[Service provided by Moa Digital Bank]

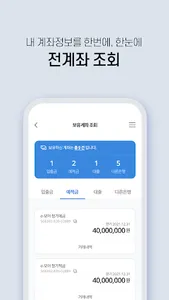

Non-face-to-face account opening service: Free deposit and withdrawal account opening through non-face-to-face real name verification (different procedures for each product)

Convenience of transfer service: easy and fast remittance such as transfer, reservation transfer, etc.

Financial Product Mall: Provides various financial products such as loans for office workers, entrepreneurs, housewives, and e-moa regular installment savings

[Moa Digital Bank digital authentication service]

Easy login with simple password, pattern authentication, and biometric authentication

Moa banking service available without going to a branch

[Moa Savings Bank employee credit loan (trust theory)]

•Subject to application

- Customers aged 19 or older with proof of income

- NICE credit score of 600 or higher

Loan limit

- More than 3 million won and less than 50 million won

(Differential application depending on personal credit score and income)

Loan period

- Repayment of principal and interest in equal installments: Minimum 12 months ~ Maximum 84 months

Loan interest rate

- Minimum annual rate of 16.4% ~ maximum annual rate of 20.0% (as of April 2023)

(Differential application depending on personal credit score and income)

•Repayment method

- Repayment of principal and interest in equal installments: Repayment of principal and interest (principal + interest) in equal installments during the loan period

How to pay interest

- Post-monthly

•charge

- Handling fee: none

•Prepayment fee

- Within 2.0% (premium repayment fee waived for transactions over 3 years from the date of loan)

•required documents

- Identification card, copy of resident registration, documents proving income, etc.

Overdue interest rate

- Loan interest rate + 3% (up to 20% per year)

•stamp duty

- doesn't exist

Standards for Calculating Loan Interest Rates

- Loan interest rate = base interest rate + additional interest rate

- Standard interest rate: Procurement cost

- Additional interest rate: Differential application according to the bank’s internal rating, etc.

•Notice

- Loan may be rejected according to internal screening criteria.

- Please check the product description and terms and conditions before signing the contract.

- You have the right to receive a sufficient prior explanation of the product, and please trade after understanding the explanation.

- Excessive borrowing can cause a drop in personal credit score.

- Restrictions or disadvantages in financial transactions may occur due to a drop in personal credit score.

- In case of overdue, an obligation to repay the principal and interest may occur before the expiration of the contract period.

- For other details, please contact the customer center (1566-0007).

[e-Revolving Term Deposit]

- A product that is automatically re-deposited by adding 0.1% to the fixed deposit interest rate by e-money for 12 months per rotation period (1 year)

- Even in the case of early termination, the contracted interest rate is provided for the section where the rotation period has already arrived

① Eligibility - Individuals over 19 years of age

- Koreans with a resident registration card or driver's license

② Subscription amount - 100,000 won or more

③ Subscription period – 3 years, 4 years, 5 years (rotation cycle 1 year)

④ Contracted interest rate (annual interest rate, before tax)

• After applying the 12-month interest rate of the e-Moa term deposit at the new point of time + the preferential rate of 0.1% per annum = contracted interest rate

• Rotation point After applying the 12-month interest rate of the e-Moa Term Deposit + the preferential rate of 0.1% per annum = contracted interest rate

▶ Apply the e-revolving time deposit contract interest rate announced on the branch office and internet homepage at the time of the new date (rotation date)

Interest rate reference: https://m.moasb.co.kr/dgd/deposit/DGD_ERD_DT3_010.do

⑤ Interest payment method

• Simple interest payment: automatic monthly interest payment

• Compound interest: Automatic transfer of compound interest for 1 year at the arrival of each year (only the principal amount is extended)

⑥ Tax deduction: non-taxation, general taxation

⑦ Early termination rate

• Elapsed annual turnover period: Contracted interest rate

• Less than 1 year leftovers: Differential application for each deposit period at an early termination rate lower than the contracted interest rate

⑧ Restrictions

• Restriction on payment of principal and interest when seizure, provisional seizure, pledge, etc. are registered in the account

⑨ Depositor protection [Applicable]

This deposit is protected by the Korea Deposit Insurance Corporation in accordance with the Depositor Protection Act, but the limit of protection is

The principal of all your financial products subject to deposit protection in this mutual savings bank

“Up to 50 million won” per person, including the prescribed interest, and

The remaining amount is not protected.

⑩ Precautions

- Please check the product description and terms and conditions before signing the contract.

- You have the right to receive a sufficient prior explanation of the product, and please trade after understanding the explanation.

[Restrictions]

- Restriction on payment of principal and interest when seizure, provisional seizure, and establishment of pledge are registered in the account

- Pledge setting: Yes

(Deposit collateral loans are available up to 90% of the deposit balance)

- Unable to change the balance on the date of issuance of the certificate of deposit balance, etc.

[Disadvantages of early cancellation]

- In case of cancellation before maturity, an early termination rate lower than the contracted interest rate is applied

[Moa Savings Bank Customer Center]

- Electronic finance, deposit inquiries and loan inquiries: 1566-0007 (weekdays 9-18:00)

[Information on the authority and purpose of using MOA Digital Bank]

Required access rights

- Use of photos, media, and files: Permissions used for storing joint certificates and security modules for joint certificates.

- Outgoing and Calling: Permission to process direct dialing buttons such as branch offices.

