AppRecs review analysis

AppRecs rating . Trustworthiness 78 out of 100. Review manipulation risk 23 out of 100. Based on a review sample analyzed.

★

AppRecs Rating

Ratings breakdown

5 star

12%

4 star

4%

3 star

2%

2 star

12%

1 star

70%

What to know

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

⚠

Mixed user feedback

Average 1.8★ rating suggests room for improvement

⚠

High negative review ratio

82% of sampled ratings are 1–2 stars

About KOPASMART

About this app:

Kingdom Bank Limited, is seeking to reach a wide range of borrowing customers ranging to about 25 million customers.

KopaSmart is a mobile lending solution which endeavors to offer a platform for borrowing customers. Disbursements shall be done directly to registered M-Pesa numbers.

Features.

To align with CBK regulations on remote account opening guidelines and the application will require users to consent to some permissions and accept the terms and conditions and privacy policies of the bank.

Permissions Requested:

• Camera

• Location

Features:

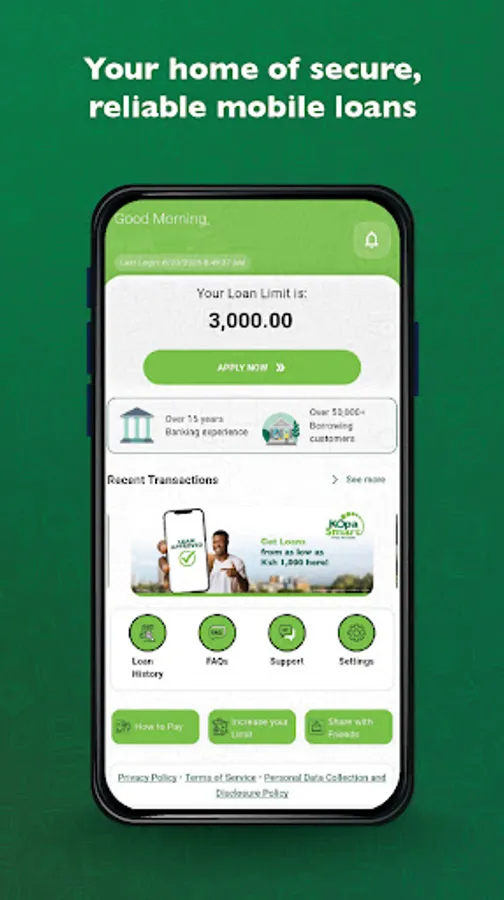

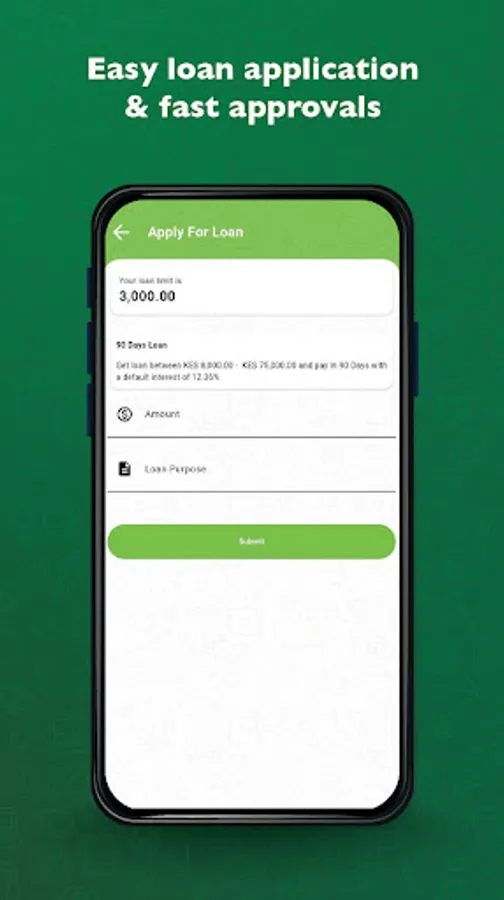

• Loan Application

• Loan Repayment

• Loan History

• Recent Transactions

• Live chat

Metadata:

