◆ Includes + α supplementary points for tax accountant exam preparation that could not be recorded in "Consumption Tax Law Invincible Question and Answer"!

◆ Corresponds to the content of various exams such as the tax accountant exam in 2023!

◆ You can enjoy learning efficiently in your spare time like a quiz game!

◆ Includes 1,000 carefully selected important issues!

◆ After the release of the app, there are many results of similar questions in the tax accountant exam.

◆ Due to its popularity, the problems recorded in this app have been made into a book! For details, please visit the official website! Please experience the efficiency of a new study method that has never existed before, a complete cooperation between books and apps!

-------------------------------------------------- ---------------------------

This application is "LITE version" and can be installed for free.

All functions can be used by upgrading to "PRO version" in the app.

● Developed by the author of “Consumption Tax Law Invincible Question and Answer” ●

This app is a new app developed by the creator of the popular app "Consumption Tax Law Invincible Question and Answer", which is a hot topic among tax accountant applicants.

The following supplementary points for tax accountant exam measures that could not be recorded in "Consumption Tax Law Invincible Question and Answer" are recorded.

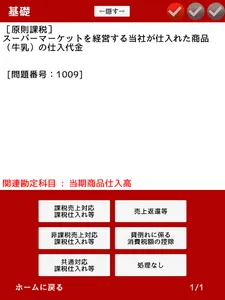

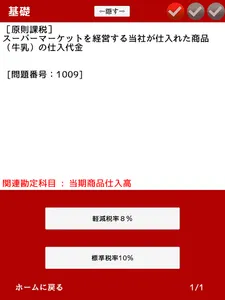

(1) Determination of application of reduced tax rate

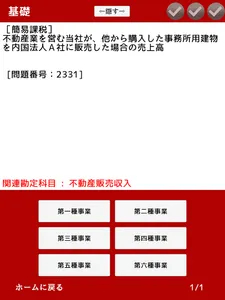

(2) Determination of business classification under the simplified taxation system

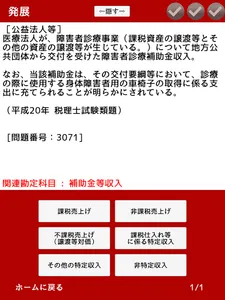

③ Exceptions for the national government, public interest corporations, etc.

The developer of this application himself also made use of his experience as a student of the consumption tax law for the tax accountant examination, thoroughly analyzing the past questions of the tax accountant examination and creating questions.

I hope that you will realize that you can acquire knowledge much more efficiently than solving problems on paper.

Use this app to solidify your exam preparation!

● App content ●

This app is a question-and-answer type problem collection app that trains the ability to judge the handling of various transactions under the consumption tax law. You can study casually and efficiently as if you were solving a quiz game using the following gap time.

① Travel time while commuting to work or school

② Company or school break time

③ When you want to study while lying down at bedtime

④ When the study room was too crowded to secure a study desk

⑤ When you want to come home late at night and study, but you are tired and it is troublesome to put out texts etc.

⑥ While waiting in line at a popular ramen shop

⑦ When you get stuck at a red light with a long waiting time

With the increase in the consumption tax rate, the importance of proper tax calculation by business operators subject to consumption tax is increasing.

In addition, with the introduction of the reduced tax rate system, it has become necessary to accurately determine the tax rate to be applied to taxable transactions.

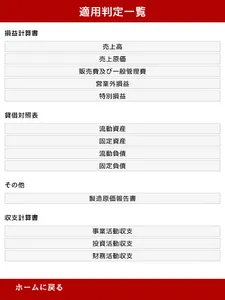

In this app, in addition to determining the application of the reduced tax rate, you can search for the classification determination of the business classification of the simplified taxation system and special cases such as public interest corporations from the application determination list, and solve problems to efficiently train. increase.

It is a highly useful app for all consumption tax learners, such as tax accountants, certified public accountants, and accounting staff, as well as for tax accountant candidates.

By repeatedly solving the problems of this app, let's train the tax processing ability of consumption tax.