Compliance officer deliberation

- No. 2023-208 (2023.04.05 ~ 2024.04.04)

Deliberation by the Korea Federation of Savings Banks

- No. 2023-00291 (2023.03.13 ~ 2024.03.12)

Non-face-to-face account opening service: Free deposit and withdrawal account opening through non-face-to-face real name verification (different procedures for each product)

Convenience of transfer service: easy and fast remittance such as transfer, reservation transfer, etc.

Financial Product Mall: Provides various financial products such as loans for office workers, entrepreneurs, housewives, and e-moa regular installment savings

[Moa Digital Bank digital authentication service]

Easy login with simple password, pattern authentication, and biometric authentication

Moa banking service available without going to a branch

[Moa Savings Bank employee credit loan (trust theory)]

•Subject to application

- Customers aged 19 or older with proof of income

- NICE credit score of 600 or higher

Loan limit

- More than 3 million won and less than 50 million won

(Differential application depending on personal credit score and income)

Loan period

- Repayment of principal and interest in equal installments: Minimum 12 months ~ Maximum 84 months

Loan interest rate

- Minimum annual rate of 16.4% ~ maximum annual rate of 20.0% (as of April 2023)

(Differential application depending on personal credit score and income)

•Repayment method

- Repayment of principal and interest in equal installments: Repayment of principal and interest (principal + interest) in equal installments during the loan period

How to pay interest

- Post-monthly

•charge

- Handling fee: none

•Prepayment fee

- Within 2.0% (premium repayment fee waived for transactions over 3 years from the date of loan)

•required documents

- Identification card, copy of resident registration, documents proving income, etc.

Overdue interest rate

- Loan interest rate + 3% (up to 20% per year)

•stamp duty

- doesn't exist

Standards for Calculating Loan Interest Rates

- Loan interest rate = base interest rate + additional interest rate

- Standard interest rate: Procurement cost

- Additional interest rate: Differential application according to the bank’s internal rating, etc.

•Notice

- Loan may be rejected according to internal screening criteria.

- Please check the product description and terms and conditions before signing the contract.

- You have the right to receive a sufficient prior explanation of the product, and please trade after understanding the explanation.

- Excessive borrowing can cause a drop in personal credit score.

- Restrictions or disadvantages in financial transactions may occur due to a drop in personal credit score.

- In case of overdue, an obligation to repay the principal and interest may occur before the expiration of the contract period.

- For other details, please contact the customer center (1566-0007).

[e-Revolving Term Deposit]

- A product that is automatically re-deposited by adding 0.1% to the fixed deposit interest rate by e-money for 12 months per rotation period (1 year)

- Even in the case of early termination, the contracted interest rate is provided for the section where the rotation period has already arrived

① Eligibility - Individuals over 19 years of age

- Koreans with a resident registration card or driver's license

② Subscription amount - 100,000 won or more

③ Subscription period – 3 years, 4 years, 5 years (rotation cycle 1 year)

④ Contracted interest rate (annual interest rate, before tax)

• After applying the 12-month interest rate of the e-Moa term deposit at the new point of time + the preferential rate of 0.1% per annum = contracted interest rate

• Rotation point After applying the 12-month interest rate of the e-Moa Term Deposit + the preferential rate of 0.1% per annum = contracted interest rate

▶ Apply the e-revolving time deposit contract interest rate announced on the branch office and internet homepage at the time of the new date (rotation date)

Interest rate reference: https://m.moasb.co.kr/dgd/deposit/DGD_ERD_DT3_010.do

⑤ Interest payment method

• Simple interest payment: automatic monthly interest payment

• Compound interest: Automatic transfer of compound interest for 1 year at the arrival of each year (only the principal amount is extended)

⑥ Tax deduction: non-taxation, general taxation

⑦ Early termination rate

• Elapsed annual turnover period: Contracted interest rate

• Less than 1 year leftovers: Differential application for each deposit period at an early termination rate lower than the contracted interest rate

⑧ Restrictions

• Restriction on payment of principal and interest when seizure, provisional seizure, pledge, etc. are registered in the account

⑨ Depositor protection [Applicable]

This deposit is protected by the Korea Deposit Insurance Corporation in accordance with the Depositor Protection Act, but the limit of protection is

The principal of all your financial products subject to deposit protection in this mutual savings bank

“Up to 50 million won” per person, including the prescribed interest, and

The remaining amount is not protected.

⑩ Precautions

- Please check the product description and terms and conditions before signing the contract.

- You have the right to receive a sufficient prior explanation of the product, and please trade after understanding the explanation.

[Restrictions]

- Restriction on payment of principal and interest when seizure, provisional seizure, and establishment of pledge are registered in the account

- Pledge setting: Yes

(Deposit collateral loans are available up to 90% of the deposit balance)

- Unable to change the balance on the date of issuance of the certificate of deposit balance, etc.

[Disadvantages of early cancellation]

- In case of cancellation before maturity, an early termination rate lower than the contracted interest rate is applied

[Moa Savings Bank Customer Center]

- Electronic finance, deposit inquiries and loan inquiries: 1566-0007 (weekdays 9-18:00)

[Information on the authority and purpose of using MOA Digital Bank]

Required access rights

- Use of photos, media, and files: Permissions used for storing joint certificates and security modules for joint certificates.

- Outgoing and Calling: Permission to process direct dialing buttons such as branch offices.

Compliance officer deliberation

- No. 2023-208 (2023.04.05 ~ 2024.04.04)

Deliberation by the Korea Federation of Savings Banks

- No. 2023-00291 (2023.03.13 ~ 2024.03.12)

Show More