AppRecs review analysis

AppRecs rating 3.1. Trustworthiness 80 out of 100. Review manipulation risk 38 out of 100. Based on a review sample analyzed.

★★★☆☆

3.1

AppRecs Rating

Ratings breakdown

5 star

57%

4 star

0%

3 star

0%

2 star

0%

1 star

43%

What to know

✓

Credible reviews

80% trustworthiness score from analyzed reviews

About Wishfin Business Loan

Wishfin Business Loan App

Need to do a quick business loan apply and fuel your growth? Wishfin got you covered. Our app makes getting a business loan simple, straightforward, and hassle-free. We provide loans up to a maximum limit with flexible repayment terms and lower interest rates. Our application process is easy and can be completed within minutes. We provide quick approvals with funds disbursed in a few hours.

Download the Wishfin Business Loan App, and apply now to unlock your business potential!

Why Choose Wishfin Business Loan App?

Pre-qualified in minutes and access to funds within a few hours.

Loan amounts from ₹1 lakh to ₹25 lakh (depending on eligibility).

Repayment terms to suit your needs.

No need to pledge property or assets

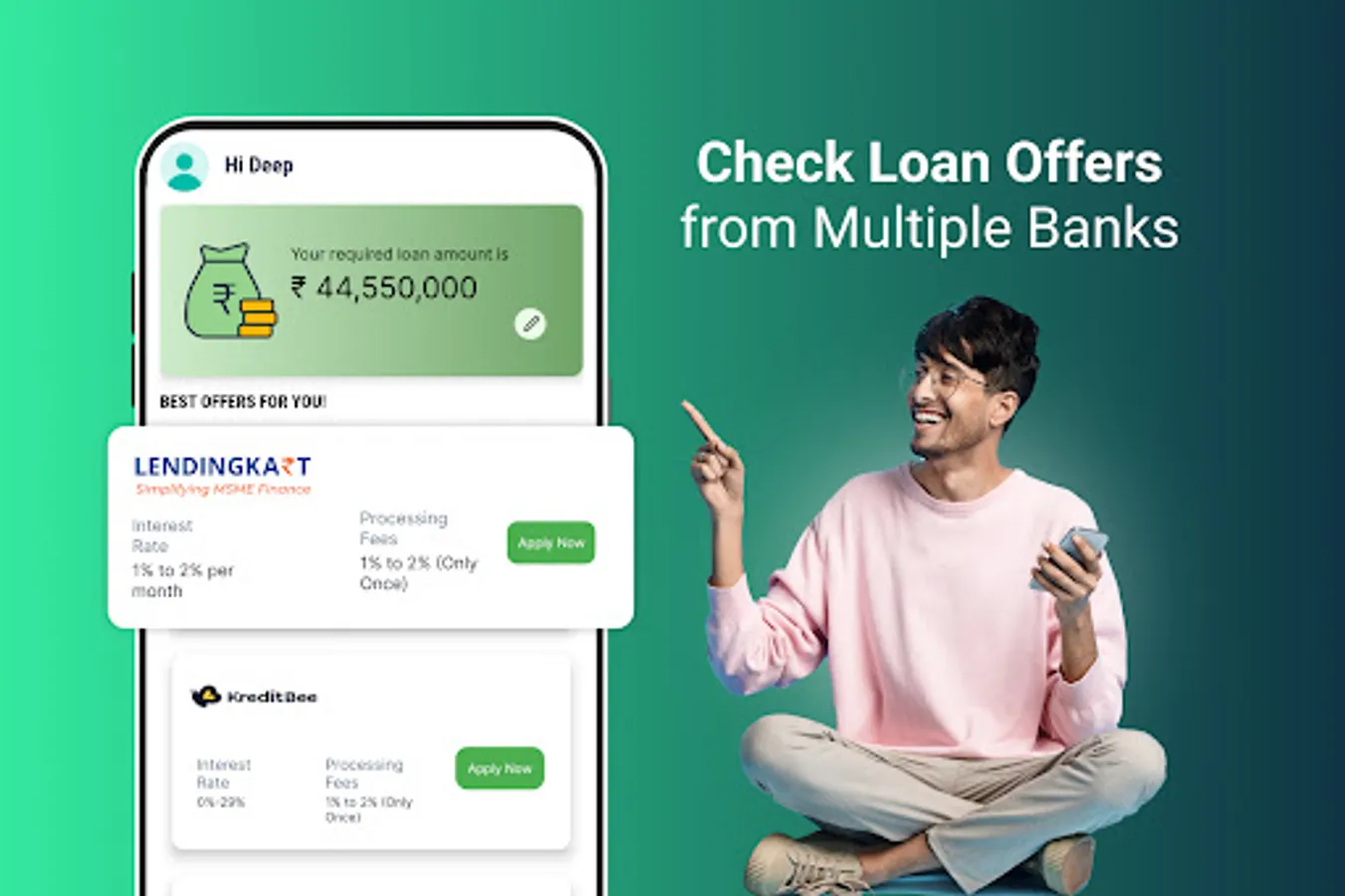

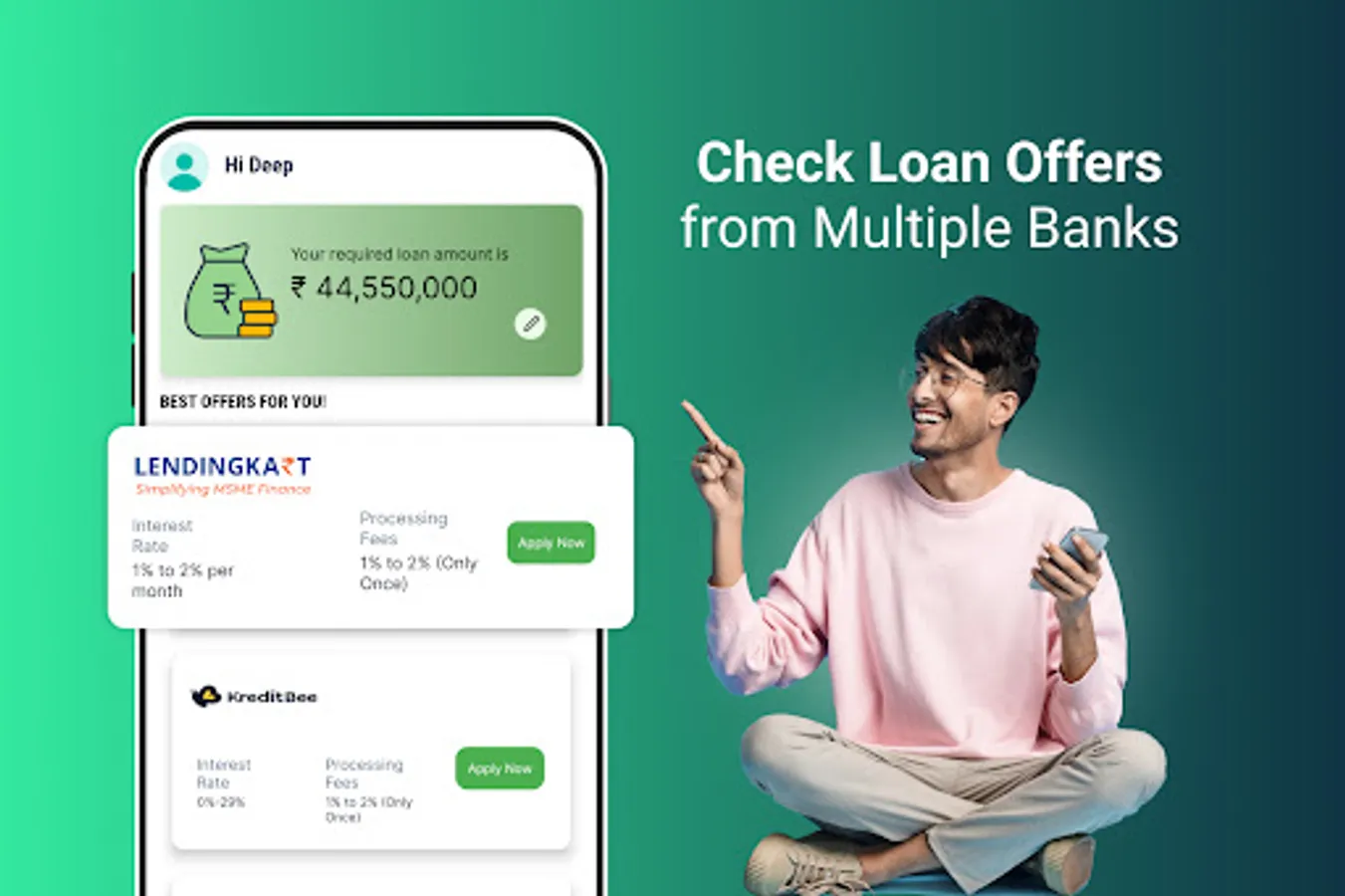

Our partners are: LendingKart, Tata Capital, and more.

Apply for a business loan online in just a few steps, right from your phone.

We value your data and keep everything confidential.

How Can the Wishfin Business Loan App Help You?

