In this app, you can view and purchase your credit report and score, update personal information, and share reports with selected recipients. Includes options for first-time registration, existing user login, and payment processing.

About AECB CreditReport

Credit Report:

Your Credit Report is a document that includes your personal identity information, details of your credit cards, loans and other credit facilities, along with your payments and bounced cheques history. It is mostly used by financial institutions to assess the credit standing of an individual or company, when reviewing an application for a loan, credit card or other credit facilities. It is also used by other entities such as telecommunication, car rental and leasing, insurance and real estate companies.

Credit Score:

Your Credit Score is a three-digit number that predicts how likely you are to make your loan and credit card payments on time. The number ranges from 300 (very high risk of default) to 900 (very low risk of default).

Your Credit Score uses an algorithm based on modern predictive analytics methodologies used by multiple credit bureaus and banks internationally. It changes according to your payment behavior, making payments on or before the due date and not bouncing cheques, reducing the number of credit cards and other credit facilities and consistently reducing outstanding balances will improve your Credit Score.

First Time Users

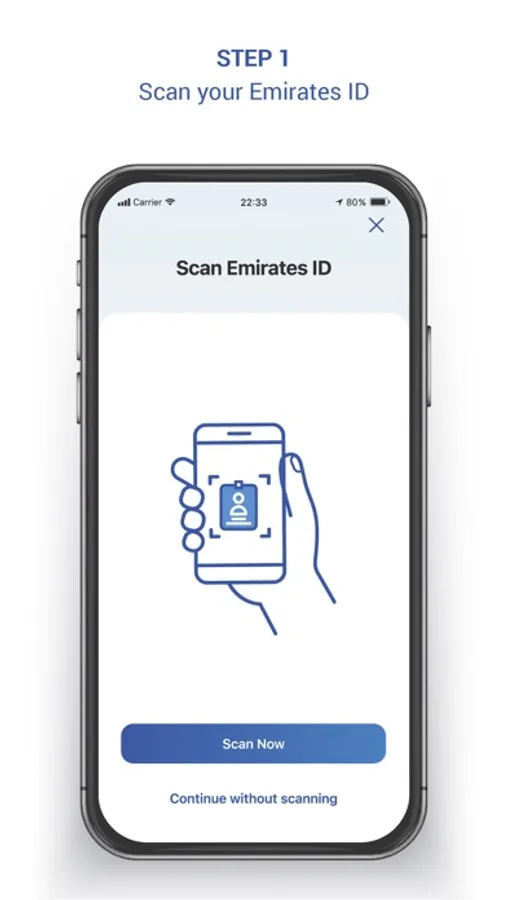

Step 1: Scan your Emirates ID

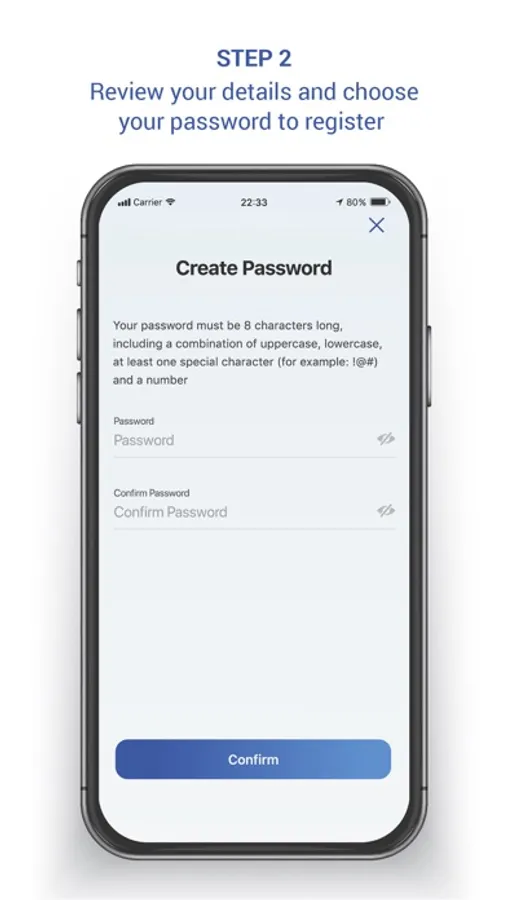

Step 2: Review your details and choose your password to register

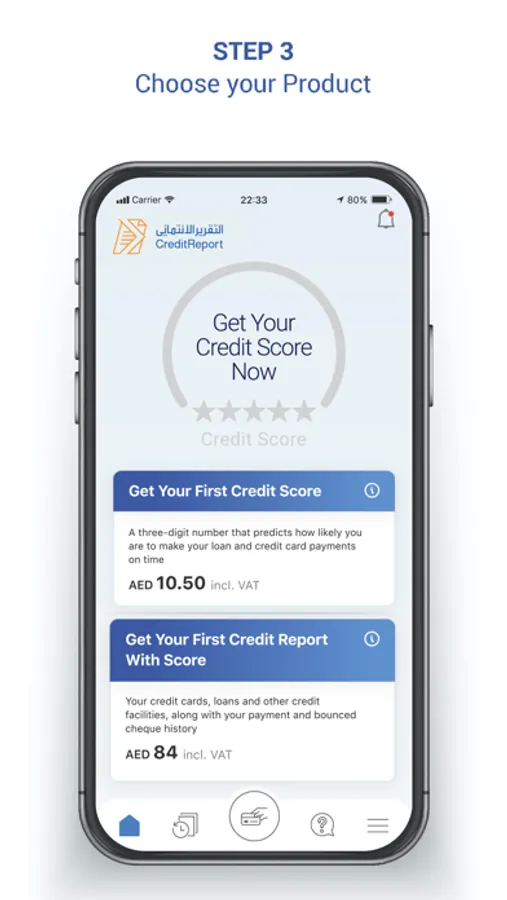

Step 3: Choose your Product:

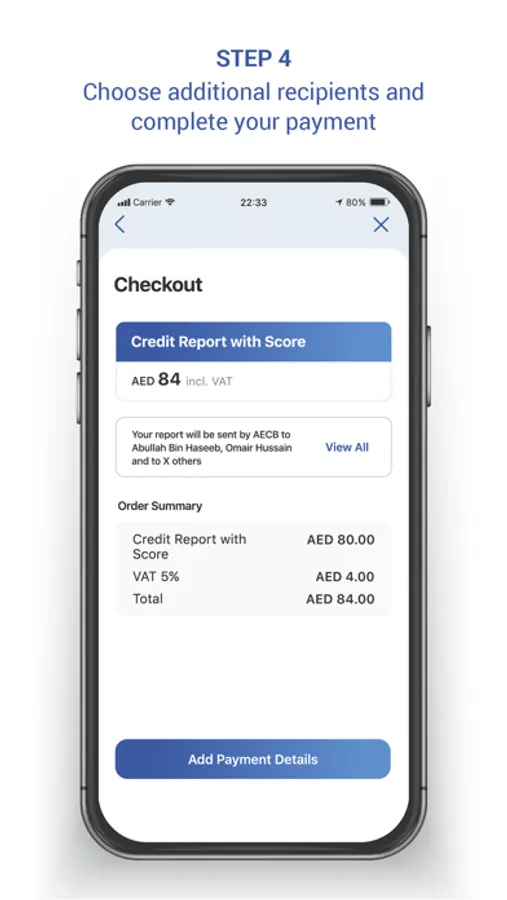

Step 4: Choose the recipients you would like to share your report with

Step 5: Complete your payment by Debit or Credit Card.