● Cooperation with books ●

The book "Consumption Tax Law Plus Q&A Applicability Judgment List" that contains the problems of this application is also on sale.

Of course, you can systematically deepen your knowledge with this app alone, but since the content is linked to the "Consumption Tax Law Plus Q&A Applicability Judgment List", for example, "Input is a book, You can learn more efficiently by using "output is in the app" properly!

You can purchase the "Consumption Tax Law Plus Q&A Application Judgment List" from the following page.

Book sales page: https://shouhizei-quiz.com/?lp=bookstore

● Features of the app ●

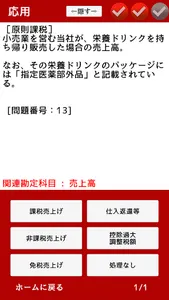

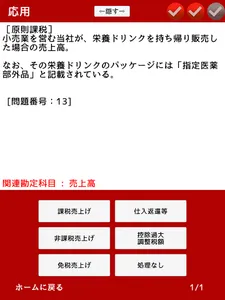

① Overwhelming volume of 1,000 recorded questions

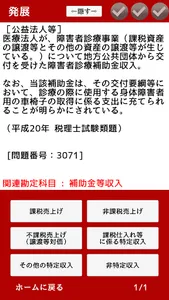

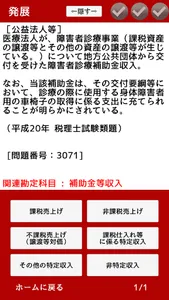

② There are three types of problems: judgment on application of reduced tax rate, judgment on business classification of simplified taxation, and judgment on special cases such as public interest corporations

③ Difficulty is divided into 4 levels: basic level, applied level, advanced level, and research level, so you can learn according to your level of proficiency.

Basic level: questions that require basic judgment skills with high importance (280 questions)

Application level: questions that require applied judgment skills based on the basics (325 questions)

Development level: Problems that require the ability to deal with complex transactions and specialized knowledge such as judicial precedents and notifications (319 questions)

Research level: Advanced questions to deepen research on consumption tax (76 questions)

④ You can use the check mark function to overcome weak points (*)

⑤ Use your spare time to study casually and efficiently as if you were solving a quiz game

⑥ Some questions have [Hints].

⑦ Corresponding to the latest tax system

● 3 modes ●

① "Challenge mode" to challenge 30 questions that gradually become difficult

② "Practice mode" (*) where you can select the difficulty level of the problem and the number of checkmarks and repeatedly solve the problems in the selected range to overcome your weak points.

③ "Applicability judgment list" (*) that can list all 1,000 question sentences, answers, and explanations

● (*) About the LITE version ●

This application is a LITE version and can only be used in challenge mode. By updating to the PRO version in the app, you will be able to use the following functions.

① Hide ads (PRO version will not display any in-app ads)

② Display of commentary text and problem text

③ Check mark function

④ Practice mode

⑤ Class decision list

⑥ Checkmark/difficulty on/off switching function

Note that feature update prices are subject to change without notice.

● Recommended for: ●

・ Those who aim to pass the tax accountant examination (consumption tax law)

・Those who aim for a high score in the CPA examination (tax law)

・ Those who are involved in high-level tax affairs at large companies and accounting firms

・Those who are studying taxation at graduate school, etc.

● Precautions when solving problems ●

The problem with this app is, as described in "How to use the app" on the home screen, the same question condition as the tax accountant exam, etc., "If there are multiple methods to be applied, the tax amount to be paid for the current period is the highest." We have prepared the correct answers based on the premise that "choose the way to reduce it." Therefore, if it is more advantageous in terms of tax amount calculation for the current period to adopt an exception rule (a rule that can be applied) than a rule rule for a certain transaction, the correct answer is to use the exception rule. Please solve the problem based on the prerequisites described in "How to use the app" on the home screen.