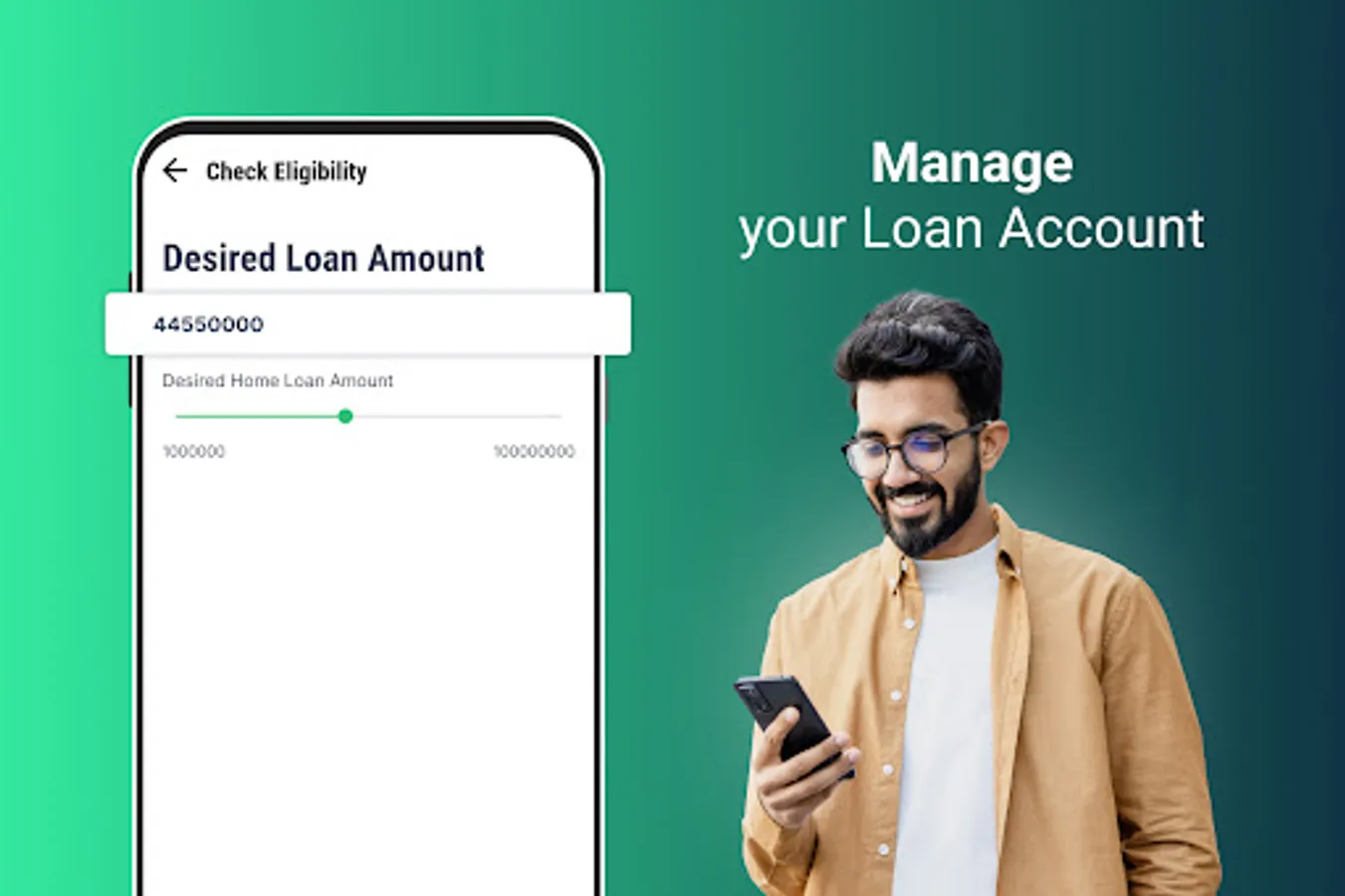

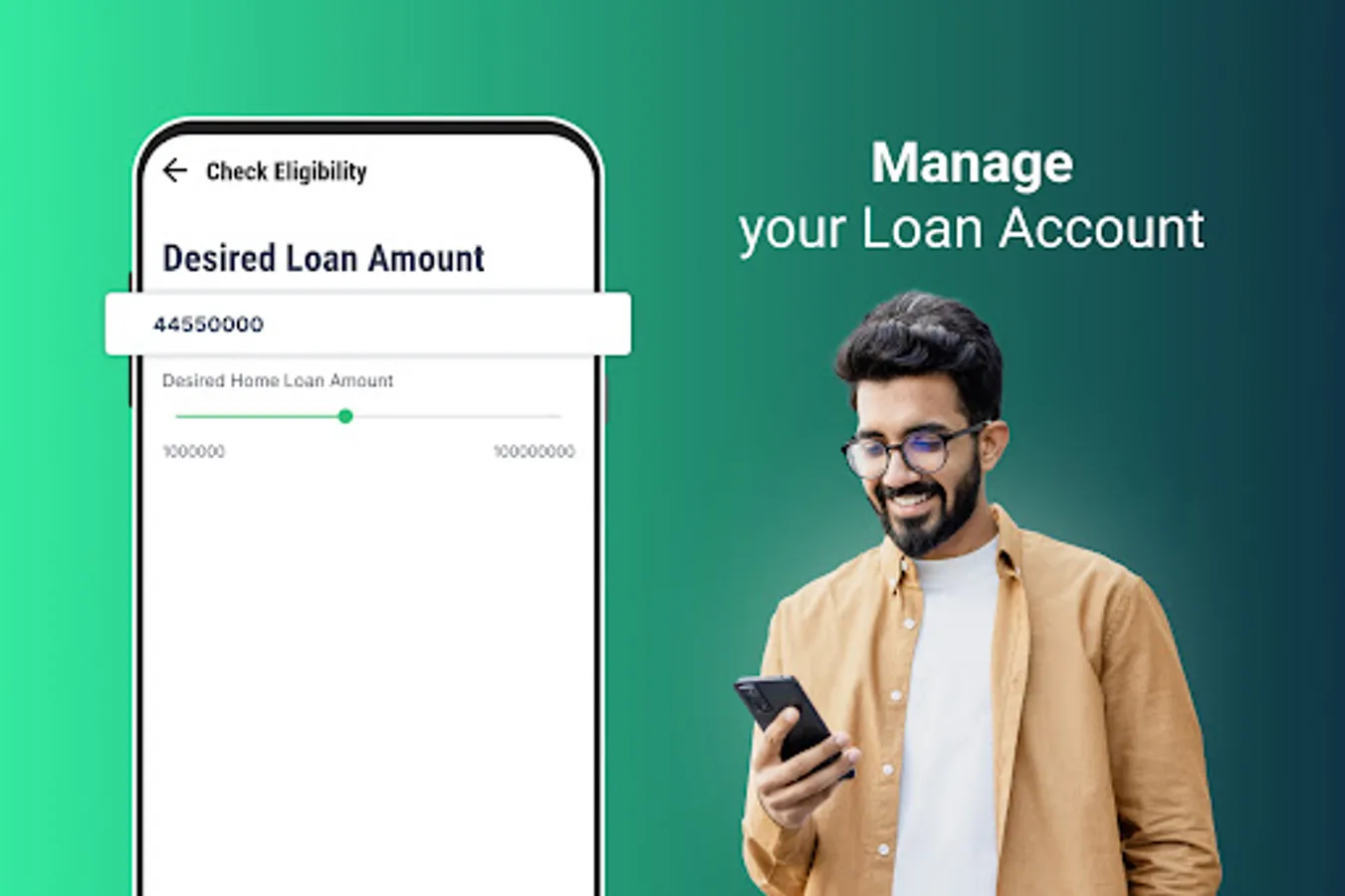

Using basic details about your business we see if you qualify.

Compare interest rates, terms, and fees from multiple lenders.

Stay updated on the progress of your loan request.

View your loan details, make payments, and track repayments.

