AppRecs review analysis

AppRecs rating . Trustworthiness 80 out of 100. Review manipulation risk 17 out of 100. Based on a review sample analyzed.

★

AppRecs Rating

Ratings breakdown

5 star

25%

4 star

17%

3 star

0%

2 star

17%

1 star

42%

What to know

✓

Low review manipulation risk

17% review manipulation risk

✓

Credible reviews

80% trustworthiness score from analyzed reviews

⚠

Mixed user feedback

Average 2.7★ rating suggests room for improvement

About PKO Junior

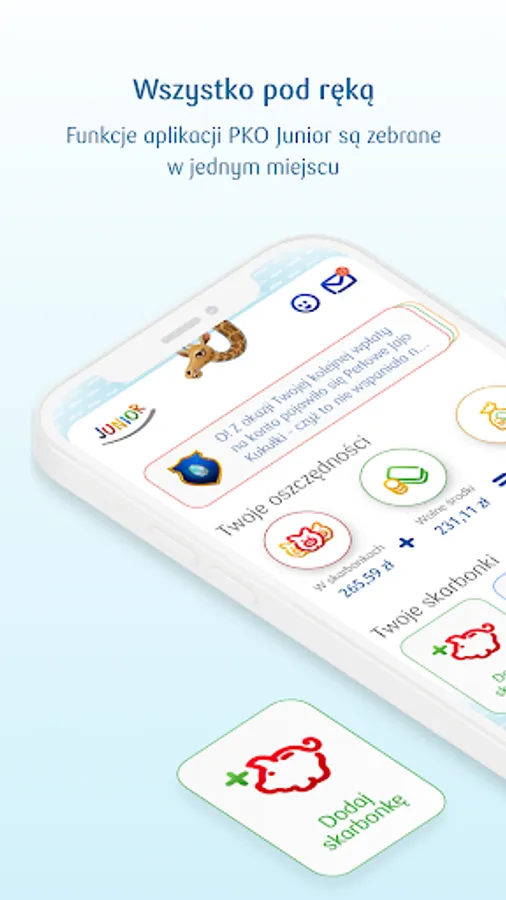

The PKO Junior application is created for children up to 12 years of age who have a PKO Children's Account at PKO Bank Polski. It teaches children how to manage their budget on their phones under their parents' supervision.

Child with application:

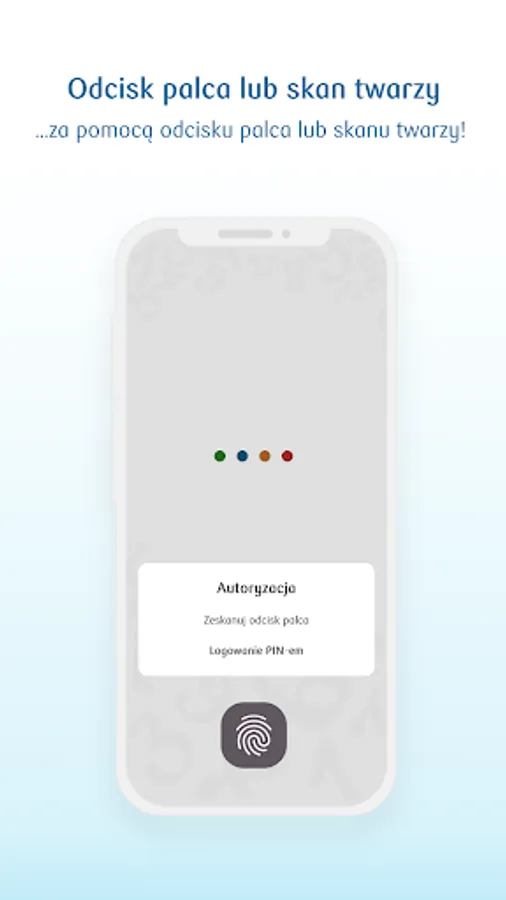

- log in conveniently using PIN, fingerprint or face recognition

- pays contactless by phone

- learns about finances with the help of a talking robot that gives him tips

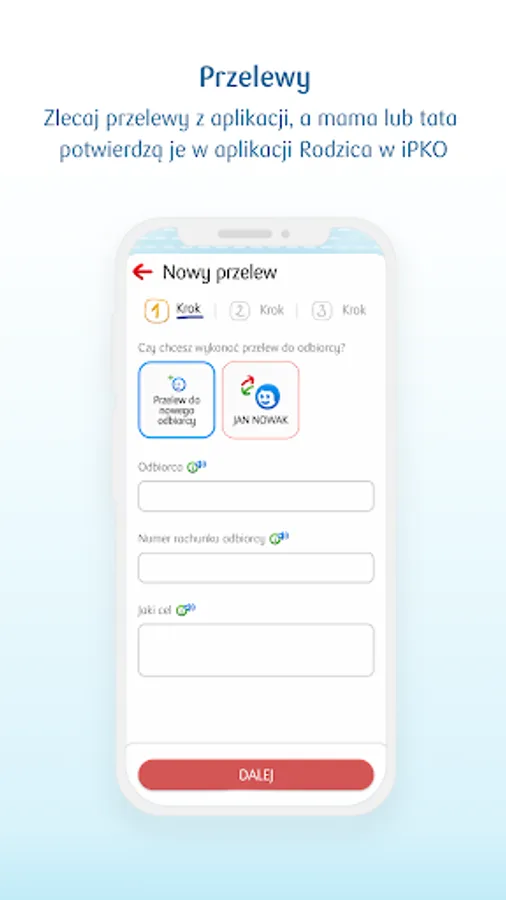

- initiates transfers and phone top-ups, the parent accepts them on the iPKO website

