With this community finance platform, you can lend or borrow up to $625 on your terms and access financial tools like SoLo IQ. Includes secure communication, no hidden fees, and a focus on social impact.

AppRecs review analysis

AppRecs rating 4.0. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.0

AppRecs Rating

Ratings breakdown

5 star

79%

4 star

4%

3 star

2%

2 star

2%

1 star

13%

What to know

✓

High user satisfaction

83% of sampled ratings are 4+ stars (4.3★ average)

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About SoLo Funds: Lend & Borrow

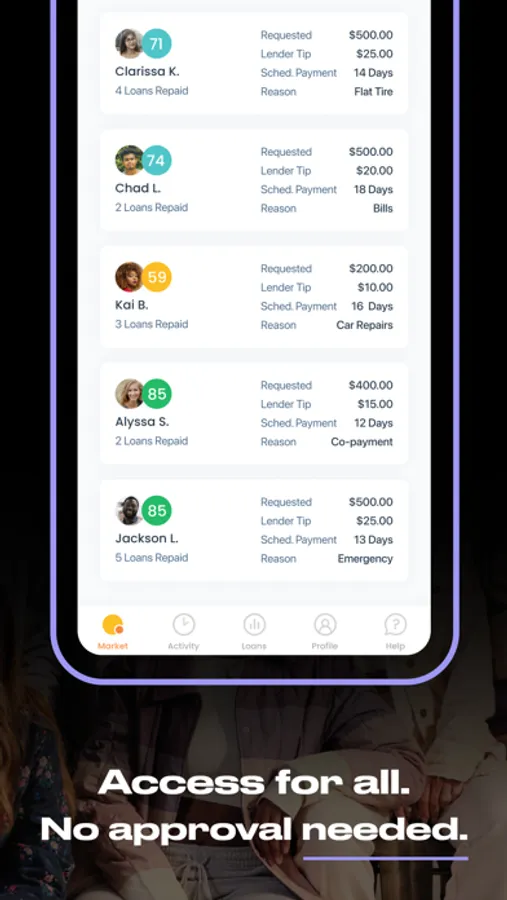

Access up to $625 on your own terms or supply funds to make a social impact and return.

Fun fact → SoLo Funds is a Certified Public Benefit Corporation.

SoLo is a community finance platform where our members step up for one another. We enable financial services for real people, powered by people. We back each other because we believe in each other.

Here’s why thousands of members use SoLo…

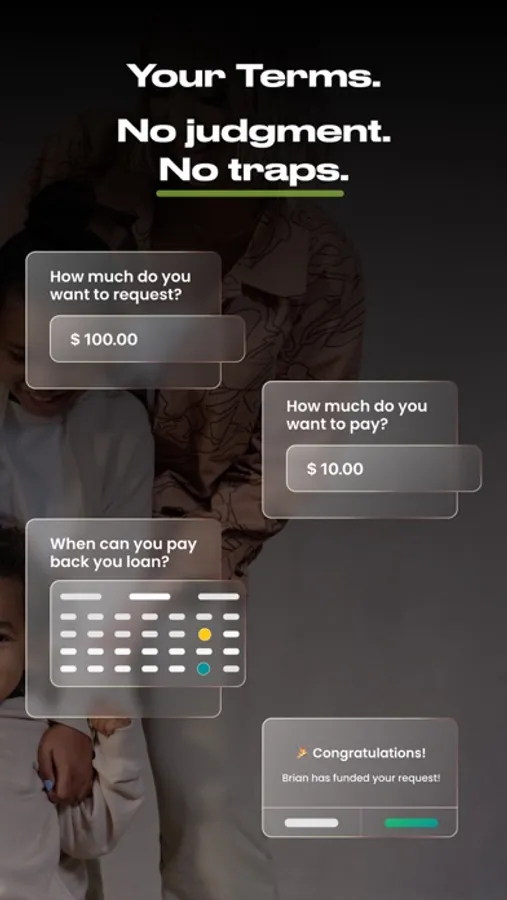

ACCESS UP TO $625 ON YOUR OWN TERMS

We give you choice and control where others don't. No credit checks. We come through for each other because we're in this together.