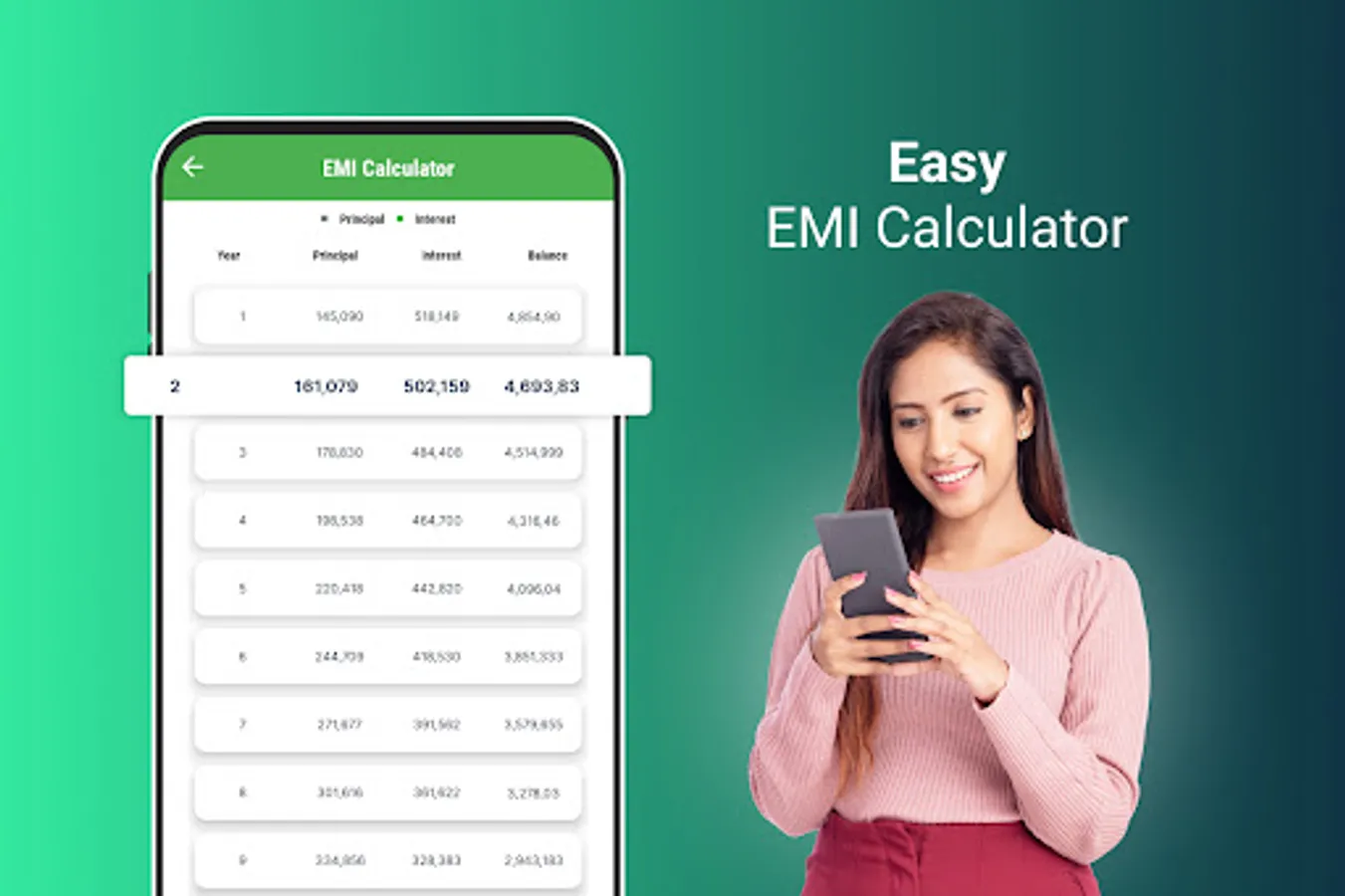

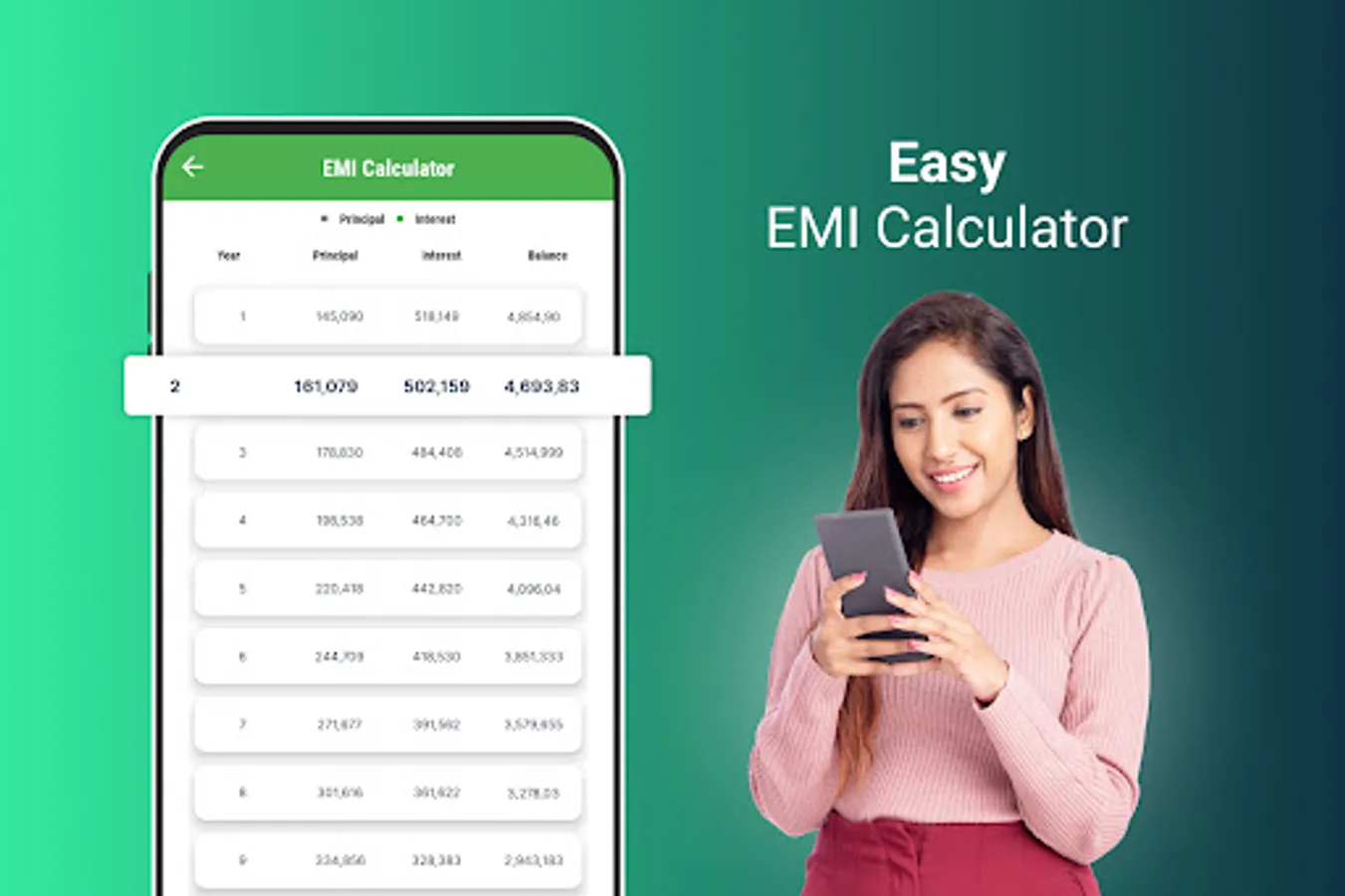

Estimate your monthly EMI and total payable amount before applying.

Simple calculator

1. Enter Your Loan Details:

Loan Amount: Type in the total amount you wish to borrow.

Tenure: Select the desired repayment period in months or years.

Interest Rate: Enter the annual interest rate offered by your lender.

2. Click "Calculate Now":

Once you've filled in the required fields, simply hit the "Calculate Now" button.

3. View Your Amortization Schedule:

The calculator will instantly generate a detailed amortization schedule, showcasing:

Your estimated monthly EMI (Equated Monthly Installment).

The breakdown of each payment into principal and interest components.

The total interest payable over the entire loan tenure.

The outstanding loan balance after each payment.

Feel free to adjust the loan amount, tenure, or interest rate to explore different scenarios and find the most suitable repayment plan for your business. Use the amortization schedule to visualize your loan repayment journey and plan your finances accordingly.

Calculate your business loan EMI today!

Apply Now

Enter your current annual salary or the salary of your business.

Your business must have been in operation for a minimum of 12 months.

Provide your business's annual revenue to help us understand its financial health.

Specify the legal structure under which your business is registered (e.g., sole proprietorship, LLC, corporation).

Once you've filled in the required information and confirmed your eligibility, click the "Apply Now" button to proceed.

You will be seamlessly redirected to our trusted lending partner's website to finalize and submit your loan application.

Our lending partner will review your application promptly and guide you through the next steps. If you have any questions or need assistance during the application process, feel free to reach out to our support team.

Additional Features:

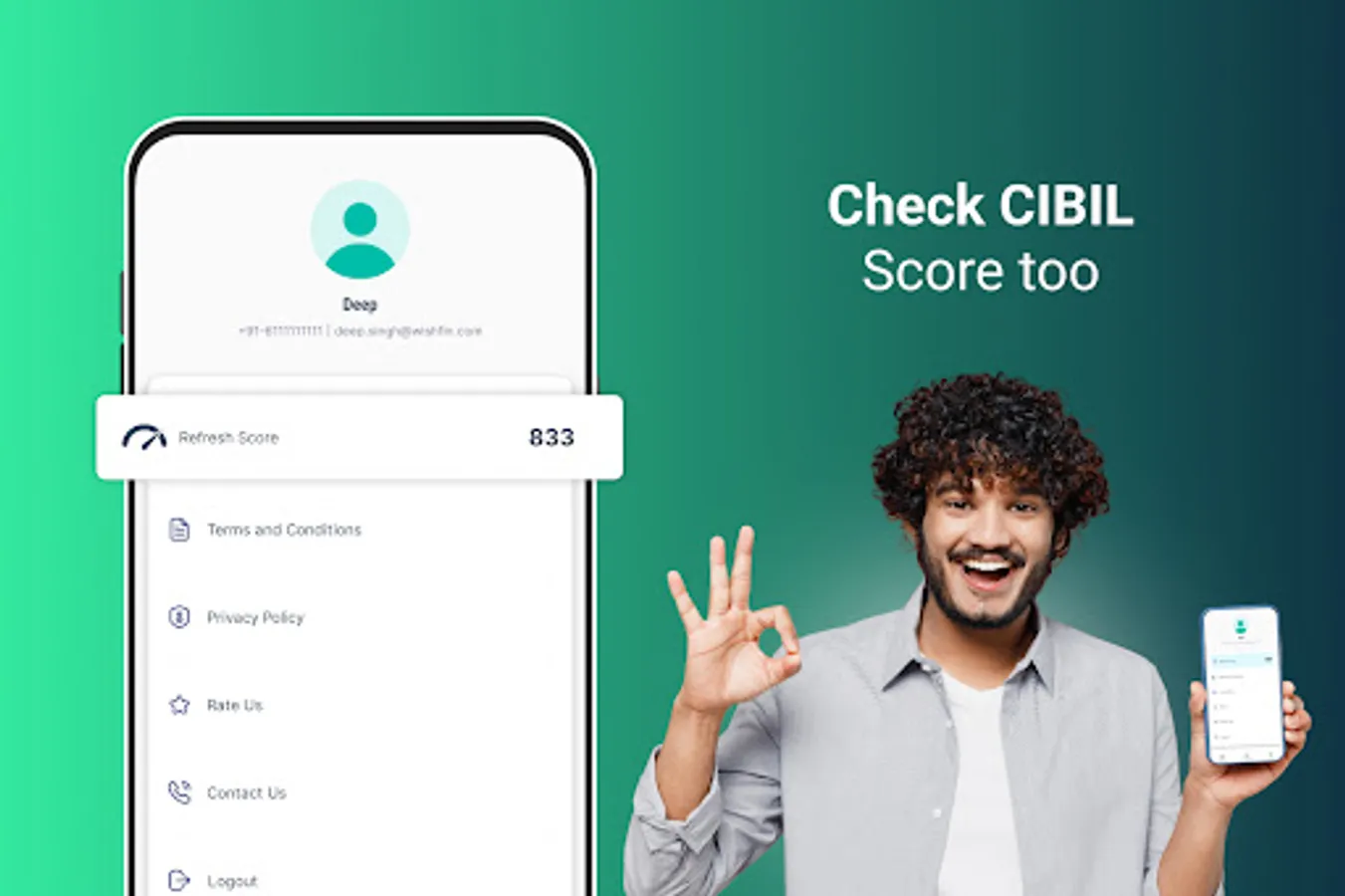

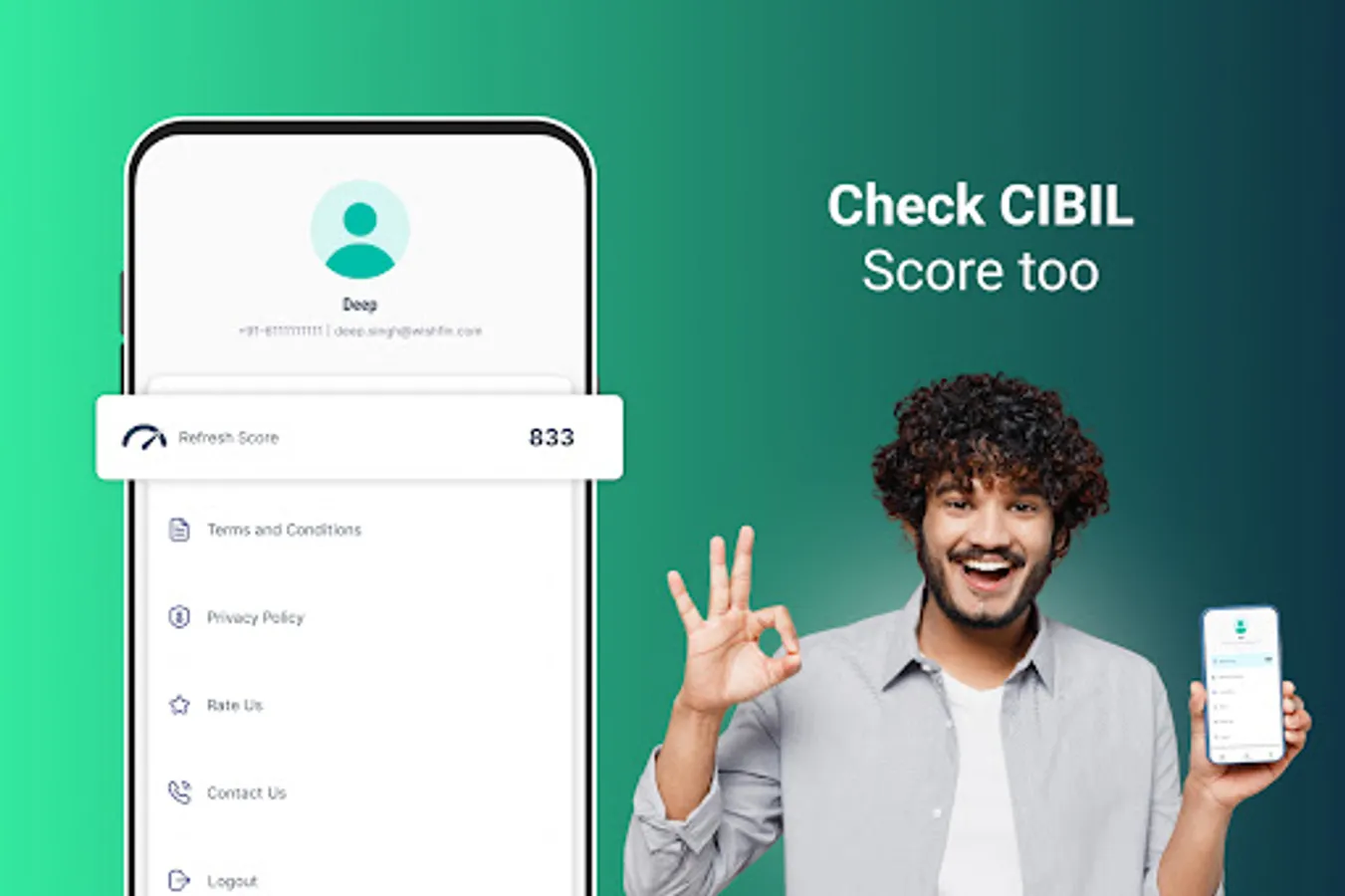

Get a free credit score report and understand your loan eligibility better.

Read FAQs and T&Cs and get answers to all your questions about the loan process.

Need to do a quick business loan apply and fuel your growth? Wishfin got you covered. Our app makes getting a business loan simple, straightforward, and hassle-free. We provide loans up to a maximum limit with flexible repayment terms and lower interest rates. Our application process is easy and can be completed within minutes. We provide quick approvals with funds disbursed in a few hours.

Download the Wishfin Business Loan App, and apply now to unlock your business potential!

Why Choose Wishfin Business Loan App?

Pre-qualified in minutes and access to funds within a few hours.

Loan amounts from ₹1 lakh to ₹25 lakh (depending on eligibility).

Repayment terms to suit your needs.

No need to pledge property or assets

Our partners are: LendingKart, Tata Capital, and more.

Apply for a business loan online in just a few steps, right from your phone.

We value your data and keep everything confidential.

How Can the Wishfin Business Loan App Help You?

Using basic details about your business we see if you qualify.

Compare interest rates, terms, and fees from multiple lenders.

Stay updated on the progress of your loan request.

View your loan details, make payments, and track repayments.

Estimate your monthly EMI and total payable amount before applying.

Simple calculator

1. Enter Your Loan Details:

Loan Amount: Type in the total amount you wish to borrow.

Tenure: Select the desired repayment period in months or years.

Interest Rate: Enter the annual interest rate offered by your lender.

