AppRecs review analysis

AppRecs rating 4.8. Trustworthiness 75 out of 100. Review manipulation risk 21 out of 100. Based on a review sample analyzed.

★★★★☆

4.8

AppRecs Rating

Ratings breakdown

5 star

100%

4 star

0%

3 star

0%

2 star

0%

1 star

0%

What to know

✓

Low review manipulation risk

21% review manipulation risk

✓

Credible reviews

75% trustworthiness score from analyzed reviews

✓

High user satisfaction

100% of sampled ratings are 5 stars

About Smart Budget

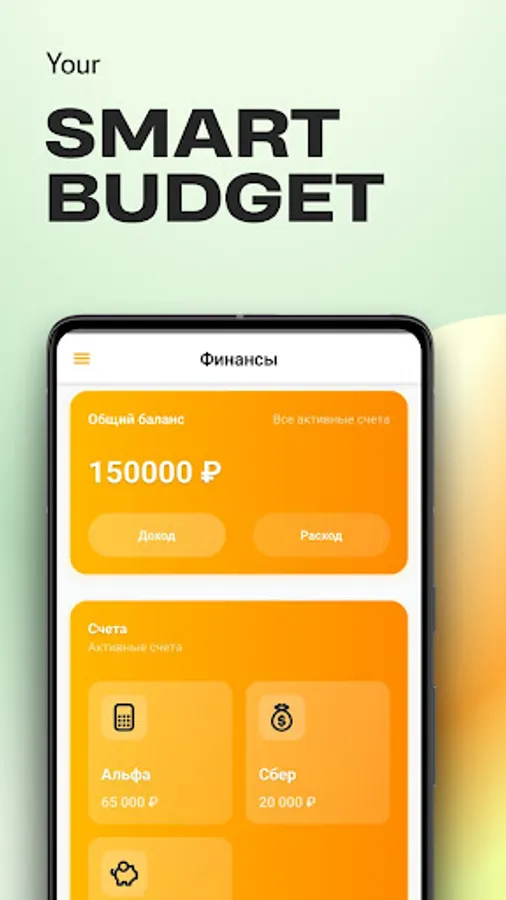

Smart Budget is a user—friendly and intuitive personal finance management application that helps you monitor income and expenses, analyze your spending, and improve your financial well-being.

With a Smart Budget, you can easily keep track of your finances, plan a budget, and make informed decisions.

The main functions of the application:

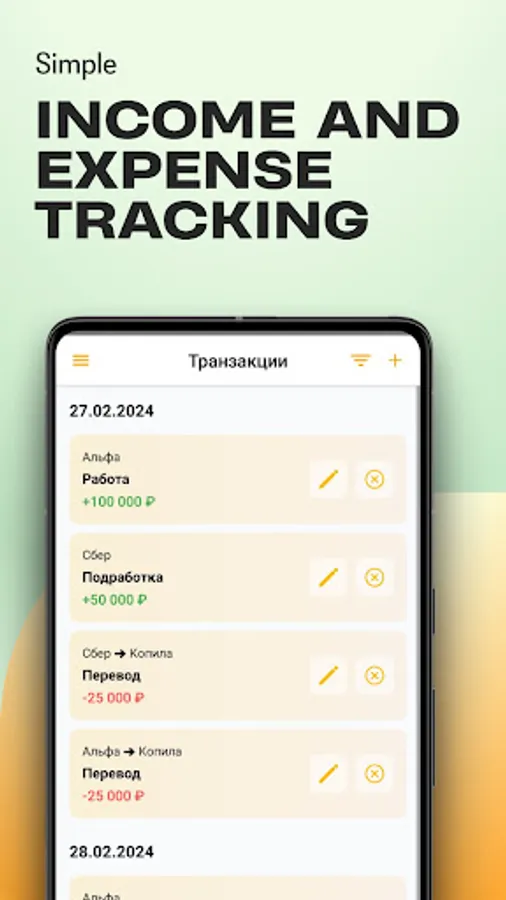

Deposit all your income and expenses in a few clicks. The app makes it easy to track where your money goes and where the funds come from.

