments

🔄 Flexible credit line – borrow, repay, and borrow again anytime

✅ No foreclosure charges – close your loan early without penalties

🧾 Check safely – checking your credit limit doesn’t affect your credit score

🏦 Trusted lending – loans are provided by RBI-regulated NBFC and Bank partners

🔒 Fully digital & secure – 100% paperless with best in class encryption

LOAN AGAINST MUTUAL FUNDS

Turn your mutual funds into a source of instant liquidity without redeeming them. With creditcase, your mutual fund units remain invested and continue to earn returns, while you unlock a loan against them.

- Borrow against equity mutual funds (up to 50% of fund value) or debt funds (up to 80% of fund value).

- Loan tenure up to 36 months.

- Get cash within 2 working hours

- Continue investing in SIPs while your pledged funds remain secure.

LOAN AGAINST STOCKS

Your shares are valuable — you don’t need to sell them for cash flow. With creditcase, you can pledge your listed stocks or ETFs to access a secured loan while keeping ownership intact.

- Borrow up to ₹5 crore against approved stocks & ETFs.

- Loan-to-value up to 50% of eligible securities.

- Get cash within 24 hours

- Keep enjoying dividends, bonuses, and rights issues on pledged shares.

Tenure: 36 months

Maximum Annual Percentage Rate (APR): 13%

RBI Registered Lending Partners :

- Bajaj Finance Ltd

Example:

Interest Rate: 10.4% p.a.

Tenure: 36 months

Cash to be credited: ₹48,821

Processing Fee: ₹999

GST: ₹180

Total Loan Amount: ₹50,000

EMI: ₹433

Total Repayment Amount: ₹65,600

APR:11.33%

GET STARTED IN 4 SIMPLE STEPS:

1. Calculate your credit limit with PAN & investment details.

2. Confirm details digitally – no paperwork.

3. Link your bank account.

4. Pledge eligible MFs or stocks securely.

Funds are credited directly to your bank account once approved.

DISCLAIMER:

Loans are subject to eligibility and lender approval. All loans are facilitated via Essential Investment Managers Pvt Ltd through its DLAs - digital lending apps (smallcase.com), registered with the partner lenders.

Registered Address:

#51, 3rd Floor, Le Parc Richmonde,

Richmond Road, Shanthala Nagar,

Richmond Town, Bangalore - 560025