Munifi

Munifi

10+

downloads

Free

About Munifi

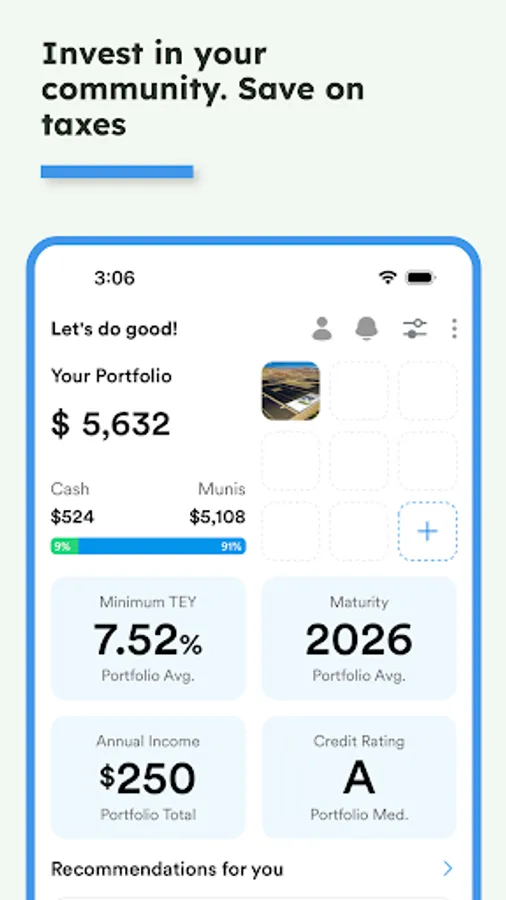

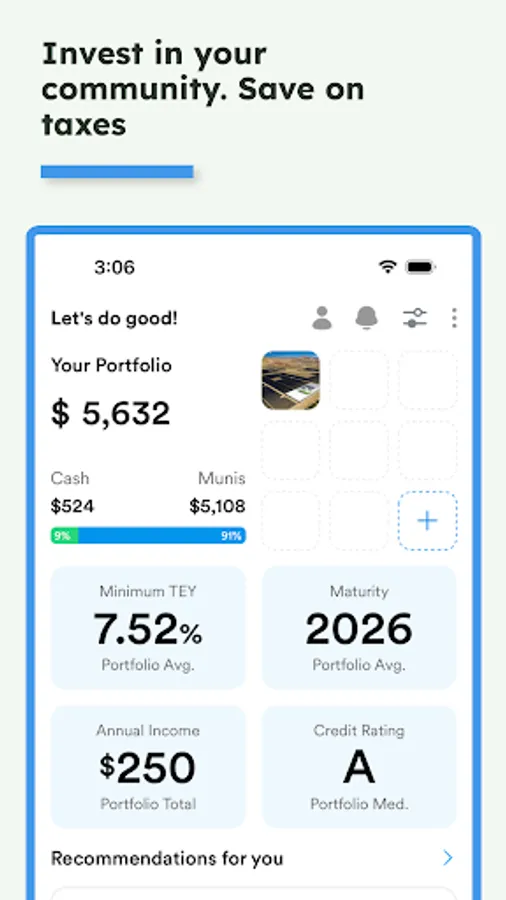

Munifi turns complex municipal-bond investing into a simple, personalized experience. Our AI-driven platform scans the entire muni market in real time, matches each bond’s community impact with your values and location, and optimizes for maximum federal- and state-tax savings. The result: steady, tax-free income that helps build the places you care about most.