● App creator profile ●

Tax accountant Yuki Kawakami

Passed tax accountant examination official gazette in 2015 (5 subjects: bookkeeping theory, financial statement theory, consumption tax law, corporate tax law, business tax)

Inspired by the memorization card of the transaction classification created for self-study when he was concentrating on studying for the tax accountant exam consumption tax law, he developed the smartphone application "Consumption tax law unbeatable question and answer".

In 2019, the “Consumption Tax Law Invincible Question-and-Answer List of Charge/Rejection Judgments”, which is a book on the problems recorded in the app, was highly evaluated for its uniqueness and innovation at the “Nekpub POD Award 2019”. , won the Special Jury Prize.

In 2024, his research paper “A study on the tax base of consumption tax when contributions in kind are made” won the Japan Tax Research Award and the tax accountant section at the youngest in history.

Currently, in addition to working as a tax accountant, he is involved in a wide range of activities, including producing teaching materials for the consumption tax law for major qualification schools, writing books related to tax accounting, and creating web content.

● Homepage ●

Consumption Tax Law Q&A App Official Website: https://shouhizei-quiz.com/

App introduction page: https://shouhizei-quiz.com/?lp=lp

Book sales page: https://shouhizei-quiz.com/?lp=bookstore

◆ Corresponds to the content of various exams such as the tax accountant exam in 2023!

◆ You can enjoy learning efficiently in your spare time like a quiz game!

◆ Includes 1,000 carefully selected important issues!

◆ After the release of the app, there are many results of similar questions in the tax accountant exam.

◆ Due to its popularity, the problems recorded in this app have been made into a book! For details, please visit the official website! Please experience the efficiency of a new study method that has never existed before, a complete cooperation between books and apps!

-------------------------------------------------- ---------------------------

This application is "LITE version" and can be installed for free.

All functions can be used by upgrading to "PRO version" in the app.

● Developed by the author of “Consumption Tax Law Invincible Question and Answer” ●

This app is a new app developed by the creator of the popular app "Consumption Tax Law Invincible Question and Answer", which is a hot topic among tax accountant applicants.

The following supplementary points for tax accountant exam measures that could not be recorded in "Consumption Tax Law Invincible Question and Answer" are recorded.

(1) Determination of application of reduced tax rate

(2) Determination of business classification under the simplified taxation system

③ Exceptions for the national government, public interest corporations, etc.

The developer of this application himself also made use of his experience as a student of the consumption tax law for the tax accountant examination, thoroughly analyzing the past questions of the tax accountant examination and creating questions.

I hope that you will realize that you can acquire knowledge much more efficiently than solving problems on paper.

Use this app to solidify your exam preparation!

● App content ●

This app is a question-and-answer type problem collection app that trains the ability to judge the handling of various transactions under the consumption tax law. You can study casually and efficiently as if you were solving a quiz game using the following gap time.

① Travel time while commuting to work or school

② Company or school break time

③ When you want to study while lying down at bedtime

④ When the study room was too crowded to secure a study desk

⑤ When you want to come home late at night and study, but you are tired and it is troublesome to put out texts etc.

⑥ While waiting in line at a popular ramen shop

⑦ When you get stuck at a red light with a long waiting time

With the increase in the consumption tax rate, the importance of proper tax calculation by business operators subject to consumption tax is increasing.

In addition, with the introduction of the reduced tax rate system, it has become necessary to accurately determine the tax rate to be applied to taxable transactions.

In this app, in addition to determining the application of the reduced tax rate, you can search for the classification determination of the business classification of the simplified taxation system and special cases such as public interest corporations from the application determination list, and solve problems to efficiently train. increase.

It is a highly useful app for all consumption tax learners, such as tax accountants, certified public accountants, and accounting staff, as well as for tax accountant candidates.

By repeatedly solving the problems of this app, let's train the tax processing ability of consumption tax.

● Cooperation with books ●

The book "Consumption Tax Law Plus Q&A Applicability Judgment List" that contains the problems of this application is also on sale.

Of course, you can systematically deepen your knowledge with this app alone, but since the content is linked to the "Consumption Tax Law Plus Q&A Applicability Judgment List", for example, "Input is a book, You can learn more efficiently by using "output is in the app" properly!