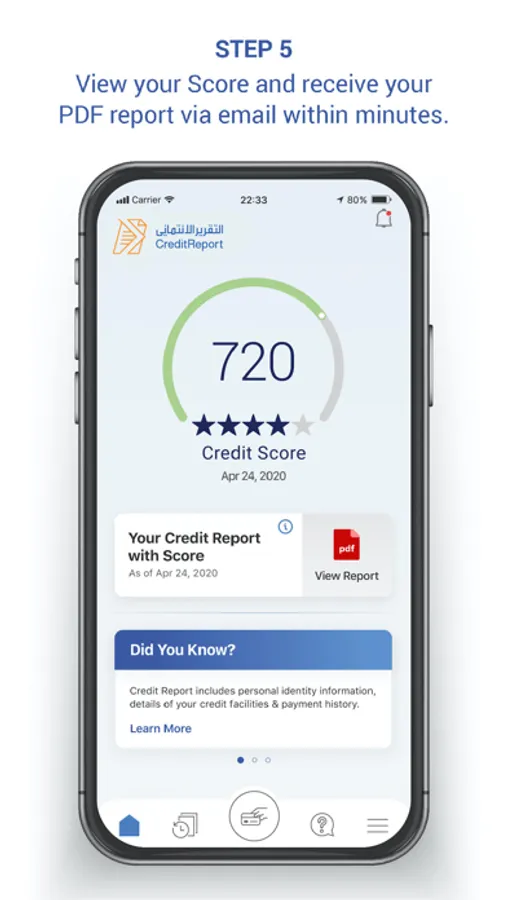

Step 6: View your Score and receive your PDF report via email within minutes.

Existing Users:

Step 1: Login with your AECB credentials

Step2: Choose the type of report you want to buy

Step 3: Choose the recipients you would like to share your report with

Step 4Complete payment using existing card or by adding a new debit or credit card

Step 5: View your Score and receive your PDF report via email within minutes.

Help and Support:

Data Correction: We strive to ensure that data supplier to us is correct. If this is not the case, it is critical that it is corrected. To resolve inaccurate information in your report, you will need to contact your banks and financial institutions who can correct and update your records. A list of all our Data Providers contact details is available within the App.

Contact Us: We are always happy to hear your comments and suggestion. Fill in your details and let us know what you think, and our team will get back to you.

Your Credit Report is a document that includes your personal identity information, details of your credit cards, loans and other credit facilities, along with your payments and bounced cheques history. It is mostly used by financial institutions to assess the credit standing of an individual or company, when reviewing an application for a loan, credit card or other credit facilities. It is also used by other entities such as telecommunication, car rental and leasing, insurance and real estate companies.

Credit Score:

Your Credit Score is a three-digit number that predicts how likely you are to make your loan and credit card payments on time. The number ranges from 300 (very high risk of default) to 900 (very low risk of default).

Your Credit Score uses an algorithm based on modern predictive analytics methodologies used by multiple credit bureaus and banks internationally. It changes according to your payment behavior, making payments on or before the due date and not bouncing cheques, reducing the number of credit cards and other credit facilities and consistently reducing outstanding balances will improve your Credit Score.

First Time Users

Step 1: Scan your Emirates ID

Step 2: Review your details and choose your password to register

Step 3: Choose your Product:

Step 4: Choose the recipients you would like to share your report with

Step 5: Complete your payment by Debit or Credit Card.

Step 6: View your Score and receive your PDF report via email within minutes.

Existing Users:

Step 1: Login with your AECB credentials

Step2: Choose the type of report you want to buy

Step 3: Choose the recipients you would like to share your report with

Step 4Complete payment using existing card or by adding a new debit or credit card

Step 5: View your Score and receive your PDF report via email within minutes.

Help and Support:

Data Correction: We strive to ensure that data supplier to us is correct. If this is not the case, it is critical that it is corrected. To resolve inaccurate information in your report, you will need to contact your banks and financial institutions who can correct and update your records. A list of all our Data Providers contact details is available within the App.

Contact Us: We are always happy to hear your comments and suggestion. Fill in your details and let us know what you think, and our team will get back to you.