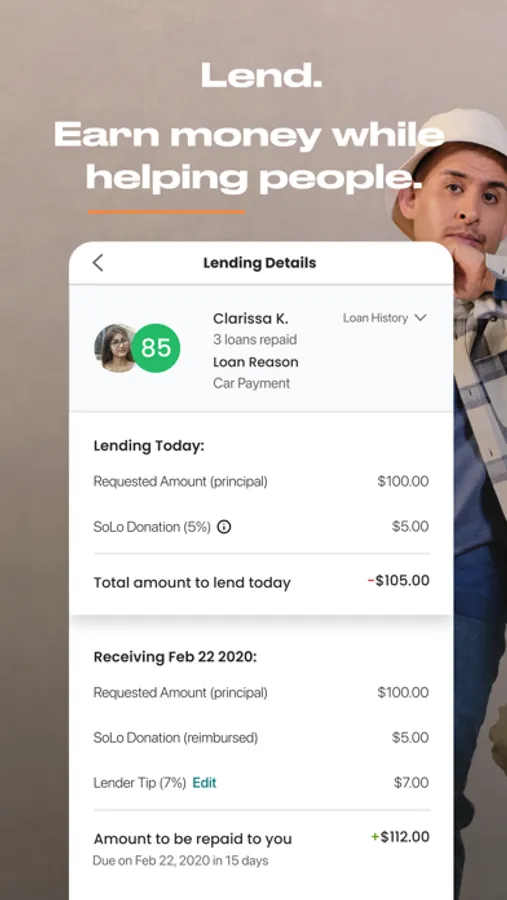

EARN MONEY WHILE HELPING OTHERS

SoLo is a great way to make a social impact while also earning a return on your money. Our data driven tools allow you to verify and make smarter choices. Fund a request today. We’re people helping people.

Fun fact → SoLo is a 2023 CNBC Disruptor 50 Company

SOLO PROTECTION

We’re in this together. We protect each member in our community via secure and easy communication between bank accounts while creating a safety net for potential losses.

Fun fact → SoLo was selected as one of Fast Company’s World Changing ideas in 2022

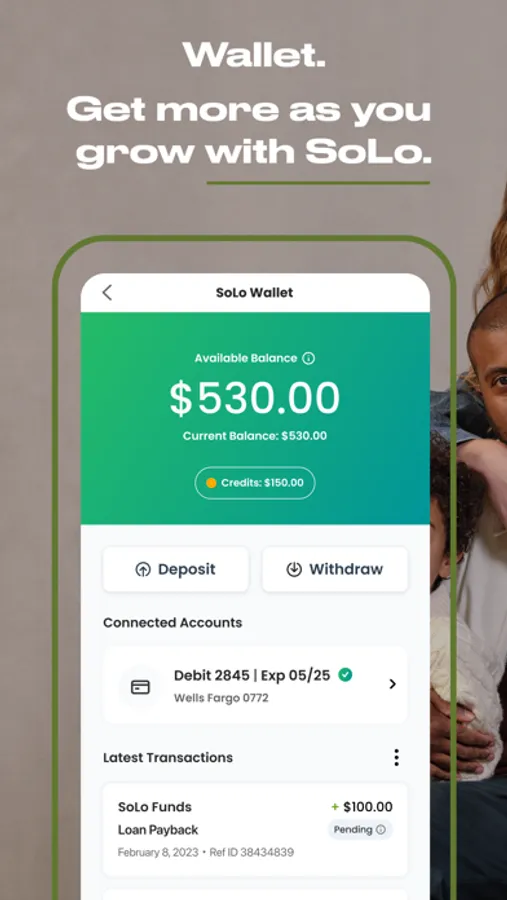

SOLO WALLET

Leverage our banking solution to build financial autonomy. Deposit, withdrawal, and bank with SoLo.