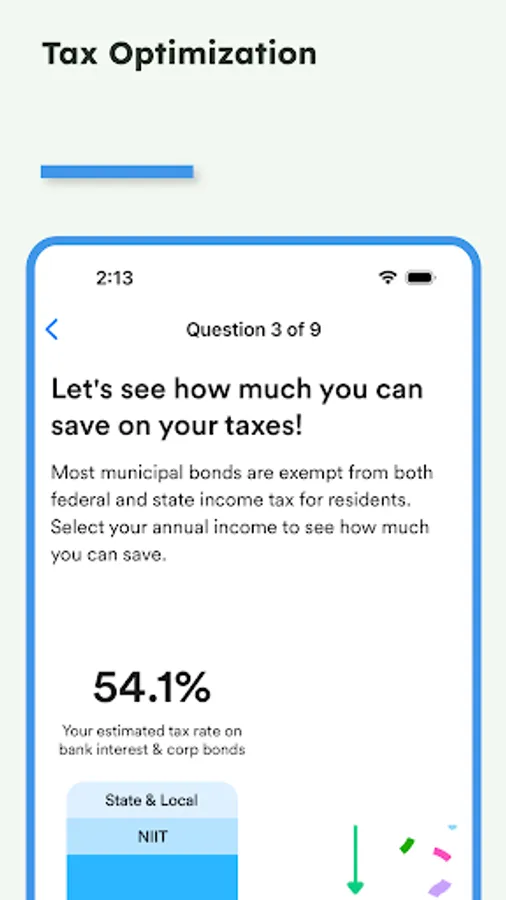

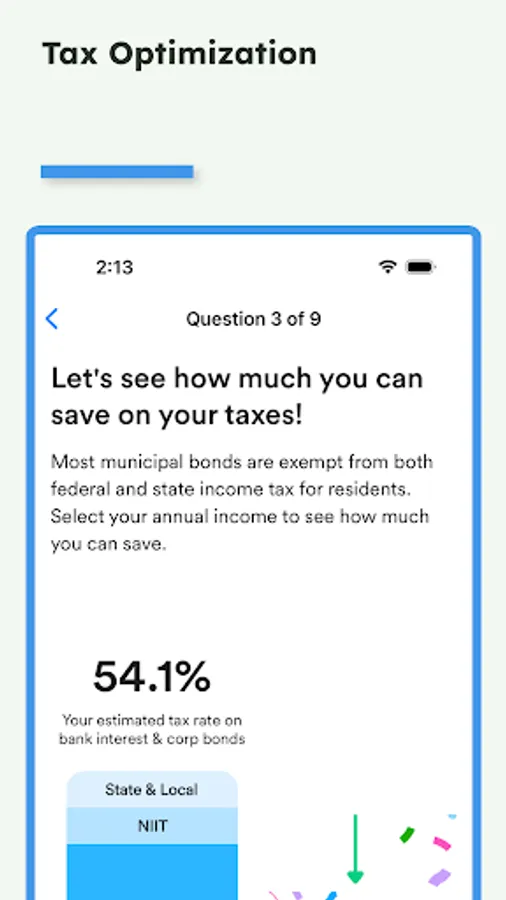

TAX-FREE INCOME

- Identify bonds exempt from federal and state taxes to maximize after-tax yield

- See estimated tax savings before you invest

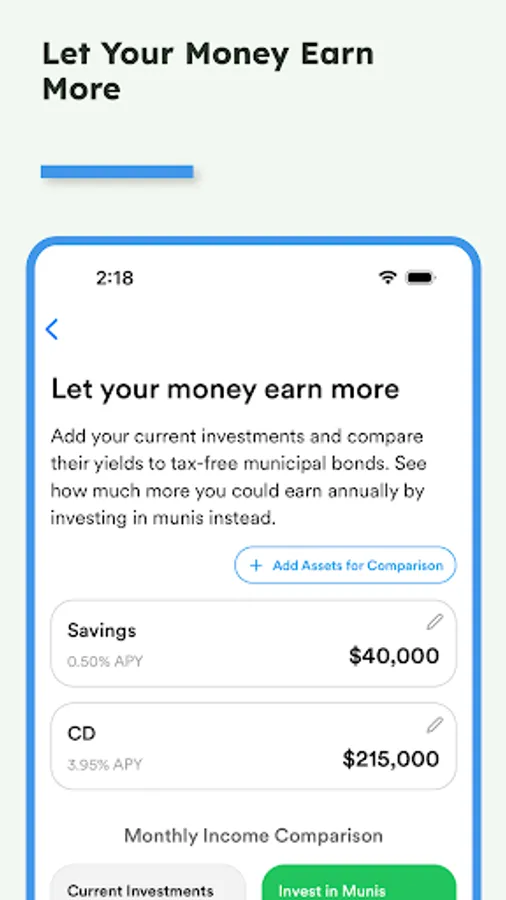

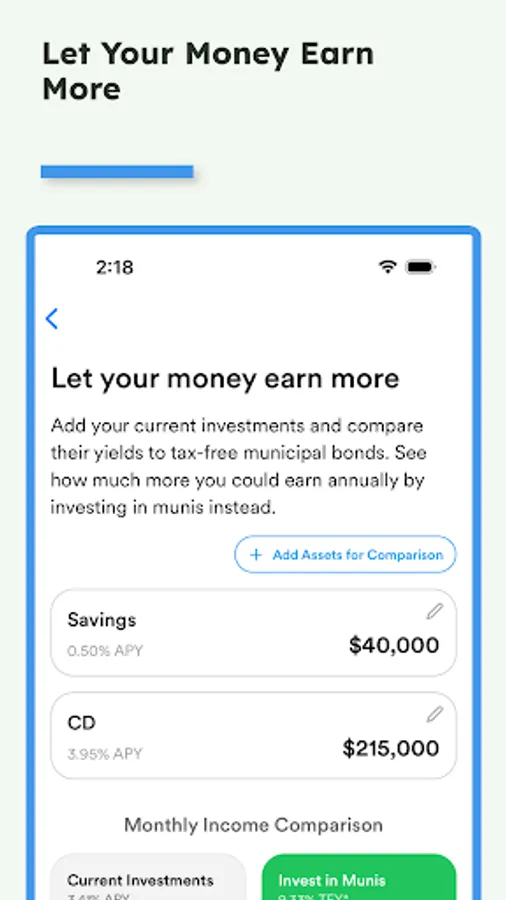

MORE INCOME THAN CDs

- Tax-exempt yields can beat the top online CD rates by hundreds of basis points once you factor in state + federal savings.

SUPER-SAFE APPROACH TO INVESTING

- We restrict portfolios to investment-grade issuers with historically low default rates

- Bonds are titled to you, in your own separate account, and held at Apex Clearing

- Your investment is SIPC insured up to $500,000 so you don’t have to worry about your broker-dealer/custodian

