Avail iLoan’s customized business loans in 24 hours*. You can boost your business with the best customized loans and enjoy lower monthly EMIs

Minimum income Required = Rs. 30,000/month

iLoan offers business loans for tenures between 3 months to 60 months. Our loans are both short term and long term with a minimum repayment period of 6 months (for long term loans) post which loan can be closed without any charges!

At iLoan, we give loans between INR 25,000 to INR 10,00,000. Our Interest Rates start from 18% and go up to 30% per annum depending upon products, personal circumstances, credit assessment procedures and other related factors. We charge processing fees at 2%+ applicable taxes; on the gross loan amount sanctioned.

Example (36 months tenure)

For ₹1,00,000 borrowed for 36 months, with interest rate @18% per annum*, a user would pay:

-> Processing fee (@ 2%) = ₹2,000 + GST = ₹2,360

-> Interest = ₹30,140

-> EMI = ₹3,615

Total amount to be repaid after 36 months = ₹1,30,140

Example with 1 year

For ₹1,00,000 borrowed for 12 months, with interest rate @18% per annum*, a user would pay:

-> Processing fee (@ 2%) = ₹2,000 + GST = ₹2,360

-> Interest = ₹10,016

-> EMI = ₹9,168

Total amount to be repaid after 36 months = ₹1,10,016

Business Loans -

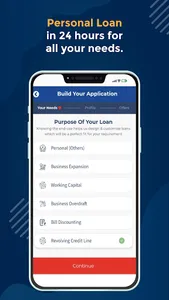

One can avail loans for various purposes like business expansion, inventory, operating capital or any other financial need arising out of daily business operations. Choose from a variety of business loans with different repayment plans such as -

Working Capital

Finance your daily business operations with a working capital to avoid financial shortcomings in your day to day business.

Bill Discounting

You can use your invoices as collateral to acquire funds to meet other expenses arising out of your business operations.

Revolving credit line

You can make multiple borrowings from your sanctioned credit limit and once repaid the credit limit is restored.

Business Overdraft -

Meet any financial requirements and enjoy Interest only payments on the amount you withdraw from your sanctioned credit limit.

Note: Final instalment options for a loan will be decided based on your profile and inputs

Reasons to download the iLoan App:

8 reasons why iLoan is the best Instant loan app:

1. Lower instalments

2. Fastest turnaround time

3. Flexible repayment options

4. No foreclosure charges #

5. Higher Loan amount

6. Higher Loan Tenure

7. Minimum documentation

8. One app for all kinds of business loans

What makes iLoan App the best online Business loan app?

1. Easy registration

2. Easy upload of documents and eKYC

3. eAgreement and Disbursal

4. Trusted customer support

Avail a contactless, completely digital business loan with iLoan. We simplify the loan process right from registration to disbursal. You can now avail a business loan from the comfort of your home with the help of the Best business loan App.

Eligibility Criteria for Loan Application:

1. Individuals with a minimum income of INR 30,000

2. Indian Citizens/Residents who are 21 years & above

Cities of Operation:

Ahmedabad

Bangalore

Bhopal

Chandigarh

Chennai

Coimbatore

Delhi NCR

Hyderabad

Howrah

Indore

Jaipur

Kolkata

Lucknow

Mumbai

Navi Mumbai

Nagpur

Nashik

Pune

Raipur

Vadodara

Security and Privacy Policy:

We have a highly secured & encrypted system to ensure safety of information shared by our customers. To read our privacy policy click here: https://loantap.in/privacy-security/

Terms and Conditions:

iLoan offers loans from its in-house RBI registered NBFC, iLoan Credit Products Private Limited. For more terms and conditions, click at https://loantap.in/terms-of-use/

To know more about us, click at https://iloan.loantap.in/about-us/

Please do reach out/write to us on contact@iloan.loantap.in or call at +91 788 804 0000 for any other information.

*: subject to credit checks

#: subject to conditions

Minimum income Required = Rs. 30,000/month

iLoan offers business loans for tenures between 3 months to 60 months. Our loans are both short term and long term with a minimum repayment period of 6 months (for long term loans) post which loan can be closed without any charges!

At iLoan, we give loans between INR 25,000 to INR 10,00,000. Our Interest Rates start from 18% and go up to 30% per annum depending upon products, personal circumstances, credit assessment procedures and other related factors. We charge processing fees at 2%+ applicable taxes; on the gross loan amount sanctioned.

Example (36 months tenure)

For ₹1,00,000 borrowed for 36 months, with interest rate @18% per annum*, a user would pay:

-> Processing fee (@ 2%) = ₹2,000 + GST = ₹2,360

-> Interest = ₹30,140

-> EMI = ₹3,615

Total amount to be repaid after 36 months = ₹1,30,140

Example with 1 year

For ₹1,00,000 borrowed for 12 months, with interest rate @18% per annum*, a user would pay:

-> Processing fee (@ 2%) = ₹2,000 + GST = ₹2,360

-> Interest = ₹10,016

-> EMI = ₹9,168

Total amount to be repaid after 36 months = ₹1,10,016

Business Loans -

One can avail loans for various purposes like business expansion, inventory, operating capital or any other financial need arising out of daily business operations. Choose from a variety of business loans with different repayment plans such as -

Working Capital

Finance your daily business operations with a working capital to avoid financial shortcomings in your day to day business.

Bill Discounting

You can use your invoices as collateral to acquire funds to meet other expenses arising out of your business operations.

Revolving credit line

You can make multiple borrowings from your sanctioned credit limit and once repaid the credit limit is restored.

Business Overdraft -

Meet any financial requirements and enjoy Interest only payments on the amount you withdraw from your sanctioned credit limit.

Note: Final instalment options for a loan will be decided based on your profile and inputs

Reasons to download the iLoan App:

8 reasons why iLoan is the best Instant loan app:

1. Lower instalments

2. Fastest turnaround time

3. Flexible repayment options

4. No foreclosure charges #

5. Higher Loan amount

6. Higher Loan Tenure

7. Minimum documentation

8. One app for all kinds of business loans

What makes iLoan App the best online Business loan app?

1. Easy registration

2. Easy upload of documents and eKYC

3. eAgreement and Disbursal

4. Trusted customer support

Avail a contactless, completely digital business loan with iLoan. We simplify the loan process right from registration to disbursal. You can now avail a business loan from the comfort of your home with the help of the Best business loan App.

Eligibility Criteria for Loan Application:

1. Individuals with a minimum income of INR 30,000

2. Indian Citizens/Residents who are 21 years & above

Cities of Operation:

Ahmedabad

Bangalore

Bhopal

Chandigarh

Chennai

Coimbatore

Delhi NCR

Hyderabad

Howrah

Indore

Jaipur

Kolkata

Lucknow

Mumbai

Navi Mumbai

Nagpur

Nashik

Pune

Raipur

Vadodara

Security and Privacy Policy:

We have a highly secured & encrypted system to ensure safety of information shared by our customers. To read our privacy policy click here: https://loantap.in/privacy-security/

Terms and Conditions:

iLoan offers loans from its in-house RBI registered NBFC, iLoan Credit Products Private Limited. For more terms and conditions, click at https://loantap.in/terms-of-use/

To know more about us, click at https://iloan.loantap.in/about-us/

Please do reach out/write to us on contact@iloan.loantap.in or call at +91 788 804 0000 for any other information.

*: subject to credit checks

#: subject to conditions

Show More