- may ask the parent to top up the payment card

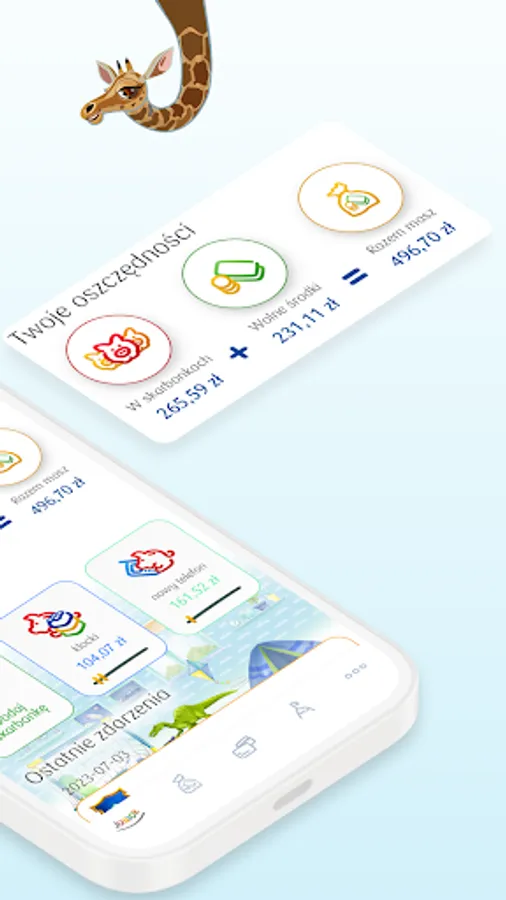

- will create virtual piggy banks and specify the purpose for which they are collecting money, they can top them up, edit or split them at any time

- use the savings calculator, which allows you to calculate how much you can potentially save, taking into account the amount and regularity of payments and the current interest rate

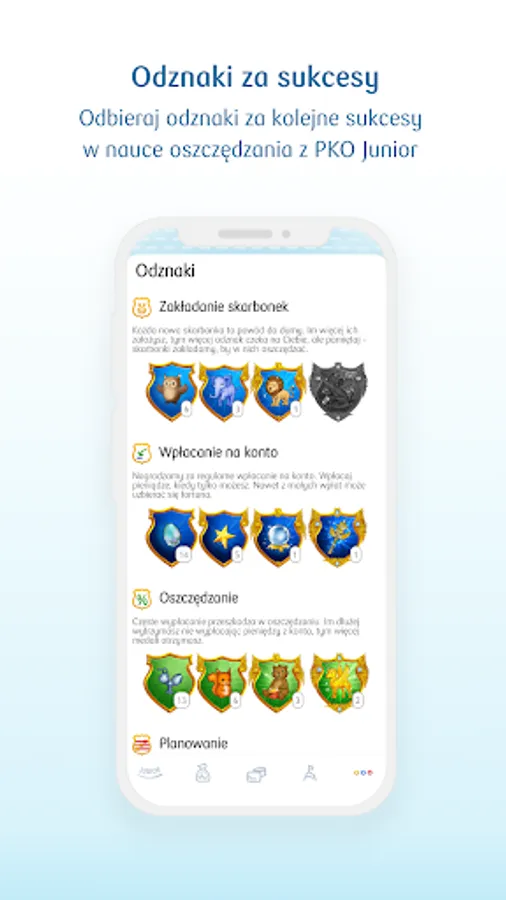

- receives awards and badges - they can get them for completing tasks from their parents

- changes the background of the application and adapts it to itself

- easy to find thanks to the intuitive menu and home page

If you want to manage your account and finances at PKO Bank Polski, download the IKO mobile application for adults - more at pkobp.pl

Child with application:

- log in conveniently using PIN, fingerprint or face recognition

- pays contactless by phone

- learns about finances with the help of a talking robot that gives him tips

- initiates transfers and phone top-ups, the parent accepts them on the iPKO website

- may ask the parent to top up the payment card

- will create virtual piggy banks and specify the purpose for which they are collecting money, they can top them up, edit or split them at any time

- use the savings calculator, which allows you to calculate how much you can potentially save, taking into account the amount and regularity of payments and the current interest rate

- receives awards and badges - they can get them for completing tasks from their parents

- changes the background of the application and adapts it to itself

- easy to find thanks to the intuitive menu and home page

If you want to manage your account and finances at PKO Bank Polski, download the IKO mobile application for adults - more at pkobp.pl