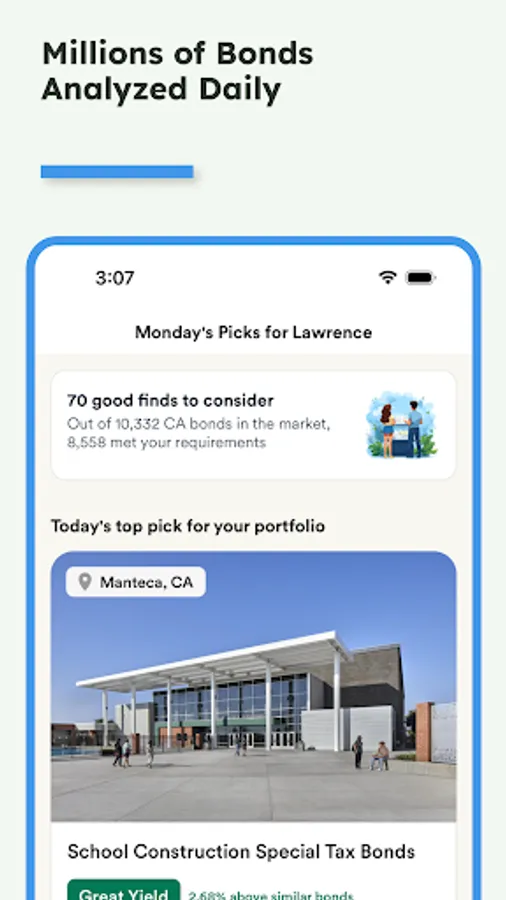

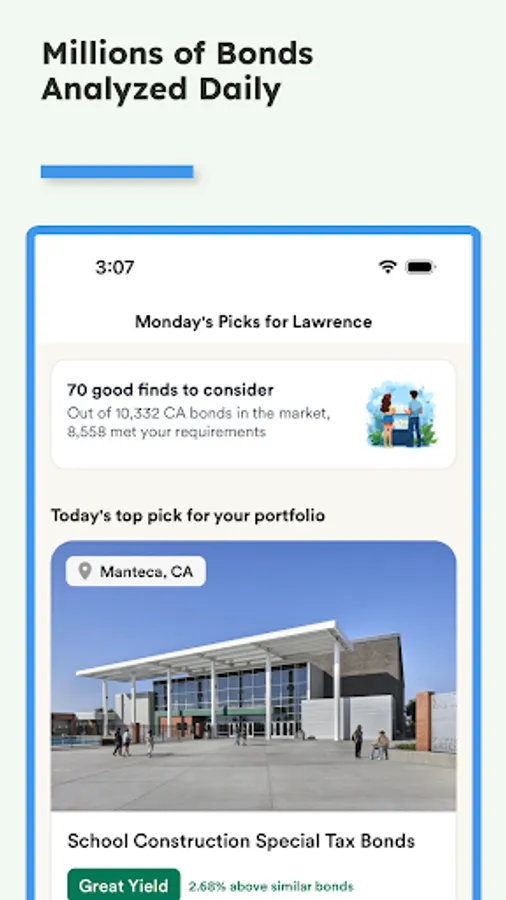

AI-DRIVEN BOND SEARCH

- Proprietary models scan 100k+ munis all day long for yield, credit quality, and call risk

