About Firmowe Zakupy - Kalkulator VA

Our calculator will help you estimate how much you will actually save by throwing a VAT invoice in tax deductible costs.

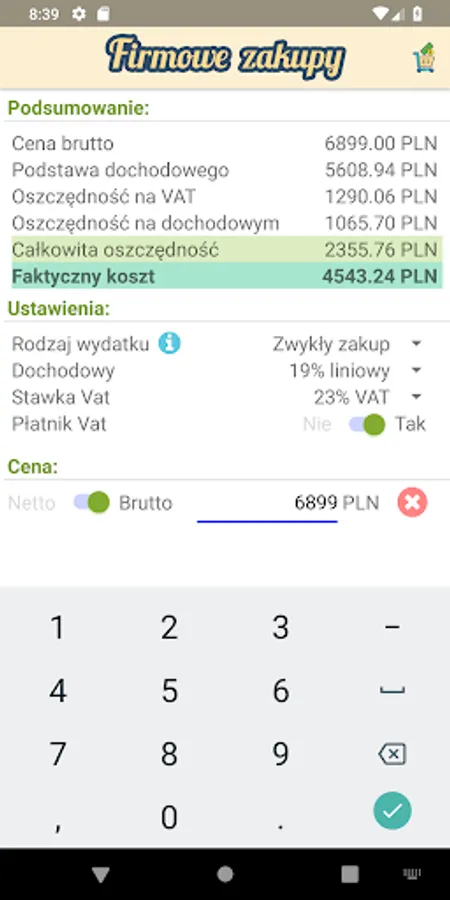

1. Specify the type of estimated expenditure - ordinary cost or related to the car also used for private purposes.

2. Enter the rate for income tax and VAT on the item, confirm whether you are an active VAT payer.

3. Enter the price of the item or service, indicate whether the value is Net or Gross by moving the slider

Go to "Summary" - the entered setting values will allow you to estimate the actual cost you need to incur with the planned purchase.

1. Specify the type of estimated expenditure - ordinary cost or related to the car also used for private purposes.

2. Enter the rate for income tax and VAT on the item, confirm whether you are an active VAT payer.

3. Enter the price of the item or service, indicate whether the value is Net or Gross by moving the slider

Go to "Summary" - the entered setting values will allow you to estimate the actual cost you need to incur with the planned purchase.