KopaSmart Personal Loans

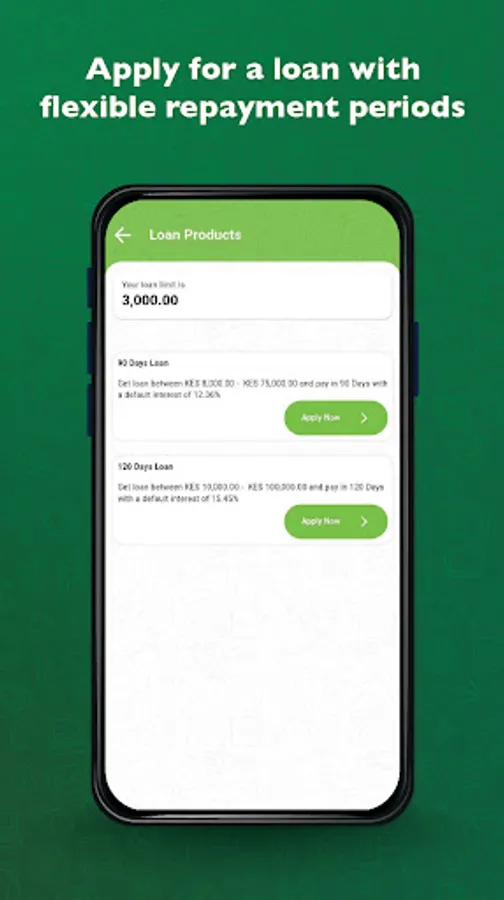

90 Days Loan

Min Amount: Ksh. 8,000.00

Max Amount: Ksh: 75,000.00

Interest Rate: 12.36%

Excise Duty: 3.09%

Example Loan – 90 Days Loan

Loan Amount: Ksh. 30,000.00

Interest: Ksh. 3,708.00

Excise Duty: 741.60

Repayment Amount: 34,450.00

120 Days Loan

Min Amount: Ksh. 10,000.00

Max Amount: Ksh: 100,000.00

Interest Rate: 15.45%

Excise Duty: 3.09%

Example Loan – 120 Days Loan

Loan Amount: Ksh. 30,000.00

Interest: Ksh. 4,635.00

Excise Duty: 927.60

Repayment Amount: 35,562.00

Eligible Customer

Any Kenyan resident of 18+ years of age who has a valid Identification Card and an M-pesa number.

Disbursement Turn-around

Disbursement is real-time to customer M-pesa number.

Customers could repay through STK push or direct paybill deposits to paybill number 4135105 and National ID Number as the Account Number.

Data privacy and safety

All data collected is to verify your identity and build your credit profile. KopaSmart does not disclose and personal information to anyone without your permissions.

We encrypt the data you choose to share with us for safety.

Kingdom Bank Limited, is seeking to reach a wide range of borrowing customers ranging to about 25 million customers.

KopaSmart is a mobile lending solution which endeavors to offer a platform for borrowing customers. Disbursements shall be done directly to registered M-Pesa numbers.

Features.

To align with CBK regulations on remote account opening guidelines and the application will require users to consent to some permissions and accept the terms and conditions and privacy policies of the bank.

Permissions Requested:

• Camera

• Location

Features:

• Loan Application

• Loan Repayment

• Loan History

• Recent Transactions

• Live chat

Metadata:

KopaSmart Personal Loans

90 Days Loan

Min Amount: Ksh. 8,000.00

Max Amount: Ksh: 75,000.00

Interest Rate: 12.36%

Excise Duty: 3.09%

Example Loan – 90 Days Loan

Loan Amount: Ksh. 30,000.00

Interest: Ksh. 3,708.00

Excise Duty: 741.60

Repayment Amount: 34,450.00

120 Days Loan

Min Amount: Ksh. 10,000.00

Max Amount: Ksh: 100,000.00

Interest Rate: 15.45%

Excise Duty: 3.09%

Example Loan – 120 Days Loan

Loan Amount: Ksh. 30,000.00

Interest: Ksh. 4,635.00

Excise Duty: 927.60

Repayment Amount: 35,562.00

Eligible Customer

Any Kenyan resident of 18+ years of age who has a valid Identification Card and an M-pesa number.

Disbursement Turn-around

Disbursement is real-time to customer M-pesa number.

Customers could repay through STK push or direct paybill deposits to paybill number 4135105 and National ID Number as the Account Number.

Data privacy and safety

All data collected is to verify your identity and build your credit profile. KopaSmart does not disclose and personal information to anyone without your permissions.

We encrypt the data you choose to share with us for safety.