About OpenCI

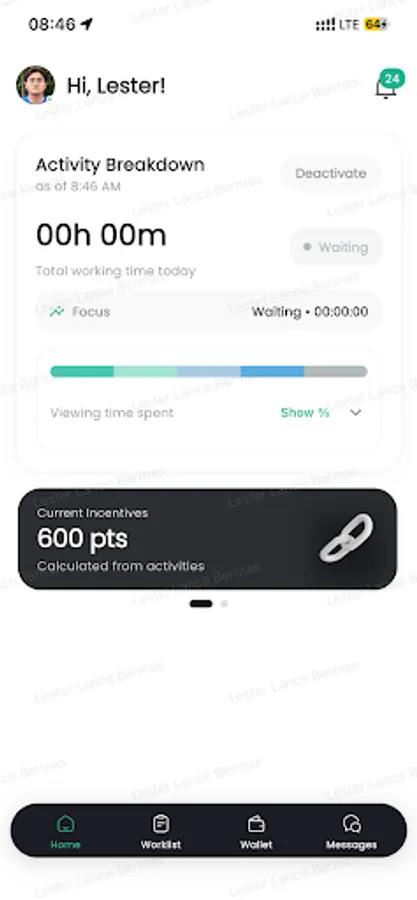

OpenCI is an AI-native field service platform built specifically for financial institutions to transform credit investigation and debt collection through verified, real-time field data. Designed for enterprise teams managing field agents — from credit investigators to debt collectors — OpenCI empowers them with digital tools that replace outdated paper-based processes and unreliable manual tracking.

Born from years of frontline experience in Philippine financial collections, OpenCI was conceived to solve a critical pain point: how to scale accurate, on-the-ground borrower verification across vast, underserved regions without relying on institutional memory or untrained personnel. Inspired by the gig-economy efficiency of platforms like Grab, OpenCI reimagines field operations as a managed, tech-enabled network — not just a workforce.

The app enables field agents (riders or investigators) to:

Receive geolocated, prioritized tasks via real-time dispatch

Capture verified photo and GPS proof of location at borrower residences

Log behavioral insights (e.g., occupancy, condition, respondent demeanor)

Communicate securely with supervisors via in-app messaging

Navigate using offline-capable maps with landmark-based search, even in low-connectivity areas

Submit digital reports instantly, reducing data lag from days to seconds

For financial institutions, OpenCI delivers:

✅ Higher approval accuracy — verified field data reduces fraud and improves risk modeling

✅ Faster recovery cycles — real-time tracking cuts collection timelines by up to 40%

✅ Scalable coverage — deploy agents across provinces with consistent quality control

✅ Compliance-ready audits — all actions are timestamped, geotagged, and stored securely

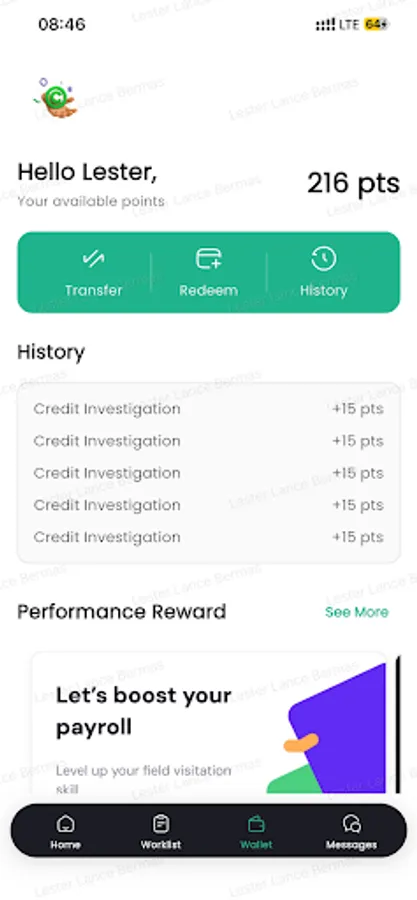

✅ Reduced attrition — intuitive UX and performance feedback improve agent retention

Unlike legacy field tools built for corporate IT departments, OpenCI was engineered for the realities of the ground: intermittent internet, low-end devices, non-technical users, and complex urban/rural addresses. Its AI-powered address recognition interprets fragmented or colloquial locations (“next to the red jeepney stop near the church”) and guides agents with pinpoint accuracy — no map expertise required.

Built with enterprise-grade SSO authentication and data encryption, OpenCI ensures compliance with financial regulations while integrating seamlessly with core loan origination and collections systems. The platform also supports role-based access, performance dashboards, and customizable workflows for different collection stages — from pre-disbursement verification to post-default recovery.

OpenCI is currently deployed by SP Madrid, one of the Philippines’ leading financial services providers, and has proven to increase field agent productivity by over 50% while reducing verification errors by 70%.

Our vision? To become a nationwide network of verified, trained field agents serving multiple lenders through a single, scalable platform. We’re opening collaboration to banks, MFIs, and fintechs seeking to modernize their last-mile operations.

Let’s build the future of financial field intelligence — together. Request a live demo or integration briefing today.

Born from years of frontline experience in Philippine financial collections, OpenCI was conceived to solve a critical pain point: how to scale accurate, on-the-ground borrower verification across vast, underserved regions without relying on institutional memory or untrained personnel. Inspired by the gig-economy efficiency of platforms like Grab, OpenCI reimagines field operations as a managed, tech-enabled network — not just a workforce.

The app enables field agents (riders or investigators) to:

Receive geolocated, prioritized tasks via real-time dispatch

Capture verified photo and GPS proof of location at borrower residences

Log behavioral insights (e.g., occupancy, condition, respondent demeanor)

Communicate securely with supervisors via in-app messaging

Navigate using offline-capable maps with landmark-based search, even in low-connectivity areas

Submit digital reports instantly, reducing data lag from days to seconds

For financial institutions, OpenCI delivers:

✅ Higher approval accuracy — verified field data reduces fraud and improves risk modeling

✅ Faster recovery cycles — real-time tracking cuts collection timelines by up to 40%

✅ Scalable coverage — deploy agents across provinces with consistent quality control

✅ Compliance-ready audits — all actions are timestamped, geotagged, and stored securely

✅ Reduced attrition — intuitive UX and performance feedback improve agent retention

Unlike legacy field tools built for corporate IT departments, OpenCI was engineered for the realities of the ground: intermittent internet, low-end devices, non-technical users, and complex urban/rural addresses. Its AI-powered address recognition interprets fragmented or colloquial locations (“next to the red jeepney stop near the church”) and guides agents with pinpoint accuracy — no map expertise required.

Built with enterprise-grade SSO authentication and data encryption, OpenCI ensures compliance with financial regulations while integrating seamlessly with core loan origination and collections systems. The platform also supports role-based access, performance dashboards, and customizable workflows for different collection stages — from pre-disbursement verification to post-default recovery.

OpenCI is currently deployed by SP Madrid, one of the Philippines’ leading financial services providers, and has proven to increase field agent productivity by over 50% while reducing verification errors by 70%.

Our vision? To become a nationwide network of verified, trained field agents serving multiple lenders through a single, scalable platform. We’re opening collaboration to banks, MFIs, and fintechs seeking to modernize their last-mile operations.

Let’s build the future of financial field intelligence — together. Request a live demo or integration briefing today.