Southbridge Credit Union Mobile Banking allows you to access popular digital banking features on the go!

Features:

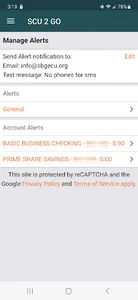

- Check Balances

- View Transaction History

- Transfer Funds

- Apply and Pay Loans

- Open a New Share Account

- Deposit and Order Checks

- Card Controls

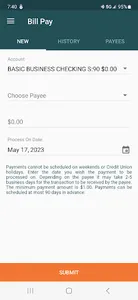

- Pay Bills

- Live Chat for Support

- Secure Messaging for Support

If you have any questions about this application, please contact Southbridge Credit Union at 888-599-2265.

Our current members may be eligible to apply for loans with Southbridge Credit Union. Please review the following to understand our lending information, and make sure to check Southbridge-Credit-Union-Consumer-Loan-Rates.pdf (southbridgecu.com) for the latest rate information.

Our personal loans have a minimum repayment period of 12 months and a maximum repayment period of 60 months. The Maximum Annual Percentage Rate (APR) for a personal loan is 17.99%. Our minimum offered loan amount is $500 and our maximum offered loan amount is $15,000.

Not all applicants may qualify for the most favorable rates or the highest possible loan amounts. Approval and actual loan terms depend on credit union membership history and credit risk evaluations (including responsible credit history, debt-to-income information, and availability of collateral). Highly qualified applicants may be offered higher loan amounts and/or lower APRs. Personal loans may not be used for college or post-college education expenses, business or commercial purposes, buying crypto or other speculative investments, gambling, or illegal purposes. Active-duty military, their spouses or dependents covered by the Military Lending Act may not pledge a vehicle as collateral.

Please review our loan cost example below:

Consider a loan where the borrower receives $10,000 at an APR of 9.25% over 60 months.

The borrower would repay $208.83 every month.

The total amount paid for the loan would be $12,529.56.

Actual loan terms may vary and depend on the prospective borrower’s credit profile, debts, income, membership history, etc.

Some of our loan options are intended for consolidating existing debts into a single loan. When consolidating existing debts or refinancing an existing loan, total finance charges and money owed over the period of the new loan may be more than the existing debt due to longer terms or higher interest rates.

Features:

- Check Balances

- View Transaction History

- Transfer Funds

- Apply and Pay Loans

- Open a New Share Account

- Deposit and Order Checks

- Card Controls

- Pay Bills

- Live Chat for Support

- Secure Messaging for Support

If you have any questions about this application, please contact Southbridge Credit Union at 888-599-2265.

Our current members may be eligible to apply for loans with Southbridge Credit Union. Please review the following to understand our lending information, and make sure to check Southbridge-Credit-Union-Consumer-Loan-Rates.pdf (southbridgecu.com) for the latest rate information.

Our personal loans have a minimum repayment period of 12 months and a maximum repayment period of 60 months. The Maximum Annual Percentage Rate (APR) for a personal loan is 17.99%. Our minimum offered loan amount is $500 and our maximum offered loan amount is $15,000.

Not all applicants may qualify for the most favorable rates or the highest possible loan amounts. Approval and actual loan terms depend on credit union membership history and credit risk evaluations (including responsible credit history, debt-to-income information, and availability of collateral). Highly qualified applicants may be offered higher loan amounts and/or lower APRs. Personal loans may not be used for college or post-college education expenses, business or commercial purposes, buying crypto or other speculative investments, gambling, or illegal purposes. Active-duty military, their spouses or dependents covered by the Military Lending Act may not pledge a vehicle as collateral.

Please review our loan cost example below:

Consider a loan where the borrower receives $10,000 at an APR of 9.25% over 60 months.

The borrower would repay $208.83 every month.

The total amount paid for the loan would be $12,529.56.

Actual loan terms may vary and depend on the prospective borrower’s credit profile, debts, income, membership history, etc.

Some of our loan options are intended for consolidating existing debts into a single loan. When consolidating existing debts or refinancing an existing loan, total finance charges and money owed over the period of the new loan may be more than the existing debt due to longer terms or higher interest rates.

Show More