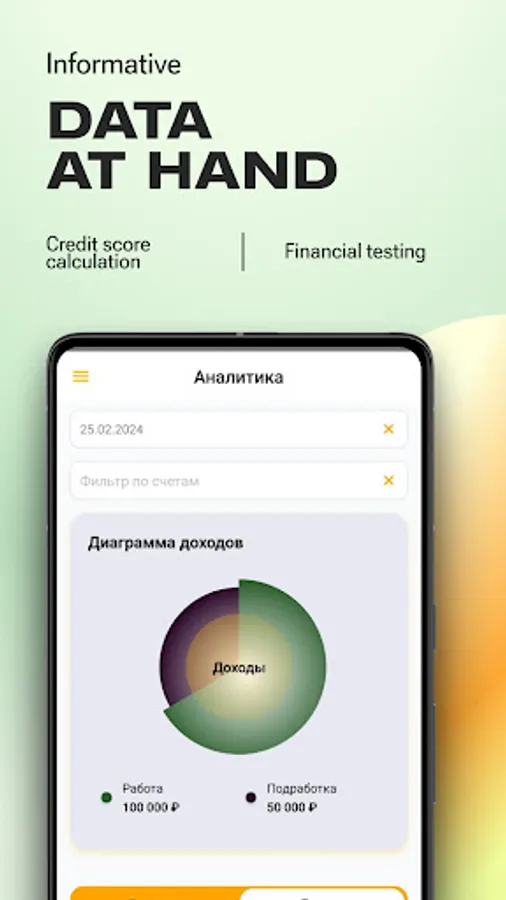

Visual graphs and diagrams will help you understand how your finances are distributed.

Create your own categories for transactions (for example, "Food", "Transportation", "Entertainment"). This will help you better understand what you spend the most on.

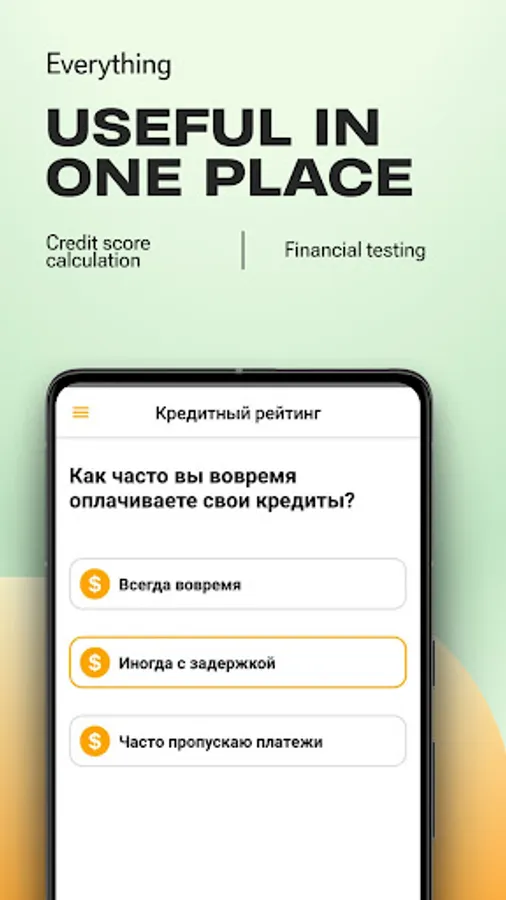

The app analyzes your answers to questions and provides an assessment of your credit score. This will help you better understand your options for obtaining loans or loans.

Why you should choose A Smart Budget?

Simplicity and convenience of use.

Visual analytics for financial control.

The ability to plan and optimize the budget.

Download Smart Budget and start managing your finances today! Your money is under control! 💰📊

The maximum annual interest rate (ARP) is 205% per annum.

The minimum loan term is 91 days.

The maximum loan term is 730 days.

Calculation example

The loan amount is 10,000.

The loan term is 110 days.

Loan usage percentage: 0.37% per day, i.e. 37 per day, or 11.1% per month (average for 30 days), i.e. 11.10 per month (average for 30 days).

The total amount of interest for 110 days will be 4070.

The total amount to be refunded, including the loan amount: 14070.

With a Smart Budget, you can easily keep track of your finances, plan a budget, and make informed decisions.

The main functions of the application:

Deposit all your income and expenses in a few clicks. The app makes it easy to track where your money goes and where the funds come from.

Visual graphs and diagrams will help you understand how your finances are distributed.

Create your own categories for transactions (for example, "Food", "Transportation", "Entertainment"). This will help you better understand what you spend the most on.

The app analyzes your answers to questions and provides an assessment of your credit score. This will help you better understand your options for obtaining loans or loans.

Why you should choose A Smart Budget?

Simplicity and convenience of use.

Visual analytics for financial control.

The ability to plan and optimize the budget.

Download Smart Budget and start managing your finances today! Your money is under control! 💰📊

The maximum annual interest rate (ARP) is 205% per annum.

The minimum loan term is 91 days.

The maximum loan term is 730 days.

Calculation example

The loan amount is 10,000.

The loan term is 110 days.

Loan usage percentage: 0.37% per day, i.e. 37 per day, or 11.1% per month (average for 30 days), i.e. 11.10 per month (average for 30 days).

The total amount of interest for 110 days will be 4070.

The total amount to be refunded, including the loan amount: 14070.