- Instant, personalized ladders: no spreadsheets, no guesswork

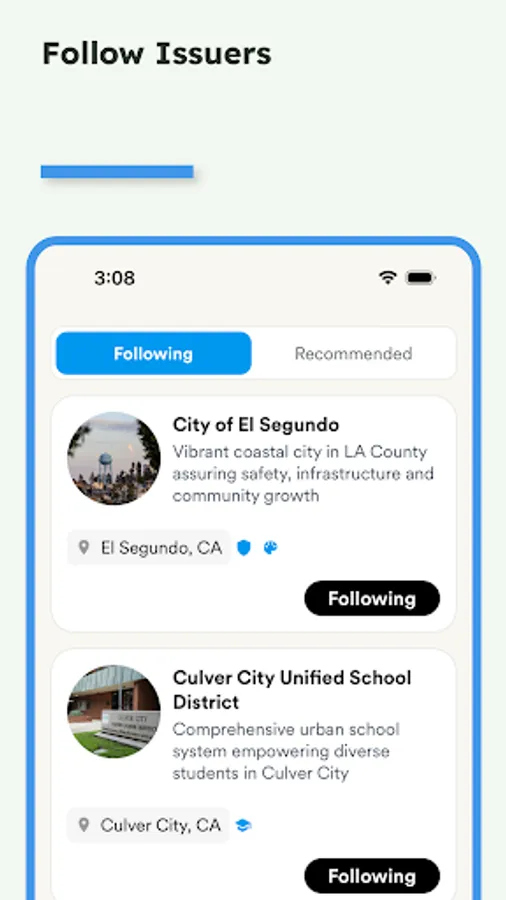

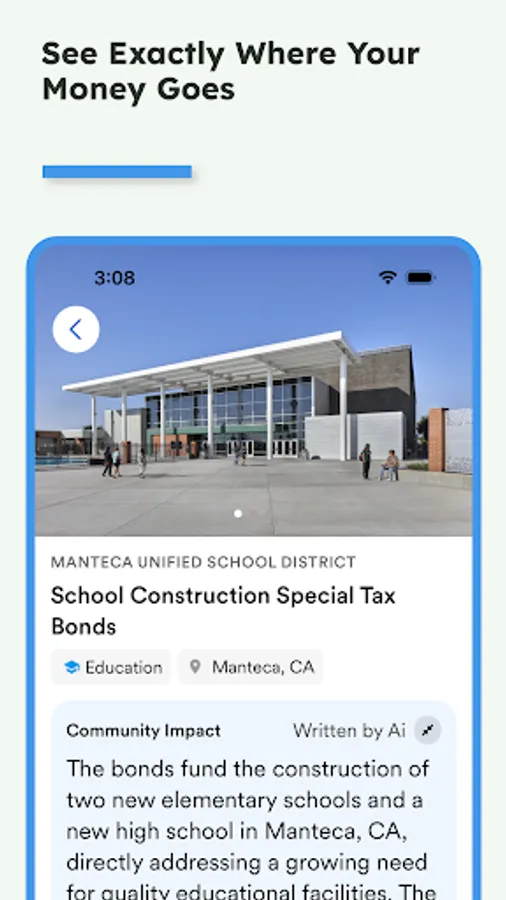

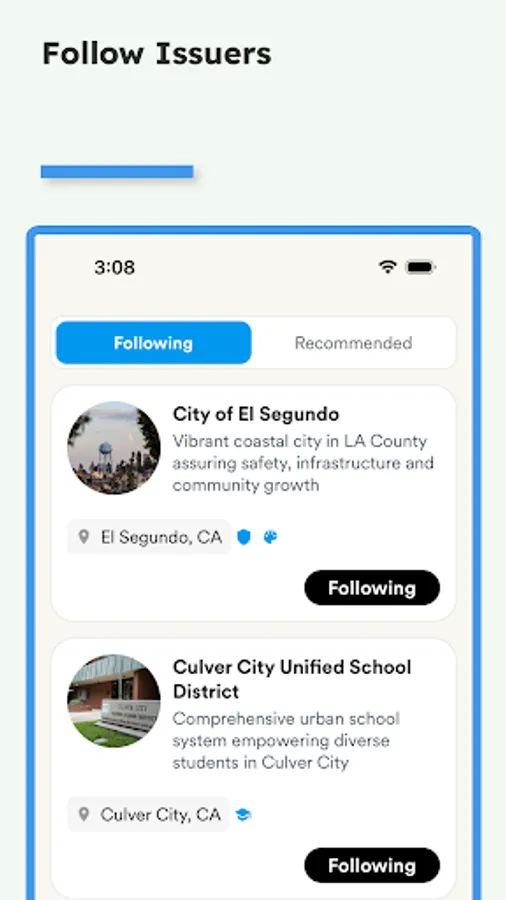

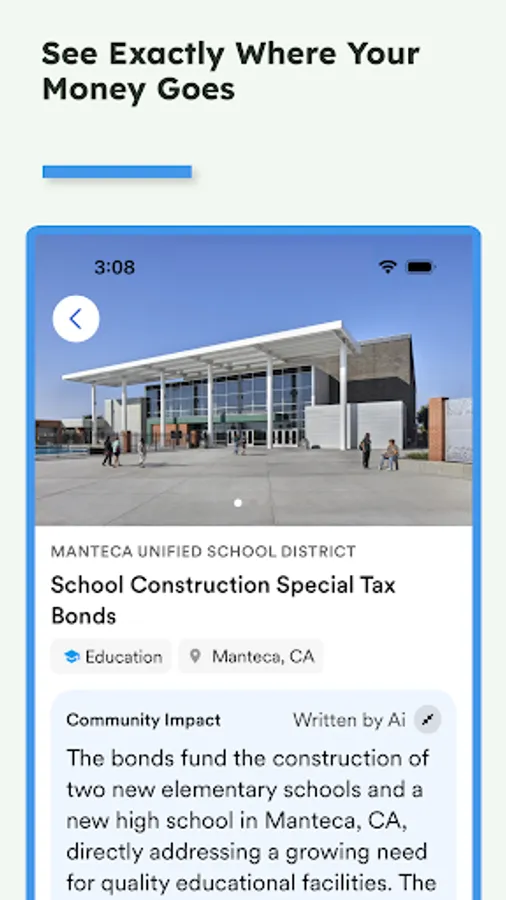

COMMUNITY IMPACT

- Every bond includes a plain-English project story (library, senior housing, light-rail, etc.)

- Search by causes: green energy, local schools, veterans, children’s hospitals, and more.

SECURE CUSTODY

- Assets held with SIPC-protected custodians; 256-bit encryption on every transaction

