What Is a Schedule C IRS form?

If you are self-employed, it's likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business. Freelancers, contractors, side-giggers and small business owners typically attach this profit or loss schedule to their Form 1040 tax return when filing their taxes.

Key Takeaways

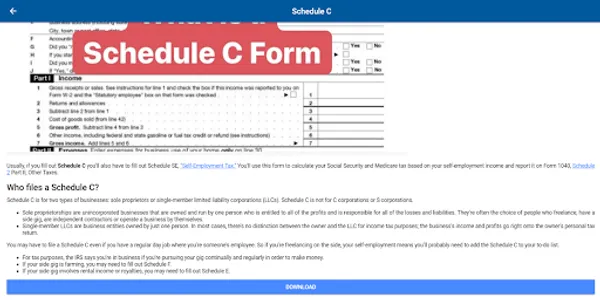

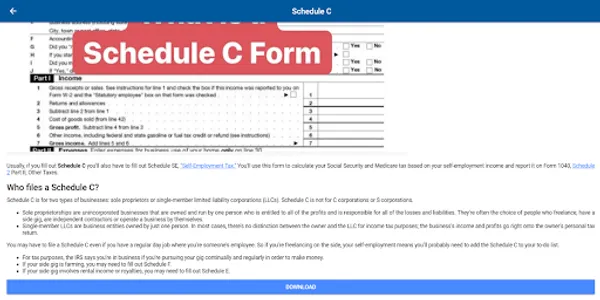

• Schedule C is used to report income and expenses from a business you own as a sole proprietor or single-member LLC.

• If you are self-employed or receive 1099-NEC Forms, you'll likely need to use Schedule C to report income and expenses for your trade or business.

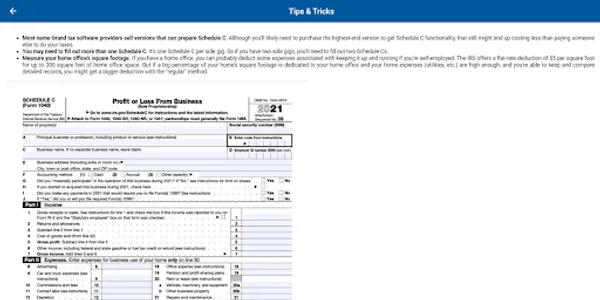

• To be deductible on Schedule C, expenses must be both ordinary and necessary for your business.

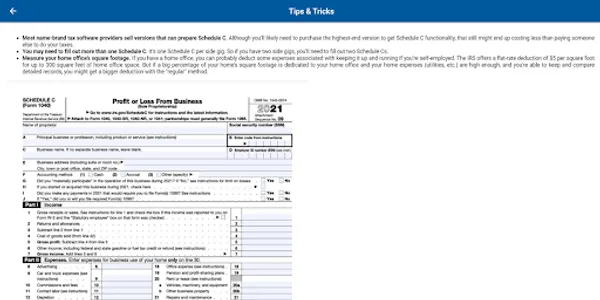

What is Schedule C: Profit or Loss from Business (Form 1040)?

IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. The resulting profit or loss is typically considered self-employment income.

If you are self-employed, it's likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business. Freelancers, contractors, side-giggers and small business owners typically attach this profit or loss schedule to their Form 1040 tax return when filing their taxes.

Key Takeaways

• Schedule C is used to report income and expenses from a business you own as a sole proprietor or single-member LLC.

• If you are self-employed or receive 1099-NEC Forms, you'll likely need to use Schedule C to report income and expenses for your trade or business.

• To be deductible on Schedule C, expenses must be both ordinary and necessary for your business.

What is Schedule C: Profit or Loss from Business (Form 1040)?

IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. The resulting profit or loss is typically considered self-employment income.

Show More