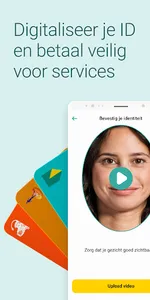

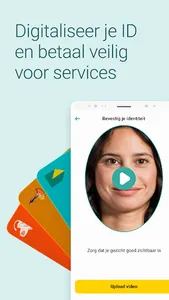

What is ID & pay?

Combine your digital identity with secure payment with ID & pay. Stay in control of the data you share with, and the payments you've made to, who, when, and why.

With ID & pay at hand, you do not have to supply data again and again and identify yourself digitally. Your profile is reusable. Therefore, consider ID & pay as your digital identity manager with which you can quickly and securely verify your identity with other service providers.

While you are and remain in control of your shared personal data, ID & pay securely processes payments for the services you have purchased. Free, safe and for anyone over 18 with a Dutch bank account.

With which service providers can I use ID & pay?

ID & pay can currently only be used to take out a subscription with Swapfiets. The number of service providers will be expanded, an overview can be found atnieuwvan.abnamro.nl/idandpay or in the app.

How does ID & pay work?

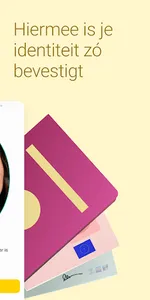

With ID & pay you create a one-time profile for which you must be identified and verified. For this you must submit your personal data to ID & pay, such as your name, address and/or date of birth.

With your profile you can identify yourself with an affiliated service provider via ID & pay. For example, for renting a scooter or opening an investment account. ID & pay also provides for the processing of payments to an affiliated service provider for a service that you purchase or want to purchase.

You must first link your bank account to your ID & pay profile. You do this when you create your profile and can, for example, make a deposit or issue an authorization through your own bank. By linking the bank account, ID & pay can check whether the account is registered in your name so that payment and identity fraud is prevented as much as possible and future payments can be processed safely.

One-time steps for creating your reusable profile:

1. Enter your first and last name

2. Choose a PIN to secure your profile

3. Verify your email address with a code to be received

4. Enter your address details

5. Identification through a photo of your ID and one-time facial recognition with your explicit permission

6. Verify your phone number with a code to be received

7. Link your bank account via your own bank so that ID & pay can check the ascription

8. Digitally sign our agreement

Once you are a user of ID & pay, it is no longer necessary to go through all the steps with every new service provider when creating an account for purchasing a product or service. ID & pay will also process payments to and from the service provider, from the account number linked by you. ID & pay also gives you real-time insight into the data you have shared with the service provider and the transactions carried out. Only with your explicit permission do we carry out transactions on behalf of, or share personal data with, the service provider connected to ID & pay.

How can I pay with ID & pay?

If you want to pay via ID & pay to affiliated service providers, you pay via your own bank to ID & pay. ID & pay receives the amount paid by you on behalf of the company or institution and then transfers this amount to the service provider to which you want to pay. For amounts to be paid monthly, for example in the case of a continuous subscription, ID & pay will debit the agreed amount from the account linked by you.

More info

ID & pay was developed by ABN AMRO and meets all strict security requirements and we handle your personal data with care. We use Onfido's technology for the onboarding process of ID & pay. More information about ID & pay can be found atnieuwvan.abnamro.nl/initiatives/id-and-pay.

Combine your digital identity with secure payment with ID & pay. Stay in control of the data you share with, and the payments you've made to, who, when, and why.

With ID & pay at hand, you do not have to supply data again and again and identify yourself digitally. Your profile is reusable. Therefore, consider ID & pay as your digital identity manager with which you can quickly and securely verify your identity with other service providers.

While you are and remain in control of your shared personal data, ID & pay securely processes payments for the services you have purchased. Free, safe and for anyone over 18 with a Dutch bank account.

With which service providers can I use ID & pay?

ID & pay can currently only be used to take out a subscription with Swapfiets. The number of service providers will be expanded, an overview can be found atnieuwvan.abnamro.nl/idandpay or in the app.

How does ID & pay work?

With ID & pay you create a one-time profile for which you must be identified and verified. For this you must submit your personal data to ID & pay, such as your name, address and/or date of birth.

With your profile you can identify yourself with an affiliated service provider via ID & pay. For example, for renting a scooter or opening an investment account. ID & pay also provides for the processing of payments to an affiliated service provider for a service that you purchase or want to purchase.

You must first link your bank account to your ID & pay profile. You do this when you create your profile and can, for example, make a deposit or issue an authorization through your own bank. By linking the bank account, ID & pay can check whether the account is registered in your name so that payment and identity fraud is prevented as much as possible and future payments can be processed safely.

One-time steps for creating your reusable profile:

1. Enter your first and last name

2. Choose a PIN to secure your profile

3. Verify your email address with a code to be received

4. Enter your address details

5. Identification through a photo of your ID and one-time facial recognition with your explicit permission

6. Verify your phone number with a code to be received

7. Link your bank account via your own bank so that ID & pay can check the ascription

8. Digitally sign our agreement

Once you are a user of ID & pay, it is no longer necessary to go through all the steps with every new service provider when creating an account for purchasing a product or service. ID & pay will also process payments to and from the service provider, from the account number linked by you. ID & pay also gives you real-time insight into the data you have shared with the service provider and the transactions carried out. Only with your explicit permission do we carry out transactions on behalf of, or share personal data with, the service provider connected to ID & pay.

How can I pay with ID & pay?

If you want to pay via ID & pay to affiliated service providers, you pay via your own bank to ID & pay. ID & pay receives the amount paid by you on behalf of the company or institution and then transfers this amount to the service provider to which you want to pay. For amounts to be paid monthly, for example in the case of a continuous subscription, ID & pay will debit the agreed amount from the account linked by you.

More info

ID & pay was developed by ABN AMRO and meets all strict security requirements and we handle your personal data with care. We use Onfido's technology for the onboarding process of ID & pay. More information about ID & pay can be found atnieuwvan.abnamro.nl/initiatives/id-and-pay.

Show More