- Two-factor authentication and we don’t sell your personal data to anyone

HOW IT WORKS

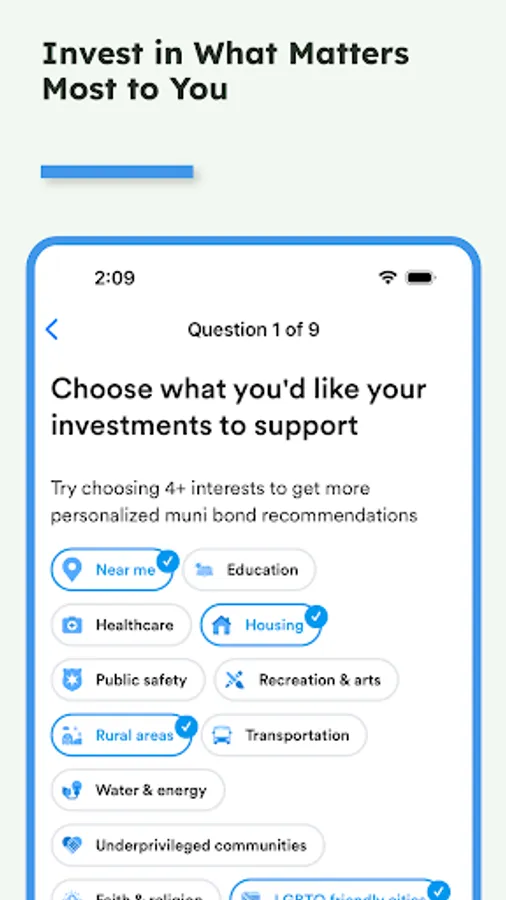

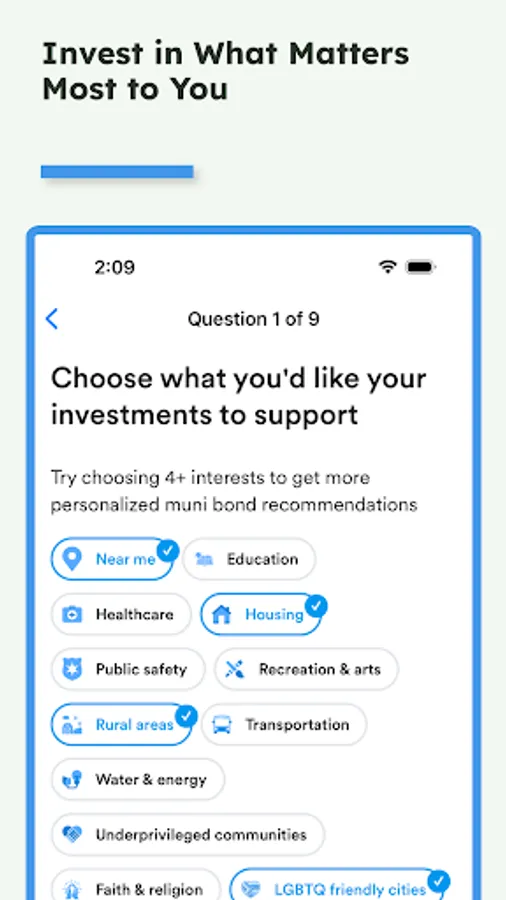

- Create Profile: Where you live, your taxable income, and causes you care about.

