SAT Móvil

Servicio de Administración Tributaria (SAT)

3.4 ★

10K ratings

5,000,000+

downloads

Free

With this app, you can access and manage tax information, generate digital signatures, and update passwords. Includes features such as viewing tax status, generating dynamic keys, and sending notifications.

AppRecs review analysis

AppRecs rating 3.5. Trustworthiness 78 out of 100. Review manipulation risk 16 out of 100. Based on a review sample analyzed.

★★★☆☆

3.5

AppRecs Rating

Ratings breakdown

5 star

42%

4 star

25%

3 star

0%

2 star

0%

1 star

33%

What to know

✓

Low review manipulation risk

16% review manipulation risk

✓

Credible reviews

78% trustworthiness score from analyzed reviews

⚠

High negative review ratio

33% of sampled ratings are 1–2 stars

About SAT Móvil

SAT Mobile is the official app of the Tax Administration Service (SAT). It offers digital procedures and services available in a personalized space for individual taxpayers using their RFC (Tax Identification Number) and Password.

The procedures include:

- Tax Status Certificate.

- Tax Identification Card.

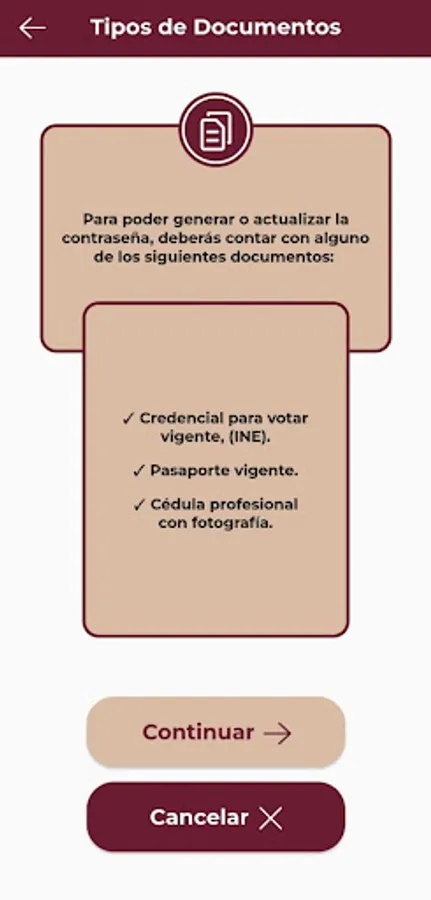

You can also view the Tax Compliance Opinion Report, generate the dynamic key for your portable e-signature, and generate or update your password through SATID.

It allows you to view tax information such as identification data associated with your RFC (Tax Identification Number), tax address, contact information, tax regimes, obligations, and economic activities, as well as a current or most recent e-signature certificate and active digital seal certificates. You can also enable or update your Tax Mailbox contact information and receive messages of interest from Tax Mailbox in the My Communications section.

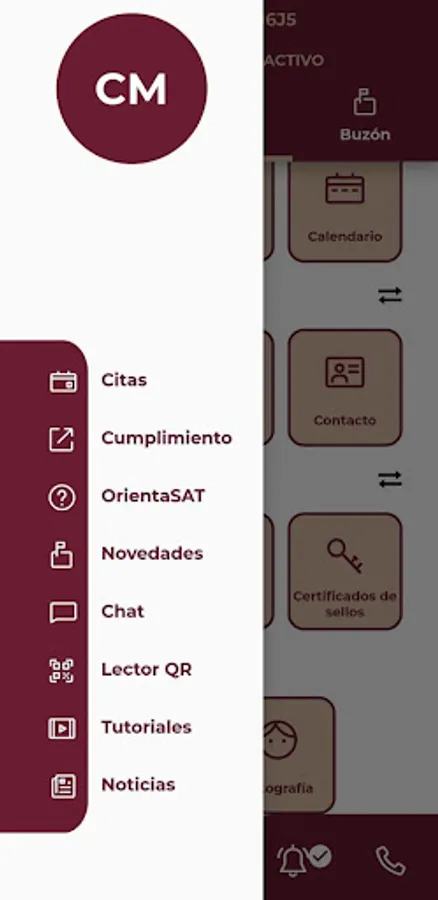

It includes other services such as: Appointments, complaints, and reports, a QR code reader, a tax calendar that allows you to send push notifications and alerts to your mobile device. Receive tax guidance through: one-on-one chat, MarcaSAT, OrientaSAT, tutorials, news, messages, tax and economic indicators, among others.

The procedures include:

- Tax Status Certificate.

- Tax Identification Card.

You can also view the Tax Compliance Opinion Report, generate the dynamic key for your portable e-signature, and generate or update your password through SATID.

It allows you to view tax information such as identification data associated with your RFC (Tax Identification Number), tax address, contact information, tax regimes, obligations, and economic activities, as well as a current or most recent e-signature certificate and active digital seal certificates. You can also enable or update your Tax Mailbox contact information and receive messages of interest from Tax Mailbox in the My Communications section.

It includes other services such as: Appointments, complaints, and reports, a QR code reader, a tax calendar that allows you to send push notifications and alerts to your mobile device. Receive tax guidance through: one-on-one chat, MarcaSAT, OrientaSAT, tutorials, news, messages, tax and economic indicators, among others.