You can purchase the "Consumption Tax Law Plus Q&A Application Judgment List" from the following page.

Book sales page: https://shouhizei-quiz.com/?lp=bookstore

● Features of the app ●

① Overwhelming volume of 1,000 recorded questions

② There are three types of problems: judgment on application of reduced tax rate, judgment on business classification of simplified taxation, and judgment on special cases such as public interest corporations

③ Difficulty is divided into 4 levels: basic level, applied level, advanced level, and research level, so you can learn according to your level of proficiency.

Basic level: questions that require basic judgment skills with high importance (280 questions)

Application level: questions that require applied judgment skills based on the basics (325 questions)

Development level: Problems that require the ability to deal with complex transactions and specialized knowledge such as judicial precedents and notifications (319 questions)

Research level: Advanced questions to deepen research on consumption tax (76 questions)

④ You can use the check mark function to overcome weak points (*)

⑤ Use your spare time to study casually and efficiently as if you were solving a quiz game

⑥ Some questions have [Hints].

⑦ Corresponding to the latest tax system

● 3 modes ●

① "Challenge mode" to challenge 30 questions that gradually become difficult

② "Practice mode" (*) where you can select the difficulty level of the problem and the number of checkmarks and repeatedly solve the problems in the selected range to overcome your weak points.

③ "Applicability judgment list" (*) that can list all 1,000 question sentences, answers, and explanations

● (*) About the LITE version ●

This application is a LITE version and can only be used in challenge mode. By updating to the PRO version in the app, you will be able to use the following functions.

① Hide ads (PRO version will not display any in-app ads)

② Display of commentary text and problem text

③ Check mark function

④ Practice mode

⑤ Class decision list

⑥ Checkmark/difficulty on/off switching function

Note that feature update prices are subject to change without notice.

● Recommended for: ●

・ Those who aim to pass the tax accountant examination (consumption tax law)

・Those who aim for a high score in the CPA examination (tax law)

・ Those who are involved in high-level tax affairs at large companies and accounting firms

・Those who are studying taxation at graduate school, etc.

● Precautions when solving problems ●

The problem with this app is, as described in "How to use the app" on the home screen, the same question condition as the tax accountant exam, etc., "If there are multiple methods to be applied, the tax amount to be paid for the current period is the highest." We have prepared the correct answers based on the premise that "choose the way to reduce it." Therefore, if it is more advantageous in terms of tax amount calculation for the current period to adopt an exception rule (a rule that can be applied) than a rule rule for a certain transaction, the correct answer is to use the exception rule. Please solve the problem based on the prerequisites described in "How to use the app" on the home screen.

● App creator profile ●

Tax accountant Yuki Kawakami

Passed tax accountant examination official gazette in 2015 (5 subjects: bookkeeping theory, financial statement theory, consumption tax law, corporate tax law, business tax)

Inspired by the memorization card of the transaction classification created for self-study when he was concentrating on studying for the tax accountant exam consumption tax law, he developed the smartphone application "Consumption tax law unbeatable question and answer".

In 2019, the “Consumption Tax Law Invincible Question-and-Answer List of Charge/Rejection Judgments”, which is a book on the problems recorded in the app, was highly evaluated for its uniqueness and innovation at the “Nekpub POD Award 2019”. , won the Special Jury Prize.

In 2024, his research paper “A study on the tax base of consumption tax when contributions in kind are made” won the Japan Tax Research Award and the tax accountant section at the youngest in history.

Currently, in addition to working as a tax accountant, he is involved in a wide range of activities, including producing teaching materials for the consumption tax law for major qualification schools, writing books related to tax accounting, and creating web content.

● Homepage ●

Consumption Tax Law Q&A App Official Website: https://shouhizei-quiz.com/

App introduction page: https://shouhizei-quiz.com/?lp=lp

Book sales page: https://shouhizei-quiz.com/?lp=bookstore

Show More