- Review Recommendations: AI driven recommendations fit your profile

- Fund & Earn: Start collecting tax-exempt income immediately

- Grow & Reinvest: Add cash anytime; Munifi sources new bonds automatically

KEY FEATURES

- ZERO account minimums

- MILLIONS of bonds analyzed daily

- FOLLOW issuers and communities you care about

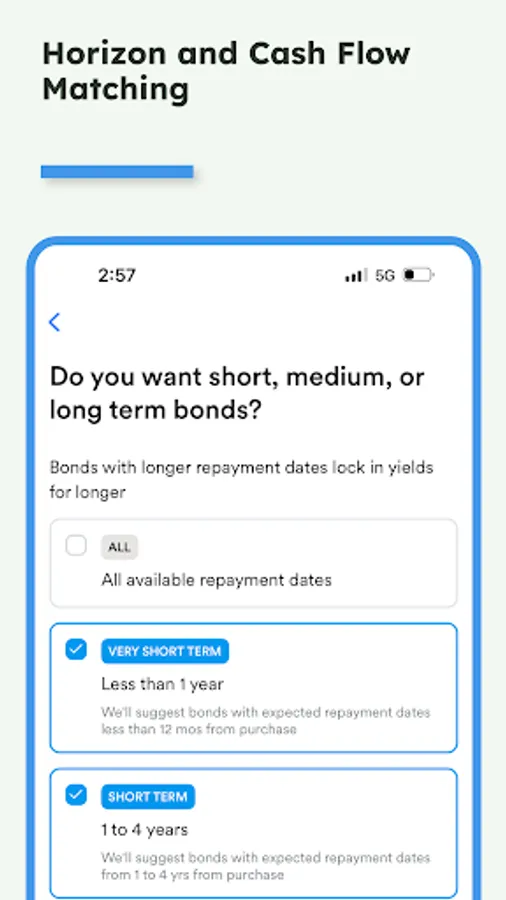

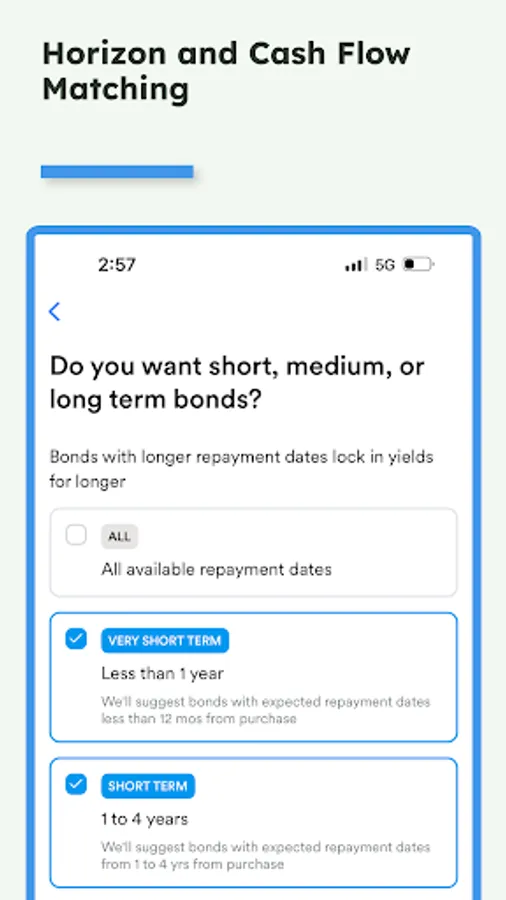

- MATCH based on horizon and cashflow

- OPTIMIZE your taxes through tax-free investing

DISCLOSURE

Municipal securities carry risk, including possible loss of principal. Interest may be subject to AMT or state tax in certain cases. SIPC insurance applies to the custodian, not the municipal issuer. Always consult a tax professional.

Download Munifi and turn your portfolio into progress.

TAX-FREE INCOME

- Identify bonds exempt from federal and state taxes to maximize after-tax yield

- See estimated tax savings before you invest

MORE INCOME THAN CDs

- Tax-exempt yields can beat the top online CD rates by hundreds of basis points once you factor in state + federal savings.

SUPER-SAFE APPROACH TO INVESTING

- We restrict portfolios to investment-grade issuers with historically low default rates

- Bonds are titled to you, in your own separate account, and held at Apex Clearing

- Your investment is SIPC insured up to $500,000 so you don’t have to worry about your broker-dealer/custodian

AI-DRIVEN BOND SEARCH

- Proprietary models scan 100k+ munis all day long for yield, credit quality, and call risk

- Instant, personalized ladders: no spreadsheets, no guesswork

COMMUNITY IMPACT

- Every bond includes a plain-English project story (library, senior housing, light-rail, etc.)

- Search by causes: green energy, local schools, veterans, children’s hospitals, and more.

SECURE CUSTODY

- Assets held with SIPC-protected custodians; 256-bit encryption on every transaction

- Two-factor authentication and we don’t sell your personal data to anyone

HOW IT WORKS

- Create Profile: Where you live, your taxable income, and causes you care about.

- Review Recommendations: AI driven recommendations fit your profile

- Fund & Earn: Start collecting tax-exempt income immediately

- Grow & Reinvest: Add cash anytime; Munifi sources new bonds automatically

KEY FEATURES

- ZERO account minimums

- MILLIONS of bonds analyzed daily

- FOLLOW issuers and communities you care about

- MATCH based on horizon and cashflow

- OPTIMIZE your taxes through tax-free investing

DISCLOSURE

Municipal securities carry risk, including possible loss of principal. Interest may be subject to AMT or state tax in certain cases. SIPC insurance applies to the custodian, not the municipal issuer. Always consult a tax professional.

Download Munifi and turn your portfolio into progress.