Zarkhez-e

Punjab IT Board

5,000+

downloads

Free

AppRecs review analysis

AppRecs rating 2.1. Trustworthiness 79 out of 100. Review manipulation risk 19 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.1

AppRecs Rating

Ratings breakdown

5 star

20%

4 star

0%

3 star

0%

2 star

0%

1 star

80%

What to know

✓

Low review manipulation risk

19% review manipulation risk

✓

Credible reviews

79% trustworthiness score from analyzed reviews

⚠

Mixed user feedback

Average 1.8★ rating suggests room for improvement

About Zarkhez-e

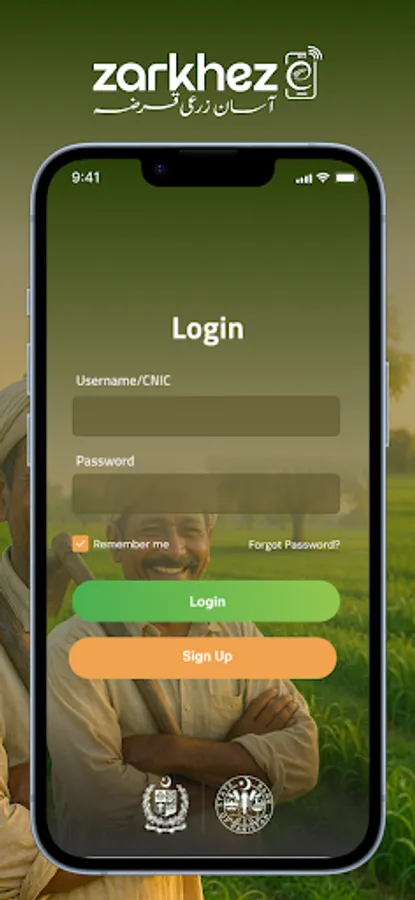

The objective of Zarkhez-e is to implement a tech-enabled, fully digital financing ecosystem that enables subsistence farmers across Pakistan to access short-term, uncollateralized crop input financing in a structured, transparent, and accountable manner.

Through a farmer-facing mobile application the initiative aims to:

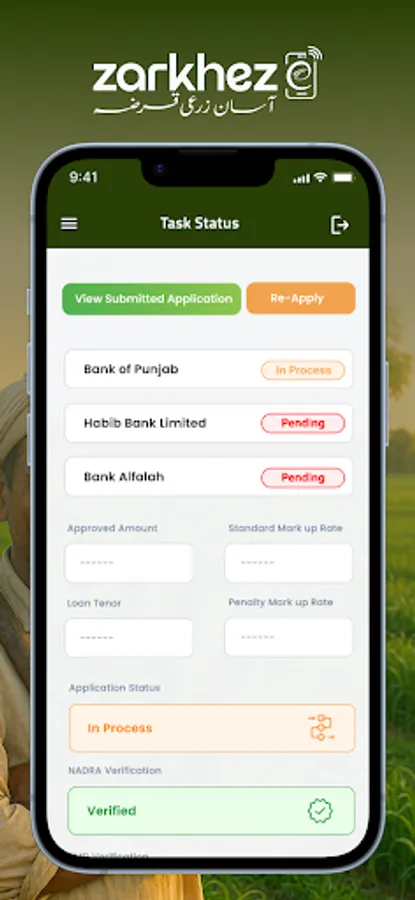

• Digitally empower smallholder farmers by providing them a single-window platform to apply for and track agricultural financing without needing to visit physical bank branches.

• Reduce loan diversion and dependency on middlemen by disbursing loans digitally and tying them to a verified network of agri-input merchants.

Ultimately, Zarkhez-e aims to enhance agricultural productivity, reduce rural financial exclusion, and uplift the livelihoods of Pakistan’s most vulnerable farming communities using modern digital tools and a data-driven implementation approach.

Decision/Evaluation Criteria

Following is proposed criteria for evaluating credit worthiness of the applicants.

1. NADRA & PMD verification

2. Sanctions list name screening, inclusive of Schedule 4/NACTA screening

3. ECIB/other private credit bureaus check for acceptable credit history and overdues/write-offs as per Financial Institution’s credit underwriting standards

4. Acceptable DBR ratio as per bank’s policy

5. Satisfactory online psychometric assessment score (BOP Customers Only)

6. Satisfactory credit risk score (considering farmer’s KYC, Financials, and Agronomy information) as per bank’s policy

7. Financial Institutions (FIs) may conduct on-site visits to verify the farmer’s identity and land ownership/tenancy records etc.

Through a farmer-facing mobile application the initiative aims to:

• Digitally empower smallholder farmers by providing them a single-window platform to apply for and track agricultural financing without needing to visit physical bank branches.

• Reduce loan diversion and dependency on middlemen by disbursing loans digitally and tying them to a verified network of agri-input merchants.

Ultimately, Zarkhez-e aims to enhance agricultural productivity, reduce rural financial exclusion, and uplift the livelihoods of Pakistan’s most vulnerable farming communities using modern digital tools and a data-driven implementation approach.

Decision/Evaluation Criteria

Following is proposed criteria for evaluating credit worthiness of the applicants.

1. NADRA & PMD verification

2. Sanctions list name screening, inclusive of Schedule 4/NACTA screening

3. ECIB/other private credit bureaus check for acceptable credit history and overdues/write-offs as per Financial Institution’s credit underwriting standards

4. Acceptable DBR ratio as per bank’s policy

5. Satisfactory online psychometric assessment score (BOP Customers Only)

6. Satisfactory credit risk score (considering farmer’s KYC, Financials, and Agronomy information) as per bank’s policy

7. Financial Institutions (FIs) may conduct on-site visits to verify the farmer’s identity and land ownership/tenancy records etc.