Fun fact → SoLo won NBCUniversal’s LIFTOff Financial Impact Challenge

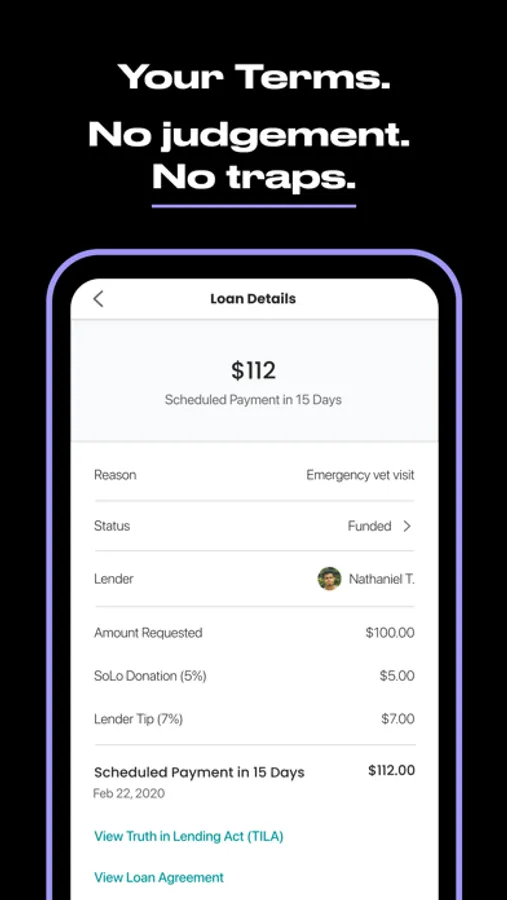

NO HIDDEN FEES

We’re not here to surprise you with fees. SoLo guarantees no hidden fees, no minimum balance fees, transactions fees, expedition fees and no overdraft fees.

SOLO IQ

SoLo IQ is an AI financial co-pilot that gives you super-personal, smart advice to get the most out of your lending, borrowing, and spending.

Fun fact → SoLo was selected in 2021 for Global Inclusive Fintech 50 by the Center for Financial Inclusion

SoLo Funds, Inc, a Certified Benefit Corporation, is not a bank. Banking services provided by Bangor Savings Bank, Member FDIC. TheSoLo Funds Mastercard® Debit Card is issued by Bangor Savings Bank, Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circle design is a trademark of Mastercard International Incorporated. Spend anywhere Mastercard is accepted.

For more information please visit our website https://solofunds.com/.

(1) $625 Cash Requests: Criteria applies, see Terms https://solofunds.com/terms/ for more details.

(2) SoLo Wallet: The bank services are provided by Bangor Savings Bank, Member FDIC.

All loans regardless of the early schedule payment have the same terms, with 90 days for repayments and default. The early repayment schedule for a loan request can differ between members with all loans up to 90 days to pay in full until defaulted. Your initial scheduled early repayment date can be skipped without issue and repaid manually in-app at any time with minimum and maximum repayment schedule up to 90 days. All loans have up to 90 days to pay in full until defaulted.

See SoLo's Privacy Policy https://solofunds.com/privacy

Fun fact → SoLo Funds is a Certified Public Benefit Corporation.

SoLo is a community finance platform where our members step up for one another. We enable financial services for real people, powered by people. We back each other because we believe in each other.

Here’s why thousands of members use SoLo…

ACCESS UP TO $625 ON YOUR OWN TERMS

We give you choice and control where others don't. No credit checks. We come through for each other because we're in this together.

EARN MONEY WHILE HELPING OTHERS

SoLo is a great way to make a social impact while also earning a return on your money. Our data driven tools allow you to verify and make smarter choices. Fund a request today. We’re people helping people.

Fun fact → SoLo is a 2023 CNBC Disruptor 50 Company

SOLO PROTECTION

We’re in this together. We protect each member in our community via secure and easy communication between bank accounts while creating a safety net for potential losses.

Fun fact → SoLo was selected as one of Fast Company’s World Changing ideas in 2022

SOLO WALLET

Leverage our banking solution to build financial autonomy. Deposit, withdrawal, and bank with SoLo.

Fun fact → SoLo won NBCUniversal’s LIFTOff Financial Impact Challenge

NO HIDDEN FEES

We’re not here to surprise you with fees. SoLo guarantees no hidden fees, no minimum balance fees, transactions fees, expedition fees and no overdraft fees.

SOLO IQ

SoLo IQ is an AI financial co-pilot that gives you super-personal, smart advice to get the most out of your lending, borrowing, and spending.

Fun fact → SoLo was selected in 2021 for Global Inclusive Fintech 50 by the Center for Financial Inclusion

SoLo Funds, Inc, a Certified Benefit Corporation, is not a bank. Banking services provided by Bangor Savings Bank, Member FDIC. TheSoLo Funds Mastercard® Debit Card is issued by Bangor Savings Bank, Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circle design is a trademark of Mastercard International Incorporated. Spend anywhere Mastercard is accepted.

For more information please visit our website https://solofunds.com/.

(1) $625 Cash Requests: Criteria applies, see Terms https://solofunds.com/terms/ for more details.

(2) SoLo Wallet: The bank services are provided by Bangor Savings Bank, Member FDIC.

All loans regardless of the early schedule payment have the same terms, with 90 days for repayments and default. The early repayment schedule for a loan request can differ between members with all loans up to 90 days to pay in full until defaulted. Your initial scheduled early repayment date can be skipped without issue and repaid manually in-app at any time with minimum and maximum repayment schedule up to 90 days. All loans have up to 90 days to pay in full until defaulted.

See SoLo's Privacy Policy https://solofunds.com/privacy