2. Click "Calculate Now":

Once you've filled in the required fields, simply hit the "Calculate Now" button.

3. View Your Amortization Schedule:

The calculator will instantly generate a detailed amortization schedule, showcasing:

Your estimated monthly EMI (Equated Monthly Installment).

The breakdown of each payment into principal and interest components.

The total interest payable over the entire loan tenure.

The outstanding loan balance after each payment.

Feel free to adjust the loan amount, tenure, or interest rate to explore different scenarios and find the most suitable repayment plan for your business. Use the amortization schedule to visualize your loan repayment journey and plan your finances accordingly.

Calculate your business loan EMI today!

Apply Now

Enter your current annual salary or the salary of your business.

Your business must have been in operation for a minimum of 12 months.

Provide your business's annual revenue to help us understand its financial health.

Specify the legal structure under which your business is registered (e.g., sole proprietorship, LLC, corporation).

Once you've filled in the required information and confirmed your eligibility, click the "Apply Now" button to proceed.

You will be seamlessly redirected to our trusted lending partner's website to finalize and submit your loan application.

Our lending partner will review your application promptly and guide you through the next steps. If you have any questions or need assistance during the application process, feel free to reach out to our support team.

Additional Features:

Get a free credit score report and understand your loan eligibility better.

Read FAQs and T&Cs and get answers to all your questions about the loan process.