MyBIAT is an application designed based on the needs and feedback of our customers. Highly secure and featuring a simple and intuitive design, MyBIAT is an innovative application that offers its users a unique digital experience. It will be continually improved with new features and adaptations inspired by our customers and technological advances.

MyBIAT features are as follows:

Access to MyBIAT:

- Secure access to your application following a login using your email address and a password of your choice.

- Faster access to your application by entering a 6-digit Passcode or through biometrics.

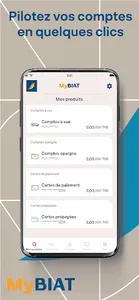

Monitoring your products:

- View the list of accounts, as well as their details, transactions, related documents (account statements, debit/credit notices, etc.), and their corresponding balances. -View your card list, transactions, and corresponding usage rights in real time, with the ability to view card details.

-View your credit list and details with their corresponding outstanding amounts, your Projets Avenir products, your investments and securities products (SICAV, FCP, and Treasury Bonds), as well as your AVA accounts.

- Download the tax regularization certificate for your Projet Avenir

View accounts for minor children

Card management:

- View the list of cards, the benefits offered, and download the travel insurance certificate for eligible cards

- Immediate deactivation and activation of cards

- Top-up BIAT prepaid cards in TND and DVS

- Change the weekly limit

Transfers:

- Simple transfers, scheduled for a specific event or programmed over a period, secure in dinars and foreign currencies, with validation by SMS code or biometrics

- Track completed transfers

Beneficiary management

Checkbook management:

- Order a new checkbook for an eligible current account

- Track checkbook orders and their interim statuses

- Link your bank details to your TuniChèque account

Other services:

- Transfer simulator Credit

- Push notification management

- Support module with a history of messages sent and received from BIAT

- Phone top-ups

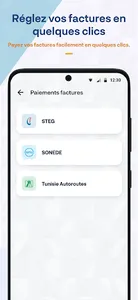

- Payment of STEG and SONEDE bills and top-ups for Tunisie Autoroutes subscriptions

MyBIAT features are as follows:

Access to MyBIAT:

- Secure access to your application following a login using your email address and a password of your choice.

- Faster access to your application by entering a 6-digit Passcode or through biometrics.

Monitoring your products:

- View the list of accounts, as well as their details, transactions, related documents (account statements, debit/credit notices, etc.), and their corresponding balances. -View your card list, transactions, and corresponding usage rights in real time, with the ability to view card details.

-View your credit list and details with their corresponding outstanding amounts, your Projets Avenir products, your investments and securities products (SICAV, FCP, and Treasury Bonds), as well as your AVA accounts.

- Download the tax regularization certificate for your Projet Avenir

View accounts for minor children

Card management:

- View the list of cards, the benefits offered, and download the travel insurance certificate for eligible cards

- Immediate deactivation and activation of cards

- Top-up BIAT prepaid cards in TND and DVS

- Change the weekly limit

Transfers:

- Simple transfers, scheduled for a specific event or programmed over a period, secure in dinars and foreign currencies, with validation by SMS code or biometrics

- Track completed transfers

Beneficiary management

Checkbook management:

- Order a new checkbook for an eligible current account

- Track checkbook orders and their interim statuses

- Link your bank details to your TuniChèque account

Other services:

- Transfer simulator Credit

- Push notification management

- Support module with a history of messages sent and received from BIAT

- Phone top-ups

- Payment of STEG and SONEDE bills and top-ups for Tunisie Autoroutes subscriptions

Show More